BMO Buffer ETFs: Staying invested in an uncertain world

Jul. 2, 2025The S&P 500 has sharply rebounded since the April lows, leaving many investors questioning the outlook for U.S. equities. Just months ago, sweeping tariffs announced April 2 by the White House on “Liberation Day” rattled markets and triggered painful drawdowns — leaving a mark on investor confidence.

There are valid reasons to remain cautious. Escalating geopolitical tensions in the Middle East and uncertainty surrounding U.S. trade policy are clouding the inflation and global growth outlook. And although the U.S. economy has shown resilience, early signs of weakening are beginning to emerge — such as a steadily rising unemployment rate. These risks contribute to investor anxiety, especially when considering how and when to deploy capital.

Given the challenges of market timing and risk of not keeping up with inflation, rather than sitting on the sidelines waiting for the “perfect” entry point, BMO Buffer ETFs offer a disciplined way to phase capital into an equity allocation and then remain positioned through periods of heightened uncertainty.

BMO Buffer ETFs ̶ refresher

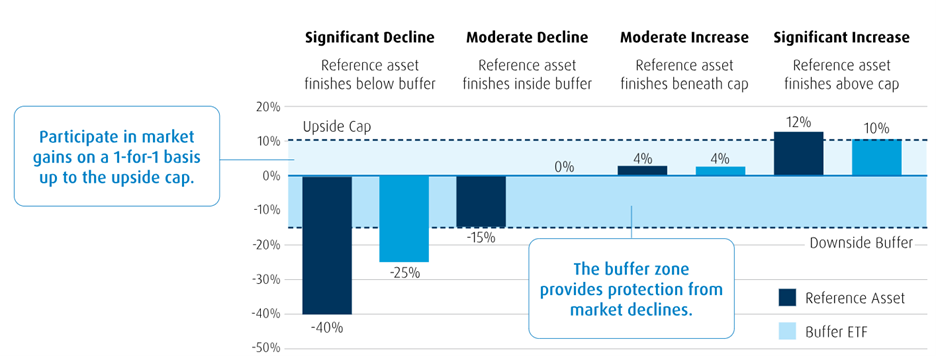

Launched in early 2024, BMO’s Buffer ETF suite allows investors to participate in U.S. equity market upside up to a defined cap while aiming to protect against the first 15% of losses over a targeted outcome period (for example, one year).

If markets decline up to 15% (before fees, expenses, and taxes), a built-in “buffer” absorbs the loss, helping preserve capital. The ETF’s underlying asset is BMO S&P 500 Hedged to CAD Index ETF (ticker: ZUE), allowing investors to benefit from dividend income as well as market growth (up to the cap).

Chart below illustrates how the fund can provide downside protection and upside participation.

BMO Global Asset Management. For illustrative purposes only.

BMO US Equity Buffer Hedged to CAD ETF – July

July 2nd anniversary date

On July 2, 2025, the BMO US Equity Buffer Hedged to CAD ETF – July (ticker: ZJUL) reached its one-year anniversary. Over the past year, ZJUL delivered on its mandate — offering broad market upside participation with approximately half the volatility.

Period July 2, 2024̶ July 2, 2025 |

||

ZJUL – BMO US Equity Buffer |

ZUE – BMO S&P 500 |

|

Return |

8.74% |

12.51% |

Standard Deviation |

8.93% |

18.66% |

Max Drawdown |

-8.60% |

-19.05% |

Source: Morningstar, BMO Global Asset Management as of July 2, 2025

Past Performance is not indicative of future results.

The anniversary also marked the reset of ZJUL’s structured outcome: an 8.30% upside cap (with dividends on top) and a 15% downside buffer. Investors who hold the ETF through the full outcome period can benefit from this defined risk-return profile.

This reset presents an ideal opportunity to reassess client portfolios and position them for a potentially more volatile market ahead.

Portfolio positioning ideas

Strategic allocation:

Long-term investors may consider a diversified approach — equal-weighting Buffer ETFs across different reset periods. This strategy can smooth returns, offer a consistent level of downside protection, and reducing the need for frequent rebalancing thus minimizing trading costs.

80/20 Allocation Example:

During the previous outcome period — including April’s significant volatility — a portfolio composed of 80% BMO Buffer ETFs (equally weighted across the suite) and 20% ZUE produced the most optimal mix. This approach blends the broad market with the embedded risk management of the buffer ETFs:

|

Fund Name |

Weight |

|

BMO US Equity Buffer Hedged to CAD ETF – January (Ticker: ZJAN) |

20% |

|

BMO US Equity Buffer Hedged to CAD ETF – April (Ticker: ZAPR) |

20% |

|

BMO US Equity Buffer Hedged to CAD ETF – July (Ticker: ZJUL) |

20% |

|

BMO US Equity Buffer Hedged to CAD ETF – October (Ticker: ZOCT) |

20% |

|

BMO S&P 500 Hedged to CAD ETF - (Ticker: ZUE) |

20% |

|

80/20 Portfolio Performance: July 2 2024 - July 2, 2025 |

|

|

Return |

8.19% |

|

Standard Deviation |

11.90% |

|

S&P 500 Hedged to Canadian Dollars Index |

|

|

Return |

12.85% |

|

Standard Deviation |

23.3% |

Source: Bloomberg, BMO Global Asset Management as of July 2, 2025

Standard Deviation: A measure of risk in terms of the volatility of returns. It represents the historical level of volatility in returns over set periods. A lower standard deviation means the returns have historically been less volatile and vice-versa. Historical volatility may not be indicative of future volatility.

Model portfolio performance is shown for illustrative purposes only. Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

Tactical opportunity:

Advisors can tactically roll current Buffer ETF holdings into a newly reset ZJUL, to reoptimize their portfolio hedge. With BMO’s Structured Outcome Tool investors can determine which buffer option to trade into that currently offers them the best downside and upside potential to meet your needs.

A roll over can lock in profits and monetize current hedges while extending the duration of portfolio protection, putting a floor at current market levels. The closing price of the underlying asset ZUE was $84.71 at the time of reset, with a new target outcome period of July 1, 2025 – June 30, 2026 for ZJUL.

Bottom line

BMO Buffer ETFs offer a compelling solution to meet a variety of investor needs. Ideal for those seeking to reduce equity risk and are perhaps nearing retirement or have done well with U.S. equities and looking to lock in gains and increase downside protection. Another case may be if you are concerned about inflation and don’t want to be overly exposed to bonds and need to bridge that risk and return gap. And finally, for clients looking to ease back into equities and have cash sitting on the sidelines, buffer ETFs are worth considering.

With ZJUL’s reset offering a new 8.30% cap and 15% buffer, July can be an opportune time to phase in new money or extend protection for existing positions. In an uncertain world, staying invested with a buffer may provide the peace of mind many investors need.

Performance (%)

Ticker |

Year-to-date |

1-month |

3-month |

6-month |

1-year |

3-year |

5-year |

10-year |

Since inception |

ZJAN |

3.30 |

1.99 |

4.48 |

3.30 |

7.67 |

- |

- |

- |

12.84 |

ZAPR |

1.69 |

1.26 |

3.24 |

1.69 |

6.88 |

- |

- |

- |

10.04 |

ZJUL |

4.36 |

2.41 |

5.39 |

4.36 |

8.98 |

- |

- |

- |

8.62 |

ZOCT |

3.40 |

2.00 |

4.55 |

3.40 |

6.68 |

- |

- |

- |

17.11 |

ZUE |

5.13 |

4.85 |

10.28 |

5.13 |

13.06 |

17.75 |

14.97 |

11.97 |

13.93 |

Bloomberg, as of June 30, 2025. Inception date for ZJAN = January 24, 2024, ZAPR = March 26, 2024, ZJUL = June 27, 2024, ZOCT = September 27, 2023, ZUE = May 29, 2009.

Past Performance is not indicative of future results.

Disclaimers

Advisor Use Only.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed represent an assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

An investor that purchases Units of a Structured Outcome ETF other than at starting NAV on the first day of a Target Outcome Period and/or sells Units of a Structured Outcome ETF prior to the end of a Target Outcome Period may experience results that are very different from the target outcomes sought by the Structured Outcome ETF for that Target Outcome Period. Both the cap and, where applicable, the buffer are fixed levels that are calculated in relation to the market price of the applicable Reference ETF and a Structured Outcome ETF’s NAV (as Structured herein) at the start of each Target Outcome Period. As the market price of the applicable Reference ETF and the Structured Outcome ETF’s NAV will change over the Target Outcome Period, an investor acquiring Units of a Structured Outcome ETF after the start of a Target Outcome Period will likely have a different return potential than an investor who purchased Units of a Structured Outcome ETF at the start of the Target Outcome Period. This is because while the cap and, as applicable, the buffer for the Target Outcome Period are fixed levels that remain constant throughout the Target Outcome Period, an investor purchasing Units of a Structured Outcome ETF at market value during the Target Outcome Period likely purchased Units of a Structured Outcome ETF at a market price that is different from the Structured Outcome ETF’s NAV at the start of the Target Outcome Period (i.e., the NAV that the cap and, as applicable, the buffer reference). In addition, the market price of the applicable Reference ETF is likely to be different from the price of that Reference ETF at the start of the Target Outcome Period. To achieve the intended target outcomes sought by a Structured Outcome ETF for a Target Outcome Period, an investor must hold Units of the Structured Outcome ETF for that entire Target Outcome Period.

All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ prospectus.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value (NAV). The yield calculation does not include reinvested distributions.

Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and NAV fluctuations.

The payment of distributions should not be confused with the BMO ETF’s performance, rate of return or yield. If distributions paid by a BMO ETF are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO ETF, and income and dividends earned by a BMO ETF, are taxable in your hands in the year they are paid.

Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Cash distributions, if any, on units of a BMO ETF (other than accumulating units or units subject to a distribution reinvestment plan) are expected to be paid primarily out of dividends or distributions, and other income or gains, received by the BMO ETF less the expenses of the BMO ETF, but may also consist of non-taxable amounts including returns of capital, which may be paid in the manager’s sole discretion. To the extent that the expenses of a BMO ETF exceed the income generated by such BMO ETF in any given month, quarter, or year, as the case may be, it is not expected that a monthly, quarterly, or annual distribution will be paid. Distributions, if any, in respect of the accumulating units of BMO Short Corporate Bond Index ETF, BMO Short Federal Bond Index ETF, BMO Short Provincial Bond Index ETF, BMO Ultra Short-Term Bond ETF and BMO Ultra Short-Term US Bond ETF will be automatically reinvested in additional accumulating units of the applicable BMO ETF. Following each distribution, the number of accumulating units of the applicable BMO ETF will be immediately consolidated so that the number of outstanding accumulating units of the applicable BMO ETF will be the same as the number of outstanding accumulating units before the distribution. Non-resident unitholders may have the number of securities reduced due to withholding tax. Certain BMO ETFs have adopted a distribution reinvestment plan, which provides that a unitholder may elect to automatically reinvest all cash distributions paid on units held by that unitholder in additional units of the applicable BMO ETF in accordance with the terms of the distribution reinvestment plan. For further information, see the distribution policy in the BMO ETFs’ prospectus.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.