Macro Notes - Why France Matters for North American Investors

August 28, 2025For the second time in less than 12 months, the French government is on the brink of collapse.

The gist of the issue boils down to the following…

a.) France is currently running a budget deficit that is close to 6% of GDP and its national debt is expected to reach 120% by 2030.

Both of those are well above the rules set out by Maastricht Treaty – which is the foundation treaty of the EU.

b.) To shore up public finances, French PM Bayrou is proposing a package of EUR44bln of spending cuts and tax increases. Unfortunately, PM Bayrou leads a minority government, and the National Assembly (France’s parliamentary body) is already deeply divided. Most of the major opposition parties have already made it clear that they will not support his fiscal package.

c.) Bayrou has called for a vote of confidence in his government on September 8th, and it’s all but certain that he will lose that vote. This will compound market concerns over France’s public finances – with the risk of a credit rating downgrade looming.

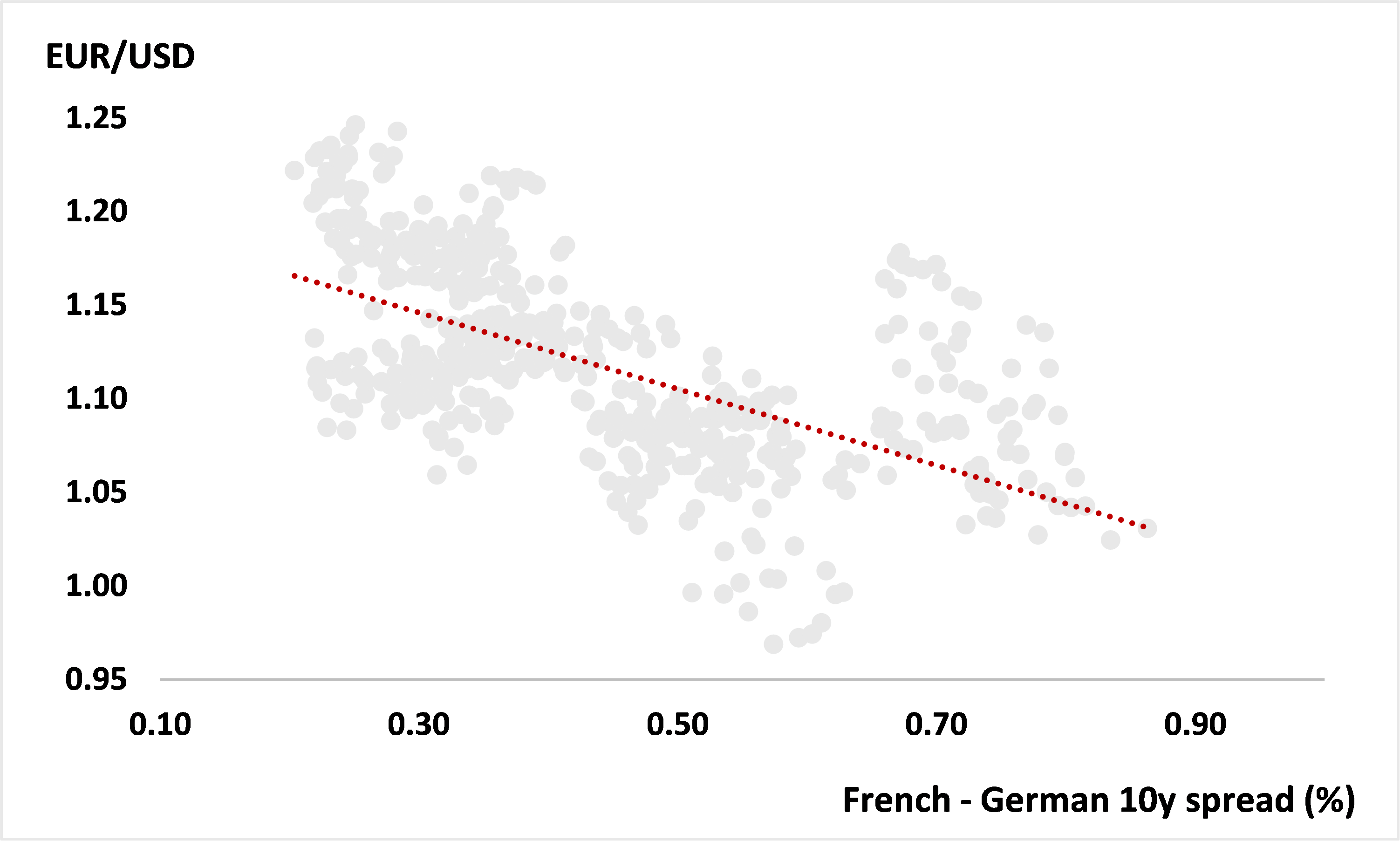

On that last point, French OAT bond yields have been rising – with the 10-year benchmark now around 82bps above the German bund equivalent.

So why does this matter for investors outside of Europe?

- France is the EU’s second largest economy. A continued rise in domestic yields could derail a nascent recovery in the EU. At the margin, that would upset the “great rotation” away from the US that has been a major market theme for North American investors this year.

- Markets may have to reassess ECB policy and price in further cuts. This would mean greater scope for EUR downside relative to the USD and the CAD.

For investors that have exposure to the region, the latter would mean the need to consider currency-hedged instruments in the near-term.

For retail advisors, that means currency-hedged versions of ETFs and/or CDRs (which unlike ADRs do obviate FX risks).

Chart 1 – Wider French-German Long-End Spreads Generally Mean a Weaker EUR

Source: Bloomberg, BMO GAM