Buffer and Accelerator ETFs – Building Bespoke Exposures with Liquid Strategies

Oct. 18, 2023The evolution of ETFs has featured several important milestones. Daniel Stanley, Director, Institutional & Advisory, introduces the next great leap: Buffer and Accelerator ETFs, which empower Investment Counsellors and Multi-Family Offices to shape portfolio risk and potentially create better outcomes for clients.

Buffers and Accelerators: The next stage in the evolution of ETFs

ETFs have come a long way since the launch of the first ETF in the world, the Toronto 35 Index Participation Fund (aka “TIPS”), in 1990. SPY, the first ETF in the U.S., was launched in 1993, the first bond ETF was launched in Canada in 2000,1 and, at the end of 2022, total ETF AUM in Canada was $350 billion.2 ETFs have evolved from giving clients exposure to broad equity or bond indices to more targeted country and sector exposures, and eventually to defined factors which screen indices for outcomes like low volatility, quality and dividends or momentum, size and value. The latest of that evolution is Buffer and Accelerator ETFs.

What Is a Buffer and Accelerator ETF?

Buffers and Accelerators are ETFs whose goals are “to take a traditional (undefined) investment and restructure it to create a new/risk reward profile,” according to Innovator ETFs.3 In simple terms, an Accelerator augments upside returns up to a cap, and a Buffer implements downside protection to a prescribed floor.

Why are they useful to a family office, Investment Counselor, or discretionary portfolio manager?

Buffers and Accelerators can help discretionary portfolio managers accentuate different investment objectives. Though they can’t control the markets, Accelerators can boost returns and Buffers can soften market compressions.

Taking a long-term view of U.S. market performance reveals some interesting results:3

- 75% of all returns were less than 20%, with a median of 3.60%

- 31% of all returns were negative with the median negative return being -12.0%

- 2/3 of all positive returns were less than 20%, with a median return of 15%

With this data in mind, Buffer and Accelerator ETFs allow discretionary managers to shape portfolio risk and return metrics to create better outcomes. For Accelerators, new terms and conditions are set each quarter, dynamically adapting as the market moves.

Using tools that calibrate to market conditions enables discretionary managers to build more specific exposures, the foundation for a more trusting client relationship.

What is an Accelerator?

Before we get into the specifics of Buffers and Accelerators, it’s important to review a concept that I previously wrote about in “Turning Volatility Into Enhanced Income” In the Winter 2022 issue of The Vault. In that article I stated:

“In physics, the law of conservation of energy states that energy can be transformed from one form to another but can neither be created nor destroyed. Volatility, in this metaphor, is the ‘energy’ of a security, in the sense that whether it’s high or low, it is always present. An option contract is a tool that transforms volatility from an observable phenomenon into a source of yield.”

In the world of Buffers and Accelerators, that “yield,” or premium from a sold option contract, is used to transform a long-only position in an asset into one with either upside or downside protection. And, if the premium cost of the purchased option contract(s) equals the value of the sold option contract(s) – or to extend the above metaphor, there is no excess energy – then the structure is costless.

An Accelerator ETF is merely a covered call ETF plus a purchased at-the-money (ATM) call option. The cost/benefit analysis of a covered call ETF is well known: the investor is long an asset and sells away any upside over the strike price and, in return, receives a monthly payout. With an Accelerator, however, the investor doesn’t receive the monthly payout; instead, the issuer uses the income to buy an ATM call option whose return is added to the return of the long position. The order of operations is as follows:

- The issuer goes long the underlying asset

- The issuer buys one long ATM call option on the underlying asset

- The issuer sells two out-of-the-money (OTM) call options on the underlying asset

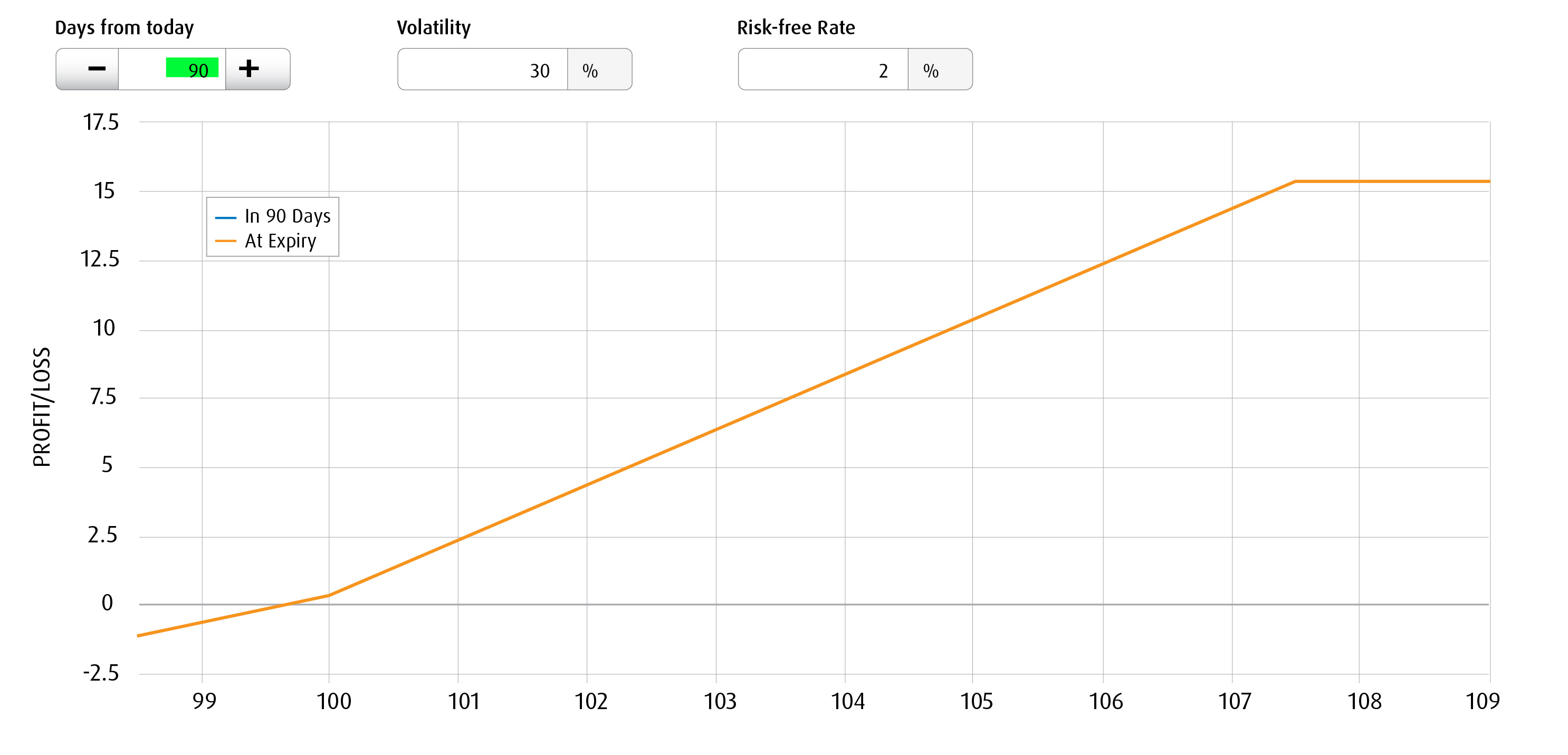

If we return to the energy metaphor, the purchase of an ATM the call option is expensive and consumes a lot of “energy.” How do we pay for that option knowing that energy can’t be created? We sell two OTM call options to convert volatility into a premium that’s used to offset the cost of the long ATM call option. Note that the strike price of the OTM calls we sell will be a variable outcome dependent on how much premium we need to cover the cost of the one purchased ATM call option. The resulting exposure with an Accelerator ETF will look like this:

- One-for-one loss below the strike/purchase price of the long asset

- Approximately 2x the price return above the strike/purchase price of the long asset to a maximum of the strike price of the sold OTM call options.

Assuming a $100 strike price, your exposure looks like this at maturity:

An Accelerator ETF use case

Accelerator ETFs are 81-102 compliant funds with outcomes generated through a mix of equities and option contracts, and as such might be helpful to organizations that can’t use options or who face added costs when doing so.

An obvious case is to use Accelerators to enhance returns in predicted below average return market environments. Because they can boost returns, Investment Counsellors can maintain more evenly balanced portfolios, yet augment upside returns while remaining compliant to a conservative asset mix.

What is a Buffer?

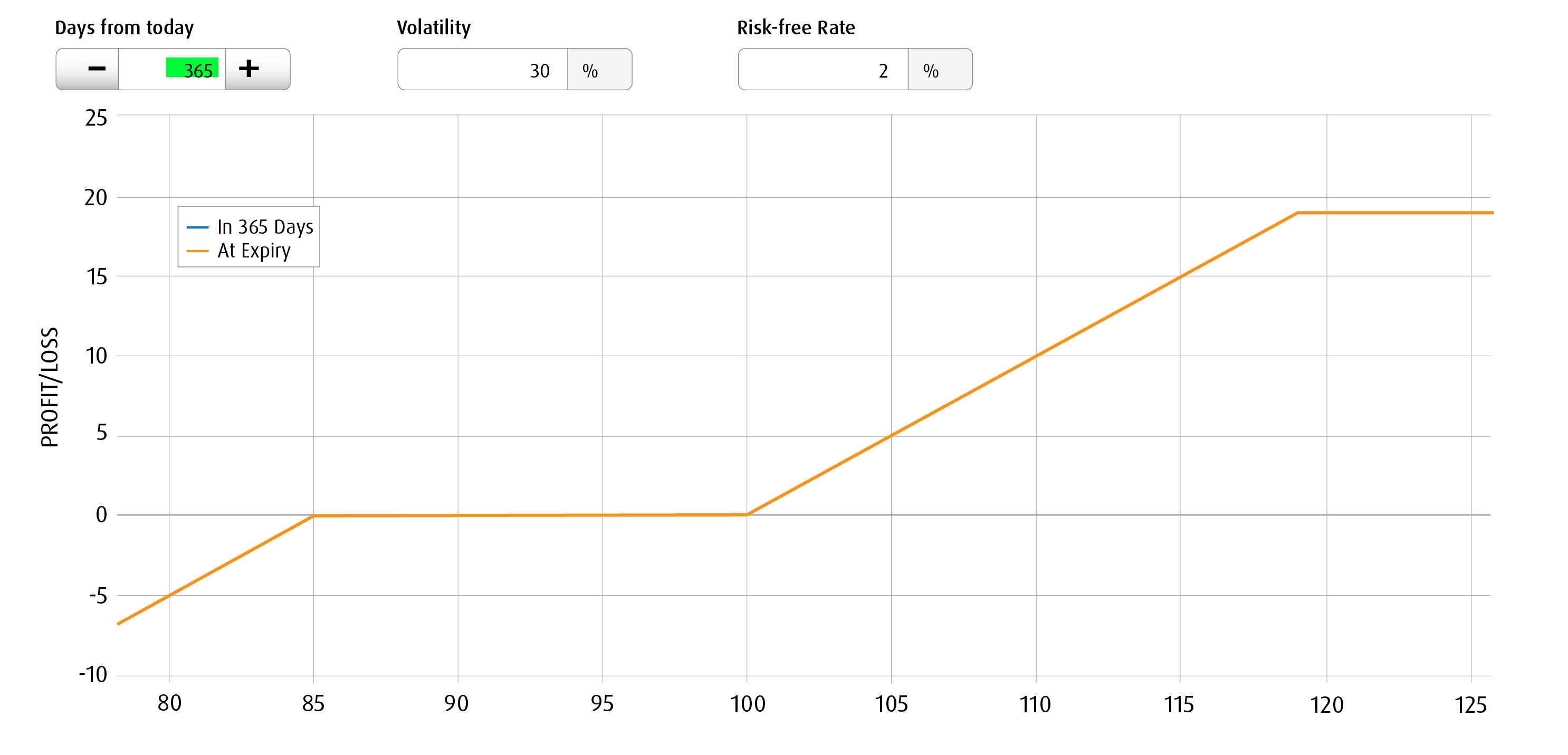

In simple terms, a Buffer ETF is portfolio insurance with an upside cap and downside risk that kicks in below a floor. As with covered calls, the cost/benefit analysis of portfolio insurance is well known: the investor is long an asset and buys downside protection below the strike price by purchasing an ATM put option. But ATM put options are costly, and to make the Buffer ETF a costless transaction, the investor has to give up the downside protection below a specified level and any gains above a cap. The order of operations is as follows:

- The issuer goes long the underlying asset

- The issuer buys an ATM put option on the underlying asset

- The issuer sells a 15% OTM put option on the underlying asset

- The issuer sells an OTM call option on the underlying asset

To again return to the energy metaphor, the purchase of an ATM put option is expensive and consumes a lot of “energy.” How do we pay for that option knowing that energy can’t be created? We sell OTM put and call options to convert volatility into a premium that is used to offset the cost of the long ATM put option. Like the Accelerator ETF, the strike price of the OTM call we sell will be a variable outcome dependent on how much premium we need to cover the cost of the one purchased ATM put option less the premium earned on the 15% OTM put option. The resulting exposure with a Buffer ETF looks like this:

- One-for-one gain above the strike/purchase price to a cap of the OTM short call.

- No losses below the strike price of the long ATM put to a cap of 15% below the strike price.

- One for one loss below the strike of the OTM put.

Assuming a $100 strike price, your exposure looks like this at maturity:

A Buffer ETF use case

A Buffer ETF may be thought of as a bond replacement strategy because the caps typically exceed the return on bond yields, while the built-in buffers help mitigate equity market losses. Buffers allow discretionary managers to refine portfolio construction and to dynamically reduce downside exposures. Suppose a client owns a Buffer ETF that inoculates them from a 15% decline off the strike price. If the market rises 15%, then the value of the 15% protection has fallen. Said another way, the client has more to lose. This provides an opportunity for the discretionary manager to purchase a new Buffer ETF with a higher strike price to protect the client from declines off the new higher market levels. This dynamic portfolio construction process leads to more orchestrated outcomes and possibly tighter client relationships.

Portfolio construction and innovation

BMO ETFs is at the forefront of innovative portfolio construction tools. We have the largest suite of bond ETFs because of the way we segment the market by credit and duration, and we have the biggest suite of covered call ETFs because of our thoughtful approach, which balances both income with some room for growth. All of our tools allow discretionary portfolio managers to build portfolios with better outcomes knowing that there are certain things beyond our control. Now, a suite of Accelerator and Buffer ETFs is a natural extension to our development as Canada’s leading ETF provider.

For more information on BMO’s ETF solutions, reach out to your regional Institutional BMO ETF Specialist.

1 Vanguard.ca, “History of ETFs.”

2 BMO Capital Markets.

Disclosures:

An investor that purchases Units of a Structured Outcome ETF other than at starting NAV on the first day of a Target Outcome Period and/or sells Units of a Structured Outcome ETF prior to the end of a Target Outcome Period may experience results that are very different from the target outcomes sought by the Structured Outcome ETF for that Target Outcome Period. Both the cap and, where applicable, the buffer are fixed levels that are calculated in relation to the market price of the applicable Reference ETF and a Structured Outcome ETF’s NAV (as Structured herein) at the start of each Target Outcome Period. As the market price of the applicable Reference ETF and the Structured Outcome ETF’s NAV will change over the Target Outcome Period, an investor acquiring Units of a Structured Outcome ETF after the start of a Target Outcome Period will likely have a different return potential than an investor who purchased Units of a Structured Outcome ETF at the start of the Target Outcome Period. This is because while the cap and, as applicable, the buffer for the Target Outcome Period are fixed levels that remain constant throughout the Target Outcome Period, an investor purchasing Units of a Structured Outcome ETF at market value during the Target Outcome Period likely purchase Units of a Structured Outcome ETF at a market price that is different from the Structured Outcome ETF’s NAV at the start of the Target Outcome Period (i.e., the NAV that the cap and, as applicable, the buffer reference). In addition, the market price of the applicable Reference ETF is likely to be different from the price of that Reference ETF at the start of the Target Outcome Period. To achieve the intended target outcomes sought by a Structured Outcome ETF for a Target Outcome Period, an investor must hold Units of the Structured Outcome ETF for that entire Target Outcome Period.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the authors represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. The statistics in this update are based on information believed to be reliable but not guaranteed.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.