A One Month Retrospective on Liberation Day

May 05, 2025What’s covered…

- A Quick Pulse Check Since Liberation Day

- Some Takeaways

- What Type of Data Matters the Most Going Forward

- Portfolio Strategy for the Week Ahead

1.) A Quick Pulse Check Since Liberation Day

It’s been just over a month since “Liberation Day”. Since then, we’ve mostly seen the Trump administration walk back the scale of tariffs while also toning down on the bellicose trade rhetoric.

Markets have responded in different ways:

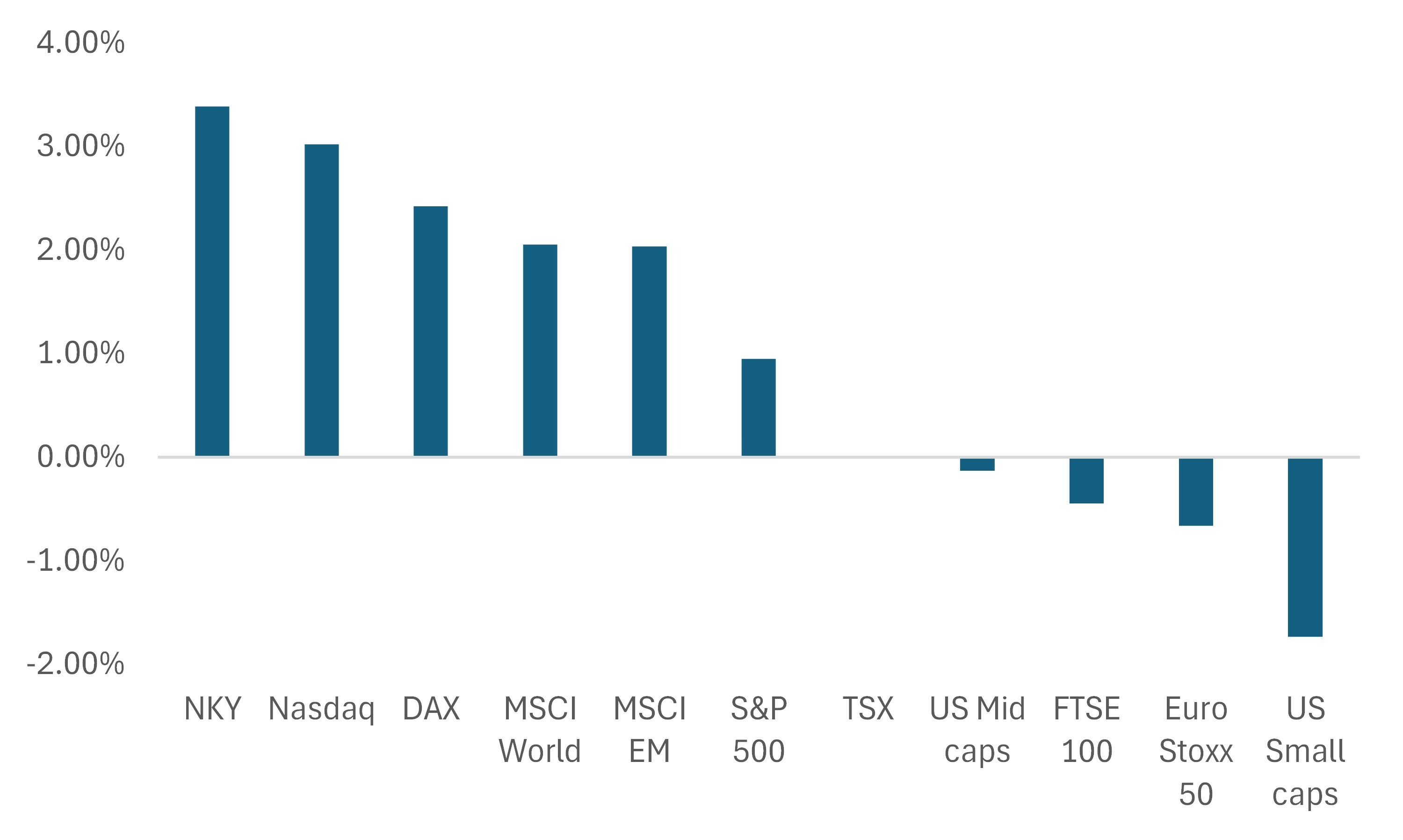

In the equities space:

- The S&P 500 has recovered its losses and is now back to where it was on April 1st. Meanwhile, the Nasdaq (+3% since April 1st) has outperformed.

- Outside of the US, the MSCI World (+2.1%), the DAX (+2.4%) and the Nikkei (+3.4%) have outperformed in the developed markets.

- From a size perspective (in the US), large and mid caps have carried the way as small caps continue to struggle (-1.7%).

In the rates space:

- Front-end US rates are only a few bps below where they were at close April 1st. In Canada, the front-end is actually above where it was ahead of Liberation day.

- Long end US and Canada rates are above where they were at the start of the month.

- Non-North American rates curves are still lower for the most part. In fact, the German/Italian and UK curves have all bull steepened (meaning front-end yields have shifted lower by more than the long end).

In Commods/FX

- The trade-weighted USD is 3.8% weaker

- The CAD, EUR, JPY and the CHF have all gained by at least 3% against the USD

- The offshore renminbi (CNH) is up +1% against the USD.

- Gold is 4.1% higher since April 1st

- Prompt contracts for oil, copper and natural gas futures are all down since April 1st

Chart 1 – How Equities Have Done Since Liberation Day

Source: Bloomberg

2.) What are the Takeaways?

a.) For one, the retrenchment in tariff talk has been primarily picked up by equities and not so much by other asset classes.

b.) In rates, there are a few different themes that are emerging.

In the US and Canada, the rise in the long end of the curve over the past month has less to do with tariffs and more to do with supply risk in the coming months. One way we can extract that is to note the rise in the 10-year term premium in the US.

Outside of North America, the rise in trade tensions has led markets to price in more aggressive easing profiles for the ECB and BoE.

c.) In the commodities and FX areas, we haven’t seen much of a shift. Markets are still inclined to fade USD gains while Gold remains higher. At the same time, concerns about the imbalance between demand and supply continue to weigh on copper and oil.

d.) The question now is – does the move higher in equities imply that the other asset classes have it wrong? Or are equity markets getting ahead of themselves.

To be fair, we see strong arguments for both sides. After all, SPX earnings have been strong for Q1 with 76% of firms reporting earnings above expectations while 62% of firms have reported revenues above expectations. But remember that these numbers cover firm activity before the impact of tariffs really sets in.

And what matters is this – trade relations have been permanently altered, tariffs are unlikely to go back to zero, and monetary policy is still fairly restrictive in the US. Those are still considerable headwinds for the US economy to deal with.

To us, we’re settling into a new range for US equities that reflects the reality of tariffs and trade talks. The good news will be slow drip for markets – but that’s not necessarily a good thing for the economy. Until the Fed starts easing rates, or tariffs go back to zero, it’s hard to envisage the S&P 500 recapturing year-to-date highs.

For now, we expect some degree of consolidation for markets. That could be a decent backdrop for yield enhancement strategies (including covered calls) to do well.

3.) US News and Notes

a.) Axios has a summary of Trump’s ‘Meet the Press’ interview from this past weekend.

Among the more salient points from the interview:

- Trump admitted that some foreign tariffs may remain even after an agreement is struck.

- The US president also indicated that he’s unsure if he has to uphold the Constitution.

- The rhetoric on US/Canadian trade was the same (“we don’t need anything from them”), but Trump ruled out using military force to annex Canada.

- He (again) denied that he was looking to fire Fed Chair Powell.

b.) The de minimis rule is now dead in the US and goods imported that were valued at $800 or less will now face a tariff of 120% or a $100 flat fee (the latter of which rises to $200 in June).

Clothing apparel makes up just over 2.5% of the inflation basket in the US. Even still, this is bad news for small retailers that rely on cheap imports and operate on thin margins.

c.) Did last week’s data tell us anything new?

Not necessarily. But it did reinforce that we should be watching the employment sector a bit more closely going forward.

For instance, last week we took note that…

- The April ADP reading came in at its lowest level since July.

- Challenger job cuts were lower from the prior month but still well above levels seen in recent years.

- Initial jobless claims jumped to a two-month high.

- While non-farm payrolls surprised to the upside, the two-month revision was -58k.

Also, federal workers that are on paid leave or have received severance as part of DOGE are not counted as unemployed at this point. That means that this category will likely shift higher in the months ahead.

At this point, the path forward for the Fed is likely to be determined by the labor side of the mandate, not the inflation side.

4.) In Canada

a.) Markets are currently pricing the BoC’s terminal rate to be at 2.25% - implying two more 25bps cuts are left for this cycle.

That we are not pricing in more makes sense for two reasons. First, Trump has backtracked to a large degree on the IEEPA (fentanyl) and Section 232 tariffs such that they only apply to non-USMCA compliant imports. Second, Carney’s ‘strong’ minority government means there will be little difficulty in passing legislation that expands the deficit this year.

The full impact of expansionary fiscal policy will take time. Until then, CAD assets are likely to remain under pressure (both equities and bonds).

b.) There will be a lot of focus around Carney’s meeting with Trump on Tuesday.

I suspect there will be some optimism going into the meeting, even if Carney has told us not to expect anything immediate.

5.) Portfolio Strategy

Our preferred ETFs for the coming week (in no order):

- ZIN

- ZUT

- ZWH

- ZPR

A lot of focus on select sectors in Canada (industrials and utilities) as well as yield enhancement.

See our prior notes for rationale.