Macro Notes - Political Pressure and What it Means for CPI

September 10, 2025A researcher at the University of Maryland has attempted to quantify just how much price levels can shift in response to political pressure in the US. Using 90 years of data, the conclusion is that if a president ramps up pressure on the Fed by half as much as Nixon did during his term – then price levels should be expected to rise by about 8%.

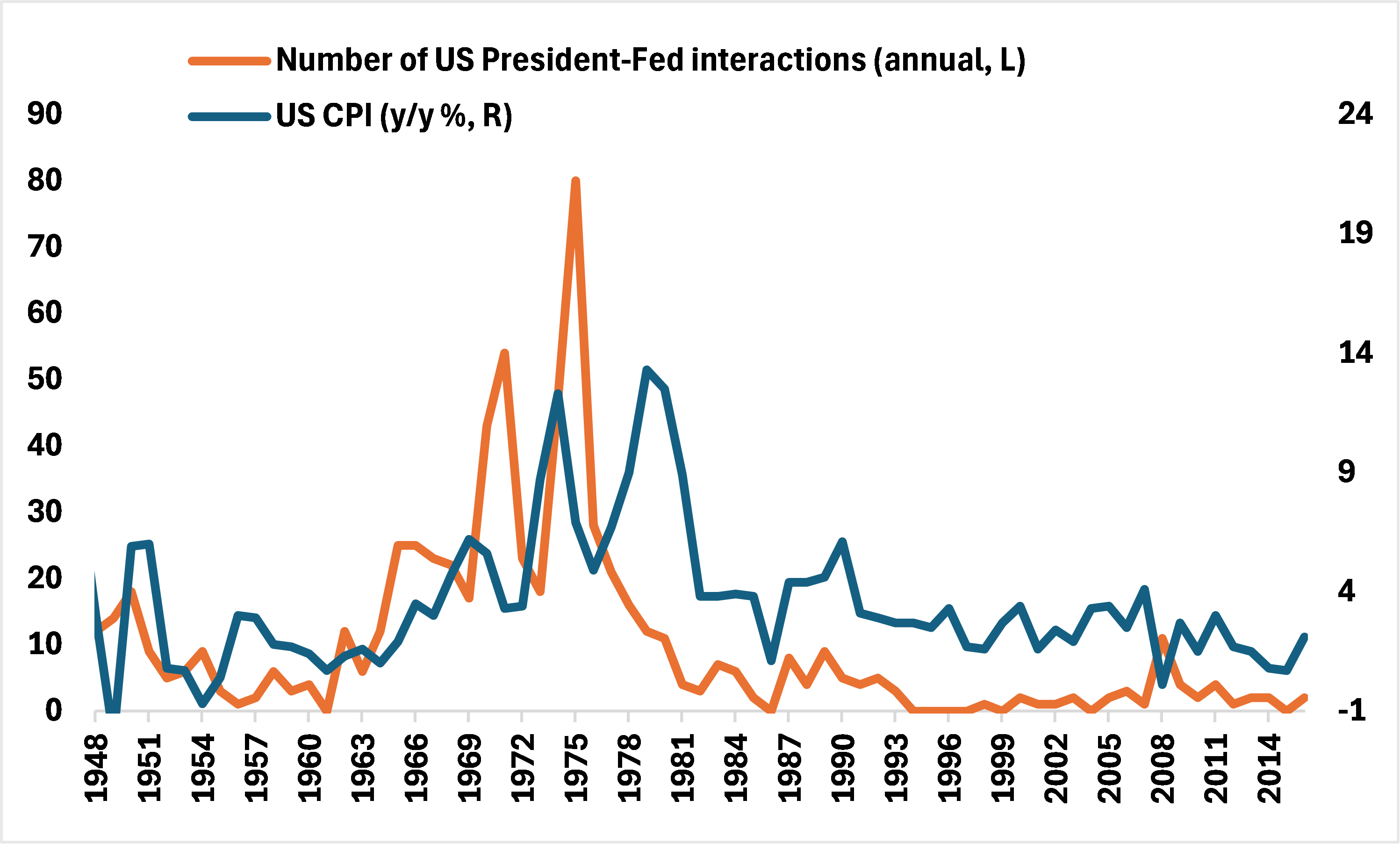

While some might quibble with that conclusion (how can we quantify the degree of pressure precisely?), we do find the below chart interesting. The number of annual interactions between a sitting US President and a Fed Reserve chair began to rise in the 1960s and then peaked in the 1970s. At the same time, we see a corresponding rise in year-over-year consumer prices.

Chart – Annual Number of President-Fed Interactions and CPI (Y/Y %)

Source: University of Maryland, BLS