Post-Liberation Day - It's as Bad as You've Heard

April 03, 2025Brace yourselves. It is going to get ugly before it gets better.

1.) The Facts:

a.) The US will apply a universal baseline tariff of 10% to all countries. These will be stacked on top of prior tariffs (IEEPA + section 232 + 301, etc) with the effective date being April 5th.

b.) For countries that run large goods trade surpluses against the US, Trump is levying an individualized reciprocal tariff. These will go into effect on April 9th and will not be stacked on top of those for part a).

All other countries will be subject to the tariff mentioned in part a).

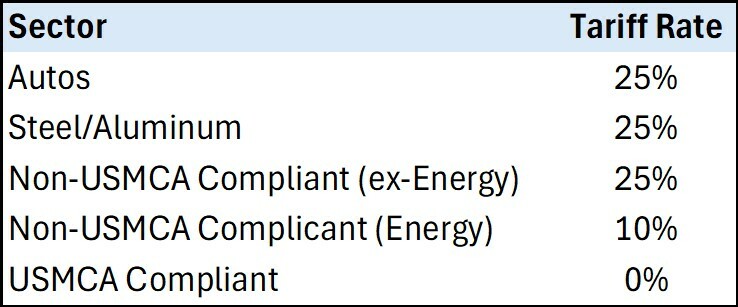

c.) Canada and Mexico are exempt from the tariffs listed in parts a) and b). Additionally, the exemptions for the 25% comprehensive tariffs (also known as the ‘fentanyl tariffs’) will continue. Recall, that these cover USMCA-compliant goods.

For now, non-USMCA compliant goods will be charged a 25% tariff, while non-USMCA compliant energy and potash will still see a 10% tariff.

d.) The fact sheet mentions that USMCA compliance will still receive preferential treatment in the event that the fentanyl tariffs are rescinded. Under that scenario, non-USMCA compliant goods would be subject to a 12% reciprocal tariff.

e.) In terms of retaliation…

- The EU is giving itself a four week window to convince Trump to drop the tariffs before taking action.

- Japan has given no indication of retaliation at this point but is “leaving all options on the table”.

- China has vowed to retaliate but has not indicated yet what that would look like.

- Canadian PM Carney is expected to hold a press briefing later this morning – with possible countermeasures announced.

2.) How Do We Interpret This?

a.) The only funny thing about these tariffs is the oddly simplistic way that the US calculated them.

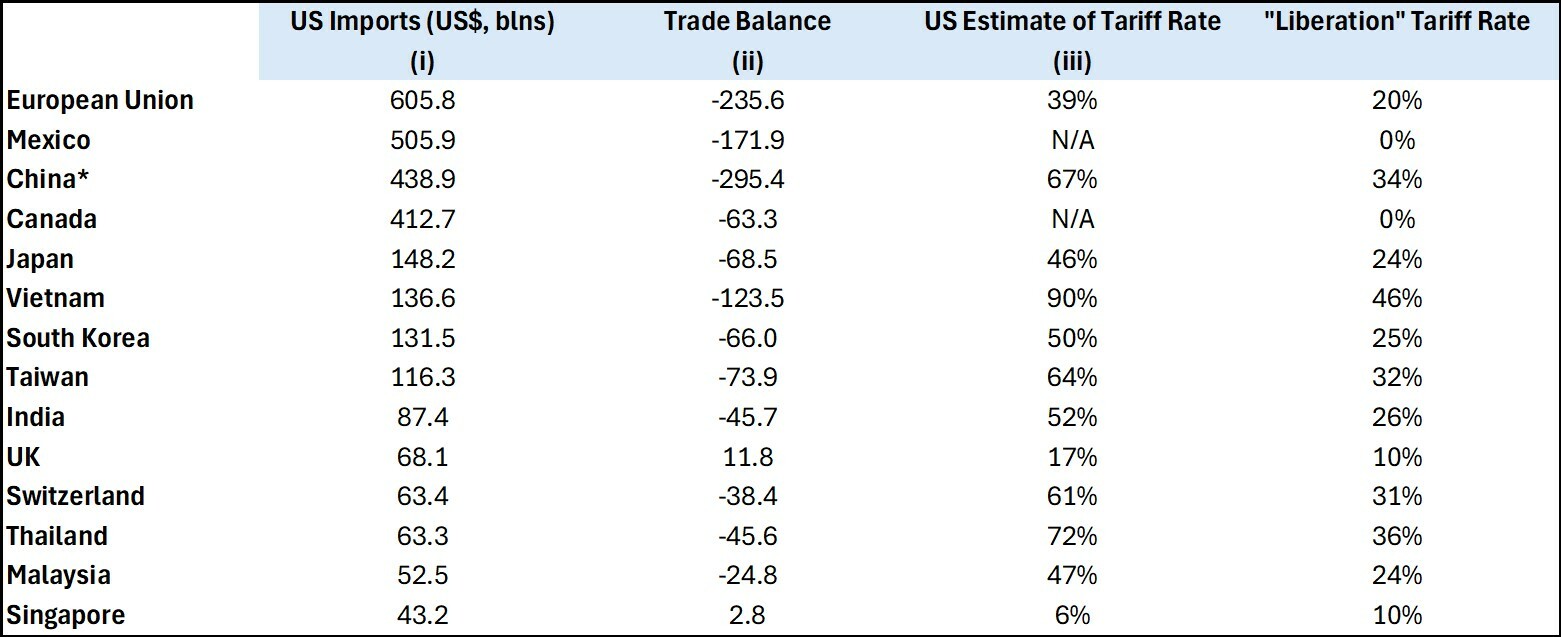

To come up with the original rate that each country was charging the US, Trump’s team appears to have just taken the total goods trade deficit and divided it by the total amount of goods imported in 2024 (in absolute terms). For example, the US imported $605.8bln of goods from the EU last year but ran a $235.6bln deficit – which to Trump’s team means that the tariff the EU equates to 39% (235.6 divided by 605.8). The US then just divided that rate by half to get the reciprocal rate.

Take a look at Table 1 below where we’ve done the math on the largest importers for you.

Table 1 – How Trump’s Team Arrived at the Tariff Rates

*This tariff rate will be stacked on top of the prior 20% announced for China

Source: USTR, BMO GAM

b.) If we strip out imports from Canada and Mexico, imports from the EU/China/Japan/South Korea/Vietnam make up over 60% of the rest. Indeed, the tariffs for goods coming from those countries are particularly punitive.

c.) There are exemptions to the above – including articles already subject to prior tariffs under 232 (steel/aluminum, autos & parts) as well as other items including copper, pharmaceuticals, semiconductors and lumber. Again, the reciprocal tariffs are non-stacking and it feels like the aforementioned exemptions will be subject to industry-specific tariffs if Trump’s prior comments are anything to go by.

d.) For the US, this will lead to further deterioration in the growth/inflation trade-off.

By our rough math, the trade-weighted US effective tariff has now gone from 2-3% to 20-21%. This would translate into a (likely) 1.5% direct contribution to the baseline for core PCE going forward – which represents a meaningful shift higher in goods prices.

The implication here is that the Fed could be slower to ease rates further from here. The rally in Z5 SOFR (or the SOFR contract that expires in December 2025) immediately after yesterday’s announcement would suggest that the market is thinking the Fed will be more aggressive with rate cuts given the risks to growth. But I don’t see that happening unless we (finally) see weakness in real economic data and not just sentiment.

e.) There’s potential for more volatility in the US markets from here. That is for the following reasons:

- As mentioned above, the Fed may ease rates more slowly if it takes longer for price pressures to subside.

- Over time, non-US asset managers are likely to continue to migrate away from the US and into alternative assets (infrastructure, gold) and/or domestic markets. That should raise the cost of capital even further for US firms at the margin.

- Retaliatory measures by other countries means that US sectors with a heavy concentration of foreign revenues are exposed. The tech and communications sectors are both very vulnerable in that regard.

- Tariffs will raise input costs for small and medium-sized enterprises.

d.) In the near-term, this is constructive for CAD assets and will likely contribute further to a boost in the polls for the Liberals. We also expect to see a short-term rally in the CAD – with USD/CAD likely to drift into the 1.41−1.42 area.

It also means that the BoC is a lock to keep rates on hold at the April meeting now. Forward OIS is pricing the BoC to end up just below the lower end of its neutral range (2.15% - 2.25%). That could shift higher if we see a degree of fiscal stimulus after the election.

Additionally, we’re a bit leery when it comes to duration in Canada as there are greater upside risks to yields coming from additional issuance (stimulus) and the removal of whatever premium was priced in for the ‘fentanyl tariffs’.

e.) Further out, the Canadian economy is still vulnerable to potential sector tariffs (lumber, agriculture) as well as weaker global demand.

Table 2 – Current US Tariffs on Canadian Goods

Source: BMO GAM

3.) Portfolio Strategy

We will be publishing our Q2 Portfolio Strategy later this week. But having said that, nothing that we saw yesterday would lead us to shift course from what we were expecting going into this quarter. Namely, that investors should retain a more defensive posture when it comes to asset allocation.

- For equities, our focus will be on low-volatility strategies (in Canada) while also diversifying into markets where fiscal space remains ample to address the trade shock (Germany and China).

- We continue to prefer US equity sectors that are relatively sheltered from the trade war (healthcare and utilities).

- Given the risks of ‘stagflation’-like themes taking root, we are long commodities and infrastructure. Energy has done well so far and we envisage momentum continuing there.

- As an extension of the last point, we like being long US TIPS.

4.) Longer-Term Takeaways

a.) Some have suggested that yesterday’s news was “better than expected” or “in-line” with expectations – which I don’t understand at all. We are talking about the hub of the world’s financial system shifting from a trade model that emphasized low barriers to a far more protectionist one. For instance, assuming our math is right, the US now has the same average tariff rate as Iran, Sudan and Algeria.

How is that NOT bad for global growth going forward?

The US economy has averaged 2.5% annualized quarterly growth over the past three years. I doubt that’s the case for 2025 if tariffs are here to stay.

b.) If history tells us anything, its that tariffs do ultimately lead to worse outcomes.

The patterns from prior episodes are usually consistent: the US will levy broad tariffs -> retaliatory measures are implemented -> certain sectors come under unusual strain (agriculture most notably) -> prices for consumers go higher -> businesses lose market share -> political backlash.

The problem is we have to go through the motions first.