Macro Notes - Key Takeaways from the BoC

January 28, 2026There are five points we’d make regarding yesterday’s decision:

i.) As expected, the Bank left policy + admin rates on hold yesterday. With the statement and communication materials, the language around real activity and employment were tonally consistent with what was said in December.

ii.) The messaging on inflation was a smidge more dovish than December. But that is because the Bank is back to highlighting its “preferred” measures of core (trim/median) as opposed to the “underlying rate” (which it had been emphasizing in December).

The constant ‘flip-flop’ here is confusing for communication and something we’ll bring up in our conversation with Bank representatives.

iii.) On trade, the Governor made note that there is a bit more uncertainty relative to the last set of projections. The implicit takeaway here is that the Bank is fine with its current policy settings but will react with a cut if trade relations with the US take a turn for the worse (the USMCA review is slated for this summer).

iv.) Within the MPR, growth projections for 2026 and 2027 were little changed from October. However, the Statscan revisions to GDP between 2022-2025 means that estimates for potential output needed to shift higher as well.

For instance, potential output is expected to slow from 2.3% in 2025 to about 1% in 2026 and 2027 due to slowing population growth (which hits labour productivity) and the effects of trade tensions (which hits total factor productivity). The output gap is estimated to be in the -1.5% to -0.5% of GDP range currently.

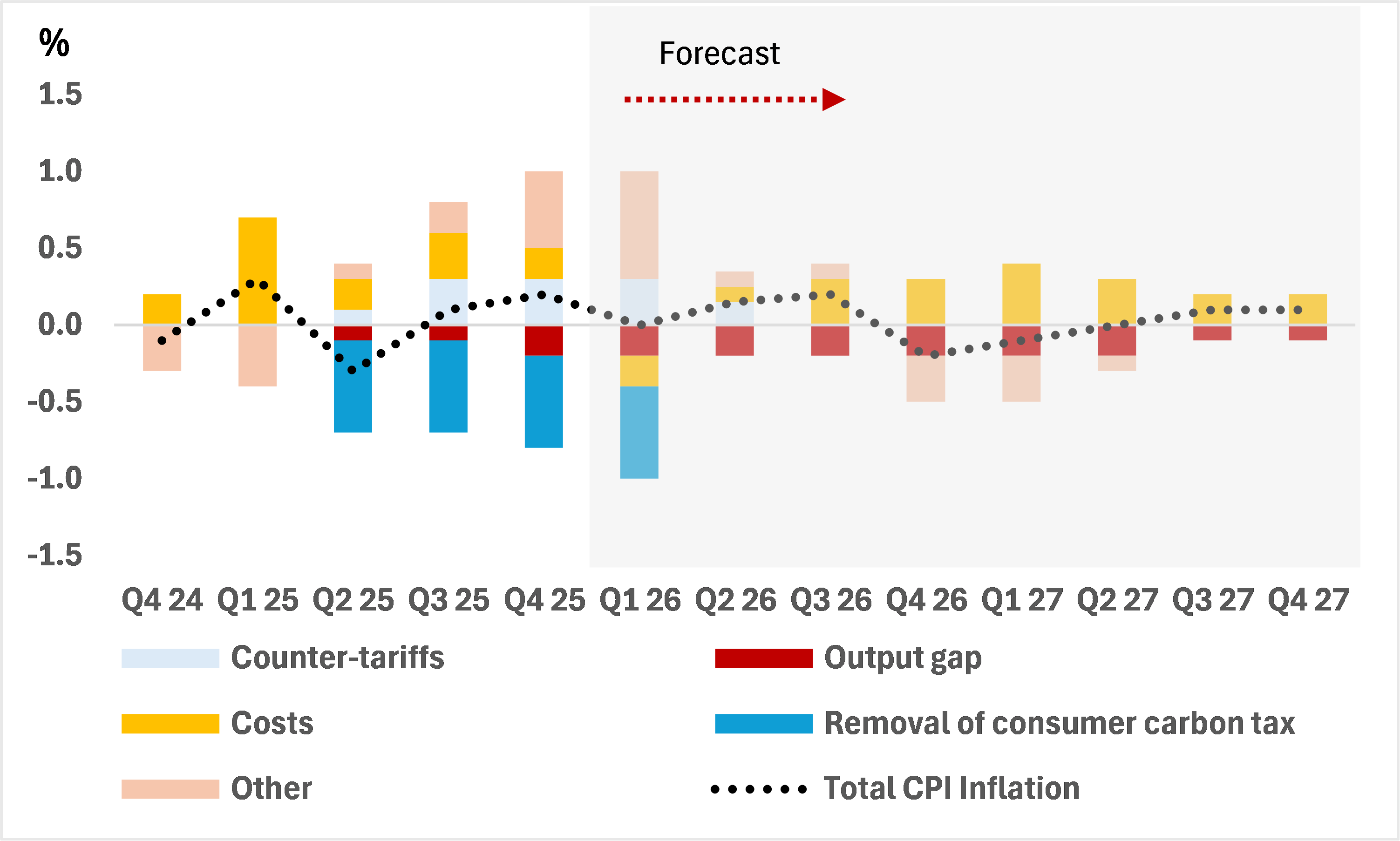

v.) For us, the key takeaway is that the Bank is more attuned to downside risks to activity and the increase in economic slack given trade concerns. Those should work against the projected rise in input costs insofar as inflation is concerned over the long-term (see Chart 1).

Right now, the CAD swaps market is currently pricing in 9bps of tightening by the end of this year. That’s down from 13bps going into yesterday’s meeting. We don’t envisage the BoC hiking at any point this year – which implies that there’s room for the CAD yield curve to ‘bull steepen’ (i.e – a steepening led by the front-end of the curve).

Chart 1 – Contributions to Y/Y CPI Deviation from Target (Quarterly)