The Investment Case for Food and Agriculture

Apr 18, 2024As populations have grown and geopolitical as well as climate-related concerns have risen, food security has become an issue of vital importance for the global community. Against that backdrop, Daniel Stanley, Director, ETF Distribution, Institutional & Advisory, BMO ETFs, makes the case that food and agriculture should join Consumer Staples and Discretionary as key components of investor portfolios.

“There is no finer investment for any community than putting milk into babies.” – Winston Churchill, 1943

It comes as no secret that food and shelter are basic needs for human existence, both elements having dominated Canadian social commentary recently due to rising living costs. Food and its production and distribution have been one of the most divisive issues in human history. Rising populations, a changing climate and geopolitical concerns about food security are three fundamental issues which underscore why food and agriculture should be considered a primary sector of interest for investors, much like Consumer Staples and Consumer Discretionary. Those three themes — demographic, environmental, and economic — make agriculture a vital component in portfolios.

Demographics

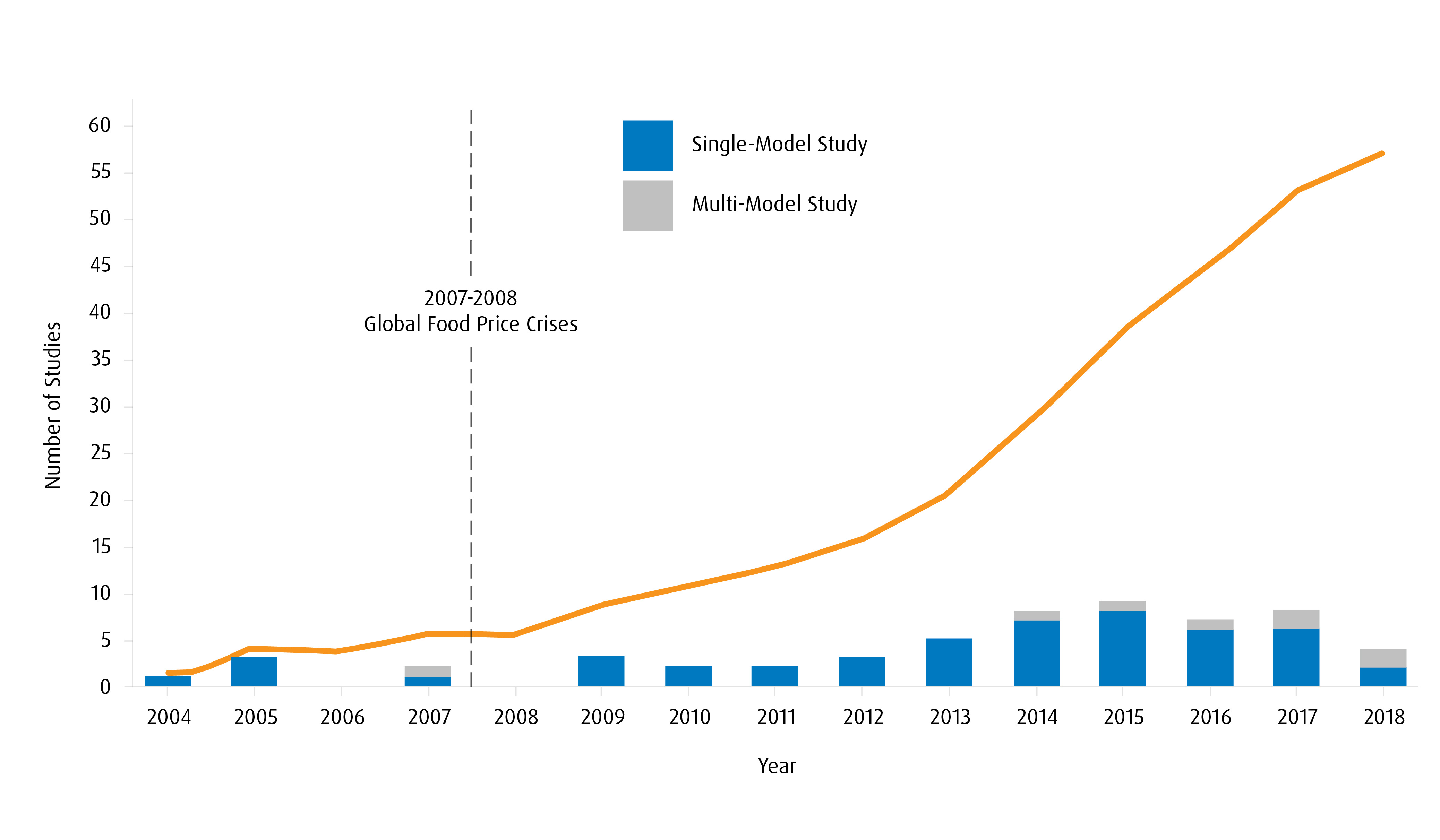

There are many reports that evaluate an anticipated rise in demand for foodstuffs as the world population expands, but perhaps the most glaring example of its importance is that the United Nations has classified No Hunger as its 2nd Sustainable Development Goal, just after No Poverty.1 A 2021 study predicts food demand will rise 35-56% by 2050.2 The same study cites the remarkable increase in food studies, reflecting the degree to which people are realizing food security is a critical component of modern societies.

Total (Cumulative) Number and Types of Global Food Security Studies Per Year

Needless to say, increased demand for food is inflationary; the well-understood relationship between supply and demand means that, absent an increase in supply, rising demand will push prices higher.

Environmental

So much has been written about the impact climate change has had and will continue to have on food production. Weather patterns are changing, causing more severe storms and drought in some areas, while lengthening growing seasons in others. Add in habitat loss and species extinction, and it is clear there will be an impact on agriculture, which is likely to raise prices.

Economic

Food inflation in Canada has been much discussed in national media, but it has been a global phenomenon. Politicians are correct to point out that food prices have gone up, and according to BMO Economics, “there is little chance of a serious about-face (in food prices) ahead. The nearly 25% jump over the past few years is unfortunately destined to be more-or-less permanent.”2 Just look at this index of Agricultural Product prices going back to 2015:

Commodity Indices and Forecasts

(US$ Terms: 2023 = 100)

All Commodities | Oil & Gas | Metals & Minerals | Forest Products | Agricultural Products | All Commodities (C$ Terms) | |

| 2015 | 170.1 | 143.6 | 229.3 | 97.5 | 150.6 | 154.8 |

| 2016 | 164.6 | 127.9 | 237.2 | 109.7 | 138.9 | 155.6 |

| 2017 | 184.7 | 150.7 | 255.6 | 144.1 | 142.0 | 171.2 |

| 2018 | 210.1 | 190.5 | 265.8 | 168.1 | 147.4 | 194.2 |

| 2019 | 196.7 | 167.0 | 271.4 | 122.9 | 141.5 | 186.4 |

| 2020 | 187.4 | 115.6 | 301.7 | 196.9 | 151.4 | 178.9 |

| 2021 | 262.9 | 201.0 | 354.1 | 319.5 | 224.1 | 235.2 |

| 2022 | 328.3 | 281.9 | 426.4 | 276.4 | 262.6 | 313.9 |

| 2023 | 275.0 | 225.5 | 395.1 | 141.2 | 205.9 | 265.2 |

| Forecast 2024 | 237.9 | 232.6 | 379.7 | 163.3 | 196.5 | 261.3 |

| Forecast 2025 | 262.3 | 219.5 | 359.3 | 172.9 | 208.2 | 274.3 |

Source: BMO Economics, as of February 7, 2024.The BMO Capital Markets Commodity Price Index is a fixed-weight, export-based index that encompasses the price movement of 20 commodities key to Canadian exports. Weights are each commodity’s average share of the total value of exports of the 20 commodities during the period 2012-21.

A global pandemic, the breakdown in globalization, and geopolitical events have all exerted upward pressure on food prices.

The Investment Case

Investors have long recognized the investment benefits in Consumer Staples (STPL – BMO Global Consumer Staples Hedged to CAD Index ETF), and Consumer Discretionary exposures (DISC – BMO Global Consumer Discretionary Hedged to CAD Index ETF), but the BMO Global Agriculture ETF (ZEAT) deserves equal merit. Food production and its subsequent consumption is not discretionary, but because it is not one of the top sectors in the S&P 500 or TSX, investors have tended not to integrate it into their portfolios as much as sectors like Technology, Financials, Health Care, or Energy.

ZEAT is a Canadian-listed, Canadian-dollar-denominated ETF that holds 30 companies in global agribusiness. Each company is selected from a Global All Cap universe and must have at least $500mln in market cap.

Importantly, the companies are screened and weighted for quality based on EBITDA (earnings before interest, taxes, depreciation, and amortization) margins, with companies ranked in the bottom quartile excluded.

ZEAT’s emphasis on quality earnings, its low cost (management fee of 0.35%), and its Canadian domicile combine to make it a compelling solution for Canadian investors wishing to incorporate the strong investment themes global agriculture has to offer into long-term portfolio construction.

To learn more about ZEAT or receive other trading insights, reach out to your BMO ETF Specialist at their email address.

Disclosures:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the authors represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. The statistics in this update are based on information believed to be reliable but not guaranteed.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The ETF referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.