Macro Notes - Tax Outlays Over the Decades

August 27, 2025Since the early 1960s, taxes paid by the average Canadian family have grown more rapidly than any other single expenditure. This includes all of the various federal, provincial, and municipal taxes that are paid (income, payroll, sales, health, property, fuel, carbon, vehicle, alcohol, etc).

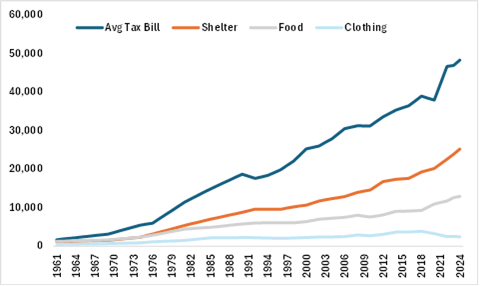

The below charts show the magnitude of this change. Indeed, the total tax bill for the average Canadian household has increased by over 2780%. That’s larger than the corresponding increase in average income (2186%) as well as the main categories of expenditures including shelter (2130%), food (927%).

What’s more is that the growth in tax outlays has outpaced inflation (925%) over that time as well.

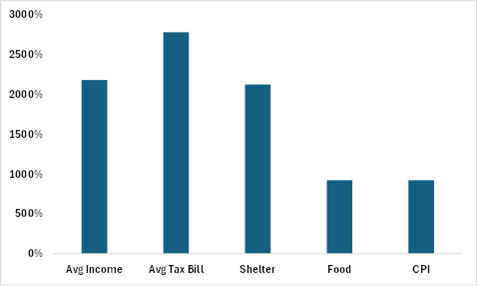

Chart 1 – Taxes and Basic Expenditures of the Average Canadian Family (C$, 1961-2024)

Chart 2 – Growth in Expenditure Categories (1961−2024)