How CDRs lower the barriers to high-quality international exposures

May 5, 2025An era likely to be defined by volatility and geopolitical uncertainty demands the rapid capability to alter models and efficiently integrate global equities. Canadian depositary receipts (CDRs) offer just that, explains Erika Cianfrone, Director, Synthetic Asset Management, Specialized Sales.

In today’s unpredictable and rapidly changing global markets, investment counsellors, their firms as well as multi-family offices face pressure to deliver resilient portfolios with adequate diversification, while streamlining operations and effectively managing risks. Rising geopolitical tensions, inflationary pressures and economic uncertainty have made finding innovative solutions more critical than ever.

Enter Canadian depositary receipts, or CDRs.

CDRs are emerging as a powerful tool for Canadian investors of all sizes and means, offering access to global equities while removing traditional barriers to geographies, as well as managing currency risk and transaction costs. For investment counsellors, the easy-access diversification benefits as well as currency hedging capability should be readily attractive when looking for high-quality international allocations.

As global trade rebalancing appears to be taking hold, Canadian asset managers are seeing increasing demand for international exposures among domestic clients, notably into blue-chip holdings with lower volatility profiles. Adopting CDRs offers not only portfolio enhancement potential, positioning clients seeking sustainable growth in an increasingly complex world, but their adoption as part of a comprehensive allocation strategy can also reinforce client trust by demonstrating access to innovative investment solutions.

Let’s explore the unique advantages of CDRs, and their place in the Canadian investment landscape.

What are CDRs?

CDRs are securities traded on Canadian exchanges that represent ownership in foreign companies. Introduced in 20211, they are designed to provide exposure to international companies without the complexity of international transactions. CDRs are priced in Canadian dollars, and contain the following innovative features:

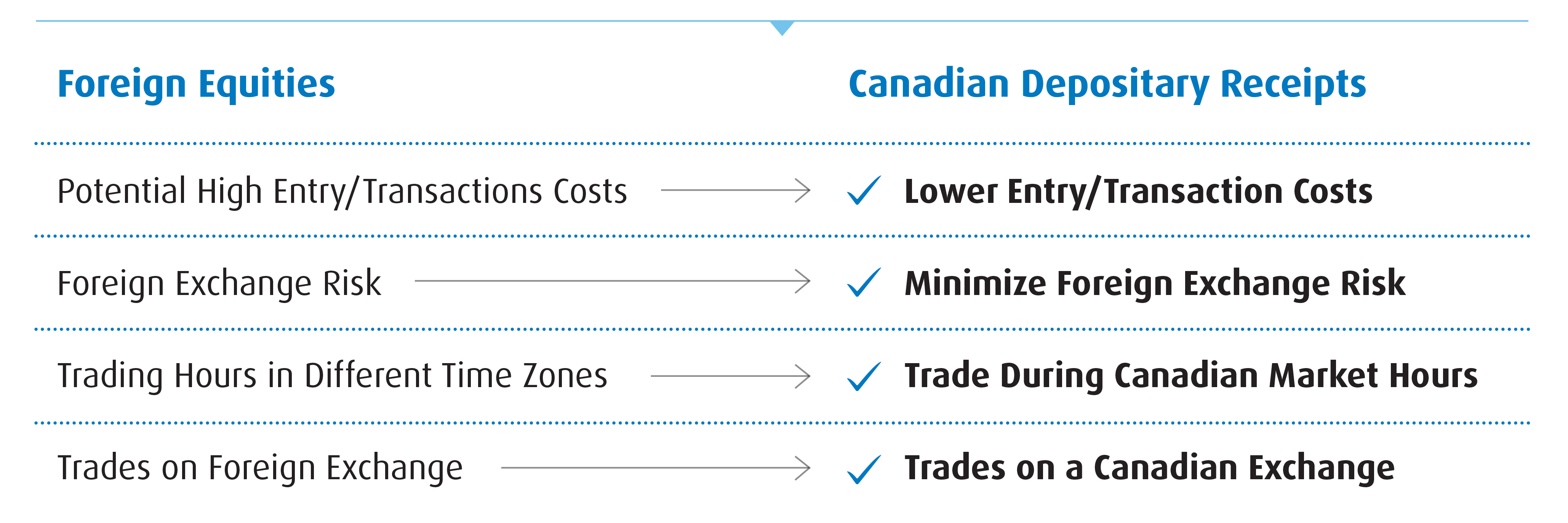

- Efficient diversification: Discretionary portfolio management can gain simplified entry into international holdings at potentially lower transaction costs.

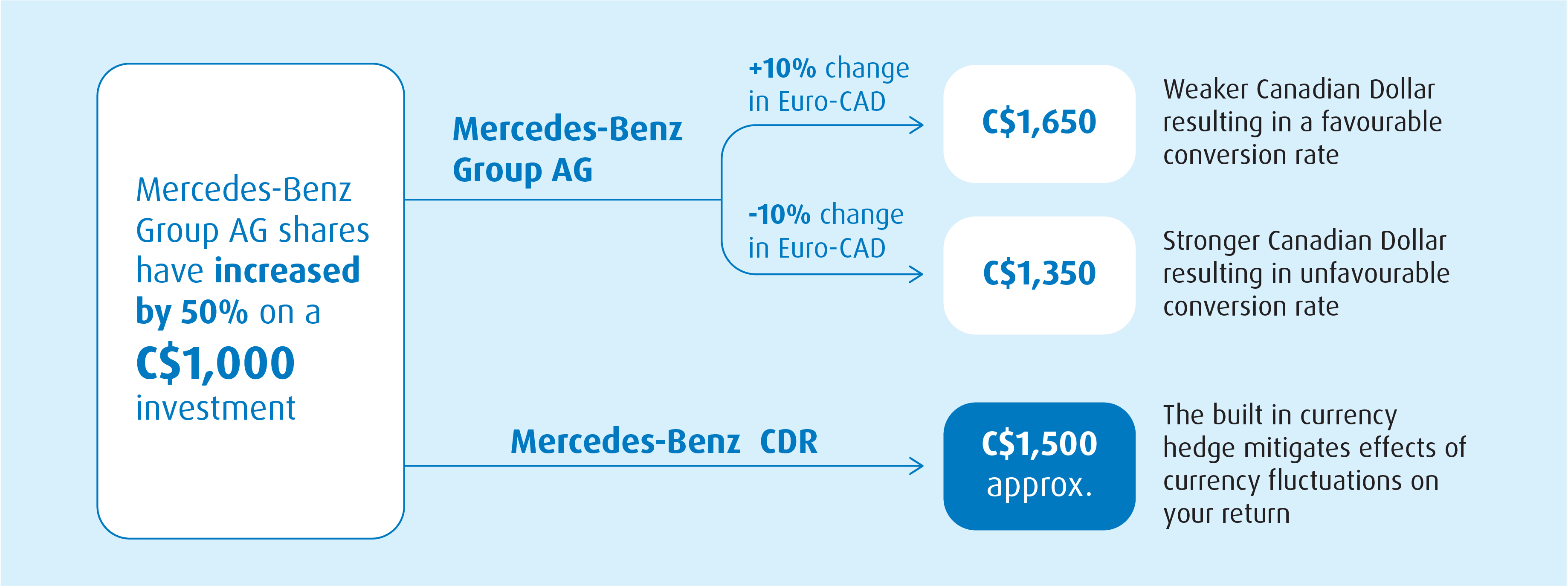

- Currency hedging: Built-in forward options manage foreign currency fluctuations, mitigating currency risk.

- Fractional ownership: Enables the ability to efficiently scale model changes across multiple portfolios.

- Domestic trading: CDRs trade on Canadian exchanges without the need for foreign accounts or currency conversions.

Why currency hedging matters

Removing operational hurdles

In managing a complex series of portfolios, the mechanisms of CDRs help to create a strategic benefit. Operational efficiency is essential to manage costs and address the potential need for portfolio rebalancing.

Traditionally, investing in foreign companies involves managing exchange rate risks, currency conversion spreads, compliance with foreign regulation and tax, and managing expensive international brokerage accounts. CDRs mitigate these challenges by providing a straightforward path to invest in global companies directly during North American market hours. The CDRs’ Canadian dollar (CAD) denomination also simplifies portfolio reporting, as alignment with Canadian accounting standards makes it easier to comply with regulations and reduces room for error. Overall, CDRs allow institutional clients to focus on strategic asset allocation rather than operational hurdles.

The present geopolitical environment has been marked by substantial risk — conflicts in Ukraine and the Middle East, escalating U.S.-China trade tensions, and a burgeoning global trade war have all significantly amplified volatility in global markets, making managing risk ever more important for institutional investors. Along with managing currency risk, CDRs also offer several risk mitigation benefits that can fit the unique needs of investment counsellors and portfolio managers:

- Diversification outside of North America: It’s no secret many Canadian portfolios have a home-country and U.S. bias.2 While these regions, particularly the U.S., have shown longstanding growth opportunities, over-reliance can expose client portfolios to regional risk – from economic weakness to overweight exposures to cycle-prone sectors like financials or energy.

- Access to stable blue-chip names: CDRs focus on globally recognized companies, with a minimum market cap of C$25 billion, many of whom are household names. These companies are world leading brands with strong fundamentals and a global reach — names like Nestle or Toyota, who might offer some stability amid turbulence. Moreover, as developing nations risk losing their investment appeal, institutional clients may prefer the stability offered by leading developed-market equities.

- Sectoral expansion: Diversifying across sectors can help domestic investors to gain exposure to high-growth industries, like European biotechnology and healthcare or Asian technology, sectors which have been underrepresented in North American indices.

Foreign equities vs. CDRs

With risk mitigation being top of mind for clients, CDRs stand to become increasingly valuable as we witness shifting geopolitical interests and economic realignments, making international positioning a potentially greater focus for managers.

CDRs represent, in our view, an important innovation for investment counsel firms and multi-family offices seeking efficient access to global markets. By addressing barriers like currency risk, transaction costs and operational complexity, CDRs enable institutional clients to achieve diversification in an effective way. An era that is likely to be defined by volatility and geopolitical uncertainty demands the rapid capability to shift models, and efficiently integrate global equities into and out of portfolios. CDRs provide clients with long-term investment objectives with a strategic edge in risk management at minimal cost.

Please contact your BMO institutional sales partner for more information on BMO GAM’s CDR capabilities, or for additional market insights.

1 The first CDRs linked to U.S. companies were issued in July 2021 by CIBC.

2 “Canadian securities represent 2.6% of global market capitalization. Canadian investor portfolios average approximately 50% in domestic allocations,” Vanguard Canada, June 2024.

DISCLAIMERS

For Advisor and Institutional use.

This material is for information purposes only. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party.

The viewpoints expressed by the author represent their assessment of the markets at the time of publication. Those views are subject to change without notice at any time.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

An investment in CDRs issued by Bank of Montreal (“BMO”) may not be suitable for all investors. Important information about these investments is contained in the short form base shelf prospectus and prospectus supplement for each series of CDRs (together, the “Prospectus”). Purchasers are directed to www.sedarplus.ca or to www.bmogam.com to obtain copies of the Prospectus and related disclosure before purchasing CDRs.

Each series of CDRs relates to a single class of equity securities (the “Underlying Shares”) of an issuer incorporated outside of Canada (the “Underlying Issuer”). For each series of CDRs, the Prospectus will provide additional information regarding such series, including information regarding the Underlying Issuer and Underlying Shares for such series. Neither BMO and its affiliates nor any other person involved in the distribution of CDRs accepts any responsibility for any disclosure provided by any Underlying Issuer (including Information contained herein or in the Prospectus that has been extracted from any Underlying Issuer’s publicly disseminated disclosure). Each series of CDRs is only offered to investors in Canada in accordance with applicable laws and regulatory requirements.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.