Credit Where Credit is Due

As credit spreads widen and central banks turn hawkish, we discuss four “plain vanilla” corporate bond ETFs to help reduce the impact of rising rates and inflation.

Jan. 21, 2022With the narrative around inflation shifting from “transitory” to “this may be with us for a while,” investors may want to consider credit-focused ETFs to offset the impact on their fixed income portfolios, as central banks may act quicker in increasing interest rates than initially expected.

After all, November 2021 saw the largest single-month widening of credit spreads since March 2020, with corporate bonds underperforming both provincial and federal bonds. Such periods of spread widening present a tactical opportunity to add credit exposure, and fixed income ETFs are a flexible and convenient tool to achieve this in a challenging area of the portfolio.

Canada reported Core Price Inflation (CPI) of 4.7% in November, stoking fears that the Bank of Canada (BoC) will accelerate its rate hike schedule in 2022. Inflation is eroding real returns and the consensus opinion is for the trend to continue over the next 12 months.1 As such, we have seen volatility on the shorter end of the curve, with expectations for the BOC going from one rate hike to five throughout the year. (Though lockdowns may take one or two increases off the table.) Assuming the central bank moves rates up 0.25% at a time, we see this as an aggressive shift that will likely lead to a steepening of the yield curve.

What should family offices and investment counsellors do in such conditions? Consider embracing tactical moves to shorter duration and credit solutions, such as those listed below.

User guide to this report

In last quarter’s edition of THE VAULT, my colleague Laura Tase explored preferred shares, U.S. TIPS and floating rate high-yield bonds as tools to counterweight the impact of inflation (you can read the article here). These solutions would fall under the “plus” category of a core plus bond portfolio.

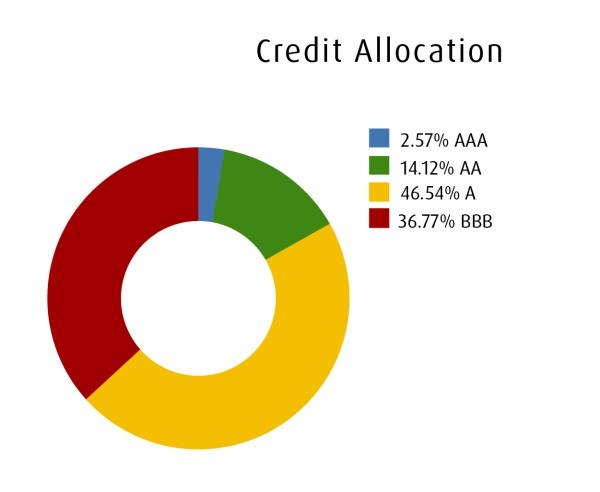

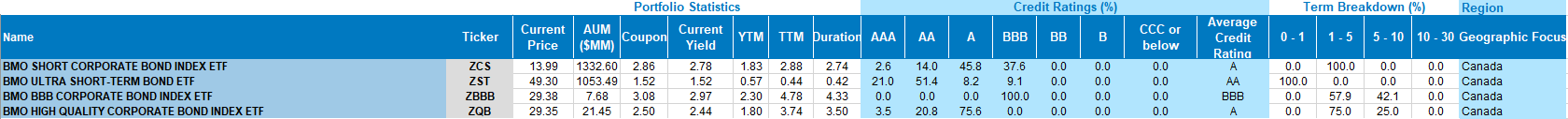

In this article, we drill down on four investment-grade solutions that provide Canadian credit exposure on the short end of the curve – yet would still fall under the “core” part of the core plus equation. If you are an investment counsel firm that requires plain-vanilla investment-grade bond exposures in order to fulfill your client’s Investment Policy Statement (IPS), these four options would fit that need, while still helping to mitigate the twin problems of rising rates and inflation.

The four options are ranked from closest to cash, to further out on the risk spectrum.

1. ZST – BMO Ultra Short-Term Bond ETF

| Holdings | Investment-grade corporate bonds maturing in one year or less |

| Duration | 0.42 years |

| Distribution Yield | 1.94% |

| Yield to Maturity | 0.45% |

| Credit Quality | AA |

Source: BMO Global Asset Management, as of December 31, 2021. Distribution yield is not an indicator of overall performance yields will change from month to month based on market conditions and is not guaranteed. See appendix for the full disclaimer.

The purpose of this ETF is to effectively park money, but with slightly more return potential, versus cash or a money market fund. It is designed to be as short duration as possible within the investment-grade universe, with an annual distribution yield of 1.94%, paid out monthly. However, if monthly cash flow is not a requirement, the BMO Ultra Short-Term Bond ETF (Accumulating Units) (Ticker: ZST.L) purchase option simply reinvests the coupon and adds it to the ETF’s NAV. This helps simplify performance reporting, by showing total returns instead of having to calculate coupon income and price gains separately.

2. ZCS – BMO Short Corporate Bond Index ETF

| Holdings | 1 to 5-year ladder of investment-grade corporate bonds |

| Duration | 2.76 years |

| Distribution Yield | 2.98% |

| Yield to Maturity | 1.85% |

| Credit Quality | A |

Source: BMO Global Asset Management, as of December 31, 2021. Distribution yield is not an indicator of overall performance yields will change from month to month based on market conditions and is not guaranteed. See appendix for the full disclaimer.

Source: BMO Global Asset Management, as of December 31, 2021.

If you’re looking for higher return potential and have a slightly longer time horizon, ZCS provides a similar offering with marginally more volatility. With a highly competitive fee of 0.11% MER and a track record that dates back to 2009, it is also one of the largest and most liquid corporate bond ETFs in Canada, closing in on $1.4 billion in AUM.2 This ETF tracks the returns of the FTSE Canada Short Term Corporate Bond Index, and is also offered in the accumulating units purchase option (BMO Short Corporate Bond Index ETF [Accumulating Units] [Ticker ZCS.L]). which reinvests the distribution and consolidates it to the NAV.

3. ZQB – BMO High Quality Corporate Bond Index ETF

| Holdings | 100% corporate bonds, with a term to maturity greater than one year and less than ten years, with a rating of A or better. Replicates the performance of the FTSE Canada 1-10 Year A+ Corporate Bond Index™ |

| Duration | 3.48 years |

| Distribution Yield | 2.56% |

| Yield to Maturity | 1.84% |

| Credit Quality | A- or above |

Source: BMO Global Asset Management, as of December 31, 2021. Distribution yield is not an indicator of overall performance yields will change from month to month based on market conditions and is not guaranteed. See appendix for the full disclaimer.

Certain investors, such as municipalities and foundations, may restrict investing in corporate bonds rated BBB or below. As such, ZQB is effectively among the best yields you can get before going further out on the risk spectrum, with the added benefits of short duration (3.53 years) and low fees (0.11% MER).

Below are two recent Investment Policy Statements (IPS) where ZQB was a fit:

a) Investment counsel firm with a foundation client:

- IPS specified 50% cash, 20% mortgages (ZMBS), 30% short-term high-quality bonds (ZQB)

- Time Frame: Less than 4 years

- Objective: to beat return of cash

b) Investment counsel firm with a crown corporation client:

- IPS specified A- and above rated bonds only

- They were sitting 100% in cash

4. ZBBB – BMO BBB Corporate Bond Index ETF

| Holdings | 100% corporate bonds, designed to replicate the FTSE Canada 1-10 Year BBB Corporate Bond Index™. The Fund invests in bonds with a maturity greater than one year and less than ten years, with a BBB rating |

| Duration | 4.40 years |

| Distribution Yield | 3.22% |

| Yield to Maturity | 2.35% |

| Credit Quality | BBB |

Source: BMO Global Asset Management, as of December 31, 2021. Distribution yield is not an indicator of overall performance yields will change from month to month based on market conditions and is not guaranteed. See appendix for the full disclaimer.

Looking at the last five years, ZBBB has delivered significant outperformance over ZQB (556 bps) and 273 bps over our broad fixed income ETF, BMO Aggregate Bond Index ETF (Ticker: ZAG),3 which illustrates the benefits of taking on that credit spread. Moreover, because it is a one to 10-year index with an overall duration of 4.4, it also eliminates some of the longer duration impact of ZAG.

Source: Bloomberg, December 30, 2016 – December 1, 2021. Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

This is precisely the type of economic environment in which to seek credit exposure, as rising rates are indicative of a strong economy. ZBBB also offers a lever for strong longer-term returns.

Bond ETFs: The right choice for family offices & investment counselors?

In our experience, family offices and investment counsellors typically find several operational efficiencies through ETFs. First, when trading a portfolio of individual bonds, you need to come up with a list of bonds you want to sell and a list you want to buy. You don’t have to do this with ETFs. They also offer reduced trade time relative to cash bonds, and there are no prescribed trading times like with active pools.

Second, they may be used as liquidity sleeves. With rates being as low as they are, cash drag could be the difference between first, second and third quartile returns. Moreover, an investor holding illiquid individual bonds may want to do an in-kind trade with an ETF, which is something we can facilitate. Simply reach out to your respective BMO ETF Specialist with CUSIPS and we will be happy to map your holdings onto our ETFs.

If you use cash bonds, you can use ETFs to portfolio trade in and out with minimal friction using cash or in-kind securities. You can also use ETFs to access or unload difficult-to-trade inventory, or loan them out if you want to earn an extra yield, as this will often cover the fee and then some.

The benefits of scale

As the largest provider of fixed income ETFs to the Canadian marketplace, we offer the widest selection of exposures that allow you to customize your portfolios. You can go extremely granular – tilting your portfolio by duration, term and credit – or toward broader exposures, depending on the clients’ needs.

You also gain the advantage of direct access to our portfolio managers. To help you obtain the best execution every time, have your trading desk call our PMs directly via our hotline (1 877 741 7263). They work with every ETF market-making desk on the street in order to provide the best pricing possible, and can share colour on the market, including which market makers specialize in what products, and so on. (Note: We do not collect a commission for this service, and you still place the order with your usual trader.)

Other excellent fixed income resources from BMO ETFs:

- BMO FTSE Russell Monthly Canadian Fixed Income Report – December 2021

- Fixed Income ETFs for Institutions – Report

- BMO ETF Roadmap (for fixed income, see page 3)

- Weekly Fixed Income Spreadsheet

We are pleased to consult with you to help you determine which bond ETFs would be suitable for your portfolios. Please contact your Institutional BMO ETF Specialist (Dan, Erika, Laura or Mark) for more information.

BMO ETFs Fixed Income Summary – As of December 31, 2021

This summary is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence

AUM – Assets Under Management

Coupon – yield paid by a fixed income security

Current yield – annual income/price

YTM: weighted average Yield To Maturity – total return expected if held to maturity

TTM: Weighted average Term To Maturity of the underlying securities

Duration – sensitivity of price to change in interest rates

Credit rating – assessment of creditworthiness of a borrower ranked by CCC or below (worst) to AAA (best)

Term Breakdown – years to maturity

1 Stéphane Rochon and Richard Belley, BMO Nesbitt Burns Portfolio Advisory Team, Equity and Fixed Income Strategy, January 2022.

2 BMO Global Asset Management, as of January 14, 2022.

3 BMO Global Asset Management; performance to December 31, 2021:

| Ticker | 1-year | 3-year | 5-year | 10-year | Since inception | Inception date |

|---|---|---|---|---|---|---|

| ZBBB | -0.83% | - | - | - | 2.77% | 02/05/2020 |

| ZQB | -1.41% | - | - | - | 1.93% | 02/05/2020 |

| ZAG | -2.64% | 4.12% | 3.17% | 3.07% | 3.75% | 01/19/2010 |

| ZCS | -0.63% | 3.29% | 2.47% | 2.60% | 2.89% | 10/20/2009 |

| ZST | 0.23% | 1.47% | 1.55% | 1.51% | 1.67% | 01/28/2011 |

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the authors represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. The statistics in this update are based on information believed to be reliable but not guaranteed.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Distributions are not guaranteed and may fluctuate. Distribution rates may change without notice (up or down) depending on market conditions. The payment of distributions should not be confused with an investment fund’s performance, rate of return or yield. If distributions paid by an investment fund are greater than the performance of the fund, your original investment will shrink. Distributions paid as a result of capital gains realized by an investment fund, and income and dividends earned by an investment fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero. Please refer to the distribution policy for BMO ETF set out in the prospectus.

Cash distributions, if any, on units of a BMO ETF (other than accumulating units or units subject to a distribution reinvestment plan) are expected to be paid primarily out of dividends or distributions, and other income or gains, received by the BMO ETF less the expenses of the BMO ETF, but may also consist of non-taxable amounts including returns of capital, which may be paid in the manager’s sole discretion. To the extent that the expenses of a BMO ETF exceed the income generated by such BMO ETF in any given month, quarter or year, as the case may be, it is not expected that a monthly, quarterly, or annual distribution will be paid. Distributions, if any, in respect of the accumulating units of BMO Short Corporate Bond Index ETF, BMO Short Federal Bond Index ETF, BMO Short Provincial Bond Index ETF, BMO Ultra Short-Term Bond ETF and BMO Ultra Short-Term US Bond ETF will be automatically reinvested in additional accumulating units of the applicable BMO ETF. Following each distribution, the number of accumulating units of the applicable BMO ETF will be immediately consolidated so that the number of outstanding accumulating units of the applicable BMO ETF will be the same as the number of outstanding accumulating units before the distribution. Non-resident unitholders may have the number of securities reduced due to withholding tax. Certain BMO ETFs have adopted a distribution reinvestment plan, which provides that a unitholder may elect to automatically reinvest all cash distributions paid on units held by that unitholder in additional units of the applicable BMO ETF in accordance with the terms of the distribution reinvestment plan. For further information, see Distribution Policy in the BMO ETFs’ prospectus.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence.