A Sector Rotation Strategy Aligned with Behavioural Finance

Seasonal spending habits exhibit a pattern which can be taken advantage of by implementing a simple rotational trading strategy. In this issue of VAULT, Mark Webster, Director, Institutional & Advisory and Vishal Bhatia, Director and Portfolio Manager, show how it is possible to easily implement a disciplined seasonal sector rotational strategy which captures instinctive human behaviours in an investment thesis.

Jul. 20, 2022Human beings are a complex species, combining strong logical capabilities and powerful emotional impulses. We often use both logic and emotion to make important decisions, though it is sometimes difficult to discern which attribute has played the leading role in that process.

The investing field provides reams of data for investors to distil in their analysis, but Behavioural Finance has recognized several inherent biases which influence investment decisions, ranging from recency bias to confirmation bias to overconfidence bias. Each of these biases has a strong emotional pull which may distract investors from objective evaluation.

Interestingly, habitual behaviours may also provide disciplined investors with a very simple but effective seasonal sector rotation strategy which has demonstrated marked advantages over a broad global equity index strategy, or merely holding a single sector. The data has demonstrated strength over the last two decades.

Sector rotation strategies have existed for many years, but most are difficult to implement. Economic data is always historical, and though we may search for patterns, different interest rates, inflation, employment, or political influences can exert idiosyncratic pressures.

Brooke Thackray did valuable research using U.S. sectors, showing that seasonal rotation could enhance returns. In a global economy, sector trends tend to be highly correlated across regions, so using global sectors provides a more robust data set.

Seasonal spending habits exhibit a pattern which can be taken advantage of by implementing a simple rotational trading strategy. When the weather is poor, consumers tend to spend more time indoors and their spending is directed to bigger ticket items, including holiday shopping, favouring the Consumer Discretionary sector. In better weather conditions, consumers go out to play, and the market often reverts to a risk-off mode, favouring the Consumer Staples sector.

Using consistent anchor dates to implement the strategy establishes a solid foundation for comparison:

- Buy STPL (FTSE Developed ex Korea Consumer Staples Capped 100% Hedged to CAD Index) on 22 April;

- Sell STPL to buy DISC (FTSE Developed ex Korea Consumer Discretionary Capped 100% Hedged to CAD Index) on 27 October.

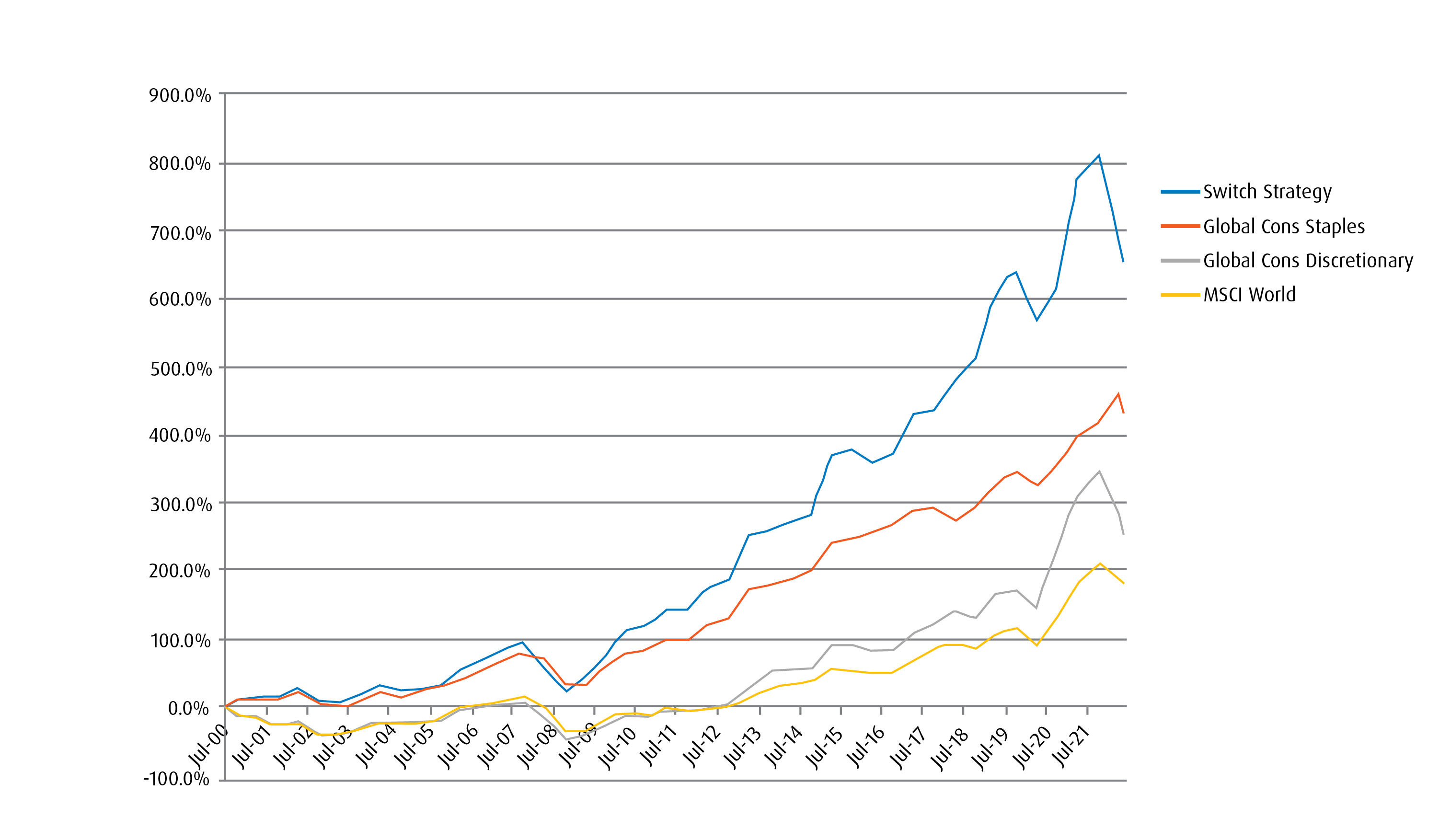

The data in the graph below is gross of transaction costs and assumes trades are made annually on 22 April and 27 October, or the next business day if those dates fall on weekends or holidays:

Global Consumer Staples/Global Consumer Discretionary Switch trade idea

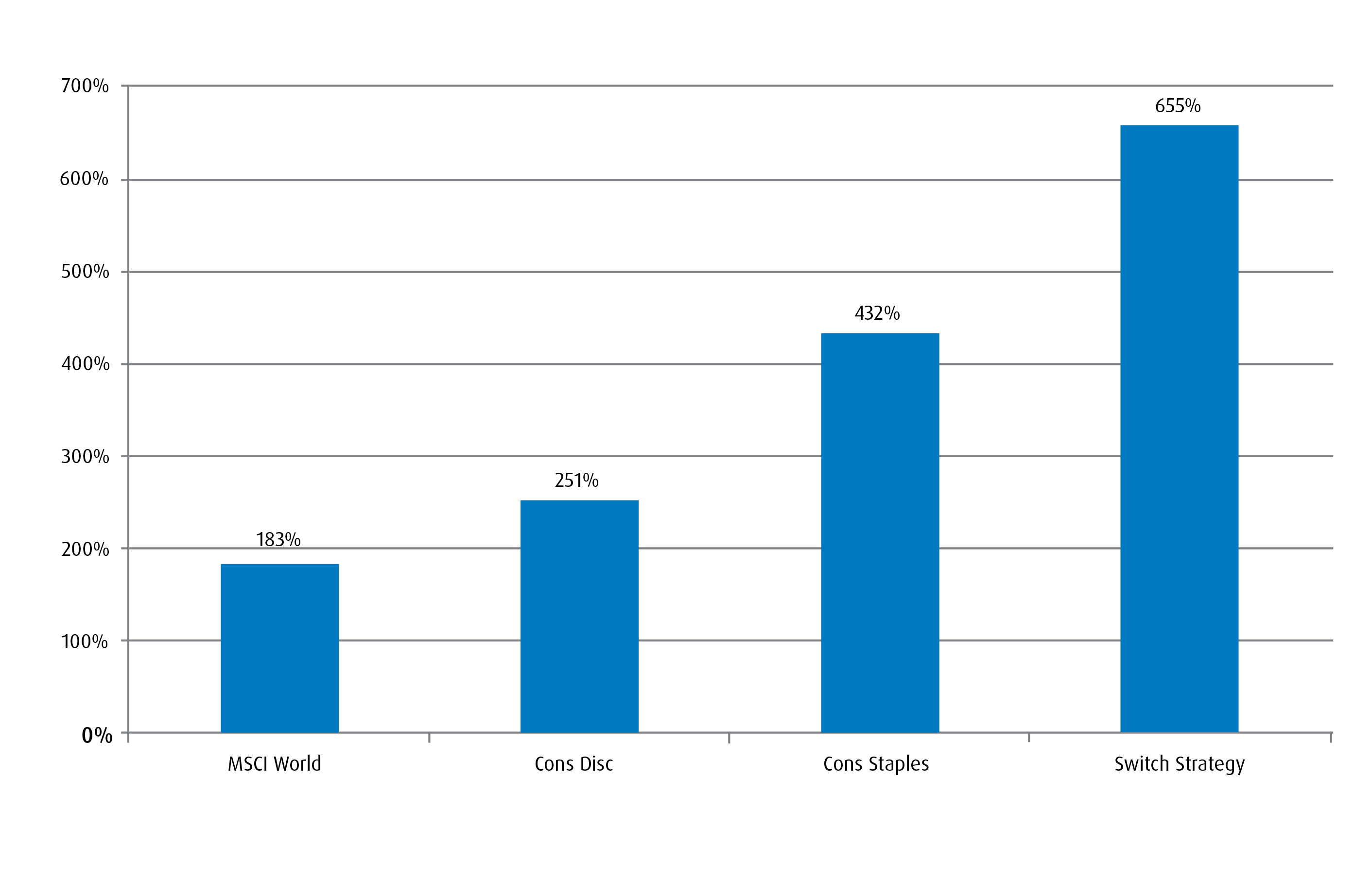

Total returns from July 2000 to May 2022

Annualized returns

| MSCI | Cons Disc | Cons Staples | Switch Strategy | |

| Annualized | 4.87% | 5.91% | 7.94% | 9.67% |

Annualized standard deviation of monthly returns

| MSCI World | 14.27% |

| Cons Disc | 17.34% |

| Cons Staples | 10.33% |

| Switch Strategy | 13.65% |

Source: Bloomberg (July 17, 2000 – June 30, 2022).

As the data suggests, it is possible to easily implement a disciplined seasonal sector rotational strategy which captures instinctive human behaviours in an investment thesis. Using low-cost BMO ETFs minimizes trading expenses and currency conversion costs.

Related BMO ETFs

BMO Global Consumer Discretionary Hedged to CAD Index ETF (Hedged Units) (Ticker: DISC)

BMO Global Consumer Staples Hedged to CAD Index ETF (Hedged Units) (Ticker: STPL)

Disclosures:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the authors represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. The statistics in this update are based on information believed to be reliable but not guaranteed.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.