Fixed Income Decision Tree

Refining Your Bond Portfolio

Aug. 21, 2023“The rise of ETFs has created more flexibility in how both dealers and clients can execute portfolio trades.”

— BANK OF CANADA, 2020

Adjusting fixed income allocations has become increasingly important in today’s environment. Investors are being forced to more actively manage their fixed income exposures as market volatility continues and the interest rate environment remains uncertain. Exchange traded funds (ETFs) are an excellent tool to help manage concerns around declining bond inventories and liquidity constraints in the market. While still providing an effective hedge against equity corrections, the two traditional roles of bonds, income generation and capital protection, are top of mind due to market uncertainty and changing sentiment among central banks.

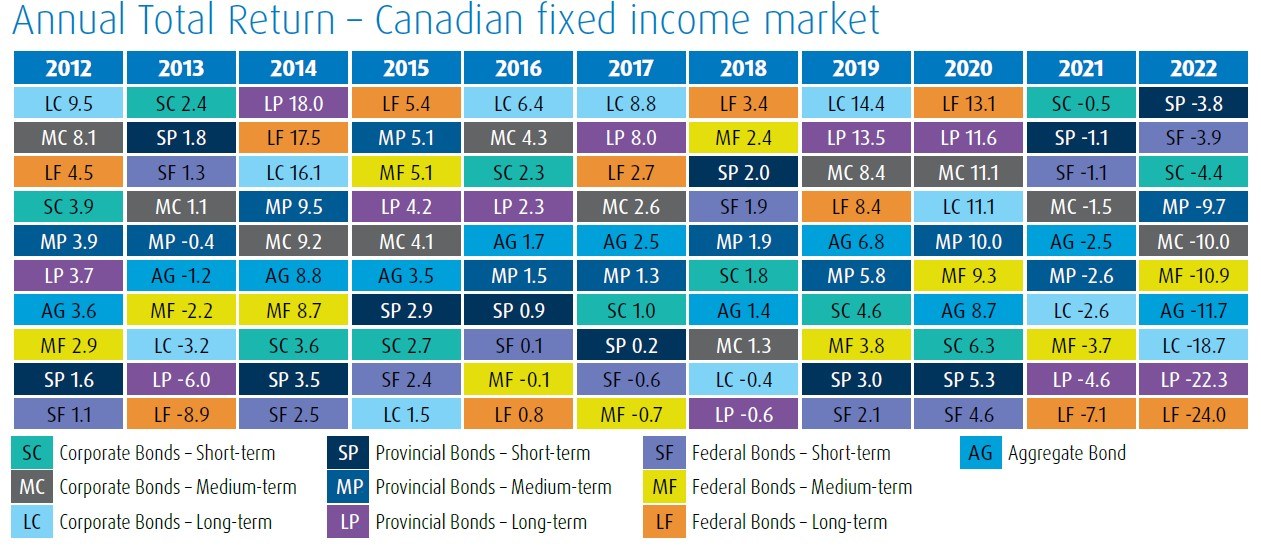

When investors consider interest rate risk, some will adjust duration under the assumption that interest rates move in a parallel manner, in other words that all yields move up and down by the same amount. In reality, beyond parallel shifts, yield curves can steepen, flatten, or twist as short-term, mid- term and long-term rates are influenced by differing factors. In addition, credit spreads can tighten or widen and currency can impact a portfolio. Increasingly, investors are using ETFs for their many fixed income needs, providing both core and satellite exposures. We have also witnessed a growing popularity of active fixed income ETFs, giving investors more choice where active management offers professional asset allocation and expertise while adding global exposure. Typically, we are seeing passive ETFs used when an investor has confidence in their views, and adding active global fixed income ETFs where they have less expertise.

Passive ETFs lead the way as low cost solutions as well as access tools that enable investors to attain precise exposures. Active ETFs are effectively priced compared to traditional investments, typically leaving more returns in an investor’s pocket.

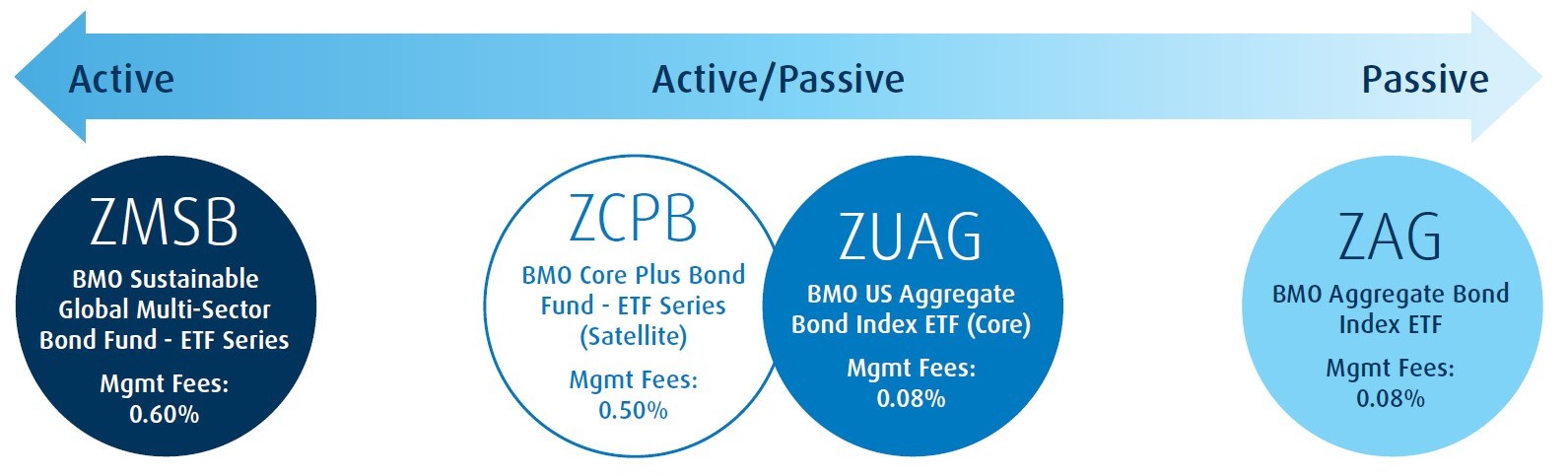

Fixed Income Decision Tree: Active, Passive or a Blend?

With the launch of active fixed income ETFs, investors have even more flexibility in their portfolio construction. The choice between active and passive may be best viewed as spectrum and not an either/or decision. An index-based approach can be more suitable for a purely passive investor who is more fee conscious and believes in efficient markets.

Moving towards the middle the spectrum, active management can be complemented by using index based, passive ETFs, to make active bets where an investor has a view on interest rates, credit, or the economy. As well, a portfolio can be built with a passive core and select active managers as satellite positions to generate alpha in asset classes where expertise can be outsourced such as high yield or emerging markets.

And for investors who prefer to rely entirely on professional active management, they can choose active fixed income ETFs to seek alpha at a low cost.

Source: BMO Global Asset Management

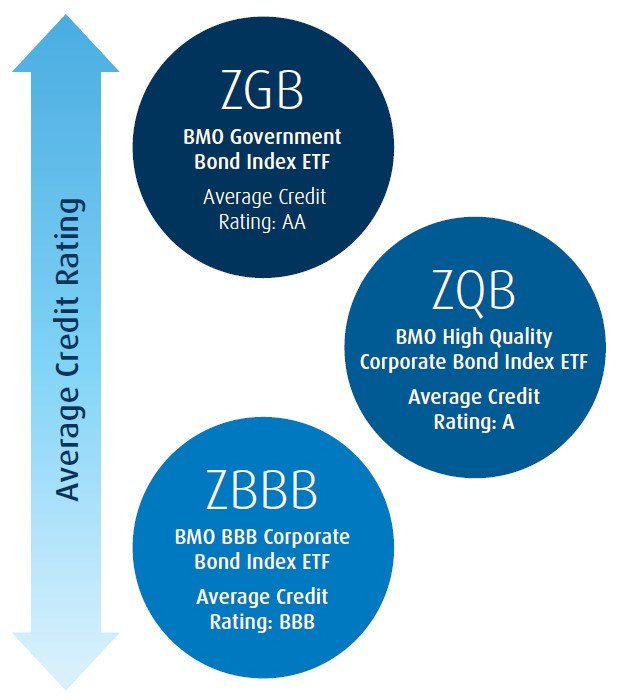

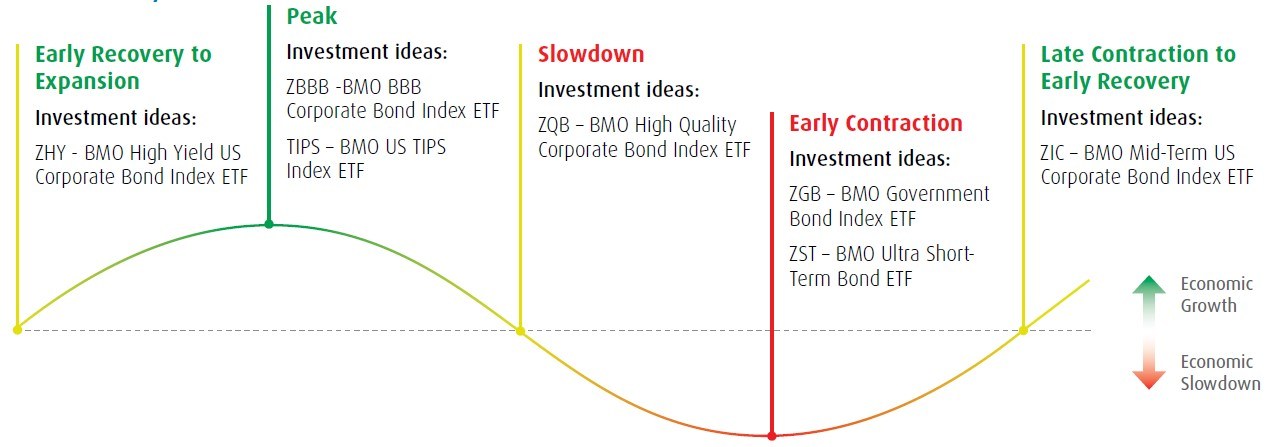

What is your view on the economy?

Depending on where investors believe we are in the economic cycle, they can position their fixed income portfolios accordingly. When confidence is high, and investors believe economic growth will be positive they can look to perhaps incorporating high yield bonds and BBB bonds into portfolios. For more nervous investors who believe an economic slowdown is on the horizon and prefer to position themselves more defensively, they can look to improving their portfolio credit quality and by perhaps adding government bonds.

A more constructive view should result in a higher weight in corporate bonds, and higher conviction would include high yield bonds and BBB Bonds.

Economic Cycle

Fixed Income Matrix

BMO Short Corporate Bond Index ETF distributing units | accumulating units |

BMO Mid Corporate Bond Index ETF |

BMO Long Corporate Bond Index ETF |

BMO Short Provincial Bond Index ETF distributing units | accumulating units |

BMO Mid Provincial Bond Index ETF |

BMO Long Provincial Bond Index ETF |

BMO Short Federal Bond Index ETF distributing units | accumulating units |

BMO Mid Federal Bond Index ETF |

BMO Long Federal Bond Index ETF |

Yield Curve Shifts - How do you anticipate Central Banks to Act?

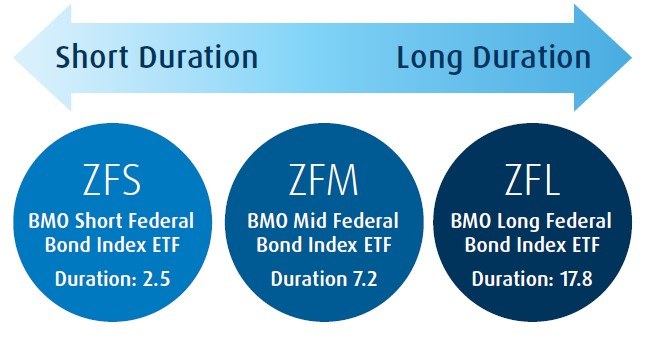

Investors can use the yield curve to make fixed income investment decisions depending on their view on how yield curve shape will change over time. BMO ETFs offers a comprehensive fixed income line up across the term spectrum to help investors choose where they want to be on yield curve and position their portfolios accordingly. For example, investors who believe longer term interest rates may be set to fall, they can look to adding duration with exposure to long government bonds. For investors who believe that short term interest rates are set to rise, they may consider shortening their duration with perhaps shorter term government exposure.

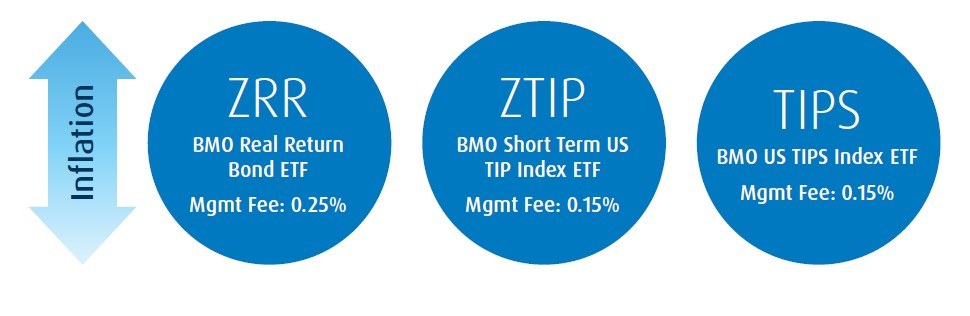

What is your view on Inflation?

Fixed Income investments are impacted significantly due to inflation. Inflation reduces the purchasing power of income generated from a fixed income investment. As inflation rises and interest rates for existing fixed income instruments remain the same, this erodes the value of bonds leading to bond prices to decline. For investors who believe inflation will be persistently high, they may consider investing in inflation protected fixed income ETFs to protect their portfolios.

Tax Efficiency in Non-Registered Accounts

Tax is often a primary concern for investors who hold bonds in non-registered accounts. In a taxable account the higher the coupon, the higher tax the investor will pay. Discount Bonds are issued at a lower price than it’s par value, since the coupon rate is lower than prevailing interest rates. The difference between the par value and it’s original price will be considered capital gains at maturity. From a tax perspective, by investing in lower coupon bonds, it follows that a discount bond will be more tax efficient.

Other considerations?

Currency – investors typically concentrate on domestic exposures for fixed income, U.S. and global bonds can offer both diversification and currency return opportunities. Typically, investors will have a view on CAD/USD and can benefit from currency momentum. Keep in mind that adding currency risk can greatly impact the volatility of a fixed income portfolio and may lower the value of the initial investment.

Market exposure – while fixed income markets are generally correlated, as the actions of the U.S. Federal Reserve and U.S. economy have far reaching global implications, investors can still benefit from outperforming economies and understanding the sector differences across markets.

Black swan events – investors concerned about market confidence can consider adding U.S. treasuries as a flight to safety trade.

Income needs – investors needing extra income can consider a higher allocation to corporate bonds, high yield bonds, and preferred shares, understanding the different risk profiles of the exposures.

Inflation protection – investors concerned about inflation can consider Canadian real return bonds or U.S. TIPs bonds.

Pricing inefficiencies – investors may identify return opportunities or mispriced risk across segments of the yield curve, using precise exposures through short-term, mid-term and long-term ETFs.

Tax efficiency – investors in taxable accounts can consider ETFs that use derivatives or invest in lower coupon bonds.

For BMO ETF’s Fixed Income Strategy:

Quarterly Fixed Income Strategy - Q3 2023

For BMO ETF Fixed Income solutions please visit bmoetfs.ca.

This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from the Bank of Montreal. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF facts or prospectus before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc., BMO Investments Inc., BMO Asset Management Corp., BMO Asset Management Limited and BMO’s specialized investment management firms.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence.”