Considerations for accessing international markets through ETFs

Many asset managers and investment council firms are well-versed in Canadian stock picking and build their brands through those picks. But these same firms are often challenged by the depth of research and expertise needed to reliably maximize returns on international investments.

Jul. 1, 2021Many asset managers and investment council firms are well-versed in Canadian stock picking and build their brands through those picks. But these same firms are often challenged by the depth of research and expertise needed to reliably maximize returns on international investments.

For instance, many of these asset managers will only focus on large cap stocks, neglecting small- and mid-cap securities that can be highly profitable for investors.

This isn’t necessarily the wrong choice, however, as asset managers should indeed continue to play to their strengths and not compromise their brands by investing in securities outside the scope of their expertise.

ETFs can be a complementary tool for precisely this reason: they offer easy and specific access to international markets (U.S., Europe, Australia, and the Far East (EAFE)) and emerging markets.

With ETFs, investors get instant diversification, simplified rebalancing, and the liquidity they need to change their allocation based on their market views and risk tolerance.

In addition, one of the key benefits that ETFs can provide is the ability to avoid punitively high U.S. estate taxes for high net-worth clients.

Family offices and investment counsel firms typically manage assets of high and ultra-high net worth individuals — individuals who also typically have many U.S. situs assets and hold a good portion of their wealth in U.S. dollars.

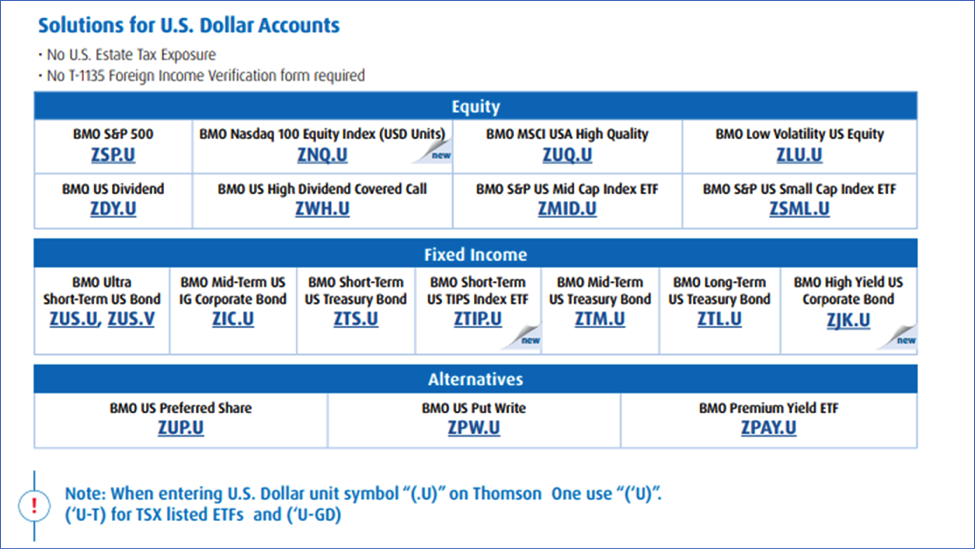

Canadian-listed, U.S-dollar-denominated ETFs allow investors to keep the assets in U.S. currency while avoiding U.S. Estate Tax exposure as well as the T1135 reporting to the Canada Revenue Agency that is often required for international investing. (See our U.S. estate taxes brochure for more details.)

Take ZSP.U (BMO S&P500) as an example. With a MER of 0.08%, that will end up being far less costly than potential U.S. Estate Taxes. The U.S.-listed ETF SPY, by contrast, while holding the same stocks, exposes Canadian investors to a potentially heavy U.S. estate tax burden.

To provide you choice in your portfolio construction, BMO ETFs now offers 19 U.S.-dollar-denominated funds, which is more than any other ETF provider in Canada.

Here are a few more details of how U.S. estate taxes can reduce your overall investment return:

- High net-worth Canadian residents’ estates with U.S. assets with a value that exceeds US$60,000 and US$11.7 million (in 2021) in worldwide assets may be required to pay U.S. estate tax on the value of their U.S. assets.

- If the value of your worldwide estate is not greater than US$11.7 million, you will not be subject to U.S. estate tax (in 2021). However, if the value of your U.S. assets is greater than US$60,000, your estate must file a U.S. estate tax return even though you will not have an estate tax liability.

- The tax rate starts from 18% and moves up to 40% for investors with U.S. assets exceeding US$1 million.

- Most U.S. stocks, U.S. real property, and some U.S. debt securities will be subject to U.S. estate tax.

The end result is that wealthy Canadians concerned about U.S. estate taxes have a suitable vehicle that allows for U.S. exposure, while avoiding those taxes via a Canadian-listed ETF or mutual fund.

Remember that Canadian mutual funds and Canadian-listed ETFs (even if they invest in U.S. equity or debt securities) are generally not considered to be U.S. assets for estate tax purposes, creating a best-of-both-worlds scenario: U.S. asset exposure without punitive U.S. estate tax.

A final note to consider when purchasing ETFs for international exposure is how the ETF is structured.

Many Canadian-listed ETFs that provide exposure to international markets wrap a U.S.-listed ETF.

It’s advised that your Canadian-listed EAFE or emerging markets ETFs own the stocks directly instead of wrapping a U.S.-listed ETF. In the wrapped structure, you will be exposed to two layers of withholding tax: the U.S. level and international level. When held outside registered plans, the US withholding tax is recoverable as a foreign tax credit, but the other level is not recoverable.

All things being equal, if you have to decide between two ETFs that track identical or similar indexes with the same MER, the ETF that directly holds these securities will produce higher after-tax returns in the long run by avoiding those extra withholding taxes.