Macro Notes - The ‘Oil to Gold’ Rotation in Canada

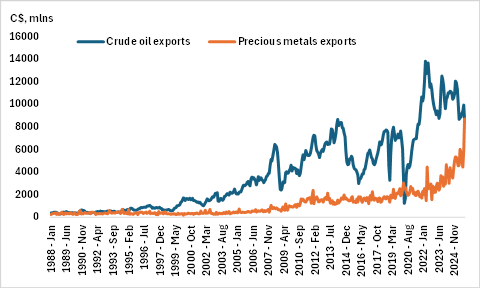

January 16, 2026This past October, the value of precious metals exported by Canada exceeded that of crude oil for the first time in decades (outside of the pandemic).

Of course, this is entirely due to the increase in prices for gold (+50% from January to October 2025), silver (+64%) and platinum (+72%) over that time frame.

For now, this is mainly a ‘gold-to-oil’ rotation story for the Canadian economy. However, a sustained increase in prices should eventually lead to additional capex in the mining space over the medium-to-long term. That would increase potential output and cushion the blow from other parts of the economy that have been hit by the trade war.

Chart 1 – CAD export rotation: Value of precious metals exports exceeded crude oil exports in October