Listed Infrastructure: Inflation Protection to Safeguard Your Clients’ Portfolios

As runaway inflation erodes investors’ yield and portfolio returns, Laura Tase, Director, Institutional & Advisory, BMO ETFs, outlines a defensive tool that can protect against rising rates and deliver valuable diversification — all within a single trade.

Jul. 20, 2022A safe haven from inflation?

A common concern shared by many investors today is the surge of inflation and its corrosive impact on both yield and long-term returns.

Inflation, by its very nature, causes erosion in fixed income assets by forcing the central banks’ hand to raise interest rates, which in turn lowers bond prices and cools down demand. Equities have also been weakened in the current environment, as the market continues to assess whether tighter monetary policy will lead to a “soft landing” or a full-blown recession. Where can investors find a safe haven?

Listed infrastructure has emerged as an attractive solution in light of the particular mix of challenges investors are facing. Owing to the rare combination of high inflation and slowing economic growth, we’ve seen growing demand for alternative asset classes that can offer predictable yield, some level of inflation protection, and low correlation to other holdings in the portfolio. Companies with their own physical infrastructure assets have historically been able to deliver on all three criteria more efficiently and reliably than the broad market.

The long tailwinds for infrastructure demand

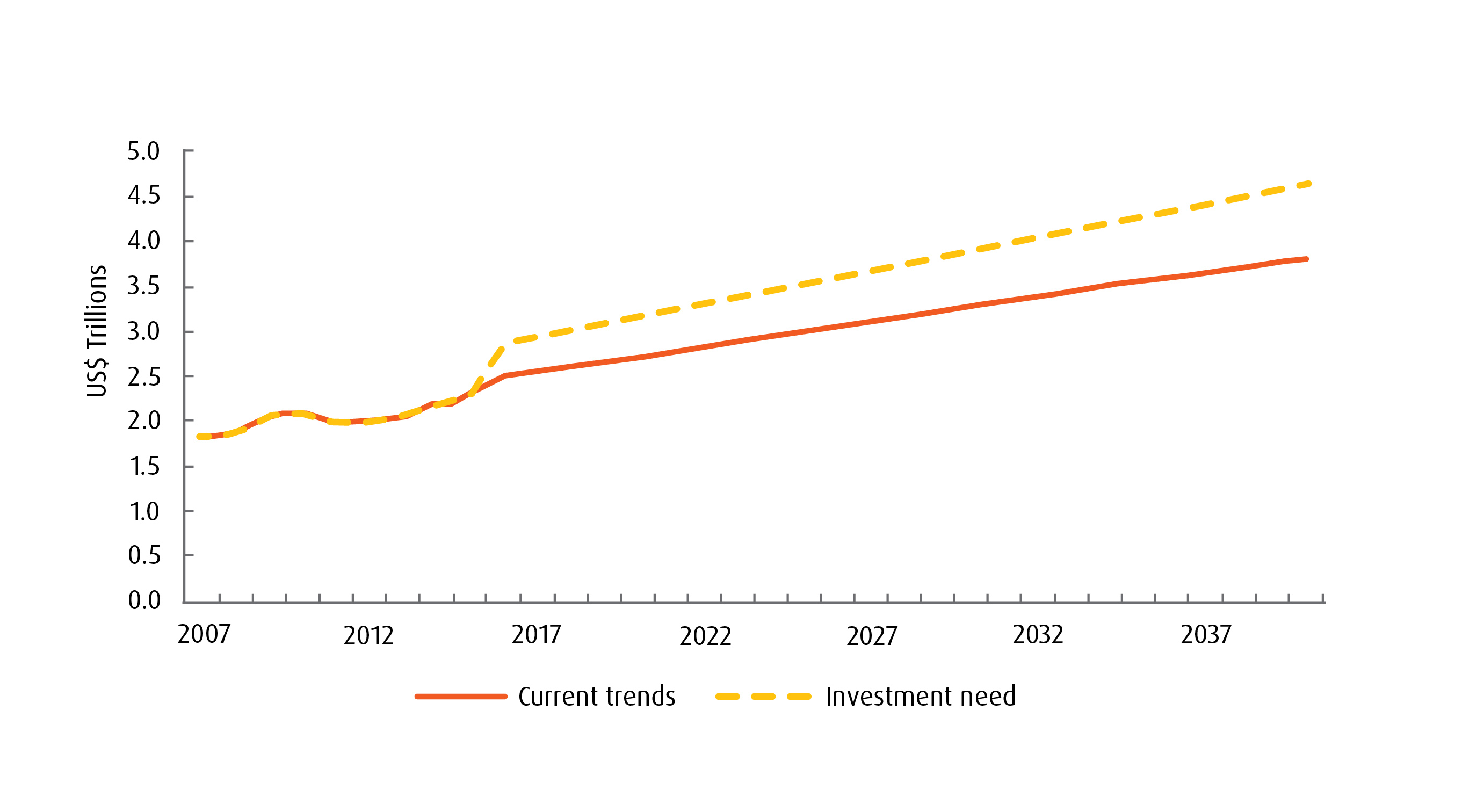

Broadly speaking, a widening global infrastructure gap has developed over the past 20 years due to under-investment by the public sector in its aging assets. For example, G20 countries are expected to face a substantial investment gap over the coming decades, with the current shortfall estimated to reach US$15 trillion by 2040.1 Examples of these heightened expenditures include the following:

- The US$1.2 trillion INVEST in America Act highlights the significance of this issue. This cash infusion in areas like electric utilities, road and bridge construction, owners/operators of railroads and cellular towers will create opportunities for investors.

- The Canada Infrastructure Bank was established in 2017 to provide financial support for domestic infrastructure projects. It plans to invest $35 billion over eleven years in revenue-generating projects.

Exhibit 1: G20 infrastructure investment – current trends and investment needs, 2007-2040

This reinforces the growth theme of this asset class over the near to long term, and the volume of the dollars that will be attracted to this sector. These public programs will also be supplemented with a variety of ongoing demands for new infrastructure, such as:

- Technological change

- Environmental-related developments (including those related to the elimination of fossil fuels)

- Demographic megatrends like rapid urbanization and population growth, which will put additional pressure on existing infrastructure.2

The climate is ripe for sizable investments in this sector over the coming years.

Key benefits of infrastructure assets

A primary strength of infrastructure is its ability to provide inflation protection for investors. Many companies in this sector have pricing power, giving them resilience in today’s inflationary times to pass on their higher costs to their clients, thus maintaining their margins and profitability. Indeed, when prices increase, infrastructure’s performance is expected to remain relatively neutral.3

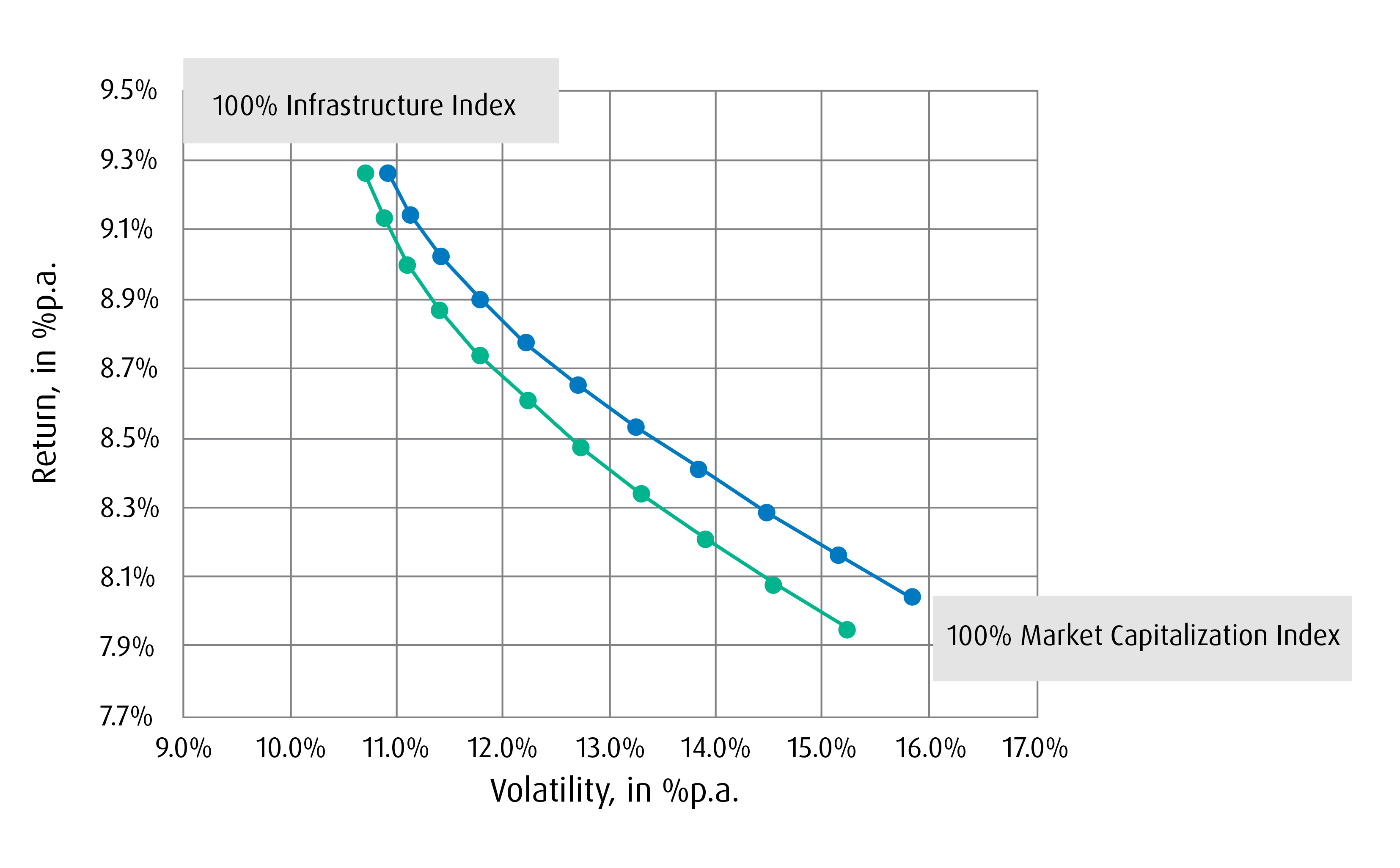

One can’t discuss infrastructure without mentioning the positive effect it has as a diversification tool. These assets have had a low correlation of 0.59 to broader global equities markets over the past decade, as represented by the MSCI World Index.4 Thus, they can provide a suitable complement to equities in your clients’ portfolios, in addition to delivering stronger risk-adjusted returns.5

Exhibit 2: Risk/return profile of hypothetical blended infrastructure and market capitalization portfolios

Additionally, listed infrastructure is characterized by providing downside risk mitigation and upside participation, which is highly relevant for investors today. As of December 2020, these assets have captured 30% of global equity market downside while capturing more than 60% of the upside, potentially helping to reduce overall portfolio volatility6. Given the current uncertainty, this will appeal to many family offices and investment counsellors.

Investing in infrastructure: Private equity vs. listed securities

From an investment perspective, infrastructure and real assets have experienced considerable growth as an asset class in recent years. This has been due to a growing awareness among investors to its many positive attributes, as we noted earlier. In addition, many investors are familiar with the potential it offers as a more reliable source of high and stable income and dividend yields.7

Large institutional investors and pension plans have long coveted global infrastructure for a variety of reasons, and have been well equipped to own these assets directly via private equity. This often represents the bulk of the money they invest in the sector. The size of these deals often aligns with the large pool of assets these money managers oversee, and the reality – particularly early on – that private assets were more readily available than those in the public sphere.

For most family offices and investment counsellors, investing in private equity isn’t a practical option for a variety of reasons. For one, they often don’t have the necessary resources to invest in these securities. In addition, many are uncomfortable with the lack of liquidity and pricing transparency, which adds complexity to the investment process.

That’s where listed infrastructure and ETFs can provide a viable alternative, one that offers the intraday liquidity and pricing transparency, among other things. In fact, in recent years there has been considerable growth in the availability of infrastructure assets as listed securities. This has helped to propel this sector and open it up to new investors.

Why invest in infrastructure via ZGI?

When looking to invest in infrastructure, ETFs like the BMO Global Infrastructure Index ETF (ticker: ZGI) offer an efficient, one-ticket solution. ZGI invests strictly in large cap securities with a minimum market cap of US$500 million and a minimum average 3-month daily trading volume of US$1 million. This provides added stability and predictability for investors.

Additional features of this fund include the following:

- Invests in globally listed companies who own and operate the many physical assets providing essential services required in today’s society (ex. toll roads, cell towers, water purification and distribution, electricity transmission and distribution, oil and gas storage and transportation).

- The current top holding in the fund (at June 20, 2022) is American Tower Corp., a REIT that’s a global owner-operator of wireless and broadcast communications infrastructure.

- More than 70% of a holding’s cash flow must be derived from the development, ownership, lease or management of infrastructure assets, making this a true “pure-play” solution.

- Listed infrastructure like ZGI have historically delivered attractive income-derived total returns through market cycles due to predictable income and cash flow growth. The revenue stream for these securities tends to be long-term by definition.

- ZGI has regularly offered a higher yield relative to broad global equities.8

- Infrastructure assets held in ZGI often benefit from being monopolies with relatively inelastic demand, which explains why their cash flows are more stable and predictable.

- The betas for these assets also tend to be lower, adding another positive element with current market volatility.

- ZGI has performed particularly well during periods of market corrections, relative to broader equities, offering a strong defensive position in down markets while delivering appreciable returns when markets are up (see Exhibit 3 below).

- 70% of ZGI’s assets are invested in U.S.-based, pure-play infrastructure companies and thus should benefit from Biden’s Invest in America Act.

- As noted by CIBC World Markets, a small allocation to ZGI resulted in a higher Sharpe ratio for the portfolio over a 12 – year period9.

- They also found that allocating a small percentage of a North American equity portfolio to ZGI helped to improve the portfolio’s yield while reducing its volatility.

- This single-ticket solution provides simplicity and efficiencies for family offices and investment counsellors, and at a lower cost.

Conclusion

As family offices and investment counsellors strive to protect their clients from inflationary pressures and the current market volatility, they can turn to listed infrastructure assets – and to ZGI in particular – as a viable solution. These securities can offer inflation protection, diversification and reliable income, plus a defensive strategy with downside protection and upside participation. With tailwinds looking to favour this sector over the coming years for a variety of reasons, investors have a compelling case to include these assets in their portfolios going forward.

Please contact your BMO ETF Specialist for more information. Our Portfolio Managers are also available to help with trading insights. They can also be reached at 1−877−741−7263.

1 “Using Infrastructure ETFs As A Portfolio Diversifier”, CIBC Capital Markets, April 25, 2022.

2 Megatrends: Rapid urbanization, Blackrock.

3 “Practical considerations for listed infrastructure”, FTSE Russell, June 2019.

4 Bloomberg, as of June 30, 2022.

5 “Practical considerations for listed infrastructure”, FTSE Russell, June 2019.

6 Dow Jones Brookfield Global Infrastructure Total Return Index vs. MSCI World total return, 10 years to December 31, 2020.

7 “Practical considerations for listed infrastructure”, FTSE Russell, June 2019.

8 “A good time to invest in listed infrastructure”, BMO Global Asset Management, September 2021.

9 “Using Infrastructure ETFs as a Portfolio Diversifier,” CIBC Equity Research, April 25, 2022.

Disclosures:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the authors represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. The statistics in this update are based on information believed to be reliable but not guaranteed.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.