Anchor Your Core

ZUAG - BMO US Aggregate Bond Index ETF

Mar. 31, 2023Why ZUAG?

- Available in Unhedged (ZUAG), Hedged (ZUAG.F) and USD Units (ZUAG.U)

- Lower Duration than Canadian Market

- Broader Exposure to Corporates

- Low Cost

- Access to Securitized Market

Key Facts

| Ticker | ZUAG / ZUAG.F / ZUAG.U |

| Index | Bloomberg US Aggregate Bond Index |

| MER* | 0.09% |

| Rebalancing | Monthly |

| Distribution | Monthly |

| Credit Quality | lnvestment Grade |

| Weighted Avg Term Coupon | 2.68 |

| Duration | 6.25 |

| Yield to Maturity† | 4.32 |

| Risk Rating | ZUAG: low to medium | ZUAG.F / ZUAG.U: low |

The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, fixed-rate Mortgage-Backed Securities (MBS), Asset Backed Securities (ABS), and Commercial Mortgage Backed Securities (CMBS) (agency and non-agency).

A low risk, diversified anchor to a fixed income portfolio, designed to protect principal and deliver long-term total return from a portfolio of US investment grade bonds.

US vs Canadian Fixed Income Market

BMO US Aggregated Bond Index (ZUAG) vs BMO Aggregate Bond Index (ZAG)

| ZUAG | ZAG | |

| Weight Avg Term Maturity | 8.51 | 10.09 |

| Weight Avg Duration | 6.32 | 7.45 |

| Yield to Maturity† | 4.32 | 3.93 |

| Quality | AA | AA |

As at March 31, 2023.

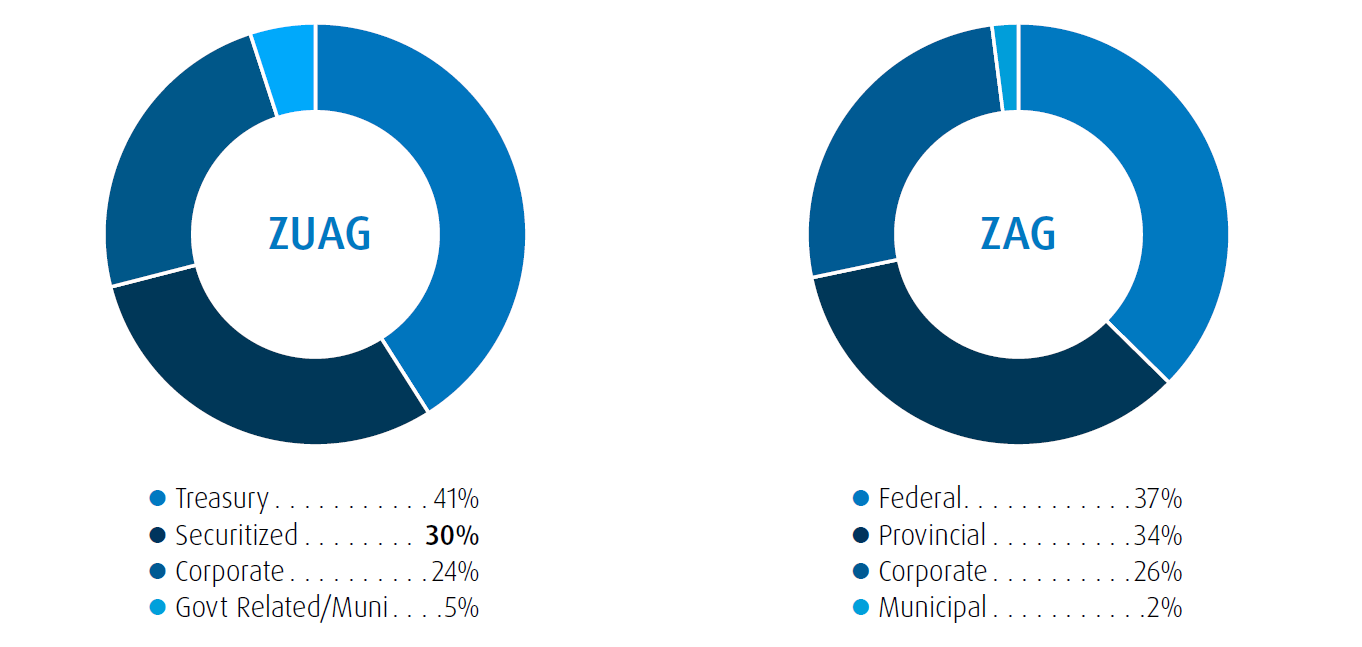

ZUAG vs ZAG Holdings Breakdown

As at January 31, 2023

The US fixed income market is broader than Canada providing more diversification to corporates and 30% weight in securitized debt.

The securitized sector is designed to capture fixed income instruments whose payments are backed or directly derived from a pool of assets that is protected or ring fenced from the credit of a particular issuer (either by bankruptcy remote special purpose vehicle or bond covenant). Underlying collateral for securitized bonds can include residential mortgages, commercial mortgages, public sector loans, auto loans or credit card payments.

There are four main sub-components of the securitized sector: MBS (AAA Rated), ABS, CMBS and Covered.

* The Management Expense Ratio is an estimate only since the fund is less than one year old.

† Yield to Maturity: The market value weighted average yield to maturity includes the coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Risk tolerance measures the degree of uncertainty that an investor can handle regarding fluctuations in the value of their portfolio. The amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult their financial advisor before making a decision as to whether this Fund is a suitable investment for them.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.