Macro Notes - About This Morning’s Data…

September 11, 2025A few interesting tidbits to point out from this morning’s data in the US.

a.) Within US CPI - core prices are still a problem. In fact, core CPI has been locked in a 2.8%-3.3% y/y range for over a year now. The largest contribution to the August print came from the shelter category (owner’s equivalent rent, in particular) and there has been scant evidence of progress in that category for months now.

Additionally, there were some signs of tariffs passthrough in this morning’s print – with core goods prices rising by more than they have in several months (including new vehicle prices).

b.) Initial jobless claims jumped to their highest level in several years with state-level data pointing to a notable increase in Texas-based claims. From a narrative standpoint, the higher claims number does jive with evidence of a general slowdown in the labor market that we’re seeing in other data points.

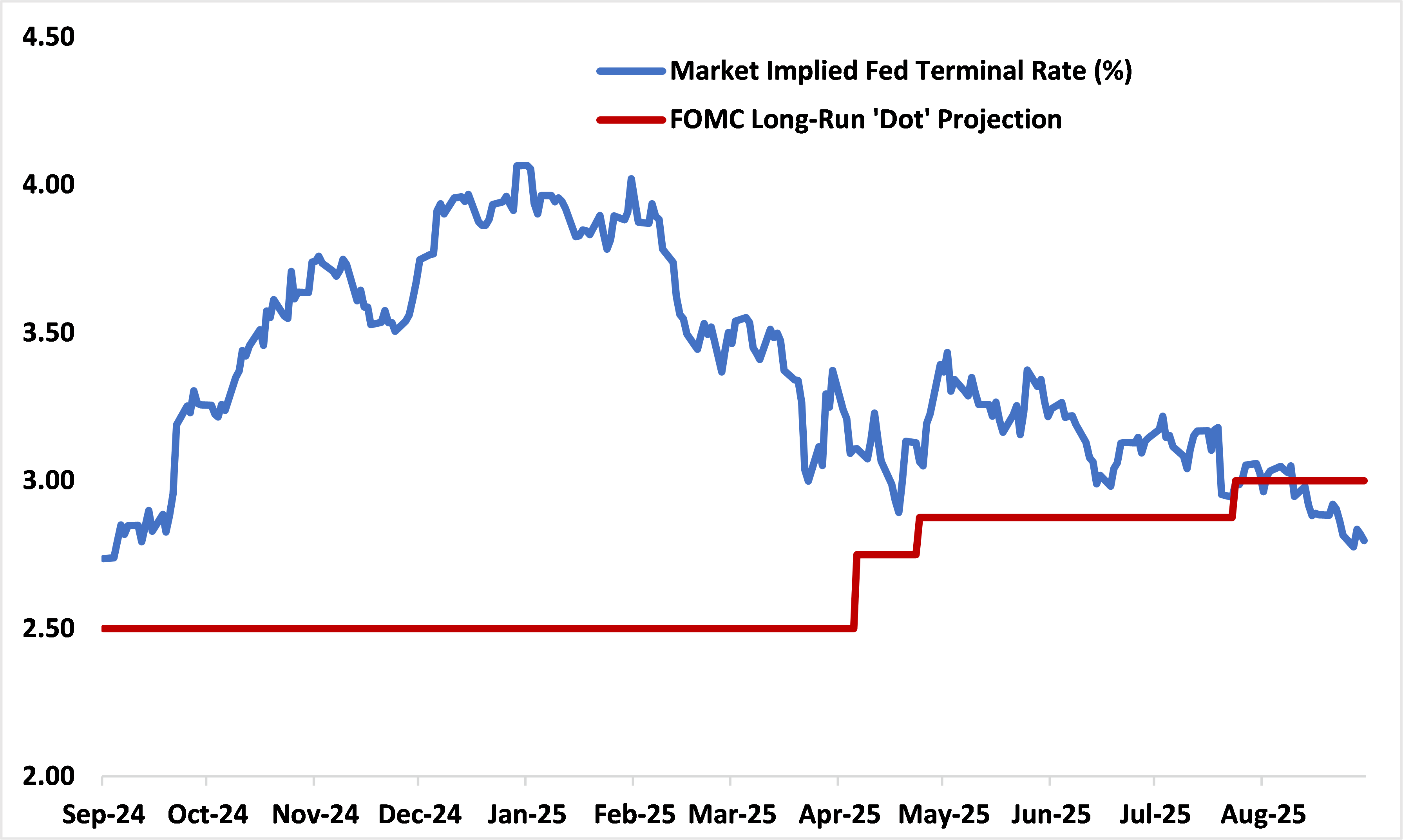

What’s interesting to us is that the market appears to be placing more weight on b) relative to a). How can we tell this? Because market proxies for the terminal rate in the US have shifted lower (see Chart). By extension, that tells us that there is a lot riding on the view that tariff-passthrough to inflation will be temporary, or one-off.

A lower terminal rate is constructive for shorter duration US fixed income. And to be sure, that space has performed over the past week. But given the risks in a), and considering what is already priced in, we are not expecting that performance to continue.

Chart – Market Implied Terminal for Fed Keeps Dropping…

Source: Bloomberg, BMO GAM