Macro Notes - How Big is the Mortgage Shock in Canada?

July 23, 2025The Bank of Canada estimates that around 60% of existing mortgages will be up for renewal between now and end-2026.

The problem? The majority of these mortgages were either originated or refinanced when rates were lower than they are now.

That means a lot of households will be facing higher interest outlays upon renewal in the coming quarters. And as households prioritize deleveraging instead of consumption, the domestic economy could come under additional pressure.

Just how big of an increase are we talking about?

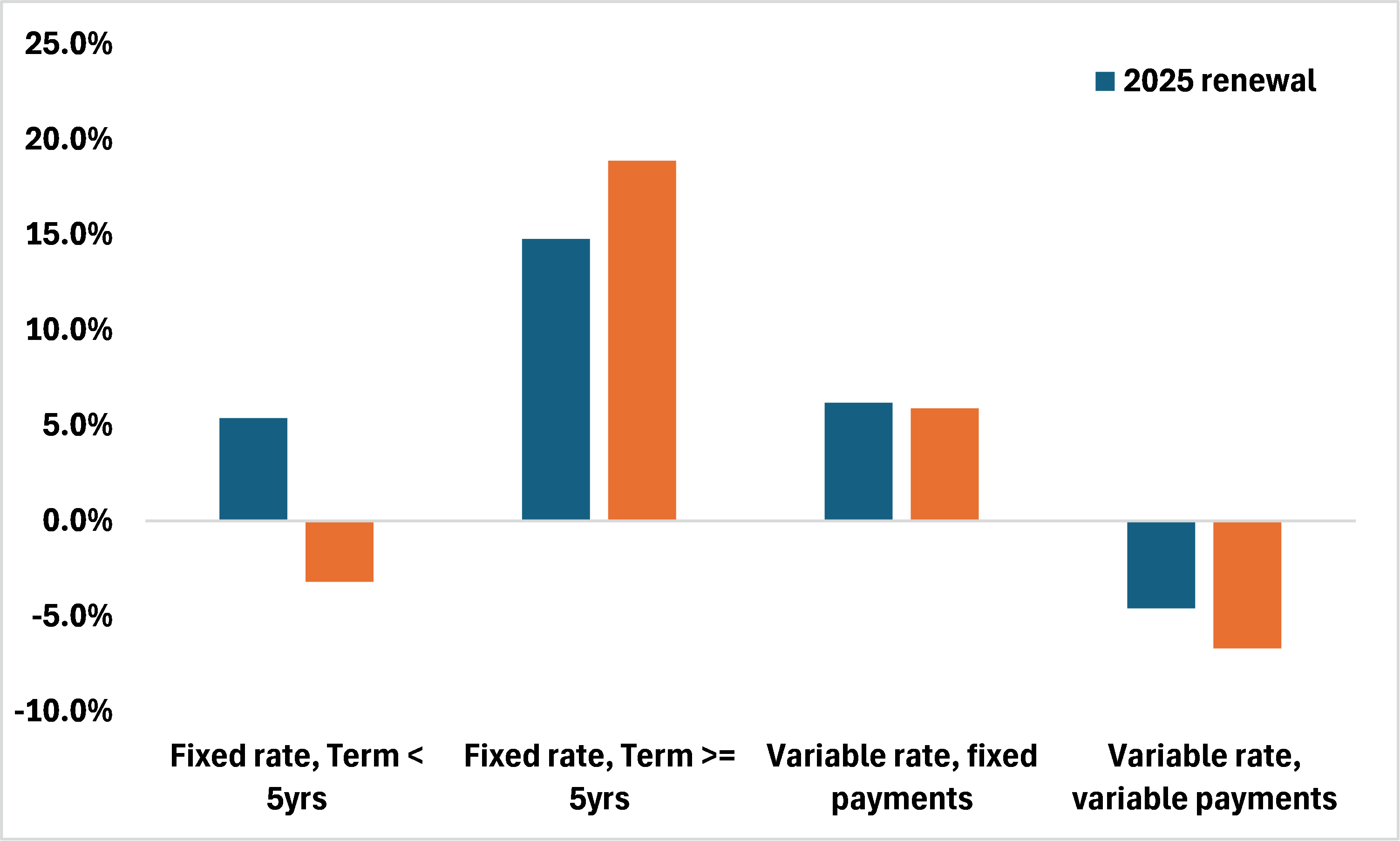

According to the BoC’s analysis, households that are renewing a 5-year, fixed rate mortgage by the end of 2025 will face an average monthly payment increase of 5.4% (from their December 2024 payments). For households that are renewing in 2026, the average increase jumps to 18.9%. We’re picking on 5-year, fixed rate mortgages here primarily because they comprise ~40% of all mortgages in Canada.

Chart: Average Monthly Payment Increases for Mortgages Renewing in 2025 and 2026

Source: BoC

At the surface, those figures are problematic for the real economy. But there are some important caveats to remember:

- First, borrowers will have options if they face a substantial monthly payment increase. For instance, some may elect to extend the amortization period, or extract equity from their home if they’ve repaid a significant amount of the principal.

- Second, household incomes have also risen substantially over the past five years.

- Third, the BoC is making the generous assumption that borrowers will renew into the same mortgage product (i.e: holders of a 5-year fixed rate mortgage will renew for another 5-year fixed term).

For now, this is just a risk to monitor. Admittedly, it’s a risk that could turn into a pronounced deleveraging shock if the trade backdrop deteriorates further.