Macro Notes - The Breadth of Long-End Weakness

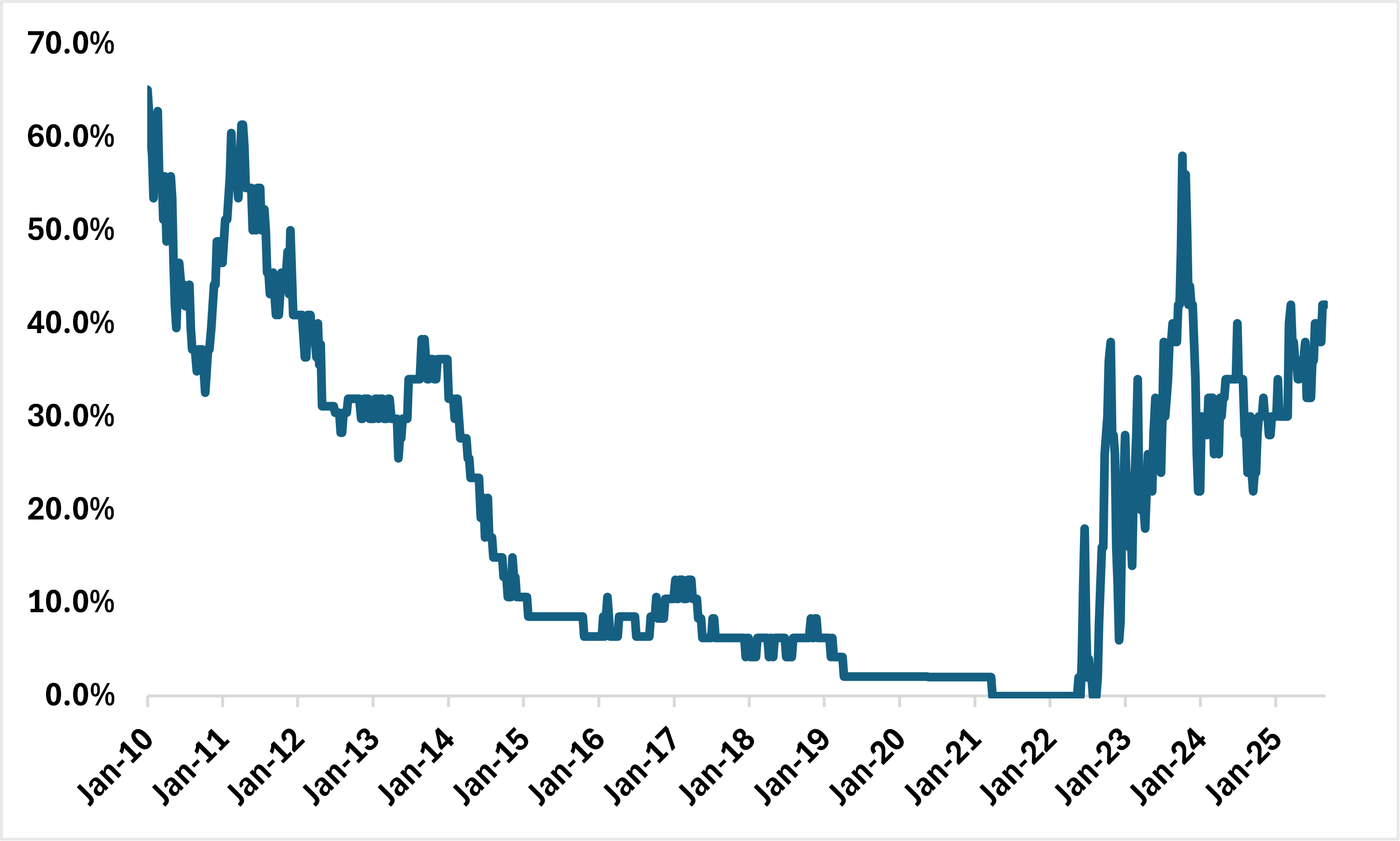

September 04, 2025As of the end of last week, we estimate that around 40% of developed market long-end bond benchmarks (10s, 15s, and 30s) were yielding more than 4%.

If we look past the late-2023 sell-off, this is the highest percentage we’ve seen since the early 2010s.

Why should you care? Because that generally portends to a sustained rise in the term premium across most markets. What’s more is that this is yet another signal that the secular ‘bull market’ in fixed income is done for.

These are a few of the reasons why we remain underweight fixed income in our balanced ETF portfolio.

Chart – Percentage of Developed Market long-end bond benchmarks that are yielding > 4%

*Percentage of 10y, 15y and 30y benchmarks that are yielding more than 4%

** Developed market economies only – with Debt/GDP above 50%

Source: BMO GAM, Bloomberg