Fixed Income: Identifying Non-Traditional Exposures Amid Rising Rates

As family offices and investment counsellors contend with a complex interest rate environment, Laura Tase, Director, Institutional & Advisory, BMO ETFs, shares her thoughts on how you can complement traditional fixed income assets by including low correlation funds in your portfolios.

Apr. 19, 2022Seeking Non-Traditional Yield

In a low-but-rising interest rate environment, yield opportunities are few and far between. Exposure to longer duration bonds, which would normally provide a higher level of income, often become a liability due to their higher interest rate sensitivity. In addition, correlations between equity and fixed income tend to increase in times of heightened volatility, and as we know, markets have recently been contending with not one but many different headwinds, from high inflation to the Russia-Ukraine war. As a result, exploring non-traditional fixed income is a way for investors to diversify their portfolios and potentially capture better risk-adjusted returns in the future.

In this article, we identify four strategies that can complement a traditional core fixed income allocation: (See Appendix 1 – Correlations Matrix).

1. Canada Preferred Shares

Despite having both equity and fixed income characteristics, Canadian preferred shares have historically demonstrated low correlation to traditional holdings,1 which makes them a great portfolio diversifier. This asset class also offers the advantage of rate resets that can make portfolios more adaptable in a rising rate environment; the securities simply need to be “laddered” in the same way as GICs or bonds, such that a portion of the portfolio’s dividends are reset each year to reflect current rates. (i.e., by evenly dividing the portfolio by calendar years or term buckets.)

However, family offices and investment counsellors may find it inefficient to trade individual preferred shares given the notorious liquidity and inventory constraints. It can also be draining to take on the responsibility of laddering yourself, as the process requires a specific kind of expertise to stagger the rate resets and continually maintain the right balance of exposures.

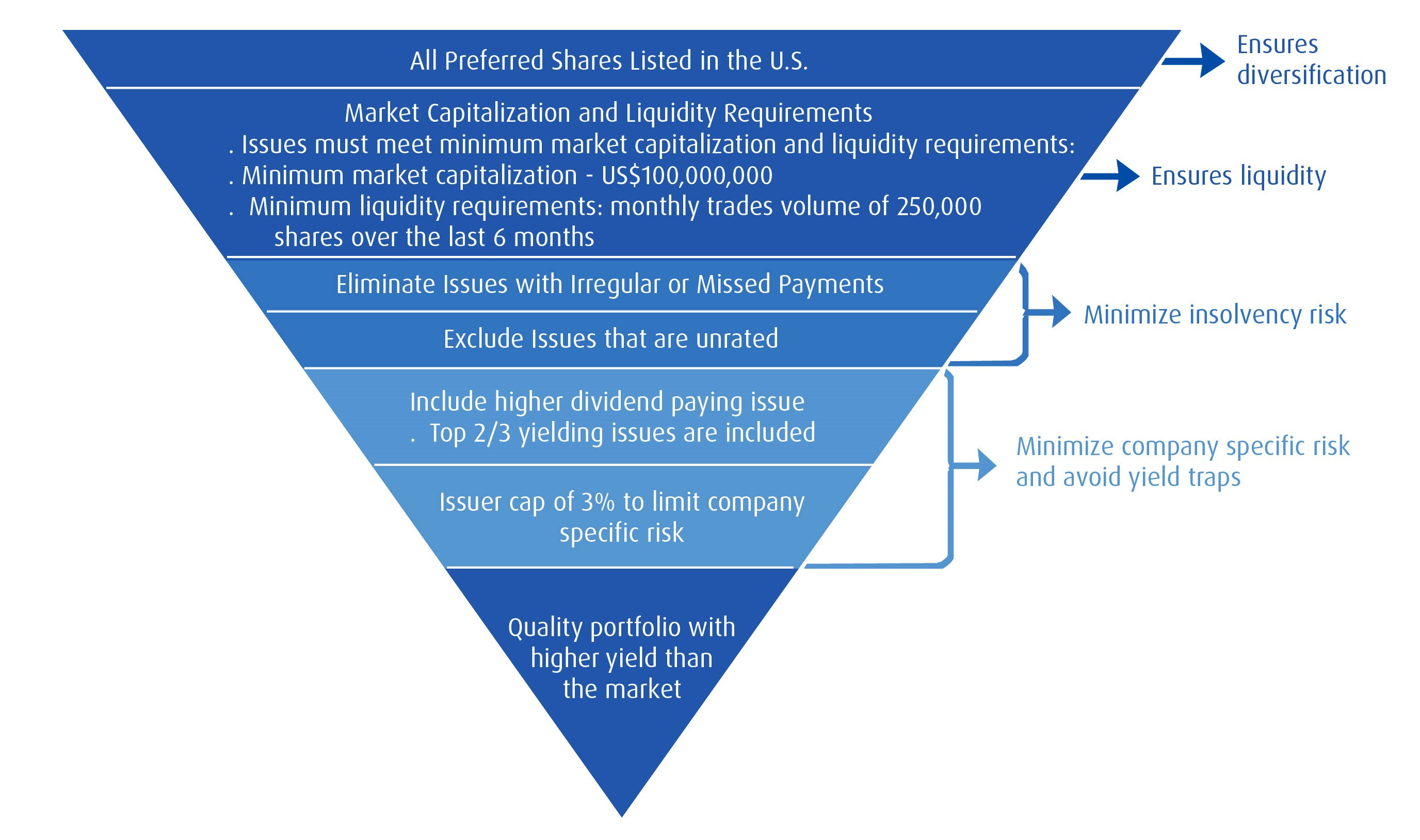

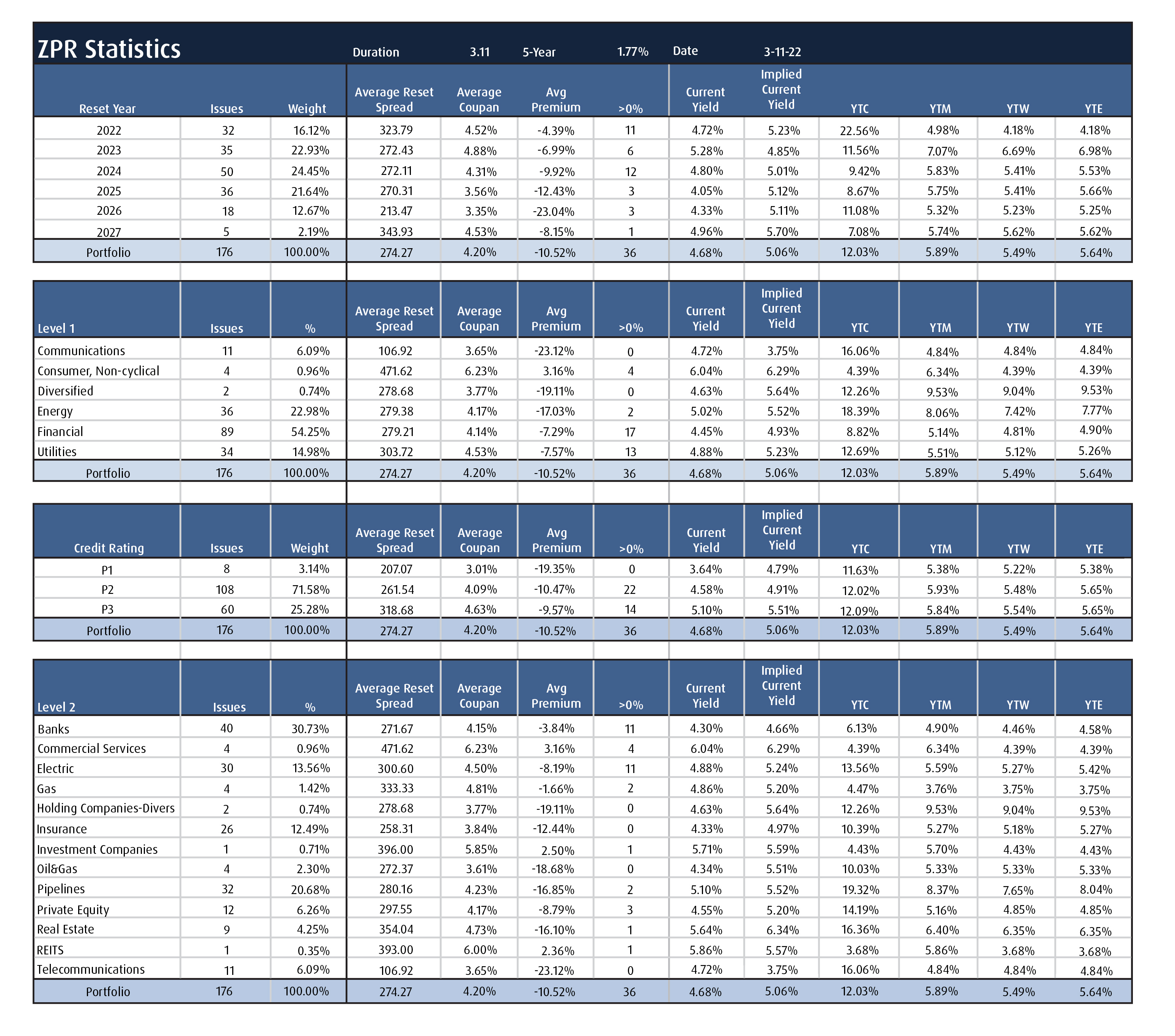

Using an ETF to access preferred shares solves many of these problems. For instance, the BMO Laddered Preferred Share Index ETF (Ticker: ZPR) offers a laddered structure with a 5-year rate reset, with 20% of the portfolio turning over each year. This fund is one of the most actively traded preferred share ETFs in Canada, with a secondary market liquidity that allows it to trade at tight bid-offer spreads.2 If you already own individual preferred shares but are concerned about a lack of liquidity, you can swap your shares for units of ZPR (Appendix 2: ZPR Metrics).

2. US Preferred Shares

Although the core benefits are similar, US preferred shares do have unique characteristics compared to their Canadian counterparts: they provide higher dividends, more diversified credit exposure, and, in general, less volatility than their northern cousins. In fact, the majority of US preferrZHPeds are perpetual, issued at wider spreads and callable after 2 years, which makes them less sensitive to interest rate changes and hence more similar to a credit product.

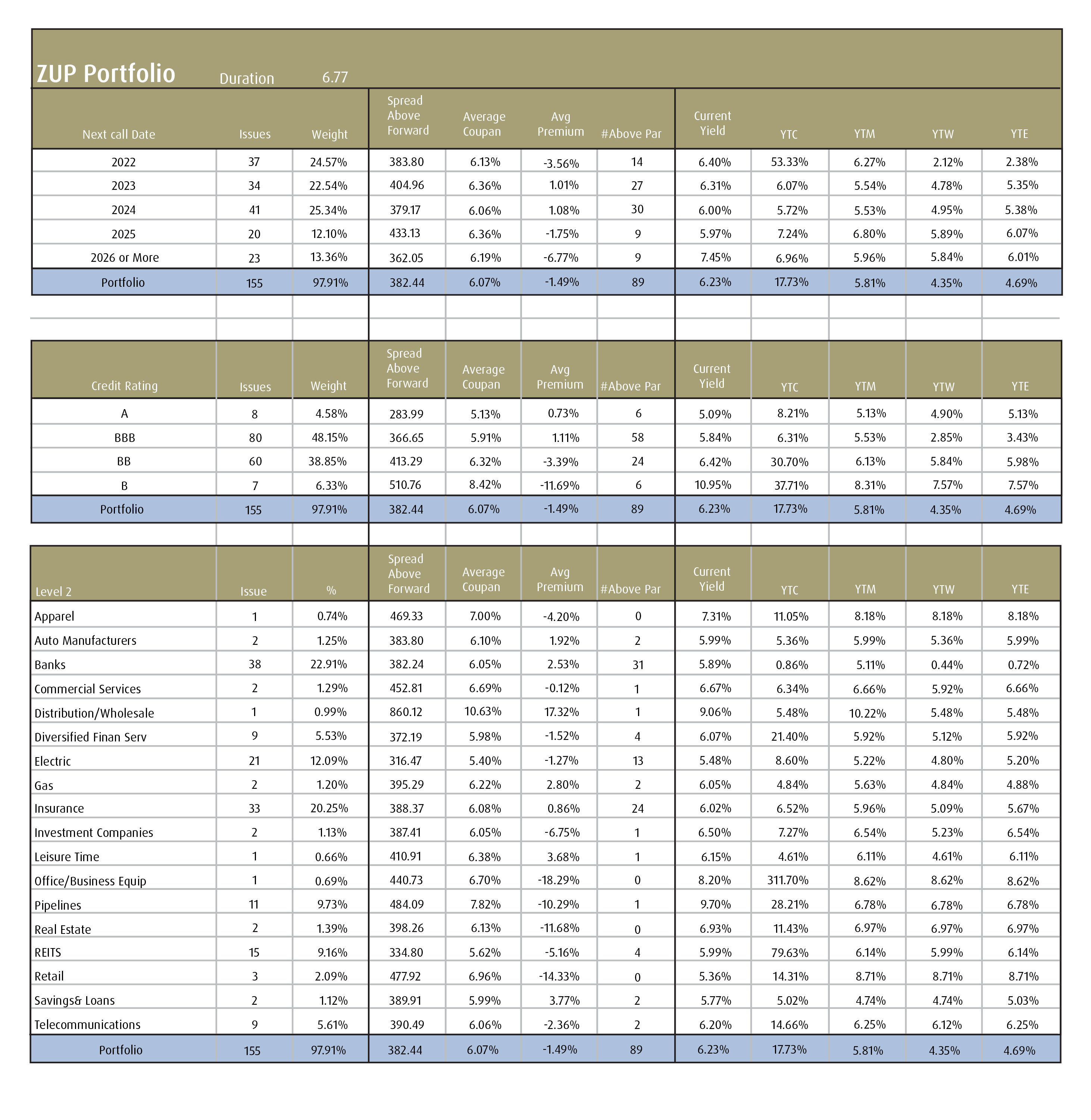

Moreover, US preferreds tend to have low correlation to bonds, equities and cash. As with Canadian preferreds, they can be a difficult asset class to trade for Canadian investors; however, ETFs provide easy access to a basket of assets with enhanced liquidity. But what about currency considerations? We understand that investors have a wide range of views on the U.S. dollar (USD) and Canadian dollar (CAD), and that those perspectives are subject to change as market conditions evolve. So, to account for different strategies, the BMO US Preferred Share Index ETF is available in three versions: hedged to CAD (Ticker: ZHP), unhedged (Ticker: ZUP) and US dollar units (Ticker: ZUP.U).

The BMO US Preferred Share ETF employs a smart beta approach that aims for quality over quantity: It starts with the US preferred share universe and narrows down the investable universe with screens for liquidity, solvency and company-specific risks. By going beyond a traditional market capitalization filter, the portfolio is able to weed out yield traps and consolidate a basket of quality assets that generate a higher yield than the market. (Appendix 3: ZUP Metrics)

3. Canadian Bank Income

Investors looking for the diversification benefits of preferred shares combined with the defensive characteristics of high-quality bonds should consider the new BMO Canadian Bank Income Index ETF (Ticker: ZBI). This solution may be particularly attractive to institutional investors and municipalities who are limited by an issuer’s credit quality when building a fixed income portfolio.

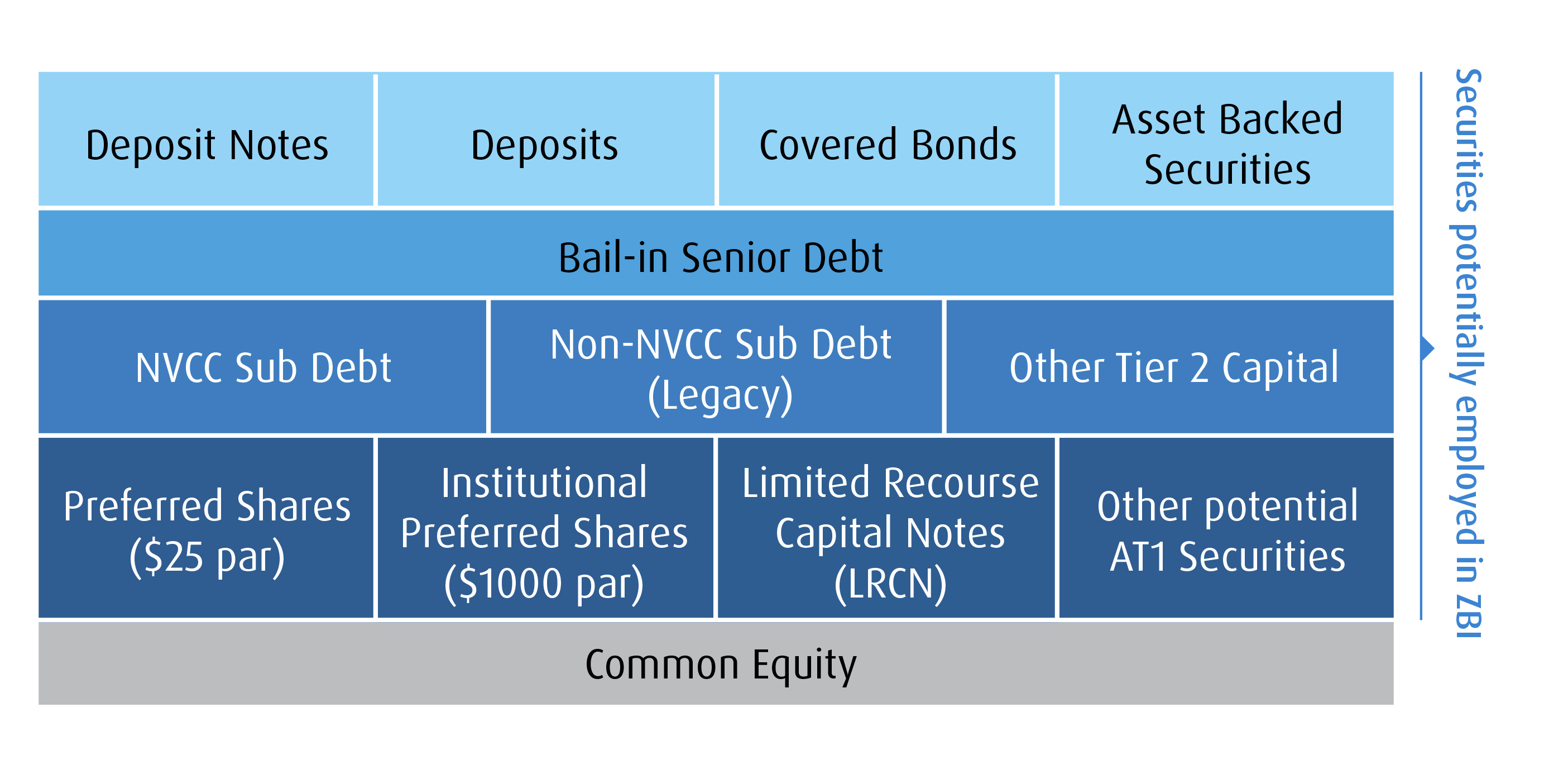

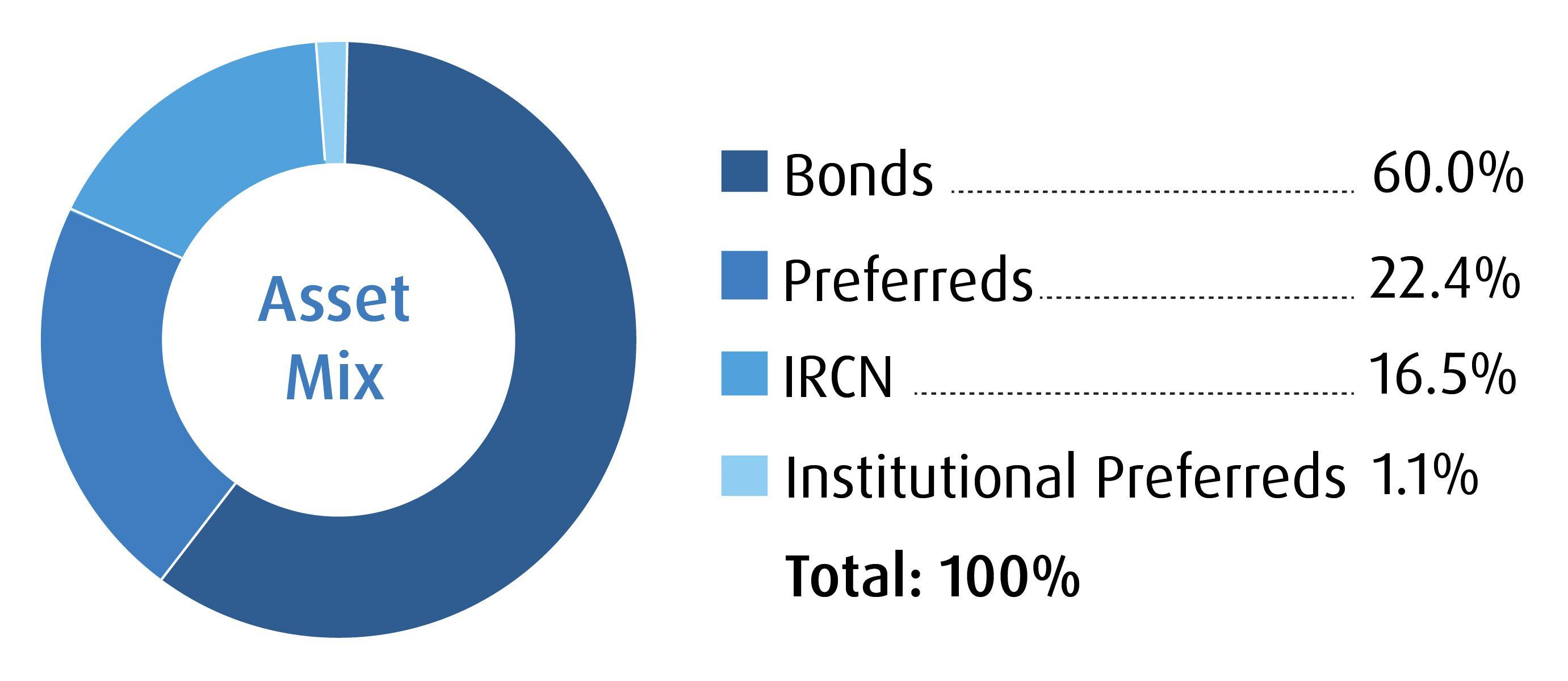

ZBI consists of debt higher up in the capital structure of Canadian banks, along with subordinate issues such as preferred shares, institutional preferred shares and limited recourse capital notes (LRCNs). It provides access to every fixed income stream available from the big banks. Investors can therefore generate appreciable yields while also achieving the capital preservation that’s characteristic of bonds, all backed by the quality and soundness of Canada’s “big six.” The banks also tend to issue primarily on the short end, making this a short-duration offering, with the preferreds and LRCNs providing protection against rising rates with enhanced yields.

Bank Capital Structure Hierarchy (“Capital Stack”)

Chart illustrates capital instruments that banks employ and their hierarchy in the “capital stack,” which determines its priority in repayment, risk and thus expected return and yield.

Portfolio Characteristics

| Current Yield: | 3.11% |

| YTM: | 2.71% |

| Coupon: | 3.07% |

| Duration: | 2.54 |

| Ave Credit Rating: | A |

Source: BMO Global Asset Management, January 31, 2022.

4. Private Debt

Asset owners and large institutional investors look at private debt as a portfolio diversification tool, however this may not be achievable for many family offices and investment counsellors due to a lack of liquidity and acceptable benchmarks, the latter making it difficult to measure correlations.

Fortunately, there are liquid strategies that can be used as proxies for private credit. The BMO Floating Rate High Yield ETF (Ticker: ZFH), for example, provides exposure to U.S. high yield credit while minimizing duration sensitivity. It employs a unique approach that isolates duration and credit risk in order to better control and target a specific risk profile.

To minimize interest rate risk, ZFH currently invests in short-term Canadian Treasury-bills (T-Bills) with an approximate duration of 90-days. In a rising interest rate environment, this means the ETF can reset and invest at a higher rate as each T-Bill matures. For high-yield credit exposure, ZFH currently utilizes a derivative strategy via a credit default swap (CDS). The CDS allows investors to earn a coupon in exchange for taking on the credit risk (or risk of default) of the underlying issuers. The ETF will short CDX and invest the proceeds in 90-day T-Bills.

| The upshot: Exposure to a CDS provides investors with several benefits, including central clearing, liquidity, pricing transparency, counterparty assurance and regulatory oversight. |

Conclusion

In a very challenging yield environment, fixed income diversification is one of the key tools that investors have to balance risk versus reward. Some of the asset classes that can provide this diversification are difficult to access and manage – making ETFs a critical tool to provide the liquidity, transparency and ease of trading that’s needed to navigate today’s market. By working collaboratively, we can assist you in determining which funds would be best suited for your portfolios.

Please contact your BMO ETF Specialist for more information. Our Portfolio Managers are also available to help with trading insights. They can also be reached at 1−877−741−7263.

Disclosures:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the authors represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. The statistics in this update are based on information believed to be reliable but not guaranteed.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence.