Macro Notes - The US Treasury’s Borrowing Binge, Part I

July 29, 2025Yesterday, the US Treasury announced that it will borrow just over $1trln in the July-September quarter. That’s around $453bln higher than what it originally projected for borrowing (back in late April).

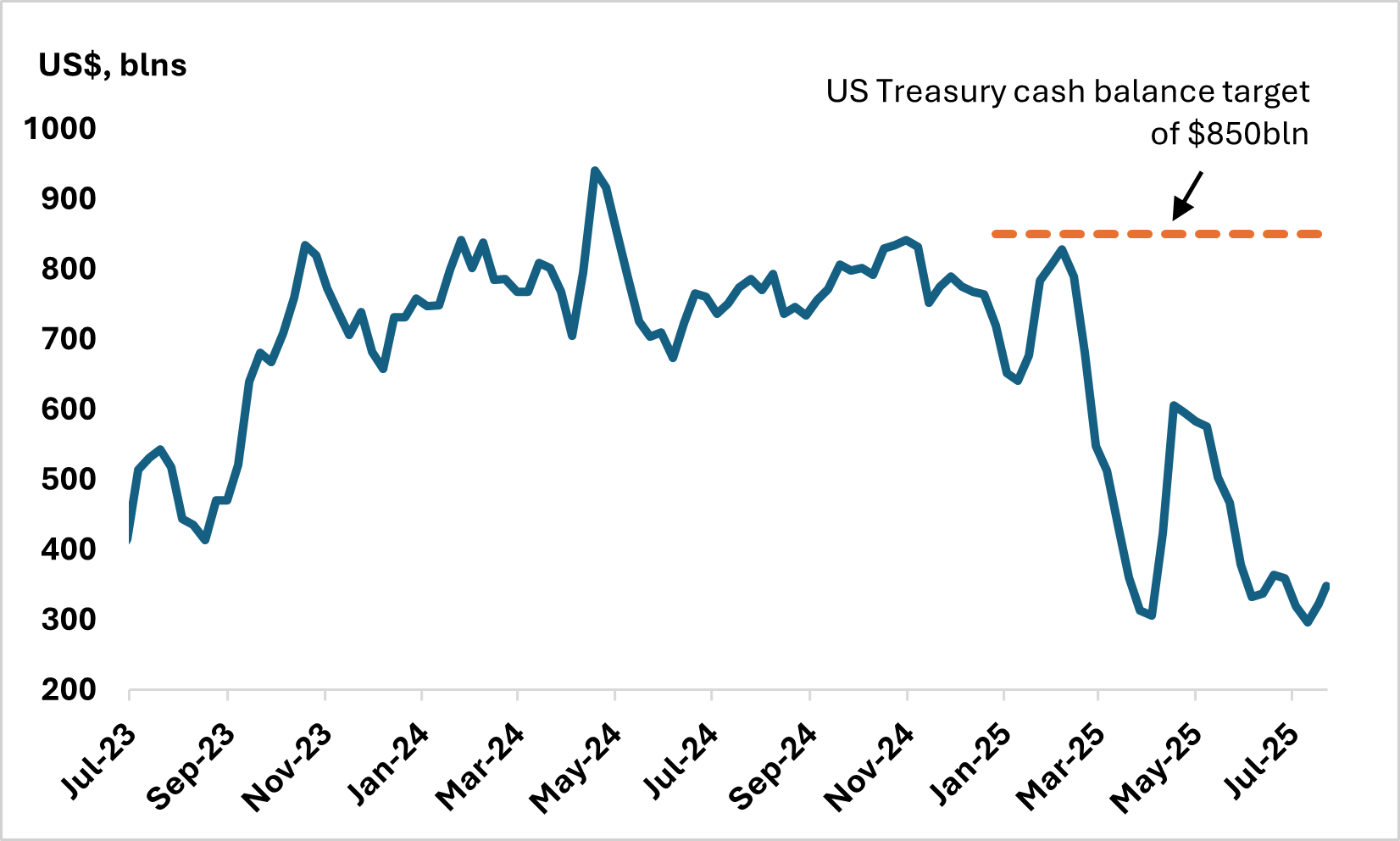

The reason for that massive revision higher? That’s because the Treasury will need to rebuild its cash balance held in account at the Federal Reserve (known as the Treasury General Account or TGA) from its current $348bln to its target of $850bln by end-September.

But its how the Treasury elects to split the $1trln in issuance (between coupons and bills) that will be of importance to markets (that will be made known on Wednesday). Given the still uncertain path on monetary policy, the most likely course of action is to maintain coupon issuance at similar levels from prior quarters – which will mean an increased supply of T-bills to shoulder the burden.

There are two important observations to be made here:

- First, the increase in issuance (both bills and coupons) portends to a decline in liquidity in the banking system.

- Second, so long as the Fed keeps rates on hold, the increased supply of bills will amplify the tension between the Fed and the US Treasury. Indirectly, this will also raise the odds of a fiscal dominance regime in the US.

We’ll have more to say on this later in the week.

Chart – US Treasury General Account Deposits at the Federal Reserve

Source: Federal Reserve, US Treasury