"I'm Not a Trade Expert, but I Play One on TV"

April 14, 2025What’s Covered…

- Understanding Trump’s Latest Exemptions

- Portfolio Strategy

- A Busy Week Ahead in Canada

- Notes on US Markets

1.) Understanding Trump’s Latest Exemptions

a.) In case you missed it, Trump issued tariff exemptions for several categories of tech devices over the weekend. Most notable among these – are automatic data processors (including computers and laptops) as well as smartphones and semiconductors.

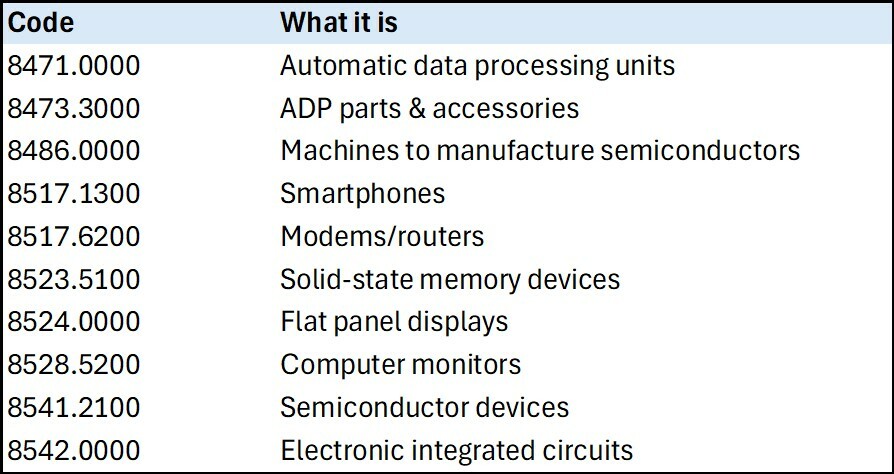

Table 1 lists the HS Codes and a quick description of what these are. All goods falling under these categories will now be exempt from reciprocal tariffs, and will include the 125% tariff imposed on Chinese imports over the past few weeks as well. For now, electronics imported from China will now be tariffed at the original 20% rate.

Table 1 – The Consumer Electronic Goods Now Exempt from Tariffs

Source: US International Trade Commission

Our take: We estimate that the affected items sum up to around $100bln – which is 22% of the US’ total trade with China. Of that $100bln – the lion share is made up computers/laptops ($38bln) and smartphones ($45bln).

By our rough math, the exemption knocks down the US’ average effective tariff rate from 26% to 22%. That’s still quite punitive on the face of things.

Additionally, Lutnick has mentioned that some of the goods listed in Table 1 might be included as part of future sector-specific tariffs (semiconductors).

b.) Nevertheless, there are some extremely important takeaways here:

First, there are clear signs now that the Trump administration is backtracking on tariffs. We can see that from (i) the carve-out for USMCA-compliant goods, (ii) the 90-day extension for reciprocal tariffs globally, and (iii) the exemption for electronic imports announced over the weekend. Keep in mind that (ii) and (iii) apply globally and not just to China.

Second, the combined pressure on Trump from markets and internal stakeholders (this time it was most likely the US tech titans) implies that we have likely reached peak escalation when it comes to tariffs. In other words, the most likely path from here is towards lower tariffs not higher. However, it’s still extremely unlikely that we go back to the halcyon days of no tariffs.

Third, the damage has been done. The combination of profligate fiscal policy and unpredictable trade/foreign policy means that US assets should see a rise in risk premium. In the near-term, that means that foreign assets should outperform the US.

2.) Portfolio Strategy:

a.) Despite signs of a ‘strategic backtrack’ in tariffs, we suspect that US markets will continue to remain under pressure. Again, the effective tariff rate is still too high in the US and administrative policy remains unpredictable. That tells us that diversifying regionally is the right approach.

In case you missed it, we did update our Q2 Portfolio Strategy last week. Our holdings for our balanced portfolio for the coming quarter are as follows:

- In the fixed income sleeve - we’re long ZDB, ZBI and ZTIP/F

- In the equity sleeve – we’re long ZUQ, ZLB, ZDI, ZXLV, ZWEN, and ZCH

- In the alternative sleeve – we’re long ZLSU, ZGLD and ZGI

We’re also taking a small cash position via ZUCM.

For splits and other weights, feel free to take a look at the write-up which is posted on our website.

b.) We’ll have more to say on the USD and UST markets in the coming days. For now, we’re monitoring and re-calibrating our assessments based on what we heard/saw over the weekend.

3.) In Canada: It’s a very important week.

a.) On Tuesday, Statscan will release the March CPI data. The February print was incredibly strong, and not just because the GST/HST holiday ended. Indeed, core measures (CPI-Trim and CPI-Median) were both up by a surprising +0.3% m/m – which is notable given that both gauges strip out the effects of direct taxes.

However, we see downside risks to the street’s call for a +0.7% m/m gain for the headline this week. That’s largely because of lower energy prices (gasoline) likely offset the increase in food prices to an appreciable degree.

b.) On Wednesday, the Bank of Canada will finish deliberating and announce its decision. In conjunction, it will also release its quarterly forecasts via the Monetary Policy Report (MPR).

It’s a close call, but our own feel is that the BoC will likely eschew the need for a rate cut at this meeting. The rationale? For one, the BoC has already eased the overnight by 225bps over the past ten months – which is an aggressive clip by most measures. Additionally, the Governing Council did seriously entertain a pause as recently as the March meeting.

Look, you could also easily talk us into a cut this week as well. The retaliatory tariff measures were lower than expected, oil prices are lower and trade-related uncertainty is likely to hold back investment and hiring.

Again – it’s a close call, though it’s worth noting that the market is only pricing in a ~30% chance of a cut this week. The point is though that the Bank is likely close to the end of this phase of the easing cycle. What happens next depends on the degree of fiscal easing in the coming quarters.

Also worth noting that the April edition of the MPR has usually also come with an update to the Bank’s nominal neutral policy range. The current estimate is 2.25-3.25%.

c.) Canadian Election:

On Tuesday, we’ll get the French-language debate at 8pm ET.

On Wednesday, we’ll get the English-language debate at 7pm ET.

The latest polls have a Liberal majority at 86% (from 87% last week). In addition…

- The Liberals are expected to win 194 seats (+2 from last week)

- The Tories are expected to win 122 seats (-3 from last week)

- The BQ are at 18 seats (+2 from last week)

- The NDP are at 7 seats (-2 from last week)

4.) In the US:

a.) The most notable data points to watch this week are March retail sales (Wed) and Net TICs flows (also on Wed).

Retail sales likely expanded on the month following weather-related disappointment in February. However, sales in key categories that flow-through directly to non-auto goods consumption were likely more subdued.

Net TICs flows will be closely watched given all the concern right now about foreign holdings of US Treasuries. The reference month is February – which of course, is too soon to capture the post-Liberation day volatility in the long-end. Still, the market is likely to run with any indication that foreign appetite is waning at the margin.

b.) This Tuesday is also deadline day for US federal income taxes.

Normally, this isn’t a market event. However, given the recent market volatility (most notably in UST) as well as the slow burn impact from QT – there is a concern that banks could become more judicious with their balance sheets this week. That would create concern for liquidity risk and should lead to a widening of the SOFR – Fed funds spread. In the past, that’s also led to increased market volatility as well.

For now, this is just something to keep an eye on.

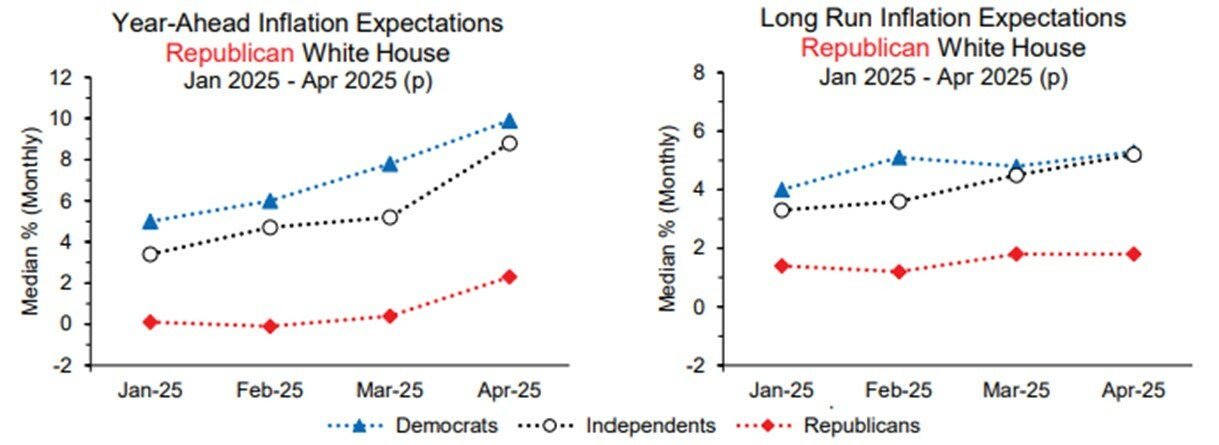

c.) The Michigan survey numbers from Friday were eye-watering to say the least.

- Year-ahead inflation expectations are 6.7% (highest reading since November 1981)

- 5-10 year inflation expectations are at 4.4% (highest since February 1993)

- The headline reading is now at its lowest level since the summer of 2022

Yes, there is a strong whiff of partisanship in those numbers (see below charts). However, even if you just track independents, the concern now is that inflation expectations are becoming unmoored. That’s a HUGE problem for the Fed if left unchecked.

Charts 1 and 2 – US Inflation Expectations by Party (Year-Ahead and Long-Run)

Source: University of Michigan

5.) Other Events to Monitor This Week…

Mon April 14th

- China: Trade balance (Mar)

- US: Fed’s Waller speaks

- Waller is usually a good bellwether for the Fed. Watch for whether he backs up Collins’ comments from Friday.

Tues April 15th

- US: Import prices (Mar)

- Canada: CPI (Mar), Existing home sales (Mar)

- Eurozone: Bank lending survey

- UK: Avg weekly earnings (Feb), Unemployment rate (Feb), Jobless claims (Mar)

Wed April 16th

- US: Retail sales (Mar), Industrial production (Mar), Net TICs flows (Feb), Fed’s Powell speaks

- Canada: BoC decision + MPR

- UK: CPI (Mar)

- Eurozone: CPI (final- Mar)

- China: Q1 GDP, Retail sales (Mar), Industrial production (Mar), Fixed asset investments (Mar), New home prices (Mar)

Thurs April 17th

- US: Initial jobless claims, Housing starts (Mar)

- Eurozone: ECB decision

- Rate cut expected, but watch for a possible hawkish shift in tone.

- Australia: Employment data (Mar)

- New Zealand: CPI (Q1)

- S. Korea: BoK decision

- Turkey: CBRT decision

Fri April 18th – Good Friday holiday in most Western markets

- Japan: CPI (Mar)