Thoughts on Auto Sector Tariffs

March 27, 2025

Topics covered…

- Trump announces a 25% tariff on all finished auto imports and some auto parts

- What this means for the US inflation picture and for the Fed

- What does it mean for Canada?

- Investment implications (low volatility and gold are where its at)

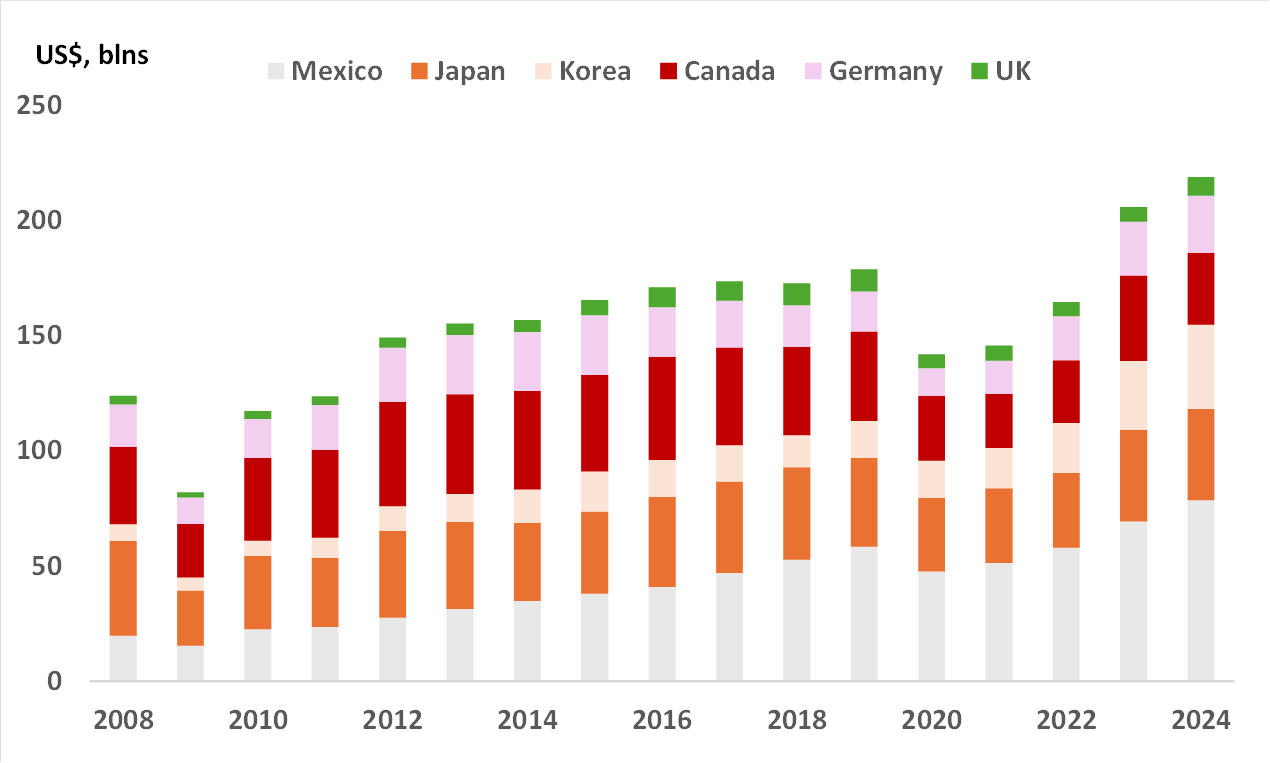

Chart 1 - US Imports of Light Vehicles by Country (Value)

Source: US Commerce Department

1.) Auto Sector Tariffs

To summarize…

- Trump announces a 25% tariff on all finished auto imports. These will apply to light vehicles (passenger cars and light trucks) and some auto parts (engines, transmissions, powertrain parts and electrical components).

- For finished autos imported under the USMCA, these tariffs will apply only to the value of non-US content. These tariffs do not apply to auto parts shipped under USMCA, but eventually they will.

- These tariffs will be imposed under Section 232 of the ‘Trade Expansion Act of 1962’ (national security).

- The tariff goes into effect on April 2nd and collections will start on April 3rd.

- These tariffs will be ‘stacked’ on top of prior levies (25% on steel/aluminum imports + 25% on non-USMCA compliant goods.

Chart 1 shows the import value of light vehicles by country over the past several years. Japan and Mexico are routinely the largest exporters of finished autos to the US.

b.) Other important facts to remember…

- 20 models of new light vehicles (cars, SUVs and trucks) are manufactured in Mexico for export to the US.

- 6 models of new light vehicles are manufactured in Canada for export to the US.

c.) Immediate global reaction has been negative to say the least.

- Japan’s PM Ishiba is now considering an appropriate response to US auto tariffs with “all options on the table”.

- Germany says that US auto tariffs will impact global supply chains.

- French finance minister says that retaliatory tariffs are on the table.

2.) What Auto Tariffs Mean in the US:

The direct impact of tariffs will hit prices for new foreign vehicles, which (in turn) will likely push more consumers towards purchasing either new domestic or used vehicles - leading to higher prices for both of those categories as well. Together, these categories make up around 3-4% of the Fed’s preferred inflation basket (PCE).

That may not sound like much but remember that these are stacked onto existing steel/aluminum tariffs and that there will be knock-on effects to other parts of the basket (notably - transportation services). Additionally, remember that some parts that cross the border will be affected by tariffs each time that they do so – which will magnify the impact. Finally, Trump will still be levying reciprocal tariffs on April 2nd while the exemption on 25% tariffs for USMCA-compliant goods also expires that day.

This tells us a few things:

- The Fed’s message from last week is reinforced. Namely, that the risks to growth are to the downside and those for inflation are to the upside. That is a combination that the Fed does not want – because it accentuates the trade-off between the competing goals of maximum employment and price stability.

- Nevertheless, the Fed is on hold until we see signs that the real economy is under pressure. Weaker sentiment data is not enough on its own.

- Unfortunately, that also means that risks to the market are to the downside. So many people forget that it’s not just tariff uncertainty that is affecting broad risk appetite – it’s also the fact that (i) the Fed is operating in a restrictive monetary policy environment, and (ii) that the US market is still vulnerable to foreign portfolio outflows.

Our message hasn’t changed. For US allocation – prioritize income and liquidity and our preference is for ZUCM.

We continue to like defensive sectors that are relatively well sheltered from the trade war. Those would be healthcare (ZXLV) and utilities (ZXLU).

3.) What it Means for Canada:

a.) In terms of direct output, motor vehicle manufacturing (excluding parts) was around C$7.2bln at the end of 2024. That equates to 0.3-0.4%% of GDP. If we add auto parts manufacturing – that shifts it closer to around 0.7-0.8% of GDP. Also, the sector accounts for close to 130,000 direct jobs in Canada (most of them in Ontario) – which works out to 0.6% of the labour force.

However, the above is understating things.

- For instance, exports of motor vehicles and parts still accounts for a meaningful share of domestic GDP sales in any given year.

- Additionally, it’s estimated that for every direct job in the sector – there are 10 other indirect jobs. If true, that would suggest that 6% of the Canadian labour force would be affected.

- Finally, the regional distribution of the impact matters. Ontario is likely to absorb the brunt of the direct hit from these tariffs – which brings other risks (household indebtedness, stretched housing market) into sharper relief.

b.) Despite the measures, we haven’t seen much of a shift in market pricing for the BoC’s terminal rate. That remains in the 230-235bps range for now.

Remember that the BoC regards neutral policy as being in the 2.25-3.25% range. That the market is still not pricing the Bank not to take settings below there implies that there is an expectation of fiscal spending that will obviate any need from the Bank to get stimulative on policy.

Already, we’re getting commitments from PM Carney for a C$2bln “strategic respond fund” that will help to protect jobs affected by the tariffs and to build a Canada-focused network for auto manufacturing. Additionally, Carney mentioned government facilities that would allow firms to delay tax payments and to tap sources of liquidity to sustain operations.

Canada does have some fiscal space to spare, but the passthrough to the real economy will take time. And remember, Canadian households are still heavily leveraged. That means that the risks of a recession are still elevated in the event that tariffs are here beyond the next few quarters.

c.) For Canada, our preference is to remain invested via low volatility strategies (ZLB). Within the fixed income sleeve, we continue to like allocation to higher quality credits while optimizing yield for shorter duration. Indeed, we still like allocating towards ZDB and ZBI.

d.) Finally, this is bearish for the discretionary sector – on both sides of the border. That’s meaningful because that sector is already the worst performing year-to-date in the US.

In Canada, expect more of the same as households focus on improving their balance sheets (paying down mortgage debt primarily). That will mean less expenditure on discretionary items.

4.) Euro-Area Notes:

a.) ECB speaker Wunsch says that a pause should be on the table for its April meeting. That’s somewhat interesting given that the market is pricing in decent odds of a rate cut.

Even if Wunsch is a known “hawk”, we do expect the mood music will shift towards his direction in the months to come.

b.) In Norway, the Norges Bank kept rates unchanged as expected. Guidance provided by the central bank still suggests that rates will be lowered at some point this year.

5.) Asia-Pacific Notes:

a.) In China, industrial profits came in at -0.3% (year-to-date, y/y). That figure is still being affected by the massive bounce in profits early last year so we wouldn’t read too much into it.

b.) In a move to boost mainland IPOs, Chinese financial authorities have signalled that they’re more open to new A-share listings. These would have to be in the technology, advanced manufacturing and consumer sectors with a revenue base of at least CNY1bln.

Our take: This is yet another signal that authorities in China are no longer as concerned with the domestic equity market.