Macro Notes - Cognitive dissonance in the US rates market

August 13, 2025The ‘on consensus’ feel of the US CPI print for July does support calls for a 25bps cut at the September FOMC (at least at the margin).

But there are a few details within the release that are problematic for anybody expecting follow up cuts at the October and December FOMC.

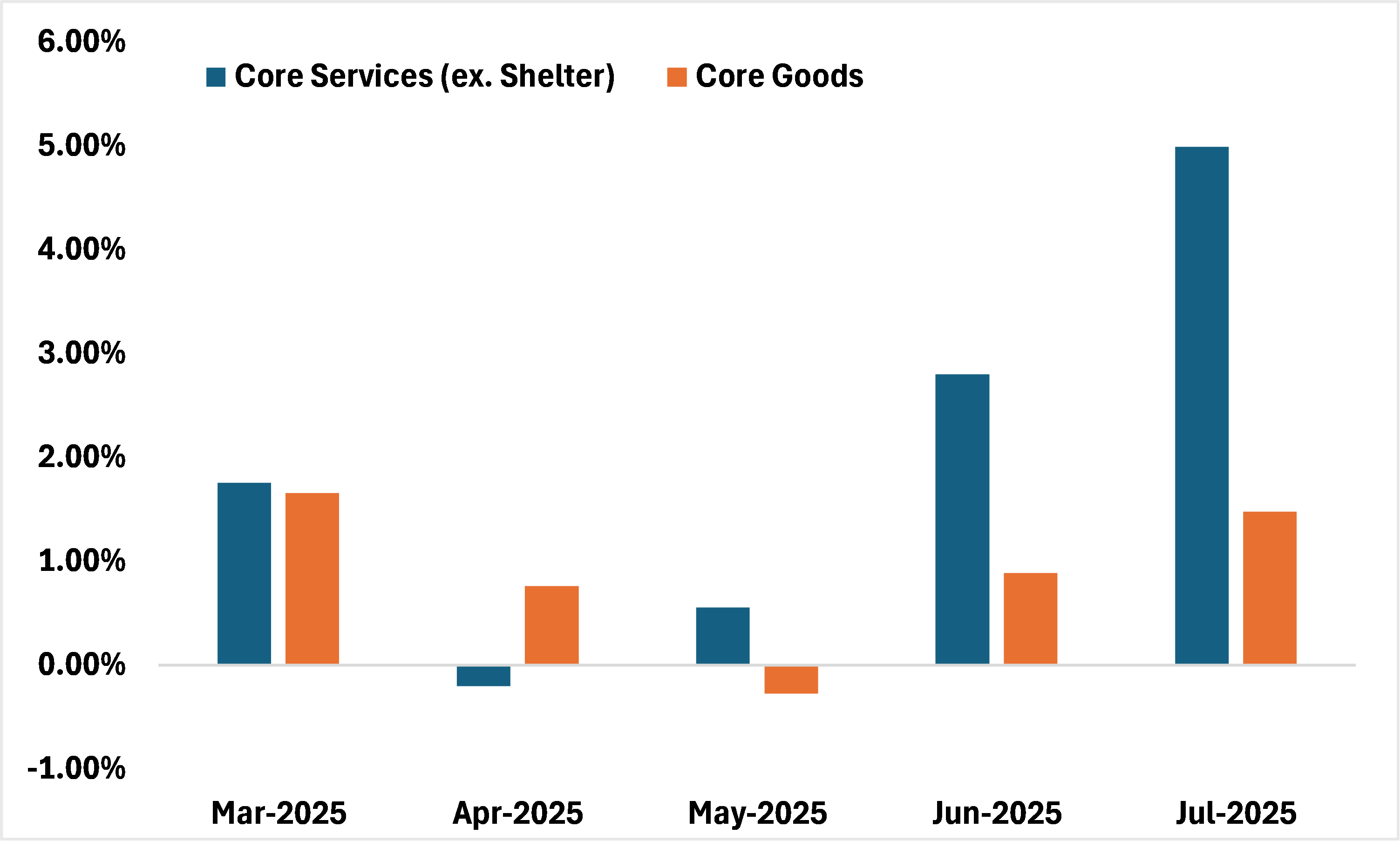

For instance, the 3-month annualized rate of inflation for…

- Core services (ex shelter) went from 2.8% in June to 5.0% in July

- Core goods went from 0.9% in June to 1.5% in July

And keep in mind that the increase in core goods was tempered by flat new vehicle prices. That should change in the months ahead as the impact of tariffs are more fully felt for that category.

What this tells us is that there is an appreciable level of dissonance at play here. The markets are expecting better than even odds for a cut at each of the remaining FOMC meetings for 2025, even though core goods prices are likely to rise further from here while the deceleration in core service prices looks to have ended.

And no, the latest nonfarms print is not enough to justify market pricing for Fed rate cuts. A decline in the demand and supply of labor is not disinflationary on its own.

The moral of the story? US rates are at risk here.

Chart 1 – Three-month annualized rate of inflation for US core services (ex shelter) and core goods

Source: BLS, BMO GAM