Should we be concerned about the credit cycle in the US?

August 11, 2025Markets will be keying in on the release of US CPI this Tuesday – and for good reason. A print that is in-line or below market expectations (headline at +0.2% m/m and core at +0.3% m/m) should give the Fed the ‘all clear’ to go ahead with a rate cut when it meets next month. By contrast, a surprise print higher would exacerbate the tension between the Fed’s twin goals (price stability at 2% and full employment) which may require keeping rates on hold for another meeting.

But for long-term investors, it’s not about trading the next FOMC meeting. It’s about ensuring that the market has the correct read on where the FOMC will eventually stop easing policy rates in the coming quarters (or the terminal rate for this cycle). And to do that, we must consider what the fundamentals are telling us. Since the disappointing July nonfarm payrolls, the US labor sector has come under increased scrutiny. Additionally, the Q2 GDP report confirmed what most were already concerned about – that incoming tariffs were affecting household spending behaviour.

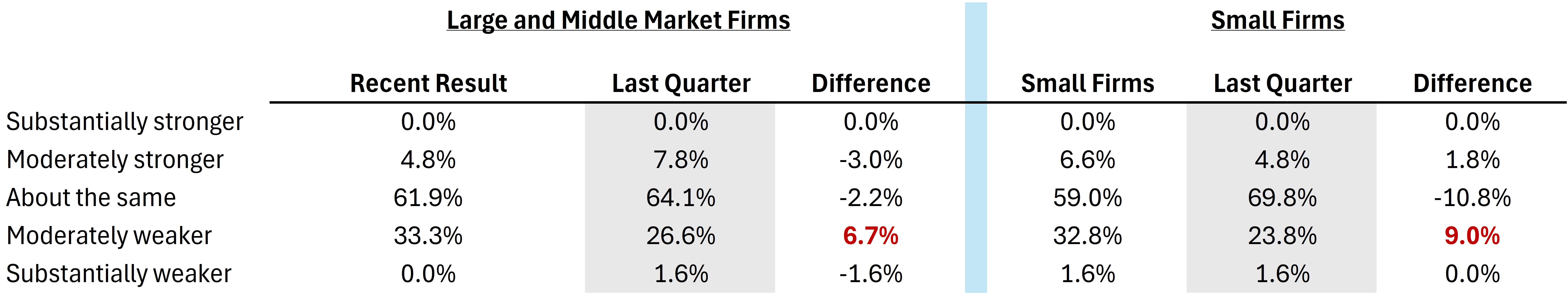

Last week, we received another piece of concerning evidence. The quarterly NY Fed Senior Loan Officer Opinion Survey (or SLOOS) on bank lending showed that credit demand from commercial and industrial firms had weakened over the past three months (Table 1). What’s more is that a follow-up question found that some of the main reasons for this was that firms were curbing investments in plant and equipment and that M&A financing needs had also decreased. Empirically, we know that a deterioration in the credit cycle is consistent with a general slowing of the real economy, which would support further downward revisions to where the market was pricing the terminal rate for the Fed and would be supportive for US fixed income.

Table 1 – Demand for Commercial and Industrial Loans by Size of Firm Over the Past Three Months*

*Question asked in survey – “Apart from normal seasonal variation, how has demand for C&I loans changed over the past three months? (Please consider only funds actually disbursed as opposed to requests for new or increased lines of credit)

Source: NY Fed

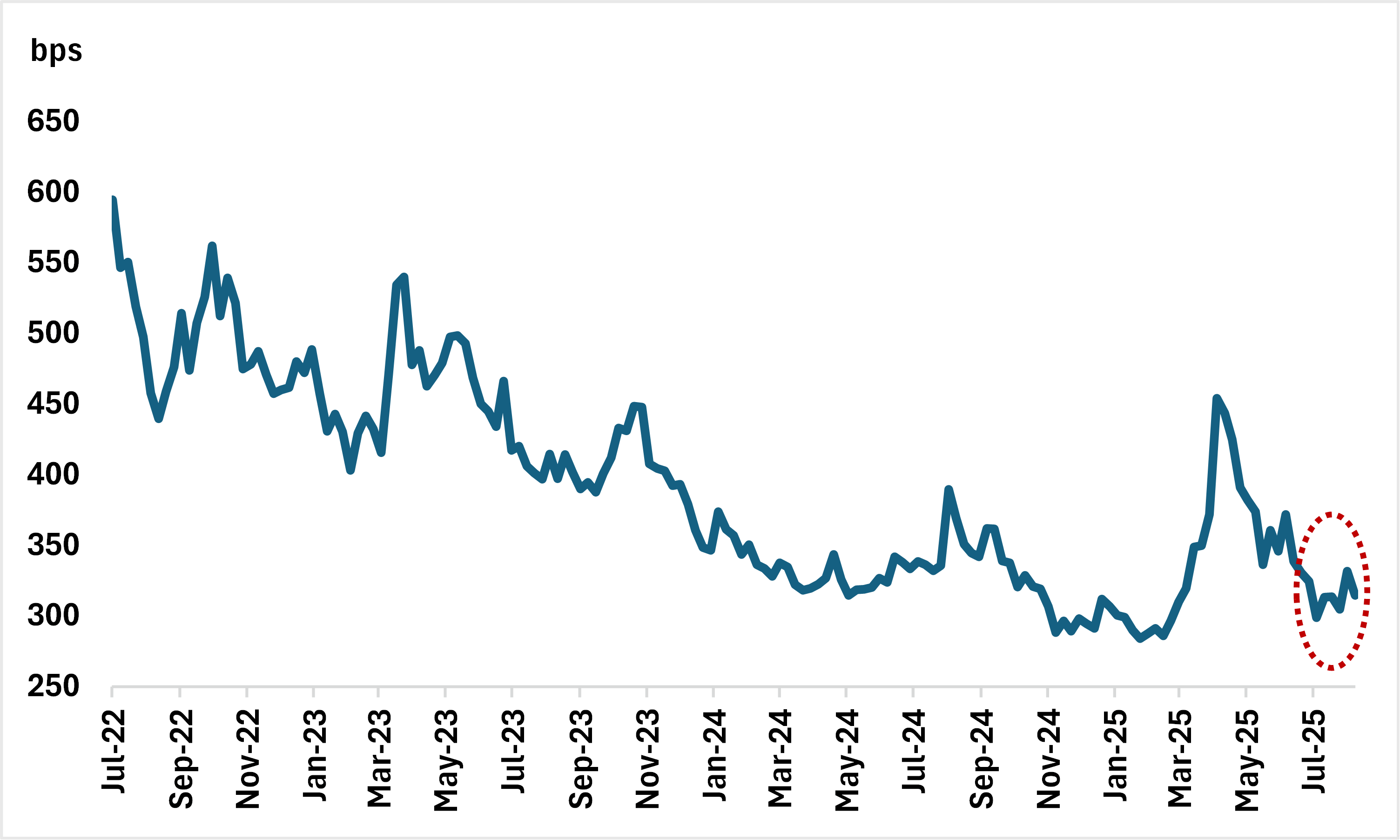

However, a silver lining in the SLOOS release is that credit supply (via bank lending standards) has not tightened materially. Typically, a slowing in the credit cycle would be more concerning if falling demand came as a result of tighter lending standards. Another positive is that despite the fall in credit demand, we have yet to see a material widening in high yield credit spreads (Chart 1). That is typically the ‘canary in the coal mine’ for a meaningful slowdown in the credit cycle.

Chart 1 – US Corporate High Yield Spreads Remain Contained

Source: Bloomberg

What this tells us is that the fall in demand is mostly due to a change in the macro backdrop. Namely, that trade policy-related volatility is leading firms to hold off on investments and M&A activity until there is more clarity and consistency from the White House on the matter. That does provide some relief – as recessions rarely (if ever) occur as a direct result of Presidential policy on trade and tariffs.

Of course, this does not mean that we are in the clear when it comes to the credit cycle in the US. Left unchecked, frequent shifts in administrative policy can lead to firms holding off on investments for longer periods of time. That is why this weekend’s news of targeted export tariffs for a few of the big tech names is particularly important to keep an eye on.

But for now? We suspect that the fall in demand is a red herring that will need to be substantiated by further proof.

Tactical ETFs that we like:

- ZAAA (BMO AAA CLO ETF): For now, we like prioritizing yield at short duration in the sub-sovereign space.

- ZWT (BMO Covered Call Technology ETF): Yield-enhancement product for anyone that is concerned about current tech valuation while also allowing for participation in a fair bit of upside.

Portfolio Strategy:

a.) Shorter-term trading will take its cue from US CPI this week, but despite what comes we still continue to favour Equities and Alts over Fixed Income.

Equities: We remain neutral in our balanced ETF portfolio. Indeed, our optimism on the fundamentals (earnings) is tempered to a degree by extant valuation and sentiment. We continue to favour US large caps (tech, communications, financials and utilities) and like augmenting that with increased exposure to EM.

Fixed Income: We’re underweight this asset class in our balanced portfolio. We continue to optimize for ‘high yield + short duration’ with preference for sub-sovereign exposure.

Alts/Cash: We continue to like gold and infrastructure as diversifiers.

b.) Current holdings (balanced portfolio):

Fixed income

- ZDB (BMO Discount Bond Index ETF)

- ZBI (BMO Canadian Bank Income Index ETF)

- ZTS (BMO Short-Term US Treasury Bond Index ETF)

Equities

- ZUQ (BMO MSCI USA High Quality Index ETF)

- ZLB (BMO Low Volatility Canadian Equity ETF)

- ZLI (BMO Low Volatility International Equity ETF)

- ZIN (BMO Equal Weight Industrials Index ETF)

- ZEM (BMO MSCI Emerging Markets Index ETF)

Alts/Non-traditional Hybrids

- ZLSU (BMO Long Short US Equity ETF)

- ZLSC (BMO Long Short Canadian Equity ETF)

- ZWGD (BMO Covered Call Spread Gold Bullion ETF)

- ZGI (BMO Global Infrastructure Index ETF)

c.) Views

Asset Class |

View |

Notes |

Equities |

Slightly bullish |

|

Fixed Income |

Slightly bearish |

|

Alternatives |

Slightly bullish |

|

FX (CAD) |

Neutral |

|

Region |

View |

Notes |

Canada |

Neutral |

|

US |

Neutral |

|

EAFE |

Neutral |

|

EM (China) |

Neutral |

|

EM (ex-China) |

Neutral |

|