The US Attacks Iran - What it Means for Markets

June 22, 2025- What the US attack on Iran means for markets

- Waller’s comments and what that means for the FOMC

- Thoughts on the macro from here

1.) On the current situation in the Middle east:

Even if the job was been described as done, the US is now directly engaged in the Israel/Iran conflict. That means an initial blanket of uncertainty that will weigh on markets in the immediate term as investors look at what’s next.

We are not geopolitical strategists. Nevertheless, that doesn’t mean we can’t look at the most likely next steps and what it all means for the macro and for markets by extension. Of course, the wildcard here is whether Iran has transported its nuclear infrastructure elsewhere ahead of the attacks, or if the damage done to them is severe enough. It’s impossible to be certain of either at this point.

From here, we see three likely paths for Iranian retaliation:

- An attack on US interests in the region (there are close to 30 US air/naval/joint bases in the region with tens of thousands of US personnel).

- Attacks on energy infrastructure in the region (including a closure of the Strait of Hormuz).

- A rise in attacks on Israel.

For 1, we doubt there’s enough of an appetite to drag the US into the conflict any further. Iran could launch an attack on a US base with lots of advance warning to purposely minimize the damage. They did use that approach in 2020 after the US assassinated a top Iranian military commander. Anything beyond that would be too much risk given that extant missile stockpiles are depleted, and US missile defence systems are highly capable.

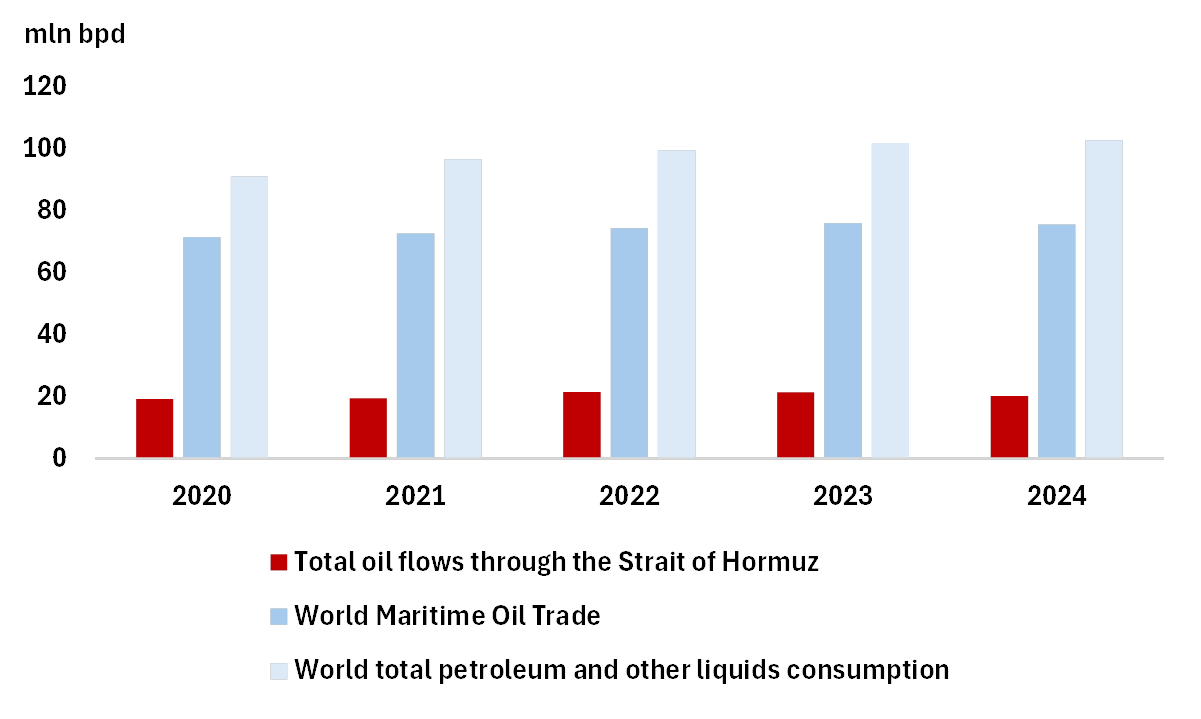

For 2, the Iranians could damage oil infrastructure in places like Iraq and/or move to close the Strait of Hormuz. Doing so would mean that more than 20% of maritime oil/petroleum trade and more than 25% of oil/petroleum consumption would be at risk (such a scenario is a near-lock for $100+ oil prices). But doing that would also mean that Iran is willing to…

- Escalate the nature of the conflict to bring other Gulf nations against it.

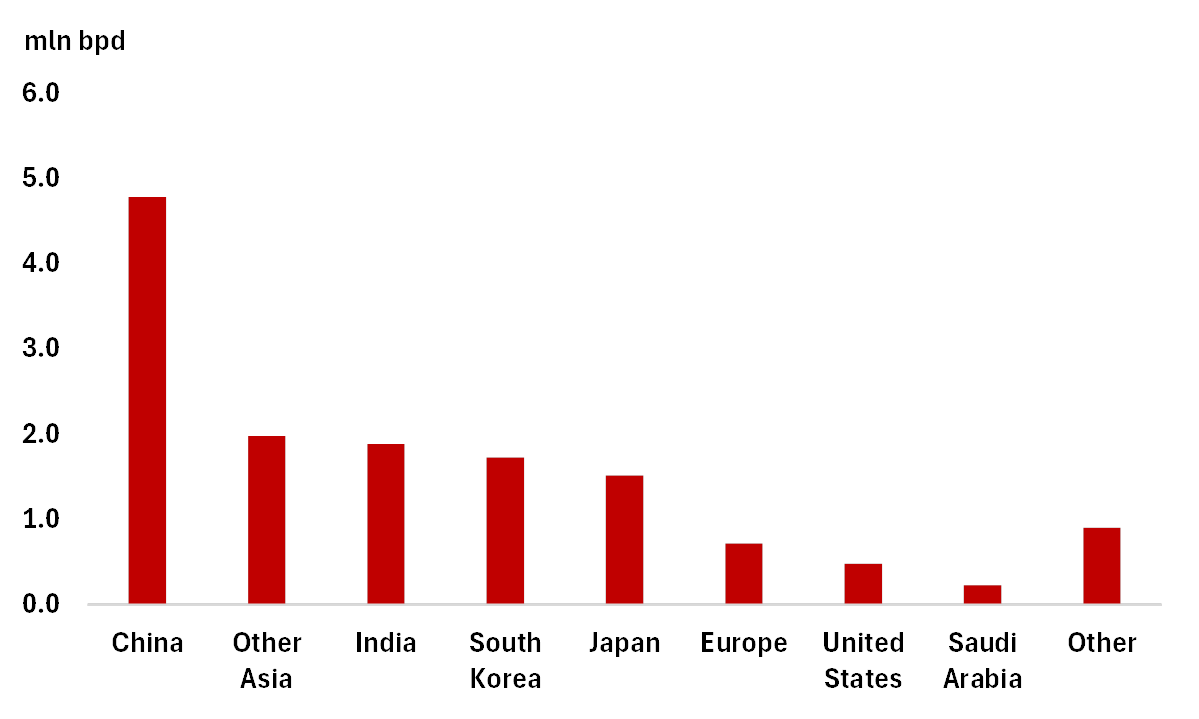

- Alienate important destinations for crude oil moving through the Strait (China, India, and Japan among them).

- Commit an act of economic suicide. Iran needs revenues right now and it’s not clear how closing the Strait would help from that aspect.

Chart 1 – Oil flows through the Strait of Hormuz accounts for over 25% of seaborne oil trade and over 20% of total global oil consumption

Source: EIA

Chart 2 – Top destinations for crude oil and condensate transported through the Strait of Hormuz in 2024

Source: EIA

Which means that point 3 is the most likely outcome here.

If that is the case, then we suspect that energy prices will remain elevated but stop short of probing too far above $100/bbl (if that).

It also means that broad risk drawdowns will likely be faded and that near-term spikes in core developed market bond yields remains in the near-term. Indeed, a rise in inflation breakevens usually coincides with a rise in energy prices and we expect that to keep UST yields higher – offsetting any near-term safe haven flows.

For the US dollar, the events over the weekend could lead to a near-term safe haven run – which would pull valuation higher. But as more time passes, we suspect that the longer-term trend of diversifying away from the US dollar will continue, if not accelerate (which is bearish). Positioning in the USD is already quite short, which helps our thesis.

Again, the situation is still very much in flux. We’ll provide market-related updates when relevant to do so, but for now we are comfortable with our current assessment.

2.) CAD News and notes:

This is an important week for incoming data.

CAD CPI for May is out Tuesday. We are watching the core CPI gauges (CPI-Trim and CPI-Median) to see any signs of cooling that may leave the door ajar for the BoC to cut rates in July. On that point, we are expecting rent prices to come off this month after a jump higher in April.

Industry-level GDP for April is out this Friday. Thus far, all signs suggest that the Canadian economy likely underperformed relative to the advanced reading of +0.1% m/m. We’ll also be getting the advanced reading for May – which should come in negative.

3.) US News and notes:

On Waller’s comments: In case you missed it, FOMC board member Chris Waller gave a revealing interview on Friday in which he stated the following:

- The Fed could cut as early as July.

- The Fed’s current policy settings are 125-150bps above neutral.

- The impact of tariffs on inflation is expected to short-lived.

Our take – this is the first time in a while that an FOMC member has had something interesting to say. Generally, Fedspeak tends to matter less when policy settings are off the zero lower bound.

- While we are of the view that the Fed is closer to easing policy, we don’t agree that July is possible at this point. We’re still too early in the post-Liberation day data cycle to definitively conclude that the tariff passthrough will be temporary. September is still the more likely time for the next cut.

- Waller’s point on Fed policy restrictiveness would imply that neutral is around 3%. That’s basically in-line with the latest dot plot – but still below where the market is. If Waller and the Fed are to be believed, there’s value in the front-end of the UST curve.

Is this Waller’s audition to be the next Fed Chair? Maybe. But unlike some others vying for the role, his view is still grounded in solid fundamentals and his arguments are rationally laid out.

What this also means is that we need to start eyeing FOMC comments a bit more closely going forward. If other members corroborate Waller’s view – it’s a good sign that we’re getting closer to a cut.

4.) Macro thoughts + Portfolio strategy

a.) Looking past the events in the middle east right now, we’re in a weird spot for the macro. The Trump-inspired drop in sentiment from prior months is starting to turn back at the same time that we should start to see hard data turn softer.

More directly for markets, there is now chatter of a Fed shift in the works towards quicker easing (again – pay attention to Fedspeak). Nevertheless, the key message from last week’s FOMC is that Chair Powell and company can afford to wait things out a bit – which keeps the onus on incoming data.

And on that front, there are two areas to watch in the US this week:

- Housing data – in the form of price data from the Case-Shiller indices (Tuesday) and new home sales (Wednesday).

- Wage and price data – in the form of personal income + spending data (Friday.

For the latter bullet point, recall that the household rate of saving has been climbing for months now. That’s usually consistent with a slower pace of growth and softening of the labor market.

b.) Having said the above – we do see the case for an increase in allocation to US risk in the coming months. This should not be interpreted to mean that we’re electing to shift to an overweight position. Instead, we’re moving from underweight to neutral on the US risk.

For one, market sentiment has now shifted to being overly bearish US. It usually pays to fade massive sentiment shifts like this.

For two, we’re getting closer to a re-start of the Fed easing cycle. Also, in our view, the market is currently mispricing where the neutral rate is.

For three, too many investors are short the US dollar now.

c.) Our strongest convictions right now:

In the US, we like…

- Bull steepeners

- Quality (as a factor)

- Communications and utilities (as sectors)

In Canada, we like…

- Industrials (as a sector)

- Low vol (as a factor)

In the cross-market/FX space, we like…

- We like US duration relative to CAD but acknowledge that this trade is already long in the tooth

- USD/CAD should continue to consolidate in recent ranges (1.3600 – 1.4000).

Asset Class |

View |

Notes |

Equities |

Neutral |

|

Fixed Income |

Neutral |

|

Alternatives |

Slightly bullish |

|

FX (CAD) |

Neutral |

|

Region |

View |

Notes |

Canada |

Neutral |

|

US |

Neutral |

|

EAFE |

Neutral |

|

EM (China) |

Neutral |

|

EM (ex-China) |

Neutral |

|