Take Advantage of Tax-Loss Selling without Exiting Exposures with Bond ETFs

Jan. 18, 2024With fixed income volatility expected to persist according to at least one important gauge, Daniel Stanley, Director of Institutional & Advisory, Ontario, lays out how to harvest tax losses on bonds while staying allocated via a single line-item ETF.

When investors speak about volatility, it is usually in reference to equity markets; but in 2023, stock market volatility was remarkably calm and overshadowed by extremely large moves in normally-sedate bond markets.

Aggressive policy tightening by the U.S. Federal Reserve (Fed) and the flood of bond sales by the U.S. government to fund its deficit have imposed historical losses on long-duration bonds and seemingly flipped the relationship between more volatile stocks and typically staid fixed-income assets on its head. The influence U.S. bonds have on debt markets globally has meant greater volatility for Canadian fixed income as well.

Moreover, it is far from clear whether this trend reverts back to conventional trading pattern despite a year-end downdraft in yields. The swings in bond prices are expected to keep exceeding those for equities by the most in at least 18 years, according to a key gauge measured by Bloomberg.1

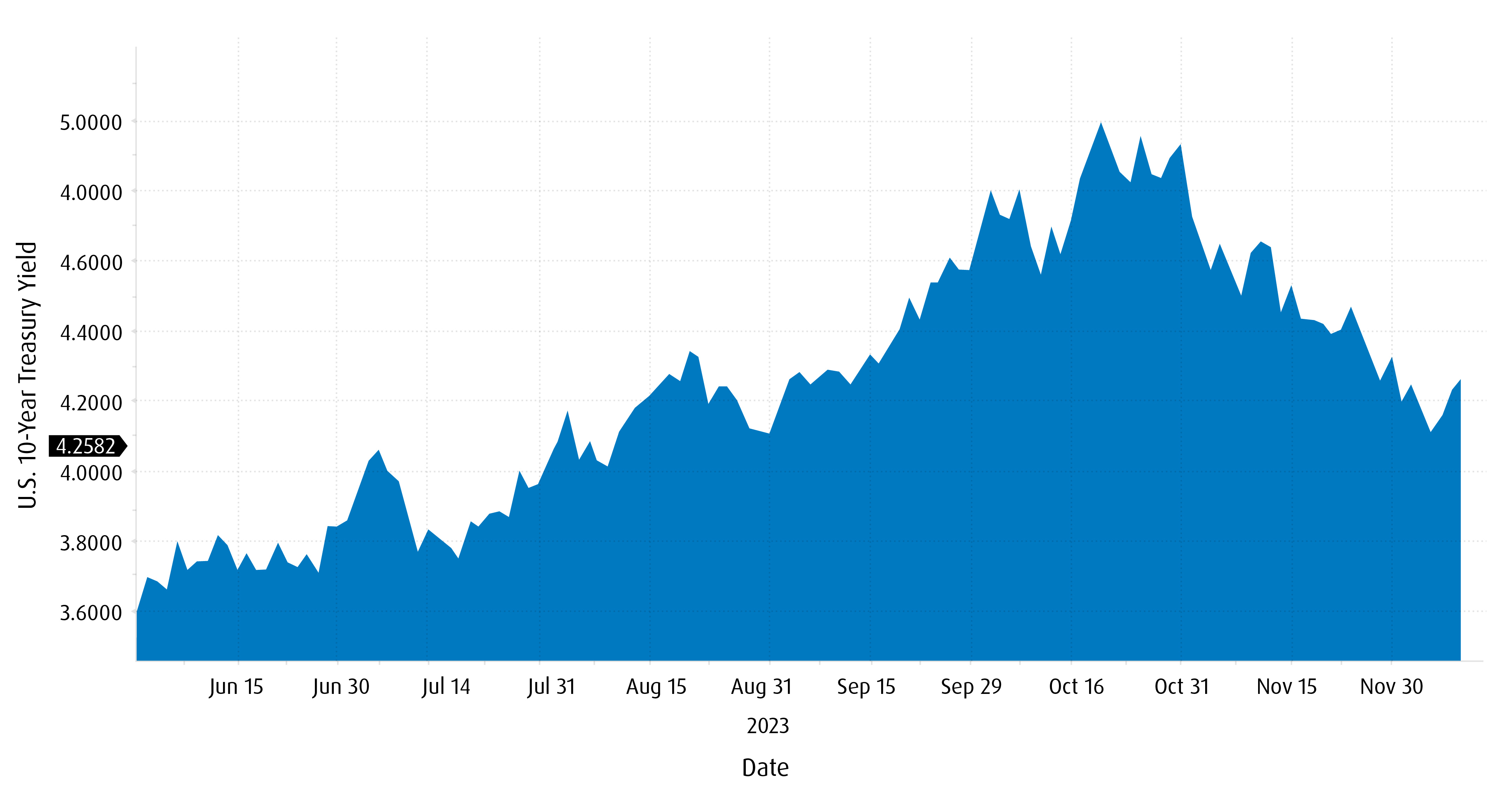

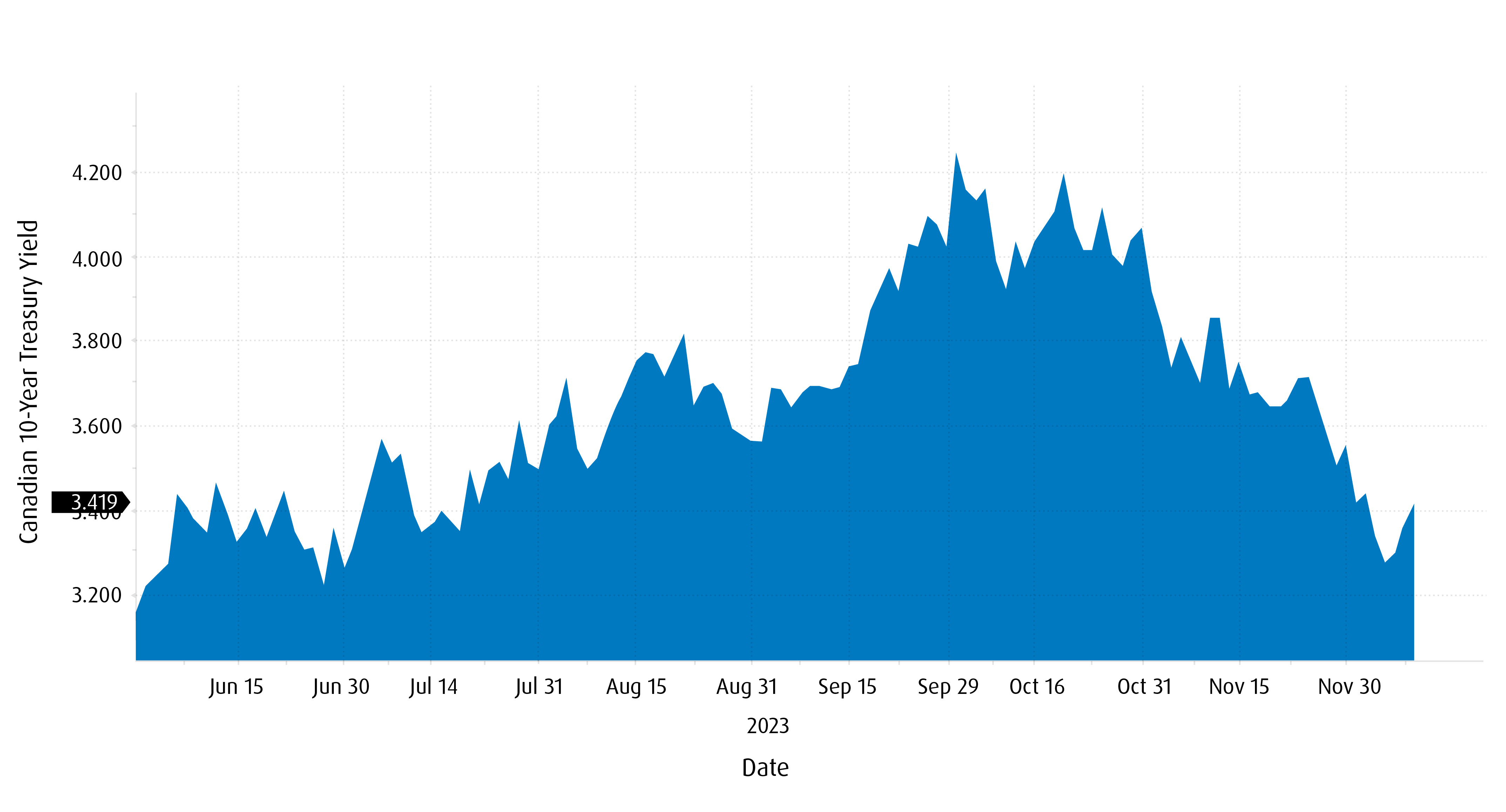

A picture is worth a thousand words and the charts below reflect the extreme moves in yield on both the U.S. and Canadian bond markets.

Between June and October 2023, the fear of “higher rates for longer” and ample bond supply resulting from growing government deficits drove the 10-year U.S. bond yield to rise 32% from 3.80% to 5.00%, and prices to fall correspondingly. In November and December, the market began pricing in earlier interest rate cuts from the Fed, due to seemingly effective inflation control resulting in the same 10-year yield falling by 15% to 4.25%.

Canadian bonds have experienced a similar trajectory. The 10-year Canadian bond yield rose 23% between June and October 2023, from 3.40% to 4.20%, only to retrace almost all of that move and fall back 20% to 3.40% by mid-December.

ETFs and Tax-Loss Harvesting

This volatility makes bond ETFs a valuable tool in an Investment Counsel Portfolio Manager (ICPM) or Family Office’s (FO) investment toolkit for two distinct reasons. First, they add operational flexibility by providing efficient and fast access to advantageous exposures and market opportunities. Yet in the current environment, if an ICPM or FO acquired bonds in a lower-rate environment, they give them the ability to efficiently harvest those losses. We encourage all investors to undertake professional tax consultation; however, it is instructive in our view to share how portfolio managers are currently benefitting from this process.

According to the BMO ETFs’ Tax Loss Harvesting Guide 2023, “by disposing of securities with accrued capital losses, investors can help offset taxes otherwise payable in respect of other securities that were sold at a capital gain. The proceeds from the sale of these securities can then be reinvested in different securities with similar exposures to the securities that were sold, to maintain market exposure.”

For example, portfolio managers who bought long-duration federal bonds last summer are likely still sitting on losses now in mid-December. That bond fund manager can approach the BMO ETFs desk, sell their Federal bond at a loss, and buy the BMO Long Federal Bond Index ETF (Ticker: ZFL).

Custom Creation

This transaction is known as a custom creation, whereby BMO Global Asset Management purchases a client’s bonds “in kind” in exchange for an ETF allocation. This transaction is facilitated through a market maker.

This kind of custom creation trade allows a portfolio manager to harvest the loss on the bond while keeping the exposure to that specific asset class via a single line-item ETF. And after the 30-day holding period, the transaction can be reversed. In addition, these trades are done without telegraphing your intentions to the market.

The financial amounts required to facilitate a custom creation trade vary widely. BMO Global Asset Management has done trades for as little as $1 million and as much as $1 billion. We mention these numbers because for portfolio managers who interact with inventories of over-the-counter bonds, working with the BMO ETFs team of professionals ensures that those inventories can be effectively traded at any size level, to take advantage of opportunities like tax-loss selling.

Please contact your BMO ETF Specialist for more information. Our Portfolio Managers are also available to help with trading insights. They can also be reached at 1−877−741−7263.

Disclosures:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the authors represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. The statistics in this update are based on information believed to be reliable but not guaranteed.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

S&P®, S&P/TSX Capped Composite®, S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and “TSX” is a trademark of TSX Inc. These trademarks have been licensed for use by S&P Dow Jones Indices LLC and sublicensed to BMO Asset Management Inc. in connection with the ETFs. The ETFs are not sponsored, endorsed, sold or promoted by S&P Dow Jones LLC, S&P, TSX, or their respective affiliates and S&P Dow Jones Indices LLC, S&P, TSX and their affiliates make no representation regarding the advisability of trading or investing in such BMO ETF(s).

The ETF referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

Nasdaq® is a registered trademark of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and is licensed for use by the Manager. The ETF has not been passed on by the Corporations as to their legality or suitability. The ETF is not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the ETF.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.