Macro Notes - The Late Cycle Confidence Paradox

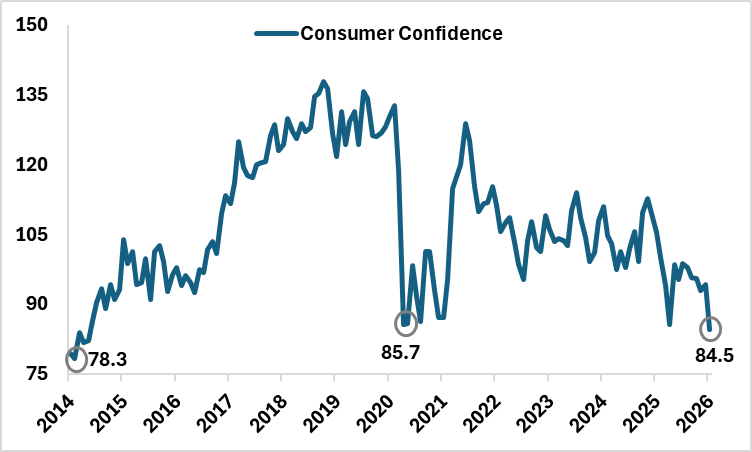

January 30, 2026Consumer confidence in the US has fallen to its lowest level since 2014, which could be another harbinger of late‑cycle dynamics. Sentiment surveys tend to get noisy at this stage, weighed down by inflation fatigue, higher rates and political uncertainty. But despite the gloom, consumer spending level tell a different story. Wage growth is still positive, real disposable income is improving, and which points to a still decent profile for consumption.

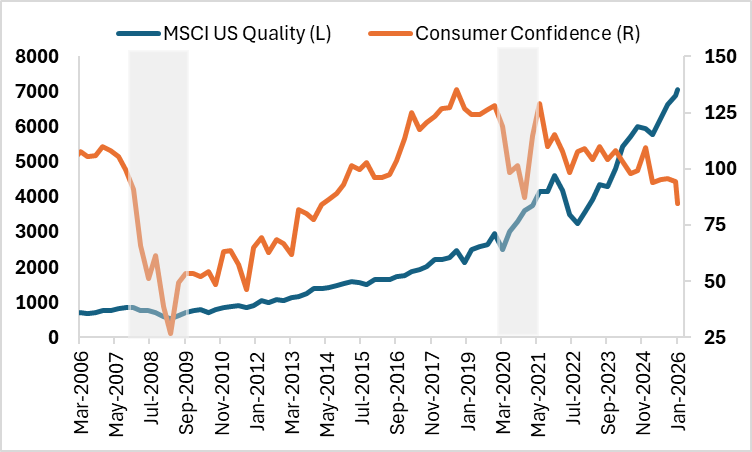

The contrast between confidence and firm spending is not unusual late in the cycle, when households report anxiety but continue to spend as long as income support remains in place. The risk only rises when labour markets or real income growth turn meaningfully lower.

For investors, the takeaway is straightforward: late‑cycle markets reward balance sheet strength and earnings resilience. Quality has historically outperformed in this phase, and steady consumer spending supports maintaining quality exposure through ZUQ.

Chart 1 - US Consumer Confidence is at the lowest since 2014

Chart 2 - US Consumer Confidence vs MSCI Quality Performance

Source: Bloomberg, BMO GAM