Thoughts on Moody's Downgrade of US Credit

May 19, 2025What’s covered…

- Trump’s “big, beautiful” bill continues to push through the House

- Moody’s downgrade of US credit - and why it doesn’t matter in the grand scheme of things

- A framework for US assets from here

- Updates on Canada + EAFE

- Portfolio strategy update

1.) US Notes

a.) After failing on Friday, Trump’s “big beautiful bill” was approved by the House Budget Committee on Sunday. That sets the stage for a review by the House Rules Committee and then (eventually) for a vote on the House floor.

b.) Of course, there is also the news on Moody’s downgrade of US sovereign credit rating from Aaa to Aa1 – with the outlook revised to ‘stable’ from ‘negative’. With the downgrade, Moody’s is the last of the US ‘big three’ ratings agencies to strip US sovereign credit of triple-A status following S&P (in 2011) and Fitch (2023).

The immediate market reaction has been for the US Treasuries to go on the defensive (yields higher). The effect is a bit more pronounced in the long-end as 30-year yields are now probing year-to-date highs just above 501bps. At the same time, broad risk is under pressure with S&P 500 e-minis down over 1%.

On its own, the Moody’s news is a red herring for several reasons:

- First, the primary reasons for the downgrade (upward trajectory of debt profile, unsustainable fiscal deficits) are already well socialized. Markets have been pricing this in for months with the 10-year term premium going from 7bps at the start of the year to 74bps as of Friday.

- Second, the downgrade will mean little from a regulatory perspective. The Basel framework for standardized calculation for risk-weighted assets for credit risk shows that the risk weighting for exposure to sovereign bonds doesn’t change until a sovereign is downgraded from AA- to A+ (three notches below where the US is now). That means that global banks do not need to increase their capital holdings to meet regulatory standards.

- Third, there are little collateral implications here. The downgrade does not lead to a change in the haircut schedule that would necessitate borrowers posting more collateral with clearing platforms.

c.) So why the outsized market reaction? We’d chalk that up to the sequencing of events more than anything.

After all, this is a downgrade from a significant ratings agency – happening at the same time that a bill proposing tax cuts that will likely lead to a substantive increase in deficits and debt is making its way through Congress.

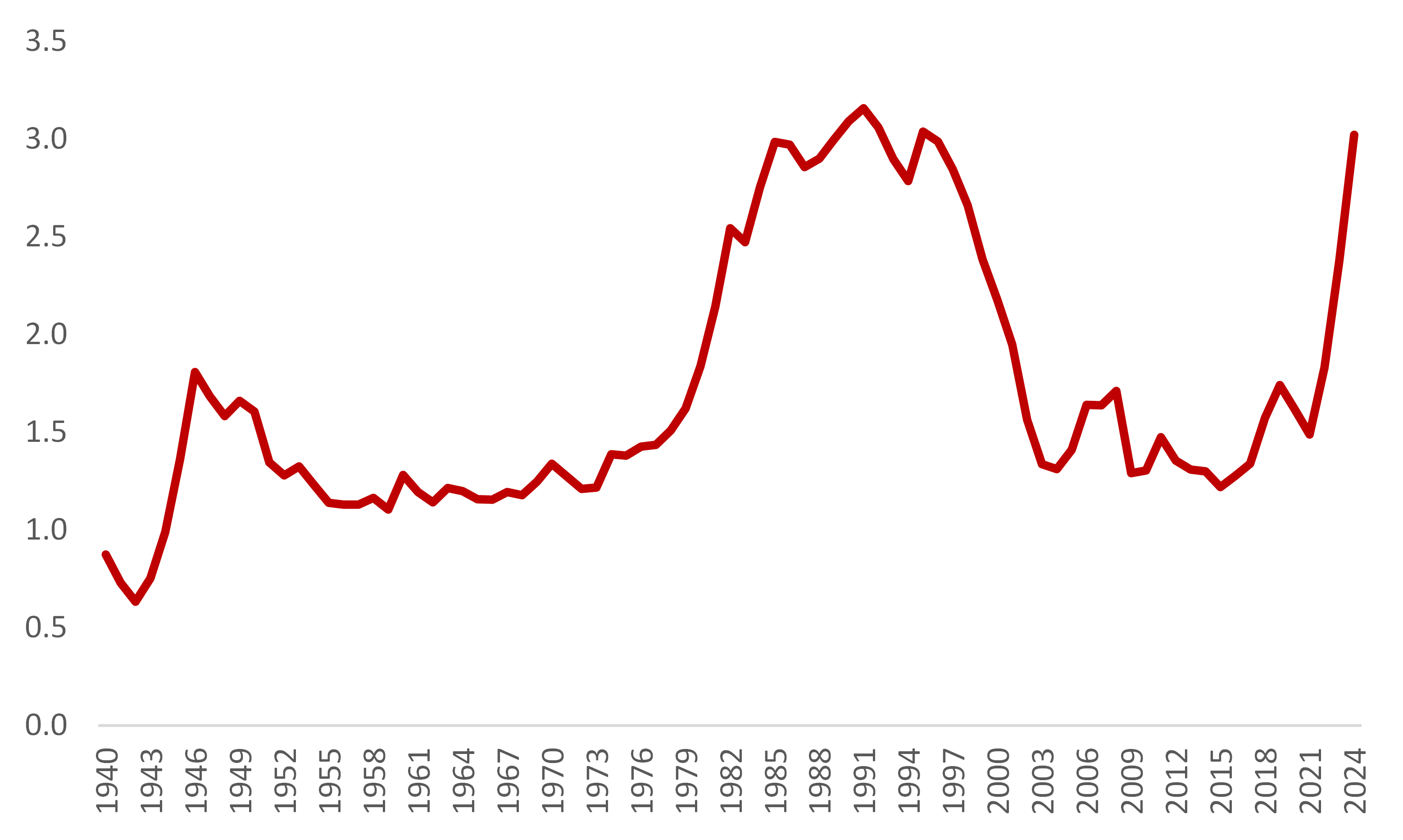

Just consider the below chart – which shows Treasury interest payments as a percentage of GDP. We’re now back at levels last seen in the mid-1980s to mid-1990s.

But the key difference now is that interest rates are much lower than they were back then.

Chart 1 – Treasury Interest Payments as a Percentage of GDP Over Time

Source: Fed Reserve

2.) How to Frame US Assets Right Now

For US assets, there are four things that matter to us now.

First (and most obvious) is trade policy. Markets have rallied over the past several weeks precisely because Trump has been trimming the extremes of his trade policy. We are now back in the green for year-to-date price action for the S&P 500. You can make a decent case that the market is likely discounting further optimism on this front at this point given that much of the ‘climbdown’ in tariffs is temporary in nature.

Second is tax cuts. You can read about what is in Trump’s “Big, Beautiful” bill here. But what is important to understand is that there are serious concerns within the Republican party on how new and expiring tax cuts will be funded without widening the deficit further. Recall, that the Republicans are operating with a slim majority in the House and Senate as well.

Without any progress on this, the risk is that the 2017 tax cuts will expire – which would effectively mean the largest tax hike in US history. At the same time, it does appear that markets will not treat any substantive increase in deficits kindly from here on out.

Third is the data and what it tells us about the real economy. Last week’s CPI data told us that tariffs aren’t really having an effect right now (likely due to large build in inventories at the wholesale and retail levels right now), but we have mentioned our concerns with the labor sector backdrop going forward.

Fourth is flow data and what it tells us about US assets. We can extract from global ETF flow data that investors are cautiously moving back to US equities. Additionally, we have yet to see any signs of a foreign buyers “strike” at UST auctions. Both of these tell us that theme of “outbound flows” from the US is likely exhausted in the near-term.

The above four criteria are how we are framing our allocations to the US at this point. Right now, the climbdown in trade tariffs is the most significant driver. However, we fail to see how markets can recapture 2025 highs without i) a complete U-turn on tariffs, ii) progress on tax cuts while curbing pressure on deficits, iii) progress on data that allows the Fed to cut rates. All of those are needed to engender further flows into US assets.

3.) Canada Notes

a.) In case you missed it, PM Carney has now stated that the Liberals will table their budget in the fall.

From a markets perspective, the implications are that federal issuance is likely to be steady in the coming months. At the same time, it’s also more likely that the onus will be on provinces to run stimulative fiscal policy to address tariff risks and to bridge things until we get more guidance on federal spending closer to the fall.

In a way, we saw this with the release of the ONT budget last week – which showed a deterioration in the budget deficit for the current fiscal year and a larger amount for borrowing requirements.

The other takeaway is that this likely means that the BoC is a shoo-in to cut rates again in June.

b.) On trade and tariffs – we’ve done some number crunching. It turns out that the average effective tariff rate levied by the US on Canada is currently at around 15.25%.

A big part of that number is that a lot of Canadian firms still have yet to complete the paperwork needed to ensure that their goods are USMCA compliant. For instance, if 50% of Canadian exports to the US are compliant, then the rate would go down to 11%.

c.) On the data front, there will be a lot of eyes on this Tuesday’s release of CPI (for April). The m/m is likely to come in negative – reflecting lower gasoline prices due to the removal of the consumer carbon tax (effective April 1). This won’t be reflected in the core CPI measures of course as those gauges tend to remove indirect taxes.

4.) Portfolio Strategy

a.) On the flows side, the main theme that we’re tracking is the migration of flows out of ultra-short rates and into US corporates and EAFE equities. To an extent, we’re also seeing investors cautiously tip toe back into the US equity market as well with optimism on trade policy increasing at the margin.

b.) As we mentioned last week, we continue to like the following strategies…

- Industrials (as a sector). Our own ZIN has performed fairly well over the past few weeks and we suspect this is due to expectations of fiscal stimulus here in Canada. It still feels like this theme has more room to run.

- Utilities (covered call). ZUT provides decent yield and some shelter from trade-related risks given its exposure to Canadian and US names.

- Gold + miners. This is a clarion call for ZGLD, and ZJG more than anything.

- EAFE > US (as a theme). Both Germany and Japan have outperformed the US so far this quarter. We see little reason to fade this momentum.

c.) Finally, we’d be remiss if we didn’t mention EM-tracking funds and how well they’ve performed over the past month.

To us, there are several reasons for why:

- Several EM countries (notably in Latam) continue to ease policy rates at an aggressive clip.

- Sentiment on trade policy is improving at the margin – which helps EM countries that export commodities.

- Relatively stable political backdrops.

We like exposure to EM equities at this point (especially Latam) and still envisage further room to the upside.

5.) Other Macro News and Notes

a.) EU countries have agreed to launch a EUR150bln scheme which would allow member countries to borrow funds to spend on defense. This is as a means to speed up rearmament with funding backed by the bloc’s budget.

As part of the scheme, at least 65% of the value of the components must come from arms companies that EU members.

Our take - Yet another signal that we are moving away from bilateral trade blocs and towards something more regionalized where ‘rules of origin’ becomes a priority.

b.) The EU and UK show progress on a ‘post-Brexit’ reset.

Our take – see point 5a). Almost 10 years after the Brexit referendum and we can clearly see the effects as UK productivity has stalled while inflation has remained stickier relative to other countries.

Investors should treat the above as bullish for EAFE assets going forward.