Equity ETF Portfolio Decision Tree

Aug 15, 2023ETFs are the gift that keeps on giving and continue to gain in popularity around the globe for their endless efficiencies. In Canada, there are over 350 equity ETFs, dwarfing that number in the US there are over 1300 equity ETFs.1 If you have an exposure in mind, chances are you can find an ETF to meet your desired outcome with products covering the spectrum of broad beta, factors and sectors. Additionally, recent innovation has led some investors to consider adopting active ETFs to enhance alpha in a portfolio.

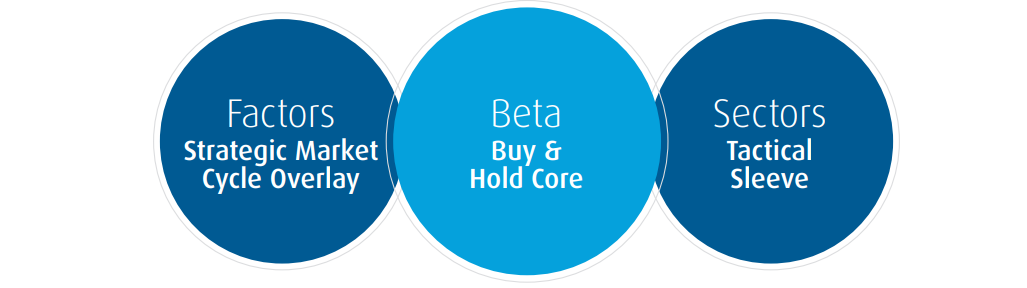

Portfolio construction is as much an art as it is a science. ETFs can simplify the portfolio construction process because they offer greater transparency. It may be helpful to review a simple framework for building an equity portfolio and the considerations that help determine what mix is right for you. For the purposes of this framework we have divided the equity ETF universe into three simple groups.

The challenge is deciding how to combine these products to build a strong equity portfolio

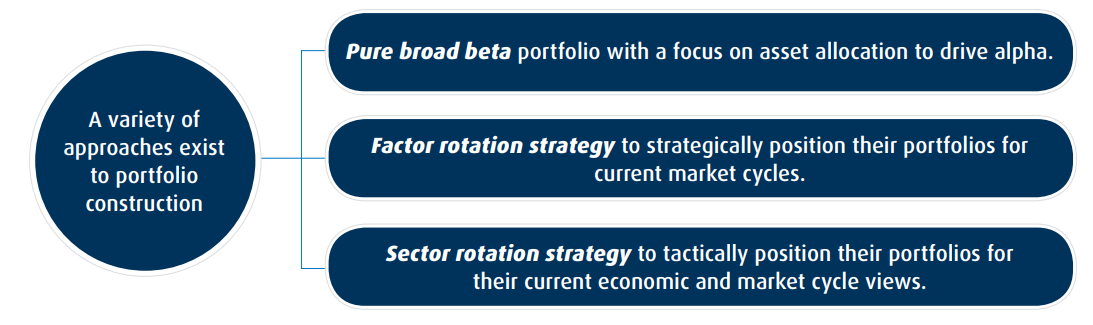

Approaches to portfolio construction

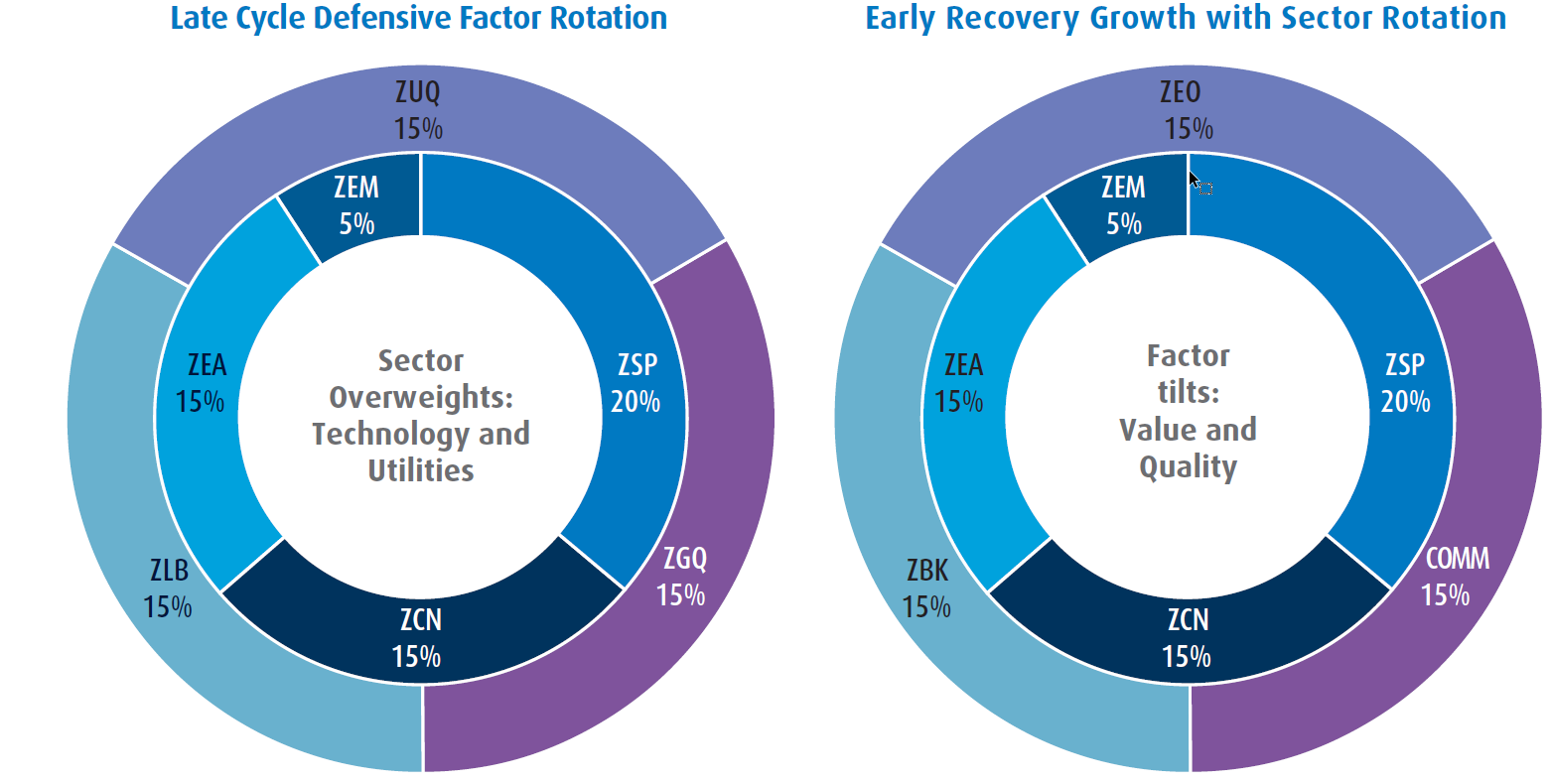

A further approach would be to adopt a blend of these approaches. Sounds simple enough but deciding how to align your portfolio weights with your economic views, level of conviction, and considering how factors and sectors intersect entails greater deliberation.

Decision Framework:

1. a) Conviction Level: How heavy in the core?

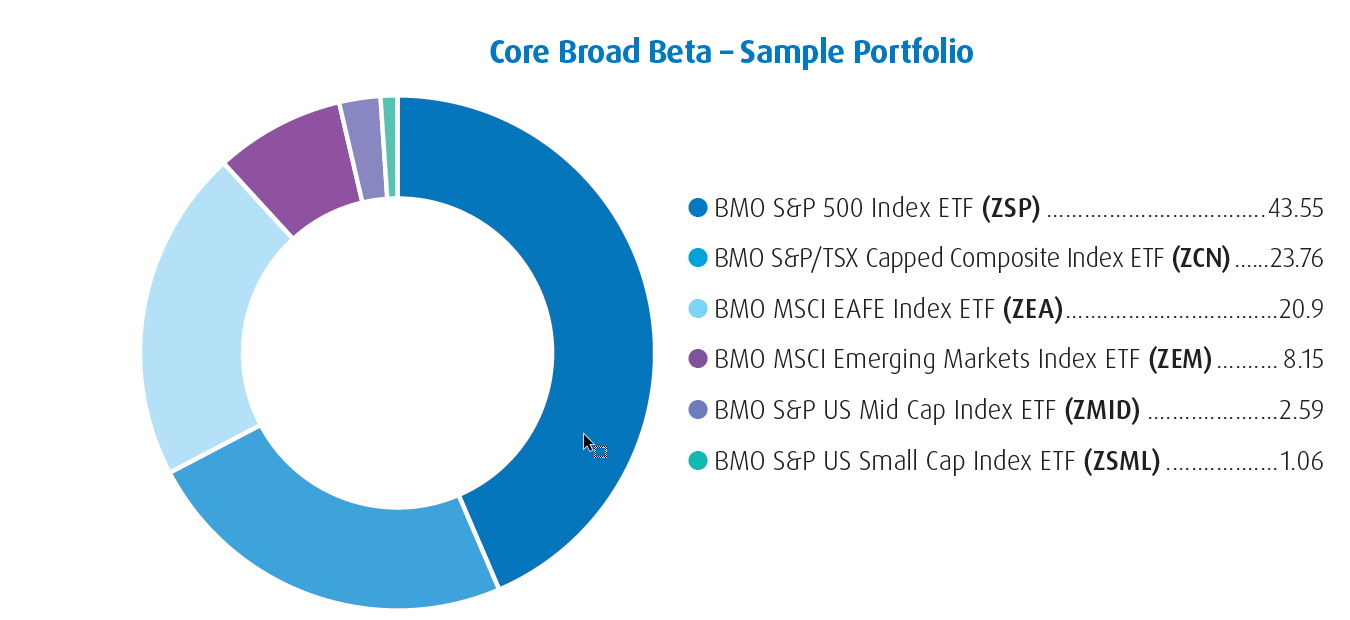

Using a core and satellite approach, higher conviction leads to higher weights in the satellites, whereas more uncertainty leads higher weight in the core. Investors with confidence in global leadership and the further expansion of coordinated global growth will put higher weights in satellites; including more cyclical factors, and less defensive sectors. Investors with limited confidence will do the opposite. Those in between, are best off with broad beta exposures.

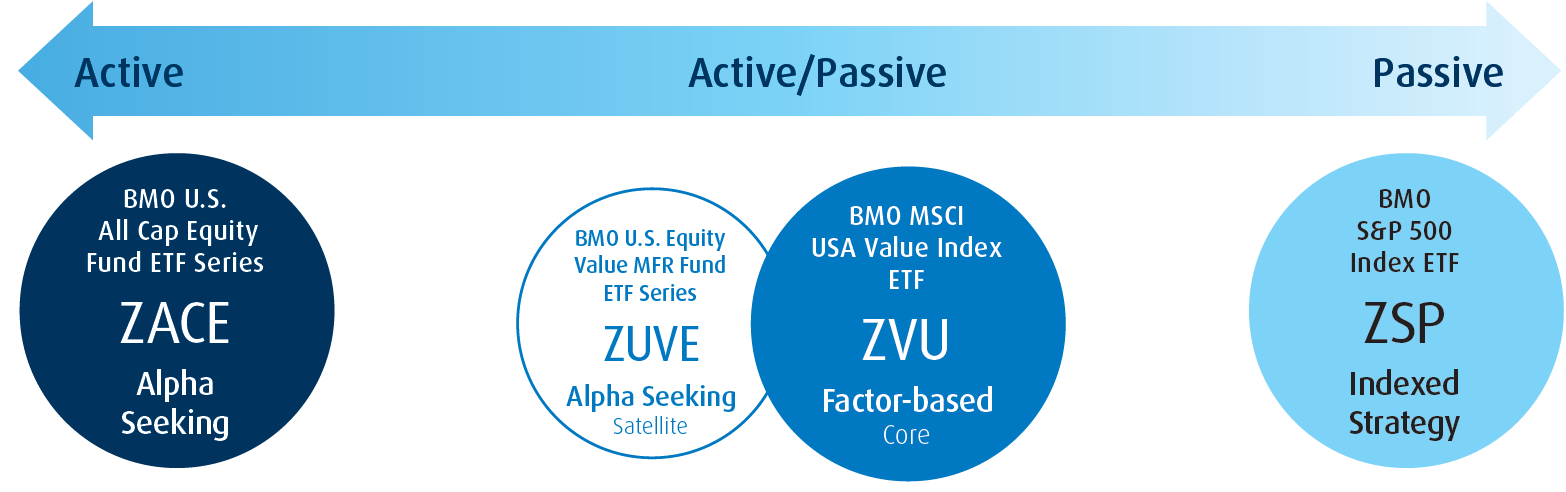

1. b) Active, Index or Blend?

With the launch of Active Equity ETFs, investors will typically follow three paths: passive portfolios for confident investors or efficient market believers, mixed active and passive portfolios for less confident investors, and active portfolios for unsure investors, and enhanced global exposure.

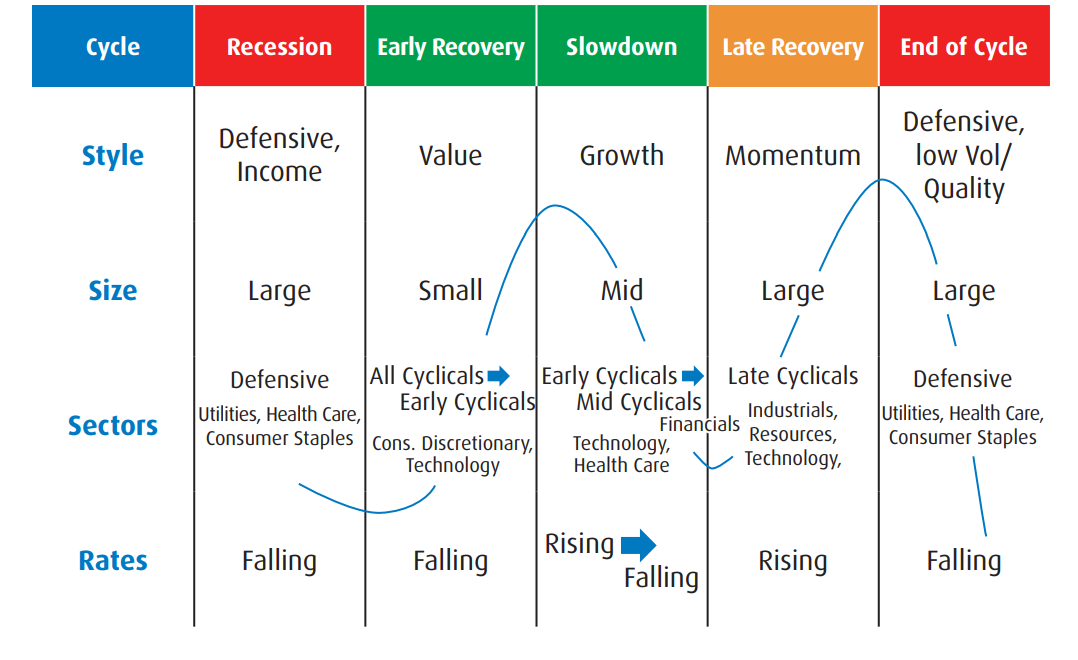

2. Economic View:

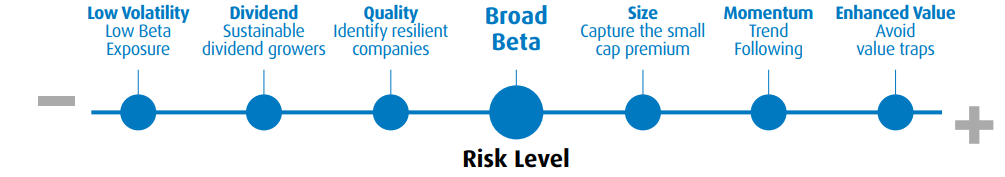

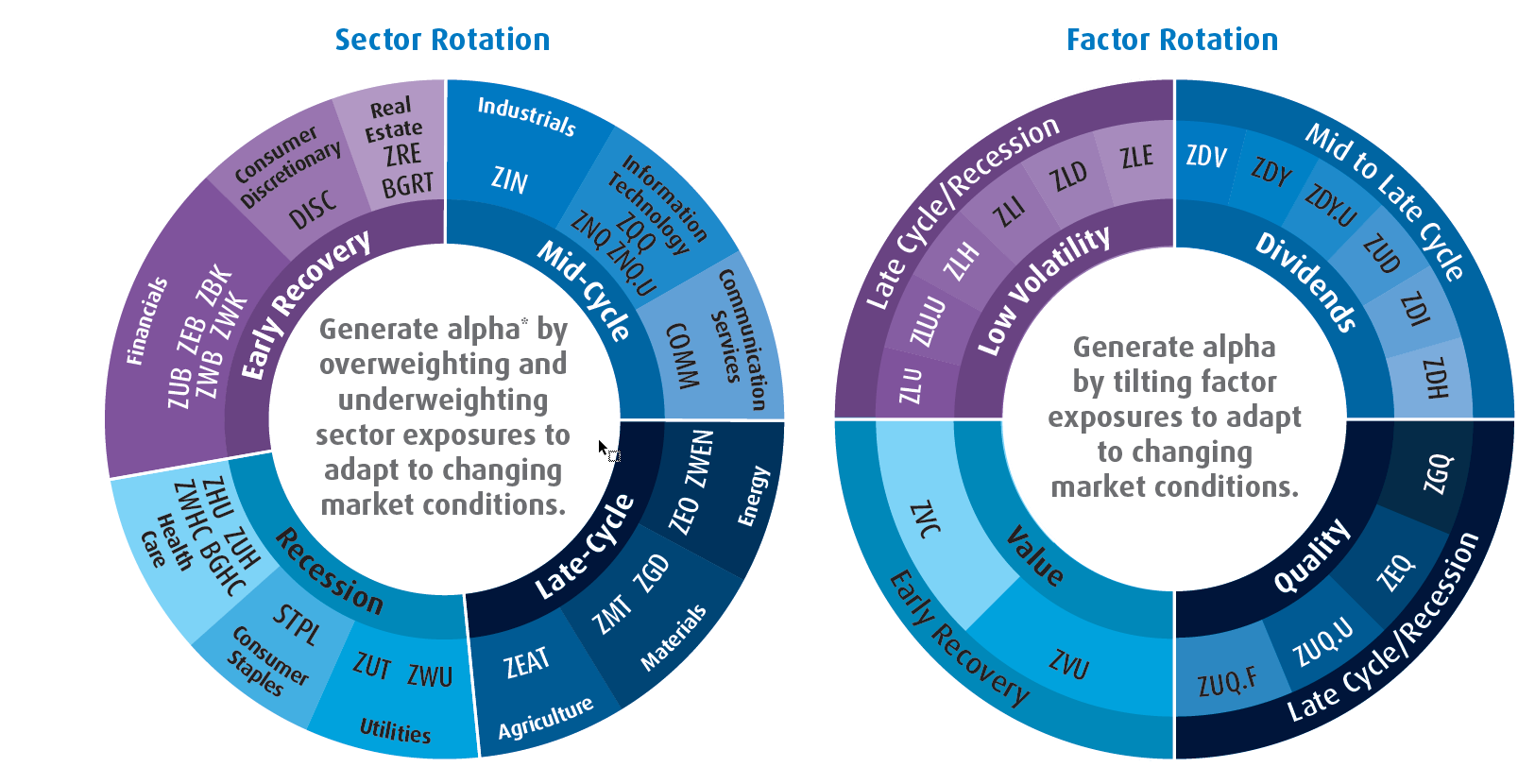

Not all factors and sectors have the same macroeconomic drivers, and therefore some factors/sectors will outperform others based on inflation, the interest rate environment, and the economic cycle. Using a rotation strategy can be profitable as a satellite to your core broad beta exposures.

3. Sector/Factor convergence - what are the biases?

Being aware of how Factors intersect with sectors and how Factors have consistent sector concentrations is an important consideration. While concentration of sectors in factors such as Momentum and Quality would change over time and tend to be more diverse, Factors such as Low Volatility have more consistent sector biases (Utilities, REITs, Consumer Staples) consider.

Other Considerations

Currency – While over the longer term there is purchasing power parity (PPP) between two currencies, to which they will revert over time, over the shorter-term currencies can trade beyond their PPP for significant periods of time. If an investor believes the U.S. Dollar will appreciate against the Canadian Dollar and are looking to invest in U.S. equities, an unhedged U.S. equity ETF may be more suitable as an example.

Geography – Political regimes, tax laws, monetary policy and business cycles are rarely the same across the globe, and these variables have an impact on the performance of your portfolio. Therefore an investor should be aware of a region’s macro-economic landscape as these variables will impact performance.

Income Needs – investors needing extra income can consider a higher allocation to higher income sectors such as financials and utilities, as well as higher exposure to yield based factor indices.

Sectors: Rotating for Success

Early Recovery

ETF Name |

Ticker |

BMO Equal Weight US Banks Hedged to CAD Index ETF |

ZUB |

BMO Equal Weight US Banks Index ETF |

ZBK |

BMO Covered Call US Banks ETF |

ZWK |

BMO Equal Weight Banks Index ETF |

ZEB |

BMO Covered Call Canadian Banks ETF |

ZWB |

BMO Global Consumer Discretionary Hedged to CAD Index ETF |

DISC |

BMO Equal Weight REITs Index ETF |

ZRE |

BMO Global REIT Fund Active ETF Series |

BGRT |

Mid-Cycle

ETF Name |

Ticker |

BMO Equal Weight Industrials Index ETF |

ZIN |

BMO Nasdaq 100 Equity Index ETF |

ZNQ, ZNQ.U, ZQQ |

BMO Global Communications Index ETF |

COMM |

Late-Cycle

ETF Name |

Ticker |

BMO Equal Weight Global Gold Index ETF |

ZGD |

BMO Equal Weight Global Base Metals Hedged to CAD Index ETF |

ZMT |

BMO Equal Weight Oil & Gas Index ETF |

ZEO |

BMO Global Agriculture ETF |

ZEAT |

BMO Covered Call Energy ETF |

ZWEN |

Recession

ETF Name |

Ticker |

BMO Covered Call Utilities ETF |

ZWU |

BMO Equal Weight Utilities Index ETF |

ZUT |

BMO Global Consumer Staples Hedged to CAD Index ETF |

STPL |

BMO Equal Weight US Health Care Hedged to CAD Index ETF |

ZUH |

BMO Equal Weight US Health Care Index ETF |

ZHU |

BMO Covered Call Health Care ETF |

ZWHC |

BMO Global Health Care Fund Active ETF Series |

BGHC |

Smart Investing with a Factor Based Approach

Quality

ETF Name |

Ticker |

BMO MSCI All Country World High Quality Index ETF |

ZGQ |

BMO MSCI Europe High Quality Hedged to CAD Index ETF |

ZEQ |

BMO MSCI USA High Quality Index ETF |

ZUQ, ZUQ.U |

BMO MSCI USA High Quality Index ETF (Hedged Units) |

ZUQ.F |

Value

ETF Name |

Ticker |

BMO MSCI Canada Value Index ETF |

ZVC |

BMO MSCI USA Value Index ETF |

ZVU |

BMO U.S Equity Value MFR Fund ETF Series |

ZUVE |

Low Volatility

ETF Name |

Ticker |

BMO Low Volatility Canadian Equity ETF |

ZLB |

BMO Low Volatility US Equity ETF |

ZLU, ZLU.U |

BMO Low Volatility International Equity ETF |

ZLI |

BMO Low Volatility International Equity Hedged to CAD ETF |

ZLD |

BMO Low Volatility Emerging Markets Equity ETF |

ZLE |

Dividend

ETF Name |

Ticker |

BMO Canadian Dividend ETF |

ZDV |

BMO US Dividend ETF |

ZDY, ZDY.U |

BMO US Dividend Hedged to CAD ETF |

ZUD |

BMO International Dividend ETF |

ZDI |

BMO International Dividend Hedged to CAD ETF |

ZDH |

1Source: ETFGI, June 2023.

ADVISOR USE ONLY

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of perfor- mance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The ETF referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

The Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by the Manager. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Manager. The ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any represen- tation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.