Macro Notes - Why The End of ‘De Minimis Duty-Free’ is Important

August 29, 2025As of midnight, the United States has eliminated the de minimis tariff exemption for all countries and imports.

That means that:

- All non-postal imports to the US under $800 will be subject to an ad valorem duty equal to the product’s country of origin effective tariff rate (under IEEPA).

- All postal shipments to the US with values under $800 will receive a flat per-item duty between $80-$200 per item (depending upon country of origin) until February 28, 2026. After that date, the tariff will adjust to the country-of-origin tariff under IEEPA.

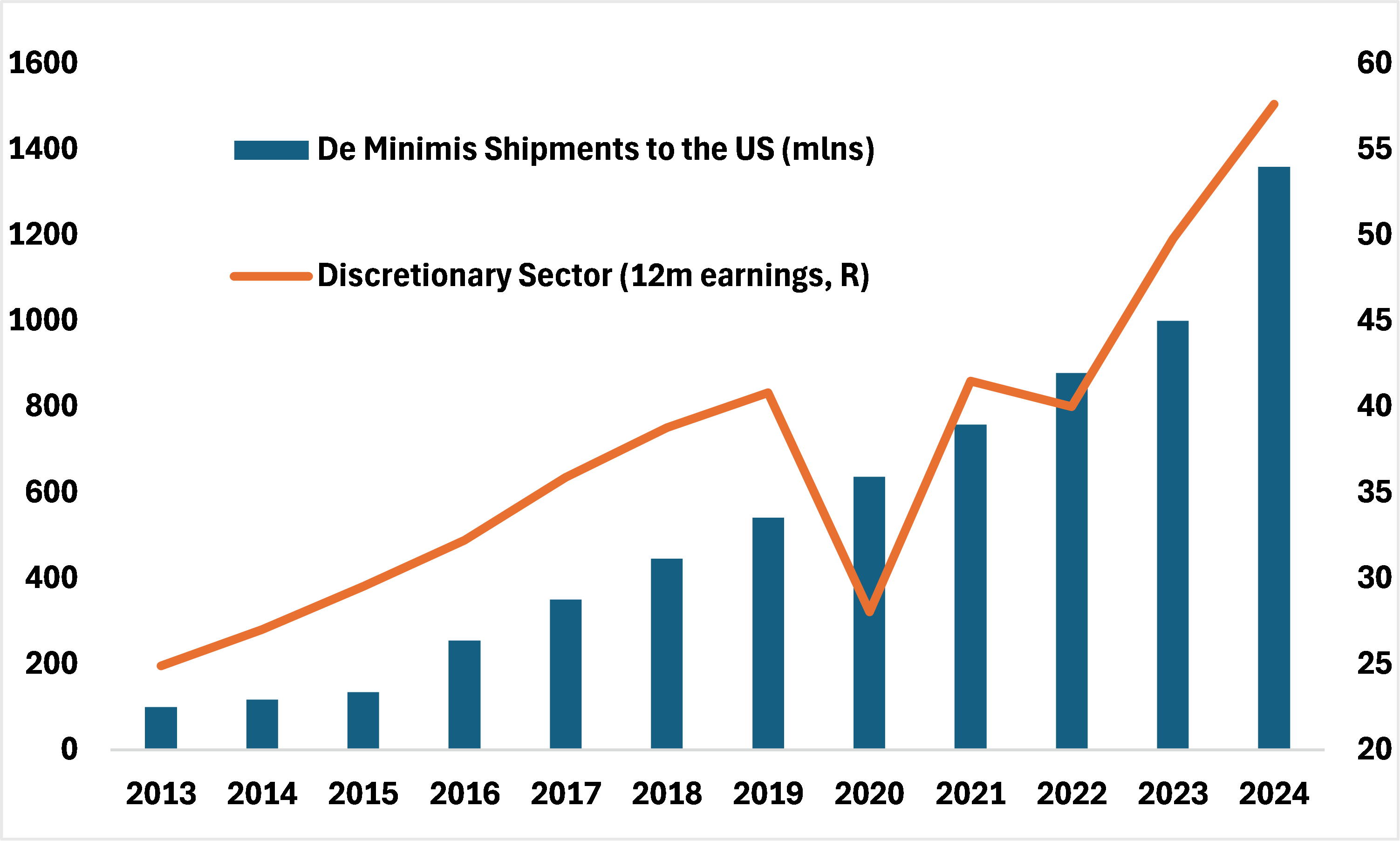

This exemption has been one of the primary reasons for the ‘direct-to-consumer’ boom over the past decade. The end of it will impact several import categories including apparel, textiles, footwear, electronics, appliances and home goods.

The GICS sectors that are most exposed to the end of this exemption is likely consumer discretionary (e-commerce platforms), tech (dependence on manufacturing in Asia), and staples. The impact of the DTC boom on discretionary earnings is displayed in the chart below.

While this is a big deal, this isn’t reason enough alone to short those sectors. For instance, the fundamentals in tech remain too strong to ignore. But when the cycle turns, this is the sort of detail that will amplify downside risks.

Chart – The ‘De Minimis’ Exemption was an Important Driver for Discretionary Earnings over the Past Decade

Source: US Customs Border and Protection, Bloomberg, BMO GAM