BMO ETFs Offering Target Cash Flow Units

Canada’s first T-Series ETFs are growing.1 The BMO Target Cash Flow Unites of the BMO ETFs (.T ETFs)2 provide investors with monthly cash flow.

Consistent Cash Flow

- Monthly payments for cashflow-focused investors

- Variety of distribution rates available from 6% to 15%

- Payout level aligned with your wealth goal

Efficient Cash Flow Delivery

- Structured approach for monthly payouts

- Flexibility to set cashflow rate while staying invested

- Regular cash flow with potential tax benefits

All Sectors. All Equal.

BMO MSCI USA Equal Weight Index ETF

ZEQL.U (USD Units) |

ZEQL.F (Hedged Units) |

|

Management Fee: 0.05% |

Management Fee: 0.05% |

Management Fee: 0.05% |

Risk rating: Medium |

Risk Rating: Medium - High |

Risk Rating: Medium - High |

Distribution: Quarterly |

Distribution: Quarterly |

Distribution: Quarterly |

Break the concentration habit

Get greater diversification to U.S. equities through a convenient, low-cost ETF. ZEQL is built on the MSCI USA Equal Weight Index, which launched in 2008. The index provides a blended rules-based approach to balancing U.S. equity exposure across all eleven sectors and provides an alternative to the market-cap weighted structure of traditional indexes.

Disciplined Cashflow. Strictly Canadian.

BMO MSCI Canada High Dividend Yield Index ETF

|

Management Fee: 0.09% |

Built for income. Rooted in Canada.

ZDIV targets high-quality, dividend-paying Canadian companies across the entire market spectrum from established blue-chips to young financially resilient companies. Built on the MSCI Canada IMI High Dividend Yield Select Index, ZDIV offers a disciplined, rules-based strategy to help you maximize your domestic income potential without the guesswork.

To learn more visit: BMO Canadian High Dividend Yield ETF – Sales Aid

International Opportunities Brought Home

BMO MSCI EAFE Small-Mid Cap Index ETF

|

Management Fee: 0.35% |

Expanded Geography. Broader Investment Opportunity.

The World is Bigger Than Large Caps. Get low-cost exposure to international high-potential small-mid cap companies across Europe, Australasia, and the Far East through a simple ETF. ZESM is built on the MSCI EAFE SMID Cap Index, which launched in 2007 and helps provide exposure to global small-mid cap stocks to broaden your holdings outside of your home country.

Commodity Investing Made Easy

BMO Broad Commodity ETF on Cboe

ZCOM – BMO Broad Commodity ETF Management Fee: 0.26% |

Commodities – The building blocks of the global economy

Get broad exposure to a wide range of commodities through one simple, low-cost ETF*. ZCOM is built on a broad-based commodity index (Bloomberg Commodity Index Total Return) that has been in existence since 1998†. The index provides a transparent and efficient way to diversify your portfolio without the complexity of trading individual commodities.

AAA CLOs - The Top of the Waterfall

BMO AAA CLO ETF on Cboe

ZAAA.F Hedged Units Risk Rating: Low1Management Fee: 0.20% | ZAAA CAD Units Risk Rating: Low to Medium1Management Fee: 0.20% | ZAAA.U USD Units Risk Rating: Low1Management Fee: 0.20% |

As Canada’s largest fixed income ETF provider2, BMO Exchange Traded Funds is now offering the BMO AAA CLO ETF! AAA Collateralized Loan Obligation (CLO) tranches are the most stable within the CLO structure because they are entitled to the highest claim on cash flow distributions in the event of default.

The BMO AAA CLO ETF offers investors exposure to a carefully curated portfolio of top-tier, AAA-rated CLO tranches3 - delivering diversified, high-quality credit exposure with a focus on seeking income and capital preservation.

Benefits of Holding the BMO AAA CLO ETF

- Underlying CLOs Provide Attractive Cashflow

CLOs often provide higher yields compared to traditional high yield bonds.4 The BMO AAA CLO ETF has a monthly distribution frequency.* - Diversification

CLO ETFs provide exposure to a distinct asset class that is less correlated with traditional fixed-income securities, enhancing portfolio diversification. - Access to Institutional-Grade Investments

ETFs allow investors access to AAA CLOs, a market historically dominated by institutional investors. - Floating Rate

CLO tranches have a floating interest rate tied to benchmarks of overnight rates which reset periodically making them an effective hedge against the movement of interest rates. - Low Default Rates

There have historically been zero defaults on AAA tranches through the 30-year history of CLOs.4 - Liquidity and Transparency

ETFs offer a more liquid way to invest in CLOs compared to purchasing individual tranches directly, which can be illiquid and complex. ETFs also provide daily pricing and greater transparency.

Investment-grade with High Yield Potential

BMO BBB CLO ETFs on Cboe

|

Management Fee: 0.40% | ZBBZ–BMO BBB CLO ETF (CAD Units) Management Fee: 0.40% Monthly Distributions Risk Rating: Low to Medium1 | ZBBZ.U–BMO BBB CLO ETF (USD units) Management Fee: 0.40% Monthly Distributions Risk Rating: Low to Medium1 |

As Canada’s largest fixed income ETF provider2, BMO Exchange Traded Funds is proud to offer BBB CLO ETFs — giving investors access to a curated portfolio of top tier, BBB-rated CLO tranches. These ETFs provide diversified, investment-grade credit exposure with a focus on consistent income and capital preservation—positioned right at the sweet spot of the CLO capital stack.

BBB CLOs - an elegant solution for cash flow generation

Benefits of Holding the BMO BBB CLO

- Underlying CLOs Provide Attractive Cash Flow Potential

Get access to investment-grade debt with elevated cash flow potential. BBB CLOs often provide higher yields compared to traditional investment-grade bonds.3 - Diversification

CLO ETFs provide exposure to a distinct asset class that is less correlated with traditional fixed-income securities, enhancing portfolio diversification. - Access to Institutional-Grade Investments

Get access to BBB CLOs, a market historically only available to institutional investors. - Floating Rate

CLO tranches have a floating interest rate tied to bench- marks of overnight rates, which reset periodically making them an effective hedge against the movement of interest rates. - Low Default Rates

There have been a low number of defaults on BBB tranches through the 30-year history of CLOs compared to traditional corporate bonds.4 - Liquidity and Transparency

ETFs offer a more liquid way to invest in CLOs compared to purchasing individual tranches directly, which can be illiquid and complex. ETFs also provide daily pricing and greater transparency.

To learn more about BMO CLO ETFs please visit our:

Brighten Up Your Cash Flow with ZWGD2

BMO Covered Call Spread Gold Bullion ETF – ZWGD Management Fee: 0.65% |

Combine the beauty of gold with the benefit of monthly cash flows. ZWGD offers monthly cash flow with the foundational strength of physical gold. With ZWGD investors can get exposure to gold and keep all the traditional benefits of diversification, inflation hedging and return potential, with monthly cash flow.

Key Highlights:

- Cash Flow2: Regular monthly cash flow from a gold bullion ETF.

- Maintain Upside Potential: ZWGD is uniquely designed to generate cash flow while maintaining some potential for upside exposure3.

- Diversification: Gold bullion tends to have a lower correlation to traditional asset classes like stocks and bonds historically.4

- Shield Against Currency and Inflation Risk: Gold tends to retain its value when currencies weaken, and inflation rises which makes gold a popular asset class for investors.

- Return Potential: gold historically shines in volatile times3 – driven by flows, strong momentum and global demand.

BMO Human Capital Factor US Equity ETF

BMO Human Capital Factor US Equity ETF-ZHC Management Fee: 0.35% |

Beyond the Balance Sheet: Quantifying Human Capital

What if a potential driver of equity outperformance isn’t found on the balance sheet – but in the behaviours of a company’s employees? ZHC targets firms with high performing workforces which is often an overlooked driver of sustainable shareholder value.

Key Highlights:

- Factor Diversification: Offers potential for broadening factor exposure that differs from traditional factors such as Value, Quality, and Momentum.

- Forward Looking: Focuses on workforce strength as a signal of future performance.

- Data Driven, Actively Monitored: Uses a robust quant model and active monitoring to identify firms with strong human capital.

- Institutional Grade Strategy: Allows investors access to a strategy historically limited to institutional- level research and execution.

Target Your Fixed Income ETFs with Precision

As Canada’s largest fixed income ETF provider1, BMO Exchange Traded Funds is now offering Target Maturity Bond ETFs! Whether the goal is cashflow generation, education funding, or purchasing a home, BMO’s Target Canadian Corporate Bond ETFs provide more yield to maturity (YTM)2 certainty to help investors meet their financial objectives3.

|

|

Maturity Date: |

Maturity Date: |

Get the Precision of a Bond, with the Liquidity and Diversification of an ETF!

Important Key Points:

- ETFs with an Individual Bond Like Experience – These ETFs are designed to act like an individual bond with a defined maturity and the reduction of duration risk2 over time.

- Not Your Typical Target Maturity Bond ETF – Unlike traditional target maturity ETFs, the goal of these ETFs is to not transition into cash in the year of maturity to manage performance and YTM outcome expectations.

- Get More YTM Certainty – These ETFs hold a static portfolio and will not rebalance providing greater yield certainty for investors upon maturity.

- Personal Goal Setting – Similar to holding an individual bond, investors can have the ability to match the ETFs’ maturity dates with their investment time horizons.

- Management Fee of Only 0.15% – The consideration of fees in your investment decision making process is important as fees can impact overall performance.

- Risk2 Rating – Low

- To learn more about BMO’s New Approach to Target Maturity Bond ETFs please visit our:

Target Your Fixed Income ETFs with Precision PDF

FAQs PDF

Video

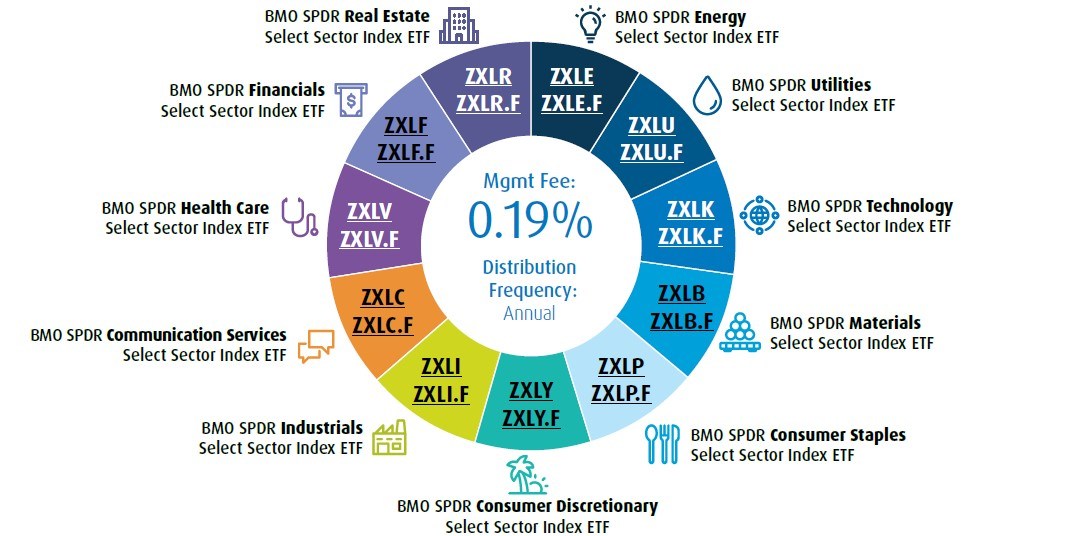

Sector Investing Just Got Easier for Canadians

BMO Asset Management Inc. has expanded its line-up of sector ETFs by adding a full suite of 11 BMO SPDR Select Sector Index ETFs. For the first time Canadian investors can access all 11 Global Industry Classification Standard System (‘GICS’) sectors of the S&P 500 in both unhedged and hedged to CAD (.F).

Key Highlights:

- Choose Your Currency Exposure: The unhedged and hedged to CAD (.F) ETFs empower investors to either gain or reduce U.S dollar exposure.

- Save on Currency Conversion Costs: Investors with Canadian dollars no longer need to convert to U.S dollars to get access to GICS Sector ETFs.

- Mitigate Tax Friction: Investing in Canadian-listed ETFs allows Canadians to manage the potential impact of U.S. tax issues and filing.1

- A Powerful Portfolio Construction Tool: Ability to take advantage of tactical opportunities, manage risk, or align a portfolio to an economic viewpoint.

- More Diversification: Reduce single stock concentration and gain exposure to an entire sector in one single trade.

- Management Fee: 0.19%

- For more information please see our BMO SPDR Select Sector Index ETFs Brochure.

Access the U.S. Market How You Want to Access it

Available in Hedged to CAD (.F) or Unhedged

1 The first T Series in ETF form in Canada was launched by BMO GAM as Fixed Percentage Distribution Unit ETFs, specifically BMO Balanced ETF (ZBAL.T) in January 2022, since renamed as Target Cash Flow Units. Source: BMO GAM, January 2022.

2 Target Cash Flow Units are a series of Units of certain BMO ETFs designed to provide investors with a monthly distribution based on a target annual distribution rate which is based on the NAVPS at the end of the prior year, or in the case of a newly created series, based on a target annualized distribution rate which is based on the initial starting NAVPS.

Disclaimers - BMO T-Series ETFs

This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The Dow Jones Industrial Average Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by the Manager. S&P®, S&P 500®, Select Sector®, SPDR®, US 500, The 500 are trademarks of S&P Global, Inc. or its affiliates (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Manager. The ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.

The dollar amount of the monthly distribution that you will receive is reset at the beginning of each calendar year. The dollar amount is a factor of the annualized distribution rate for the Target Cash Flow Units (which is the rate set out in the individual BMO ETF profiles), the NAVPS as of the end of the previous calendar year, and the number of Target Cash Flow Units of the BMO ETF held at the time of the distribution. Although not expected, we may also adjust the monthly distribution during the year, if capital market conditions have significantly affected the ability of the BMO ETF to maintain the applicable distribution. If we make any such adjustment to the monthly distribution, we will issue a press release to communicate the change.

The distribution rate applicable to the Target Cash Flow Units may be higher than the rate of return or the portfolio yield of the BMO ETF that offers such Units. As a result, if you elect to receive some or all of the regular monthly distributions in cash, the value of your investment in the BMO ETF may decline over time.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., an investment fund manager, a portfolio manager, and a separate legal entity from Bank of Montreal.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

Published: February 2026.

1 All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ prospectus.

2 All logos and trademarks of other companies are the property of those respective companies.

3 Source: Morningstar, December 31, 2025.

Disclaimers - BMO MSCI USA Equal Weight Index ETF

This material is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal

advice to any party. Particular investments and/or trading strategies should be evaluated and professional advice should be obtained with respect to

any circumstance.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees

of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be

reasonable, there can be no assur- ance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on

any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described

in the most recent simplified prospectus.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past

performance is not indicative of future results.

The performance of an Index fund is expected to be lower than the performance of its respective index. Investors cannot invest directly in an index.

Comparisons to indices have limitations because indices have volatility and other material characteristics that may differ from a particular fund.

The ETF referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which

such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds. Please read the ETF Facts or simplified

prospectus of the BMO ETFs before investing. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not

be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs

trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are

not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate

legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

Published: February 2026.

1 Source: MSCI Canada IMI High Dividend Yield Index Methodology, as of January 2026.

2 All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the

standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a

risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ prospectus.

3 Dividend yields are relative to their respective parent index. Source: MSCI High Dividend Yield Indexes Methodology, August 2025.

4 Source: MSCI High Dividend Yield Indexes Methodology, August 2025.

Disclaimers - BMO MSCI Canada High Dividend Yield Index ETF

Any statement that necessarily depends on future events may be a forward‑looking statement. Forward‑looking statements are not guarantees

of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be

reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on

any forward‑looking statements. In connection with any forward‑looking statements, investors should carefully consider the areas of risk described

in the most recent simplified prospectus.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past

performance is not indicative of future results.

This material is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal

advice to any party. Particular investments and/or trading strategies should be evaluated and professional advice should be obtained with respect to

any circumstance.

The ETF referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which

such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

The ETF is not in any way sponsored, endorsed, sold or promoted by FTSE Global Debt Capital Markets Inc. (“FGDCM”), FTSE International Limited

(“FTSE”), Frank Russell Company (“Frank Russell”), FTSE Fixed Income LLC (“FTSE FI”) or the London Stock Exchange Group companies (together with

FGDCM, FTSE, Frank Russell and FTSE FI, the “Licensor Parties”). The Licensor Parties make no claim, prediction, warranty or representation whatso

ever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE BMO ETF Indices, (ii) the figure at which any of the

FTSE BMO ETF Indices stands at any particular time on any particular day or otherwise, or (iii) the suitability of an Underlying Index for the particular

purpose to which is it being put in connection with the FTSE BMO ETFs. Each of the FTSE BMO ETF Indices is compiled and calculated by FGDCM of

FTSE and all copyright in any of the FTSE BMO ETF Indices values and constituent lists vests in FGDCM or FTSE, respectively. The Licensor Parties shall

not be liable (whether in negligence or otherwise) to any person for any error in any of the FTSE BMO ETF Indices and the Licensor Parties shall not

be under any obligation to advise any person of any error therein. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is

used under licence.

Total distribution per unit for tax purpose: The exact tax treatment of the distributions for a calendar year is calculated after the BMO Funds’ tax

year‑end. As a result, investors will receive an official tax statement from their broker detailing the type of income they have to report for tax

purposes for the entire year and not for each distribution. Please note that before the tax treatment is calculated there is no guarantee on what

proportion of potentially generated cash flow will be income, capital gains or dividends.

Commissions, management fees and expenses all may be associated with investments in exchange‑traded funds. Please read the ETF Facts or

simplified prospectus of the BMO ETFs before investing. Exchange‑traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs

trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are

not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., an investment fund manager, a portfolio manager, and a separate legal entity from Bank of

Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M‑bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

Published: February 2026.

1 Source: MSCI EAFE Index total return, one-year as of December 31, 2025.

2 Source: BMO Quality ETF Methodology, December 2024.

3 Beta: A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole

Disclaimers - BMO MSCI EAFE Small-Mid Cap Index ETF

This communication is intended for informational purposes only and is not, and should not be construed as, investment, legal or tax advice to any

individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can

be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In

connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return

of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency,

divided by current net asset value (NAV). The yield calculation does not include reinvested distributions. Distributions are not guaranteed, may fluctuate

and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and NAV

fluctuations. The payment of distributions should not be confused with the BMO ETF’s performance, rate of return or yield. If distributions paid by a BMO ETF

are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO

ETF, and income and dividends earned by a BMO ETF, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount

of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Cash distributions, if any, on units of a BMO ETF (other than accumulating units or units subject to a distribution reinvestment plan) are expected to be paid

primarily out of dividends or distributions, and other income or gains, received by the BMO ETF less the expenses of the BMO ETF, but may also consist of

non-taxable amounts including returns of capital, which may be paid in the manager’s sole discretion. To the extent that the expenses of a BMO ETF exceed the

income generated by such BMO ETF in any given month, quarter, or year, as the case may be, it is not expected that a monthly, quarterly, or annual distribution

will be paid. Certain BMO ETFs have adopted a distribution reinvestment plan, which provides that a unitholder may elect to automatically reinvest all cash

distributions paid on units held by that unitholder in additional units of the applicable BMO ETF in accordance with the terms of the distribution reinvestment

plan. For further information, see the distribution policy in the BMO ETFs’ prospectus.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds. Please read the ETF Facts or prospectus of

the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder

that would have reduced returns. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks,

fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are

subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., an investment fund manager, a portfolio manager, and a separate legal entity from Bank of Montreal.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

Publication date: February 2026.

1 All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ prospectus.

* The BMO Broad Commodity ETF is an exchange traded alternative mutual fund within the meaning of NI 81-102. As an alternative mutual fund, the BMO ETF has the ability to invest in asset classes and use investment strategies that are not permitted for conventional mutual funds, including the ability to invest in other alternative mutual funds, employ leverage and borrow cash to use for investment purposes and increased ability to invest in commodities. While these strategies will be used in accordance with the BMO ETF’s investment objective and strategies, during certain market conditions, they may accelerate the pace at which an investor’s investment decreases in value.

† Source: Bloomberg as of September 30, 2025.

Disclaimers-BMO Broad Commodity ETF on Cboe

This material is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated and professional advice should be obtained with respect to any circumstance.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

“BLOOMBERG®” and the Bloomberg Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by BMO Asset Management Inc. (the “Licensee”).

Bloomberg is not affiliated with the Licensee, and Bloomberg does not approve, endorse, review, or recommend the ETF. Bloomberg does not guarantee the timeliness, accuracy, or completeness of any data or information relating to the ETF.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. “BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

Published: October 2025.

1 All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ simplified prospectus.

Disclaimers-BMO Human Capital Factor US Equity ETF

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc. “BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

Published: June 2025

1 All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ simplified prospectus.

2 Distributions are not guaranteed and are subject to change and/or elimination.

3 Please review the BMO Covered Call Methodology for more information

4 Source: Bloomberg April 30, 2025.

Disclaimers-ZWGD

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc. “BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

Published: May 2025

1 All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ simplified prospectus.

2 Source: Bloomberg March 31st 2025

3 AAA herein refers to the order of payments, should there be any defaults, and does not represent the ratings of the underlying loans within the CLO.

4 Source: Bloomberg, as of December 31, 2024.

Disclaimers-BMO AAA CLO ETF

CLOs are floating- or fixed-rate debt securities issued in different tranches, with varying degrees of risk, by trusts or other special purpose vehicles (“CLO Issuers”) and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The BMO ETF pursues its investment objective by investing, under normal circumstances, at least 85% of its net assets in CLOs that, at the time of purchase, are rated AAA or the equivalent by a nationally recognized statistical rating organization.

AAA herein refers to the order of payments, should there be any defaults, and does not represent the ratings of the underlying loans within the CLO. If there are loan defaults or the CLO Issuer’s collateral otherwise underperforms, scheduled payments to senior tranches take precedence over those of mezzanine tranches (a tranche or tranches subordinated to the senior tranche), and scheduled payments to mezzanine tranches take precedence over those to subordinated/equity tranches. The riskiest portion is the “Equity” tranche, which bears the first losses and is expected to bear all or the bulk of defaults from the corporate loans held by the CLO Issuer serves to protect the other, more senior tranches from default.

*Distributions are not guaranteed and are subject to change and/or elimination

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaran- teed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

This material is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated and professional advice should be obtained with respect to any circumstance.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

1 All investments involve risk. The value of an Exchange traded fund (ETF) can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ prospectus.

2 Source: Bloomberg, August 31, 2025.

3 BBB herein refers to the order of payments, should there be any defaults, and does not represent the ratings of the underlying loans within the CLO.

4 Source: Bloomberg, as of December 31, 2024 (Jan-1995 to Dec-2024). Past default rates do not guarantee future default rates.

Disclaimers-BMO BBB CLO ETF

This material is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated and professional advice should be obtained with respect to any circumstance.

CLOs are floating- or fixed-rate debt securities issued in different tranches, with varying degrees of risk, by trusts or other special purpose vehicles (“CLO Issuers”) and backed by an underlying portfolio consisting primarily of below investment-grade corporate loans. The BMO ETF pursues its investment objective by investing, under normal circumstances, at least 75% of its net assets in BBB CLOs that, at the time of purchase, are rated BBB or the equivalent by a nationally recognized statistical rating organization.

BBB herein refers to the order of payments, should there be any defaults, and does not represent the ratings of the underlying loans within the CLO. If there are loan defaults or the CLO Issuer’s collateral otherwise underperforms, scheduled payments to senior tranches take precedence over those of mezzanine tranches (a tranche or tranches subordinated to the senior tranche), and scheduled payments to mezzanine tranches take precedence over those to subordinated/equity tranches. BBB is a mezzanine tranche. The riskiest portion is the “Equity” tranche, which bears the first losses and is expected to bear all or the bulk of defaults from the corporate loans held by the CLO Issuer serves to protect the other, more senior tranches from default.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds. Please read the ETF Facts or prospectus of the BMO ETF before investing. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETF, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guar- anteed and are subject to change and/or elimination.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. “BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

* Internal Rate of Return Source: BMO Global Asset Management as of March 17, 2025. The internal rate of return (IRR) is the annual rate of growth that a fixed income ETF is expected to generate if held to maturity. IRR calculations on are based on the fund’s NAV, scheduled net flows from the bond portfolio and hedges, and annual compounding for that specific point of time. IRRs are generally updated on a weekly basis, and are before commissions, management fees and expenses. Distributions, yields, and rates are not guaranteed and are subject to change and/or elimination. Past IRR performance is not indicative of future IRR performance.

1 Source: Bloomberg January 31, 2025.

2 Yield to maturity (YTM): The total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments.

3 Duration & Duration Risk: A measure of the sensitivity of the price of a fixed income investment to a change in interest rates.

Duration is expressed as number of years. The price of a bond with a longer duration would be expected to rise (fall) more than the price of a bond with lower duration when interest rates fall (rise). Essentially, duration estimates the percentage change in a bond’s price for a change in interest rates. This sensitivity is what constitutes the risk: as interest rates rise, bond prices fall, and vice versa.

Disclaimers-BMO Target Maturity Bond ETFs

For Advisor Use Only

No portion of this communication may be reproduced or distributed to clients.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

This material is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

1 Source: Tax Issues, U.S. Investing and Your Clients. As of January 31st 2025.

Disclaimers-Sector Investing Just Got Easier for Canadians

This is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

You cannot invest directly in an index.

Sector ETF products are also subject to sector risk and non-diversification risk, which generally will result in greater price fluctuations than the overall market.

The Select Sector SPDR Trust consists of eleven separate investment portfolios (each a “Select Sector SPDR ETF” or an “ETF” and collectively the “Select Sector SPDR ETFs” or the “ETFs”). Each Select Sector SPDR ETF is an “index fund” that invests in a particular sector or group of industries represented by a specified Select Sector Index. The companies included in each Select Sector Index are selected on the basis of general industry classification from a universe of companies defined by the S&P 500®. The investment objective of each ETF is to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in a particular sector or group of industries, as represented by a specified market sector index.

The S&P 500, SPDRs, and Select Sector SPDRs are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use. The stocks in- cluded in each Select Sector Index were selected by the compilation agent. Their composition and weighting can be expected to differ to that in any similar indexes that are published by S&P.

The S&P 500 Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. The index is heavily weighted toward stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks. The S&P 500 Index figures do not reflect any fees, expenses or taxes. An investor should consider investment objectives, risks, fees and expenses before investing.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simpli- fied prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. “BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.