Stay Invested with Buffer ETFs

Feb. 12, 2024A recent JP Morgan note from a team of quantitative strategists made the rounds on Wall Street warning investors to be aware of persistently rising concentration in the U.S. stock market in 2024 and drew similarities of this period to the Dotcom Bubble1.

We’ve seen the magnificent seven deliver terrific returns and in turn increase their weight within the S&P 500 Index. Microsoft, Apple, NVIDIA, Amazon, Meta, Alphabet and Tesla combined make up about 28%2 of the market capitalization of the index. While the Magnificent seven drove the markets to new highs, the breadth of the overall market remains worrisomely narrow and shallow for many investors.

From a valuation perspective, the S&P 500 is currently trading a P/E ratio of about 233 which from a historical perspective can be considered rich relative to average of 16.

On the US geopolitical front, risks of further tension are heating up in the Middle East. Also, a prolonged and deep economic slowdown in China that might spill over the rest of global capital markets and upcoming elections in the US are potential catalyst events and headwinds that bring about higher volatility in the markets as we move forward.

At the macro-economic level, the US economy seems resilient and has been performing above market expectations with better-than-expected job numbers and higher wages which might keep interest rates higher for much longer than the markets have been pricing in. In turn, this economic robustness leads investors to want to stay invested in the market, despite the various levels of risks and headwinds outlined above.

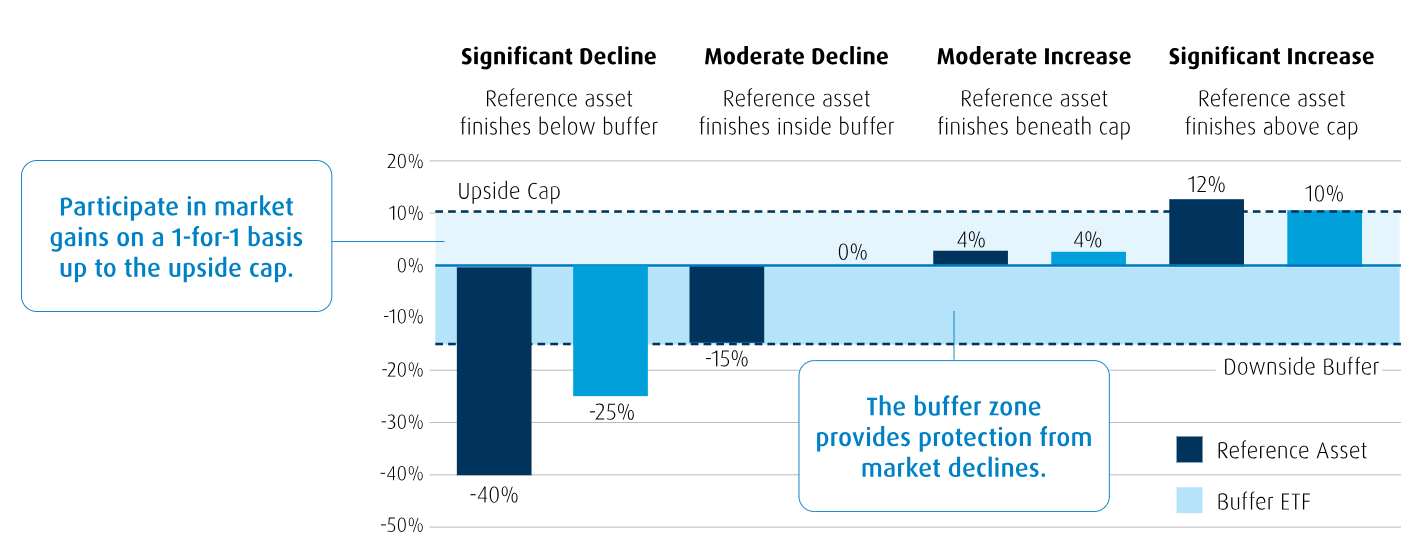

For investors who may be anticipating a market pullback and want to buffer some of that potential downside risk but still want to maintain their equity exposure, BMO ETFs has recently launched BMO US Equity Buffer Hedged to CAD ETF - January (Ticker: ZJAN) for the cautiously optimistic investor. ZJAN seeks to provide investors some peace of mind by providing a buffer against the first 15% (before fees, expenses and taxes) of a decrease in the Reference Index over a period of approximately one year, starting from the first business day of the stated outcome period. While still participating in potential upside up to cap of 9% (before fees, expenses and taxes). So, if the market is down 15%, it is only after a breach of the buffer that you will start to incur any losses. And since ZJAN owns the stocks in the S&P 500 as the underlying, investors collect dividends on top of the 9% cap4.

Potential Outcomes Scenarios: Day 1 to Day 365

BMO ETFs is the largest option writing ETF provider in Canada5 and ZJAN employs the use of options6 to provide that layer of protection with a cap on market participation.

A Buffer ETF can compliment or substitute your core equity positions, providing a built-in cushion on the downside to help keep you invested in broad U.S equities. Since 2010, 90% of the time the market is down over a one-year period, it has been down less than 15%7, illustrating the chances of being within the buffer zone8.

This buffer structure will be an important tool going forward for cautious investors who are concerned about rich valuations and macro-economic risks.

Overview for ZJAN and ZOCT

| Ticker | Reference ETF | Estimated MER* | Management Fee | Buffer | Upside Cap | Target Outcome Period | Distribution Frequency | Buffer/Cap Reset (Annually) |

| ZJAN | ZUE | 0.73% | 0.65% | 15% | 9% | 12 months | Quarterly | January |

| ZOCT | ZUE | 0.73% | 0.65% | 15% | 10.5% | 12 months | Quarterly | October |

* As the ETFs are less than one year old, the actual Management Expense Ratio (MER) will not be known until the Fund financial statements for the current fiscal year are published. The estimated MER is an estimate only of expected Fund costs until the completion of a full fiscal year and is not guaranteed.

2 BMO Global Asset Management, January 31, 2024.

3 Morningstar January 31, 2023.

4 An investor must purchase the structured outcome ETF at starting NAV on the first day of a Target Outcome Period to achieve the stated buffer and cap. If the ETF is purchased at any other time or sold before the end of the outcome period, the results may be very different from the target outcomes sought.

5 CIBC Capital Markets, December 31, 2023.

6 Buffer ETFs employ option writing strategies which creates the upside cap and helps offset the cost of the downside buffer.

7 Bloomberg, December 31, 2023.

8 Past performance is not indicative of future results.

Disclaimer:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus. This material is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only. An investor that purchases Units of a Structured Outcome ETF other than at starting NAV on the first day of a Target Outcome Period and/or sells Units of a Structured Outcome ETF prior to the end of a Target Outcome Period may experience results that are very different from the target outcomes sought by the Structured Outcome ETF for that Target Outcome Period. Both the cap and, where applicable, the buffer are fixed levels that are calculated in relation to the market price of the applicable Reference ETF and a Structured Outcome ETF’s NAV (as Structured herein) at the start of each Target Outcome Period. As the market price of the applicable Reference ETF and the Structured Outcome ETF’s NAV will change over the Target Outcome Period, an investor acquiring Units of a Structured Outcome ETF after the start of a Target Outcome Period will likely have a different return potential than an investor who purchased Units of a Structured Outcome ETF at the start of the Target Outcome Period. This is because while the cap and, as applicable, the buffer for the Target Outcome Period are fixed levels that remain constant throughout the Target Outcome Period, an investor purchasing Units of a Structured Outcome ETF at market value during the Target Outcome Period likely purchase Units of a Structured Outcome ETF at a market price that is different from the Structured Outcome ETF’s NAV at the start of the Target Outcome Period (i.e., the NAV that the cap and, as applicable, the buffer reference). In addition, the market price of the applicable Reference ETF is likely to be different from the price of that Reference ETF at the start of the Target Outcome Period. To achieve the intended target outcomes sought by a Structured Outcome ETF for a Target Outcome Period, an investor must hold Units of the Structured Outcome ETF for that entire Target Outcome Period. BMO Buffer ETFs seeks to provide income and appreciation that match the return of a Reference Index up to a cap (before fees, expenses and taxes), while providing a buffer against the first 15% (before fees, expenses and taxes) of a decrease in the Reference Index over a period of approximately one year, starting from the first business day of the stated outcome period. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.