Macro Notes - Death...Taxes...and Partisan Brinkmanship in the US

October 01, 2025As expected, the US government has shut down for the first time in seven years. That will mean that hundreds of thousands of government employees will be temporarily furloughed – with risks of permanent dismissal if Trump’s remarks from yesterday are to be believed.

A few notes from us on this:

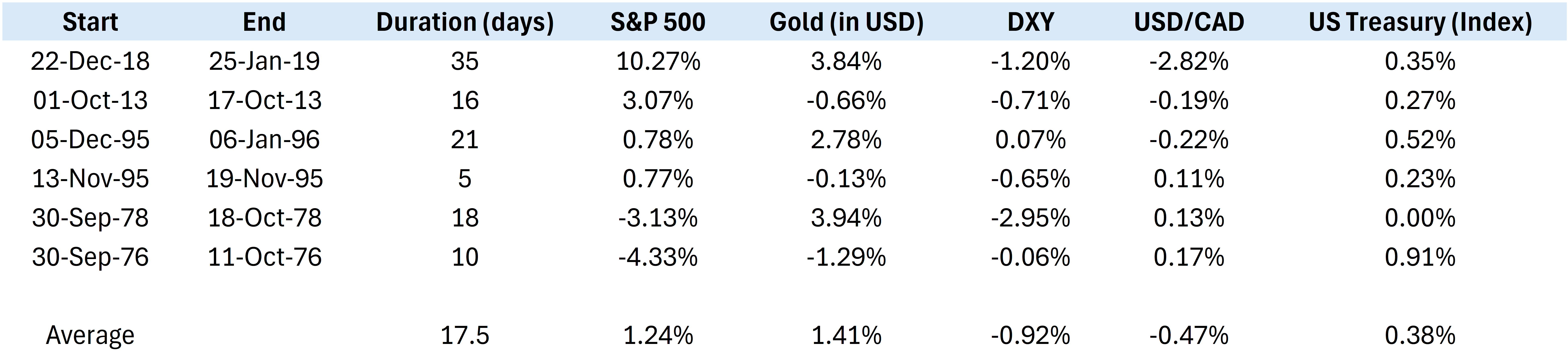

- Outside of short-term gyrations, we don’t see this as a material market driver. That is primarily because government shutdowns don’t typically last that long. For instance, from Table 1, we can see that prior shutdowns averaged just over two weeks.

- Judging from Table 1, the most reliable trades for shutdowns have been i) a weaker US dollar, and ii) lower UST yields.

- Given the current erosion of trust in US institutions, we’d expect Gold to outperform by even more the longer the shutdown persists.

Outside of the above points, the other important consideration is that many government operations will be paralyzed – including economic data collection and reporting. Already, the BLS has stated that both weekly jobless claims and the monthly nonfarms report will not be released in the event of a shutdown.

That matters given that the market is placing a lot of weight on incoming employment reports to justify further cuts from the FOMC. Indeed, as of late yesterday, the market had priced in a rate cut for both the October and December meetings.

Table 1 – Prior US Government Shutdowns (> 5 days) and Market Performance