The Long and Short of Liquid Alternative ETFs

Jan 18, 2024As investment models evolve, so too must the range of strategies that Investment Counsellors and Family Offices should consider. In this article, Mark Webster, Director, Institutional & Advisory, BMO ETFs, discusses the many benefits of liquid alternative ETFs as a complement to a portfolio’s core equity holdings.

Our objective in writing articles for Investment Counsellors and multi-Family Offices is to provide guidance on how Exchange Traded Funds (ETFs) can provide scalable access to complementary investment strategies that may be beyond the reach of these practices. Such firms normally have strong capabilities in core Canadian and U.S. equities, moderate expertise in bonds and limited resources in alternative asset classes and strategies. Because of their ease of use, ETFs can be very effective instruments to integrate into client accounts, expanding portfolio construction and, by extension, possibly share of wallet too.

Much has been written about pension model investing and the necessity to include alternative strategies. The case for alternatives was clear when yields were lower but, with continued volatility in equity markets, there is also a strong case to be made for using alternative strategies to mitigate equity risk. With many portfolios heavily weighted to equities, it may be a good idea to consider tempering some of the risk budget by applying a transparent liquid alternative strategy to complement core equity holdings.

We recently listed two long-short liquid alternative strategies: the BMO Long Short Canadian Equity ETF (Ticker: ZLSC) and the BMO Long Short US Equity ETF (Ticker: ZLSU), both of which feature a transparent, rules-based methodology created by our very experienced Quantitative investing team. Building on our proprietary Factor capabilities, we employ a rigorous security screening discipline — and then further reinforce it with prudent weighting or construction rules to manage portfolio risks.

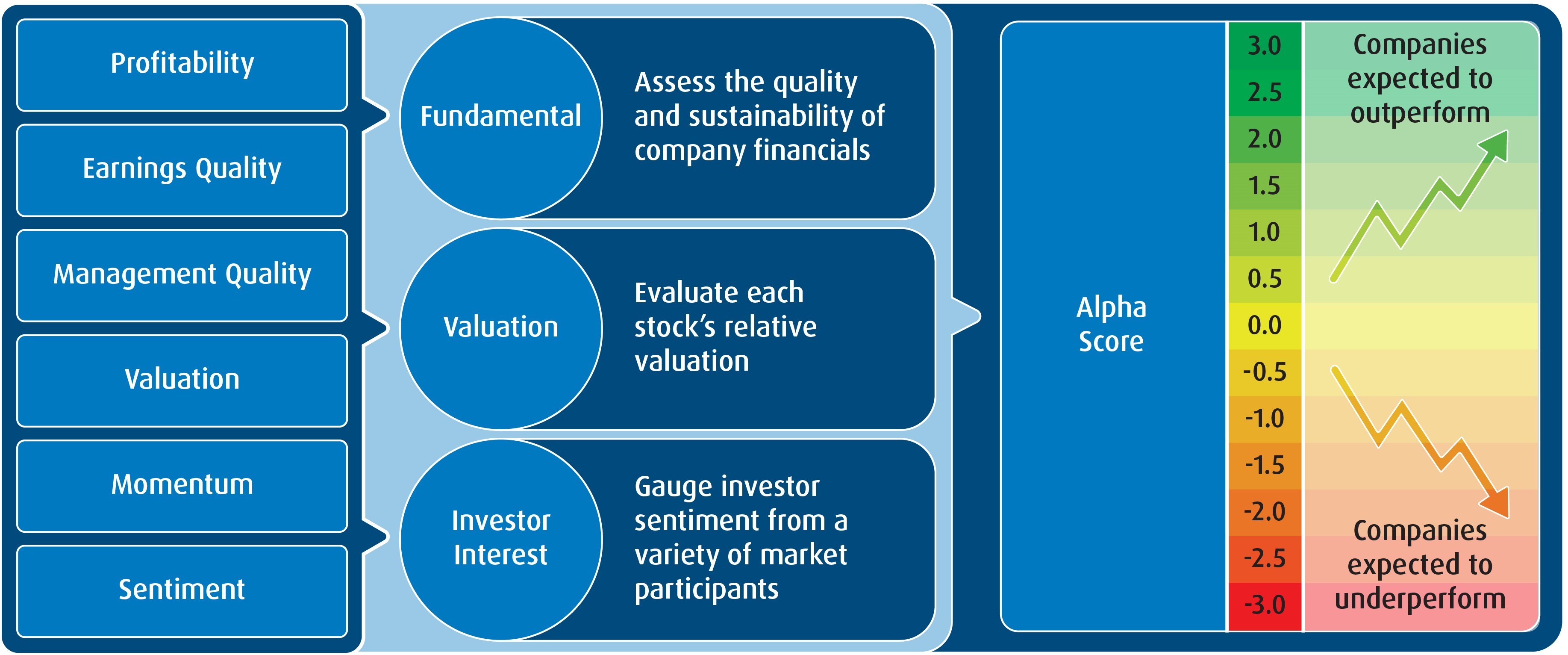

Objective rules are followed to identify companies with solid fundamentals, strong management and to ensure materiality, measured as broad interest in the market. Market sentiment — an important consideration to escape fundamental traps — has two important components:

- Market price strength over successive months;

- Positive analyst forecasts.

BMO GAM’s Quantitaive Investing Team – Alpha Forecasting Process.

Starting from a broad, large-cap selection universe, both portfolios establish long positions in 70 to 100 names, complemented by 50 to 70 others on the short side.

The objective is to provide a portfolio which can generate returns in variable market conditions. The long-short exposure aims to mitigate equity risk, creating a portfolio with a fractional Beta, yet still be able to benefit in rising or falling markets.

Applications

Traditional investment models have become increasingly obsolete. The mythical 60% equity/40% fixed income model was created in the 1980s, when yields were generally much higher (even taking into account the recent spike). As yields compressed, equity levels — and portfolio risk — expanded accordingly.

A good reference for current institutional asset mixes can be found on the Pension Investment Association of Canada (PIAC). It reveals an average asset mix that has approximately equal (one-third) allocations to equities, fixed income and alternatives. There is a wide variation of exposures within each asset class, determined by size and sophistication, but the trend is clear.

Investment counsellors may wish to emulate institutional portfolios but, without the expertise or the access, might instead consider ETFs like ZLSC and ZLSU. In an increasingly competitive industry, firms that can build more robust portfolios featuring broader diversification will be able to consolidate assets from competitors, expanding share of wallet. Real asset exposure in Infrastructure (BMO Global Infrastructure Index ETF – ZGI), Real Estate (BMO Equal Weight REITs Index ETF – ZRE), Agriculture (BMO Global Agriculture ETF – ZEAT), and Gold (BMO Equal Weight Global Gold Index ETF – ZGD/BMO Junior Gold Index ETF – ZJG) may also provide very useful complementary exposures to equity-heavy portfolios.

Portfolio construction requires a trained eye and a steely nerve. Firms that can demonstrate their acumen and their insight, showing the courage to expand their horizons, will help their clients to simplify their lives. Dealing with a single firm is much easier than spreading assets around, but counsellors must show they are willing and able to incorporate more strategies than they possess internally. Due diligence on Exchange Traded Funds can provide these kinds of opportunities to build a more expansive approach to investment management.

For more information on BMO’s ETF solutions, reach out to your regional Institutional BMO ETF Specialist.

Disclosures:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the authors represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. The statistics in this update are based on information believed to be reliable but not guaranteed.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Distributions are not guaranteed and may fluctuate. Distribution rates may change without notice (up or down) depending on market conditions. The payment of distributions should not be confused with an investment fund’s performance, rate of return or yield. If distributions paid by an investment fund are greater than the performance of the fund, your original investment will shrink. Distributions paid as a result of capital gains realized by an investment fund, and income and dividends earned by an investment fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero. Please refer to the distribution policy for BMO ETF set out in the prospectus.

Cash distributions, if any, on units of a BMO ETF (other than accumulating units or units subject to a distribution reinvestment plan) are expected to be paid primarily out of dividends or distributions, and other income or gains, received by the BMO ETF less the expenses of the BMO ETF, but may also consist of non-taxable amounts including returns of capital, which may be paid in the manager’s sole discretion. To the extent that the expenses of a BMO ETF exceed the income generated by such BMO ETF in any given month, quarter or year, as the case may be, it is not expected that a monthly, quarterly, or annual distribution will be paid. Distributions, if any, in respect of the accumulating units of BMO Short Corporate Bond Index ETF, BMO Short Federal Bond Index ETF, BMO Short Provincial Bond Index ETF, BMO Ultra Short-Term Bond ETF and BMO Ultra Short-Term US Bond ETF will be automatically reinvested in additional accumulating units of the applicable BMO ETF. Following each distribution, the number of accumulating units of the applicable BMO ETF will be immediately consolidated so that the number of outstanding accumulating units of the applicable BMO ETF will be the same as the number of outstanding accumulating units before the distribution. Non-resident unitholders may have the number of securities reduced due to withholding tax. Certain BMO ETFs have adopted a distribution reinvestment plan, which provides that a unitholder may elect to automatically reinvest all cash distributions paid on units held by that unitholder in additional units of the applicable BMO ETF in accordance with the terms of the distribution reinvestment plan. For further information, see Distribution Policy in the BMO ETFs’ prospectus.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.