Macro Notes - What are the Odds that Gold will Break $4500? It Depends…

October 09, 2025A few weeks back, we made the case for the Gold prices to breach $4500 by end-Q2 2026.

Of course, what we didn’t anticipate was that the rally would be this aggressive. Indeed, Gold prices have risen by a swift 7% since we published our note – sometimes, it’s just better to be lucky than good.

What does the market think of that call? Well, we’d need to be a bit careful as to how we pose the question. For instance, are we interested in whether Gold will be above $4500 by end-Q2 2026? Or are we just interested in whether Gold will touch that level at least once before end-Q2 2026? The former is path agnostic, whereas the latter is path dependent.

For the former, we can price up a ‘digital call option’ on Gold with a strike price of $4500 that expires at the end of Q2 2026. This is a binary option that pays a fixed amount if a certain condition is met (in this case, that spot Gold will be above $4500 by the end of Q2-2026), and nothing otherwise.

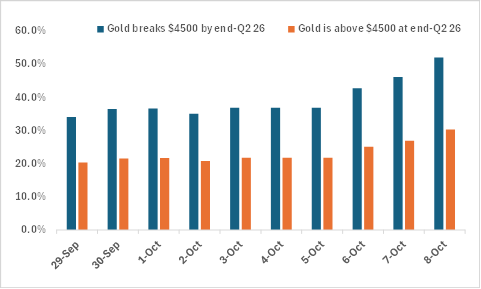

The price (or premium) of this digital option is a useful market proxy on the odds that it will happen. Right now, that premium is 30.32%, which is up from 20% a few weeks back.

For the latter, we’ll use the price of a ‘One Touch’ option. Again, this is a binary option that pays if Gold breaches $4500 at least once before end-Q2 2026, and nothing if that doesn’t happen. Right now, the price of that option is 52%, which is up from 34% a few weeks back.

So to summarize…

- What are the odds that Gold is above $4500 at the end of Q2 2026? Close to 30% (or under 1/3).

- What are the odds that Gold will break above $4500 by the end of Q2 2026? Around 52% (or better than even odds).

Chart – Market Implied Odds for Gold

Source: BMO GAM