BMO Long-Short Strategy ETFs Sales Aid

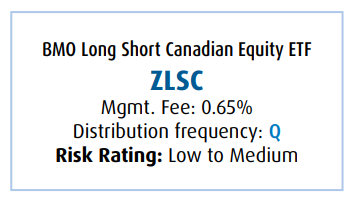

Investment Options

|  |

Strategy Overview

A long-short strategy is a popular alternative strategy that has been traditionally used by hedge funds that combines long and short positions within a portfolio to capitalize on rises and declines in stock prices at the same time. The goal of the strategy is to generate better risk adjusted returns by benefitting from both directions of price movements in the market. The long portion benefits from the growth of high-quality stocks, while the short portion will provide a portfolio hedge and generate returns when prices are declining, all positions are hand picked by the portfolio management team.

Why Invest in BMO ETF’s Long-Short Strategy?

- Access – Easy access through liquid alternative ETF structure, with no rigorous documentation requirements

- Highly Liquid – Intraday liquidity on Canadian stock exchanges

- Expertise – Managed by the team that brought Low volatility solutions to market; BMO GAM’s Disciplined Equity team which has a 14yr track record in managing institutional equity portfolios

- Cost Effectiveness – Traditionally long-short strategies have charged much higher fees, including performance fees, which lessen the returns available to investors

Transparency – Daily portfolio transparency on BMO ETF webpage so investors will always know what’s in the portfolio - Performance – Potential for stronger risk-adjusted performance and lower beta than long only equity funds

- Diversification – Innovative portfolio structure allows for increased ability for stock selection with the ability to short

- Democratizing Investing – Make widely available traditionally more exclusive investment strategies

- Staying Invested – The combined benefits of an alternative strategy can assist with staying the course and capitalizing on drawdowns to create better risk adjusted returns

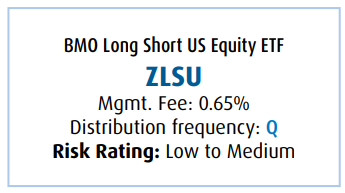

Portfolio Construction

The portfolio will target a gross exposure of approximately 100% long equity (80 – 100 names) and 50% short equity (60 – 70 names). Portfolio managers utilize a proprietary stock-ranking methodology, seeking to buy fundamentally strong, attractively valued stocks with positive market sentiment, and sell short companies that are fundamentally weak, expensive, with fading investor interest. Sector holdings net of long and short exposures are managed within 2% of the parent benchmarks; the S&P TSX Composite Index for BMO Long Short Canadian Equity ETF and the S&P 500 Index for BMO Long Short US Equity ETF. The proceeds from short selling will be invested in short-term fixed income instruments to provide an additional source of return.

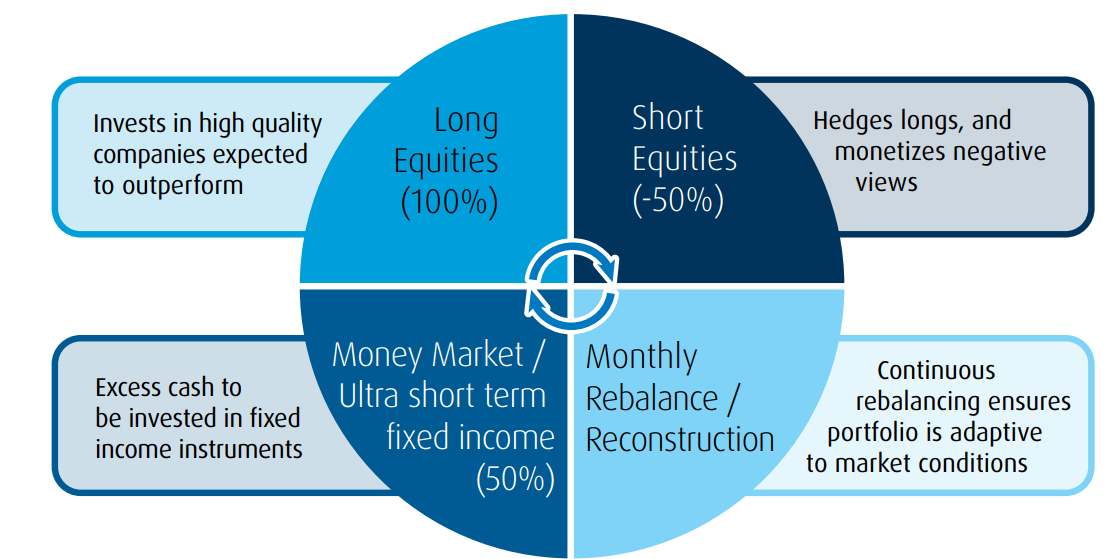

Stock Selection Process

The portfolio will purchase companies with high alpha scores and hold short positions in companies with low alpha scores. To ensure diversification and proper risk management the portfolio will have active security weights net of long and short exposures within +/- 3% in Canada and net exposures within 2% in US of their respective parent benchmarks, the S&P TSX Composite Index and the S&P 500 Index.

In addition, the portfolio management team will consider several factors that are key to a stock’s performance. The weighing of factors being considered to build the portfolio are adaptive and can change according to equity market conditions. To further mitigate risk the portfolio will not exceed an individual stock short exposure allocation of 1.75% and will be rebalanced and reconstituted monthly:

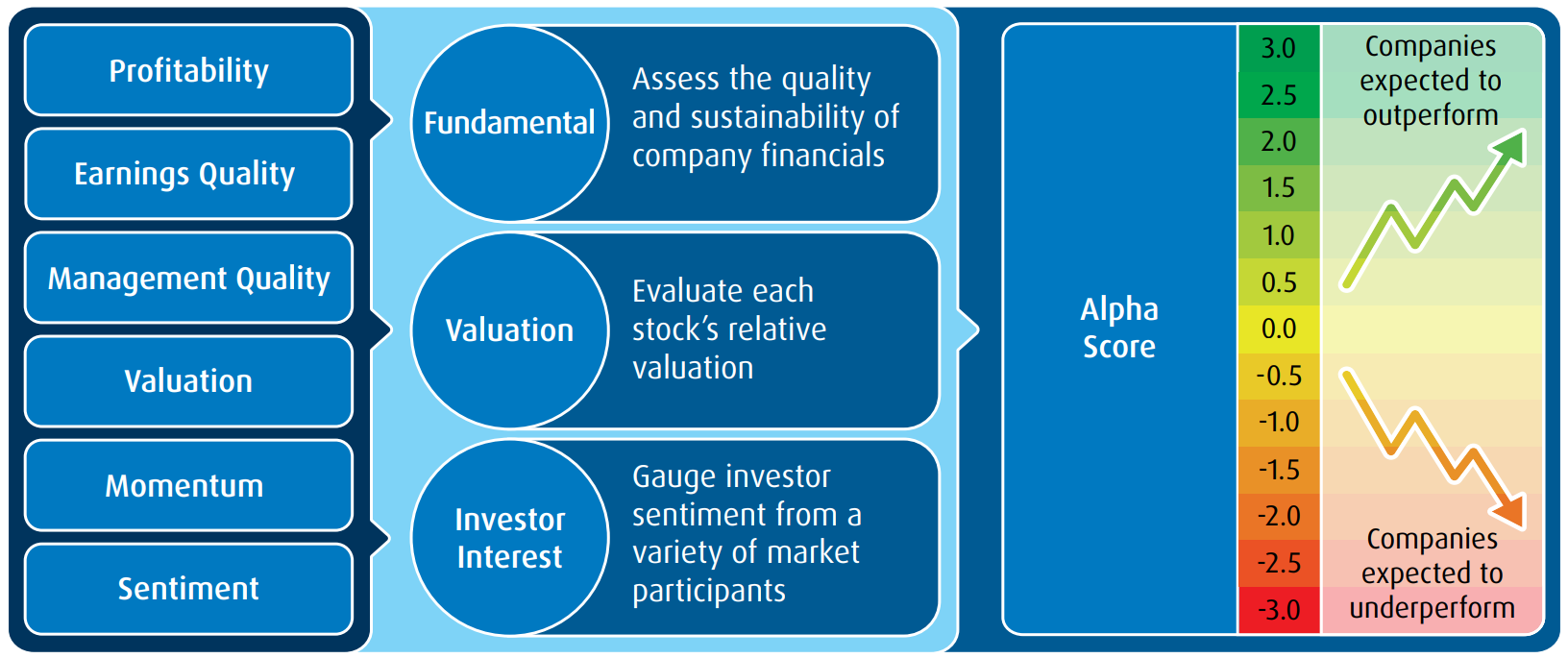

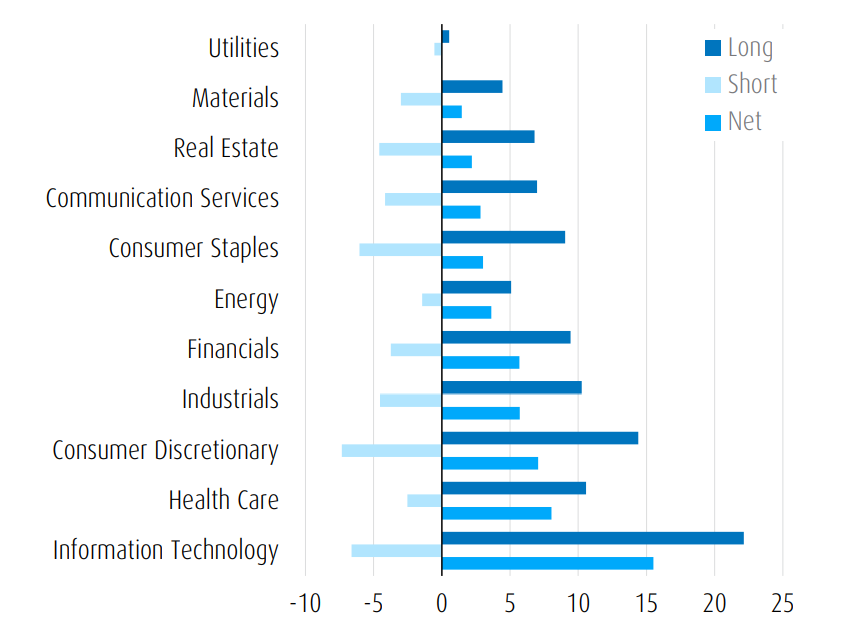

U.S. Portfolio Sector Allocation |

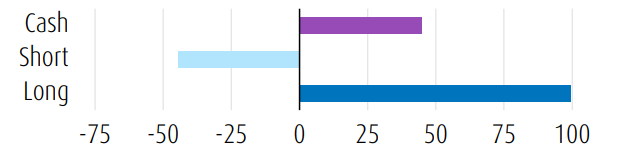

U.S. Portfolio Asset Allocation |

This material is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

Risk tolerance measures the degree of uncertainty that an investor can handle regarding fluctuations in the value of their portfolio. The amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult their financial advisor before making a decision as to whether this Fund is a suitable investment for them.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.