Quick Take on the Situation in the Middle East

June 15, 2025There are two things for the market to consider from here…

- The degree by which this conflict escalates

- What this means for input prices globally

Overnight, the conflict in the middle east escalated materially as Israel attacked Iran’s nuclear facilities and military targets. Iran has vowed to retaliate and to deal a “harsh blow” to Israel and the US.

From here, there are two things to consider:

i) The degree by which this conflict escalates: Of course, it’s extremely difficult not to consider the human element here and what a possible escalation will mean for the people living in the region.

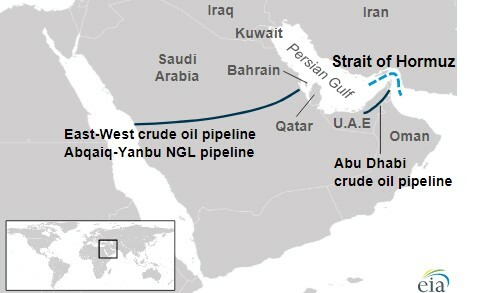

For markets, the focus will be on whether escalation will lead to critical damage to existing energy infrastructure and potentially a blockage of the Strait of Hormuz. Recall that this strait is the world’s most important artery for oil and liquified natural gas flows, and at 33km at its narrowest point, it is relatively easy to initiate a blockade.

Currently, 17 million b/d of crude and condensate flows through the Strait – representing 17% of global demand. OPEC members including Saudi Arabia, Iran, the UAE, Kuwait and Iraq use the Strait to export crude with Asia representing the largest destination market. Of those countries, only the Saudis and UAE have the ability to bypass Hormuz via other routes (Chart 1).

At least 18% of global LNG trade volumes (all from Qatar) flow through the Strait. The primary destination for much of this volume is Europe.

Chart 1 – The Strait of Hormuz + East-West and Abu Dhabi Crude Pipelines

Source: EIA

ii.) What this means for global input prices: Given the geopolitical importance that the Strait plays, as well as the proximity of the conflict to important energy infrastructure in the region, it’s easy to see further upside to prompt crude and natural gas futures in the event of escalation.

We’ve seen estimates of $100/bbl for WTI/Brent should things escalate – which we wouldn’t argue with. That would also mean a corresponding rise in prices for energy costs (gasoline) for much of the developed world. In turn, that would exacerbate the trade-off that most central banks are already dealing with as a result of the trade war – lower growth and higher prices. This is exactly why broad tariffs are bad for markets – because they amplify unexpected potential shocks like this one.

At the margin, this supports the view that the Fed will keep rates on hold until the fall. That’s despite the progress we’ve seen on CPI/PPI as well as some concerns that are starting to appear in employment data. At the same time, this buttresses the view that most developed market central banks (BoC and the ECB) are either done or close to being done with their respective easing cycles.

In terms of investment implications…

- We were already underweight US and Canadian fixed income in our balanced portfolio. The developments overnight and the potential for escalation do not portend to a shift in this view at this stage.

- We remain overweight alternatives – including Gold. Increased geopolitical uncertainty should continue to support the already existing fundamental reasons to remain long.

- We continue to prioritize defensive sectors and low volatility strategies in the equity sleeve of our portfolio.

- We see scope for the US dollar to rally in the near-term. That’s primarily as a substantial short position has been built already. Indeed, the risks of further escalation point to a possible squeeze in the FX market.

If the conflict extends for a substantial period of time, we would be wary of increasing exposure to markets that depend heavily on energy imports (India, China, Germany and Japan).