Commodities: A strategic shield against new-regime risks

Stubborn inflation, geopolitical fragmentation and rising climate risks are coalescing to form a new paradigm for asset allocators. A broad exposure to the building blocks of the economy provides both protection, and potential.

Jan 26, 2026Key takeaways

- Diversified commodity exposures have a low correlation to equities and reduce portfolio concentration.

- Shortages in industrial metals, or surges in oil prices are common during periods of geopolitical risk.

- Agriculture tends to outperform during climate related events (i.e., coffee beans have doubled in two years because of droughts).

- Commodities may experience a price boom from trade frictions and barriers.

Amid abundant supply, globalization-driven efficiency, and disinflationary forces, commodities have occupied the periphery of portfolio construction for many over the past decade or more. That regime is now shifting. Inflation is no longer transitory, geopolitical fragmentation has replaced globalization, and supply chains have proven far less elastic than markets once assumed.

In this environment, commodities are reasserting themselves not merely as a short-term inflation trade, but as strategic allocations capable of improving portfolio resilience, diversifying return streams, and providing exposure to long-cycle investments. While gold has understandably captured much investor attention, that focus risks missing a broader opportunity embedded across energy, industrial metals, agriculture, and livestock. For capital allocators, the case for commodities today is structural.

A new macro regime

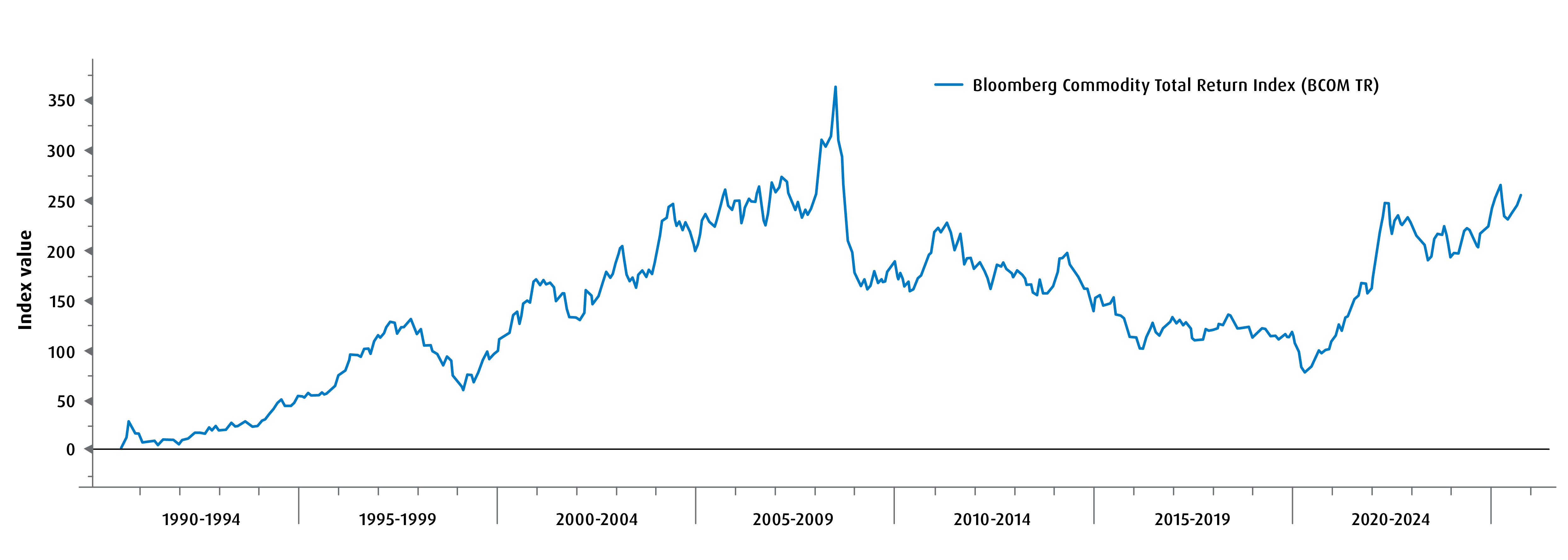

The defining feature of the modern commodity cycle is not demand alone, but the persistent inability of supply to respond quickly to price signals. Commodity markets move in extended arcs (Chart 1) precisely because production cannot be scaled quickly — whether in mining, energy infrastructure, or agriculture.

Commodity cycles tend to be long because supply adjustments are slow. Mines take years to permit and develop. Energy infrastructure requires sustained capital investment. Agricultural output is increasingly influenced by climate volatility.

These characteristics create asymmetric optionality within portfolios. Commodities may underperform during periods of surplus and disinflation, but when shocks occur — geopolitical conflicts, weather disruptions, trade barriers — the upside can be swift and material.

Chart 1. Long cycles to be expected

What makes this cycle different, in our view, is that commodities now sit at the intersection of economic growth, geopolitics and climate disruption (as well as the energy transition). Years of underinvestment combined with Environmental, Social and Governance (ESG) constraints and shareholder capital discipline, have left many resource industries operating with little spare capacity. At the same time, geopolitical fragmentation, trade barriers, and reshoring initiatives have introduced new sources of demand and volatility.

Oil-price surges during geopolitical crises, industrial metal shortages linked to electrification, and agricultural price spikes driven by droughts and tariffs are recent examples; Coffee prices, for instance, have doubled over the past two years amid climate-related supply disruptions — an illustration of how localized shocks can ripple through global markets. Our expectation is for such events to increase in both frequency and severity.

Inflation protection

The most compelling argument for commodities in the present context is inflation-driven. New inflationary regimes have historically exposed the fragility of traditional stock-bond diversifications. Consider 2022, for example, when both equities and bonds were firmly in the negative. By contrast, the Bloomberg Commodity Total Return Index (BCOM TR) finished the year 16% higher (as of December 31, 2025).

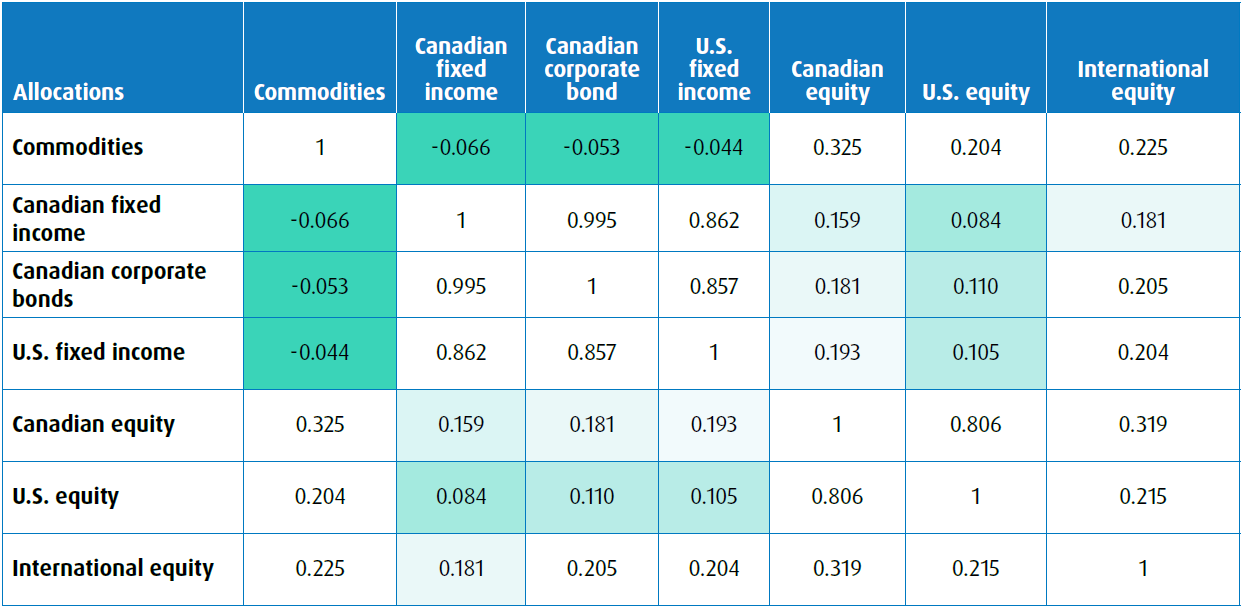

Broad commodities exposures have exhibited low-to-negative correlations with both equities and fixed income over the past five years, in contrast to the increasingly synchronized behavior of stocks and bonds (Table 1).

Table 1. Commodities correlations

During inflationary periods, correlations rise — precisely when investors expect bonds to offset equity volatility. Commodities, by contrast, derive their returns from physical supply and demand rather than financial conditions, allowing them to perform independently when other asset classes converge.

For investors with concentrated exposures, this independence represents a practical hedge against macro environments where diversification elsewhere fails.

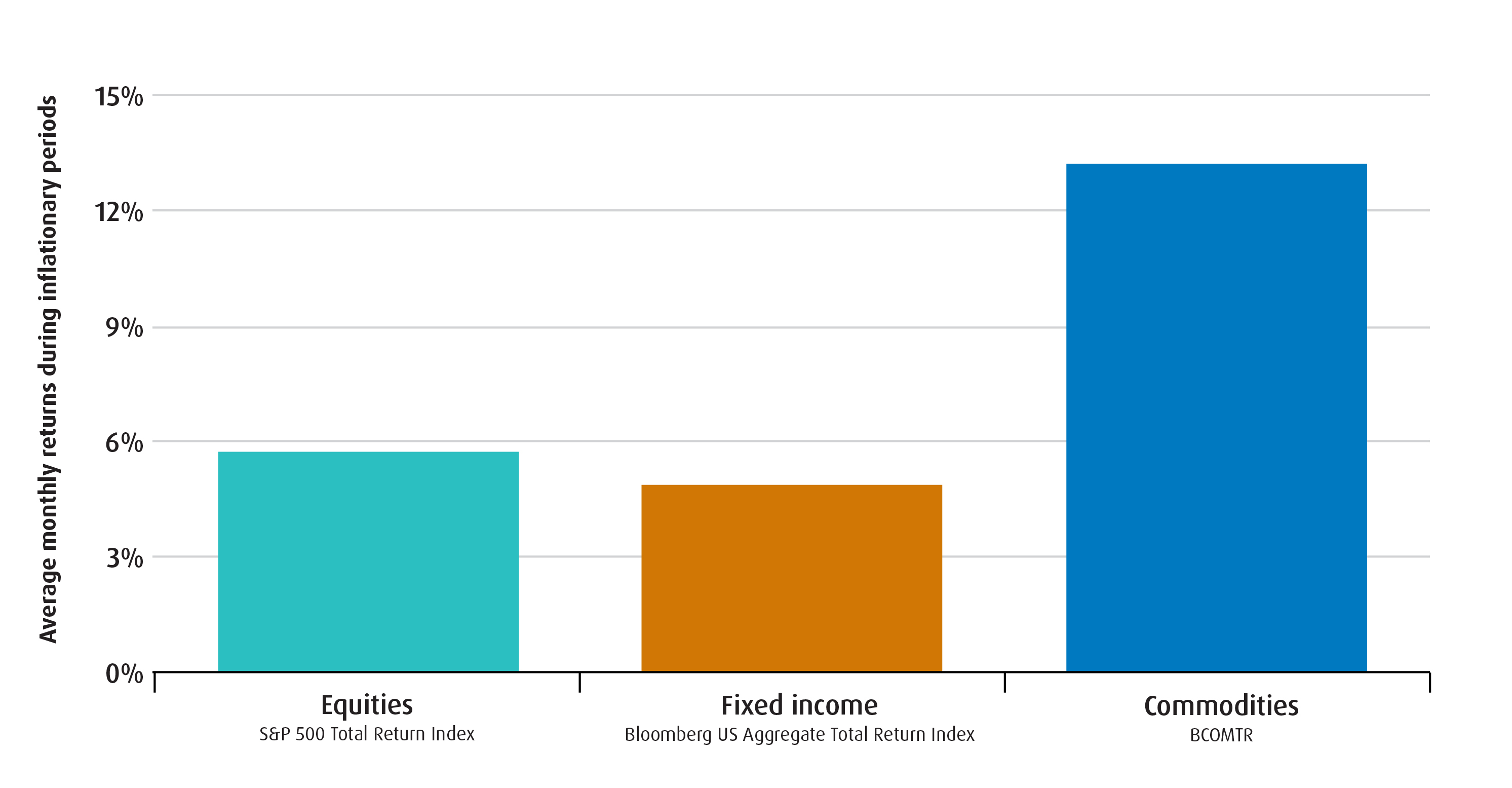

Commodities hedge inflation given that they reside upstream in the price formation process. When the cost of goods and services rises, it is often the commodities embedded in those goods that rise first.

This is not a marginal effect. It is a pronounced and repeatable pattern. Since 1977, during months when U.S. inflation (CPI) increased by more than 25 basis points, commodities delivered more than double the average monthly returns of equities and bonds (see Chart 2).

Chart 2. Different asset classes during rising inflation periods*

Crucially, commodities do not rely on policy responses to inflation. Unlike TIPS (Treasury Inflation-Protected Securities), whose returns are mediated through real yields, or equities, which depend on pricing power and margins, commodities respond directly to the imbalance between supply and demand. In inflationary environments driven by energy shocks, supply constraints, or geopolitical disruptions, this distinction matters.

ZCOM: A distinct return structure

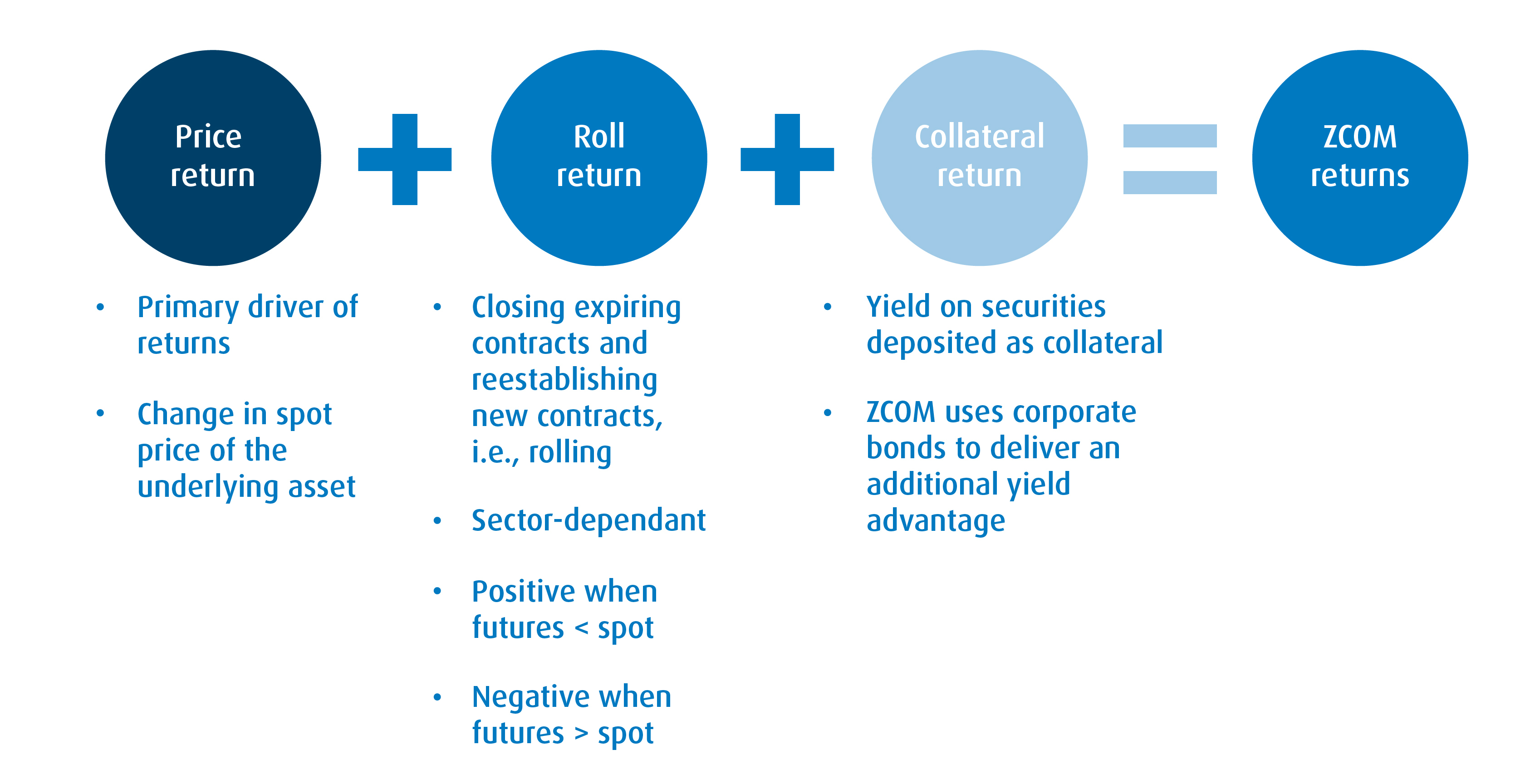

Investors can often reduce their commodities allocation decisions down to anticipated spot price movements. This oversimplification obscures the potential of the full return mechanics of the asset class, which can be generated through three distinct channels: spot price changes, roll yield, and collateral return.

Spot prices reflect immediate supply-demand dynamics. Roll yield arises from the shape of the futures curve — benefiting investors when markets are in backwardation, a common condition during supply shortages. Collateral return stems from the yield generated on cash backing futures exposure, which becomes increasingly relevant in higher-rate environments. The new BMO Broad Commodity ETF (ticker: ZCOM) uses all three levers to provide investors with a complete return profile (see Diagram 1).

Diagram 1. Returns drive by 3 components

Commodity equities considerations

One potential counterpoint to a direct exposure to the commodities complex is that the same could be achieved through resource equities. While commodity stocks do indeed complement portfolios, they do not replicate the behavior of commodities themselves.

Commodity equities are first and foremost equity investments, and are therefore materially subject to market sentiment, management decisions and balance-sheet risks. As noted, commodities, by contrast, are driven primarily by supply and demand fundamentals.

As most family office or investment councillor allocators can appreciate, owning gold miners is not the same as owning gold bullion. In periods of equity market stress, commodity stocks often decline alongside broader markets — even when the underlying commodity is rising. Direct commodity exposure avoids this, offering purer diversification when it is most needed.

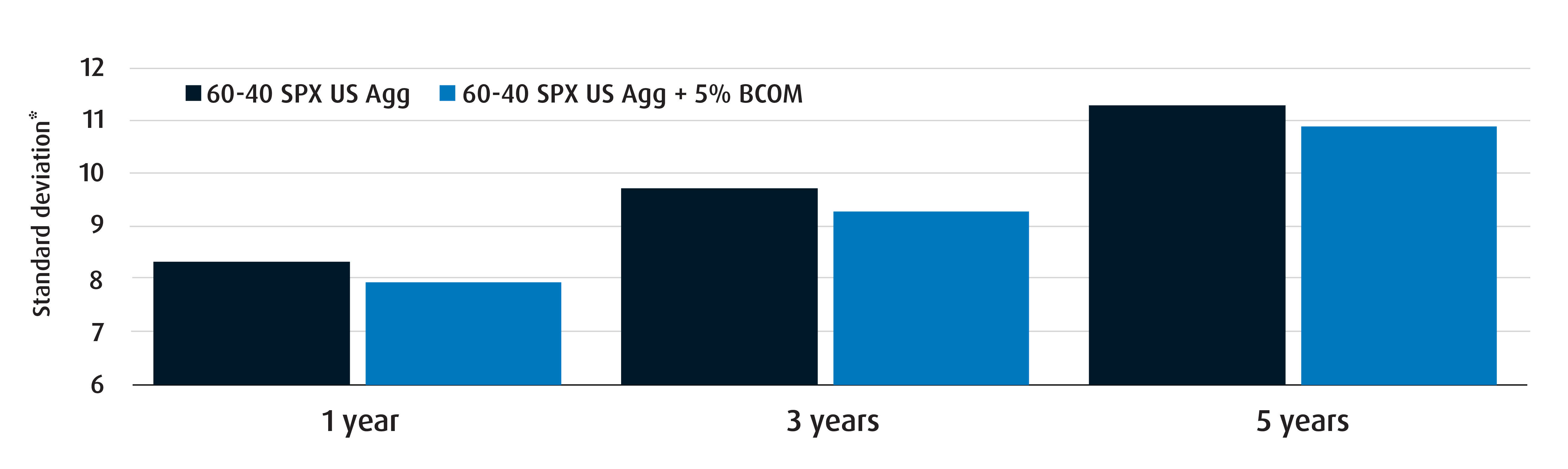

One of the most compelling considerations, in our view, is how little capital is required to improve portfolio outcomes. The standard deviation chart (Chart 3) shows that integrating a 5% commodity allocation into a traditional 60/40 portfolio can reduce volatility across one-, three-, and five-year horizons, based on historical data.

Chart 3. Small change, stronger long-term potential

This improvement is not driven by leverage or complexity, but by diversification. Commodities introduce a return stream that behaves differently across economic regimes, allowing portfolios to compound more efficiently over time.

Implementation

Historically, direct commodity exposure required managing futures contracts, roll schedules, and collateral — operational hurdles that has limited wider adoption. Those hurdles have effectively been removed through the introduction of ETF structures, with platforms like ZCOM offering one-ticket, rules-based access to a diversified commodity basket while eliminating much of this complexity.

Leveraging the underlying BCOM TR index, ZCOM provides transparent exposure across energy, metals, agriculture, and livestock, with disciplined rebalancing and liquidity suitable for most portfolios. For family offices and investment councillors, this evolution transforms commodities from a niche allocation into a scalable portfolio tool.

In an era where resilience matters as much as returns, commodities are truly foundational.

Please contact your BMO institutional sales partner for additional market insights.

Disclaimers

For Advisor and institutional use.

This article is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the author represent their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

The BMO Broad Commodity ETF is an exchange-traded alternative mutual fund within the meaning of NI 81-102. As an alternative mutual fund, the BMO ETF has the ability to invest in asset classes and use investment strategies that are not permitted for conventional mutual funds, including the ability to invest in other alternative mutual funds, employ leverage and borrow cash to use for investment purposes and increased ability to invest in commodities. While these strategies will be used in accordance with the BMO ETF’s investment objective and strategies, during certain market conditions, they may accelerate the pace at which an investor’s investment decreases in value.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

Index performance is based on hypothetical data, and is calculated using the same methodology that is employed to construct the current index. Calculated past performance data attempts to depict how the underlying index would have performed had it existed prior to its actual inception date and is shown for illustrative purposes only, and is not suggestive of future performance of the underlying index. It is not possible to directly invest in an index. The underlying index returns do not represent actual ETF returns, as commissions, management fees, and expenses may be associated with investments in BMO ETFs and BMO ETFs may earn income from lending securities.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.