U.S. Election Years Are Volatile. Here’s Where the Smart Money Goes.

Apr. 22, 2024America will decide on its next President on November 5, and history shows that there will likely be heightened volatility between now and then, with average VIX index readings typically elevated during election years compared to non-election ones. As a result, many investors have tended to be more cautious, substantially ramping fund flows into low-risk holdings such as money market and ultra-short-term bond exposures.

ETFs in Focus

- BMO Money Market Fund ETF Series (Ticker: ZMMK)

- BMO USD Cash Management ETF (Ticker: ZUCM / ZUCM.U)

- BMO Ultra Short-Term Bond ETF (Ticker: ZST)

- BMO Ultra Short-Term Bond ETF USD (Ticker: ZUS.U)

Exposure Benefits

- Preserve capital during bouts of heightened volatility

- Invest in high-quality money market instruments and fixed income securities

- Enhance yield profile through low-duration corporate bonds

Trade Idea

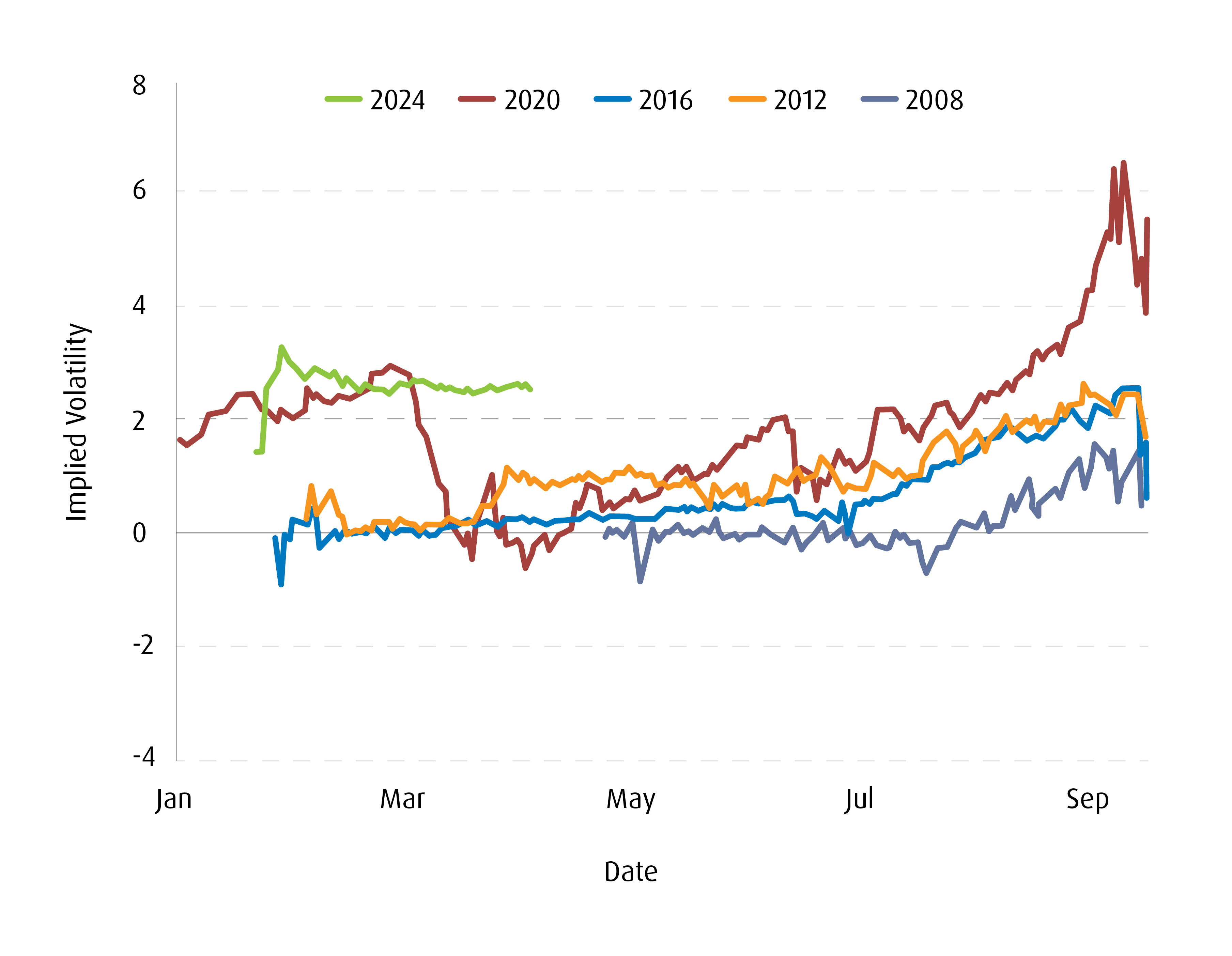

Implied volatility levels are low right now, according to the VIX Index, while tight credit spreads similarly indicate a mostly sanguine outlook in markets. However, volatility can quicky move to the upside, and there is a clear pattern that it does during U.S. presidential election years. As indicated in the chart below, forecasted volatility is up compared to previous election cycles, with the market anticipating a peak between September and October.

September-October VIX Futures Spread

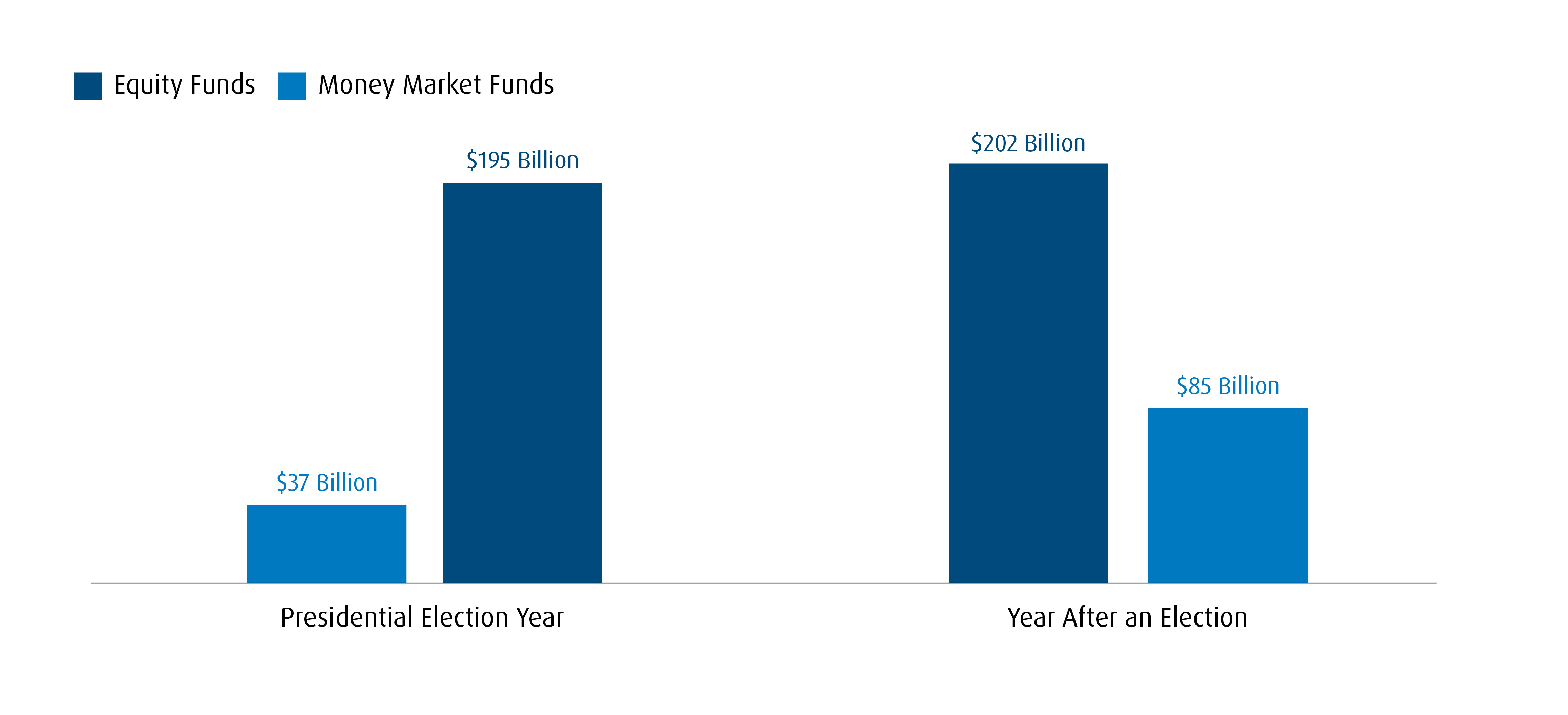

Based on historical trends, many investors will likely head for safe-haven assets, as they have done in past election years. The chart below illustrates the average increase in flows to money market funds compared to equity funds in a given presidential election year dating back to 1992, with flows into the former substantially higher compared to the year following an election.

Average Net Fund Flows by Year of Presidential Terms (1992−2023)

BMO ETFs provides options for investors seeking stability while maintaining liquidity and yield generation.

Preservation of Capital

For capital preservation, the BMO Money Market Fund ETF Series (Ticker: ZMMK) invests in high-quality money market instruments and fixed income securities issued by governments and corporations in Canada. The BMO USD Cash Management ETF (Ticker: ZUCM)1 provides unhedged exposure to U.S. T-Bills (and U.S. currency) providing a high level of liquidity and capital preservation for investors. The ETF is also available in a USD format, under the ticker ZUCM.U.

Cash-Plus Solution

For investors looking for a bump in yield while maintaining a similar risk profile, the BMO Ultra Short-Term Bond ETF (Ticker: ZST) provides defensive income by investing in a diversified portfolio of corporate bonds with a maturity of less than one year. For U.S. exposure to the same asset class, investors should consider the BMO Ultra Short-Term US Bond ETF – USD Units (Ticker: ZUS.U)1.

Bonds held within ZST/ZUS.U are also trading at a discount as a result of steep interest rate increases. As those bonds mature back to par value, this can generate returns in the form capital gains, allowing for some capital gain tax treatment rather than solely interest income.

The 2024 U.S. presidential election is expected to be a hotly contested one, with market expectations already pointing to a high likelihood of heightened volatility. The historical record also indicates that election years tend to see strong inflows of capital into short-term fixed income. It is reasonable to expect the trend to play out once again and for investors to position their portfolios accordingly.

1 Changes in rates of exchange may also reduce the value of your investment.

Advisor Use Only.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

The communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/TM Registered trademarks/trademark of Bank of Montreal, used under licence.