Macro Notes - Unpacking an Insane 24 Hours for the Macro

July 31, 2025a.) BoC + CAD GDP: Yes, the Bank of Canada left rates on hold. But if you read between the lines, there is a slight bias towards easing policy rates further.

That can be seen in the statement (“excess supply has increased since January”), and the MPR opening statement (“there are reasons to think the recent increase in underlying inflation will gradually unwind”). Within the MPR, even with the most recent fiscal measures announced (including defence spending) - projected quarterly growth for the coming quarters will still average below the pace from prior years under all three scenarios.

This morning’s GDP print had output contracting by -0.1% m/m, while the advance print for June implies a +0.1% m/m expansion. A quick estimate has Q2 tracking at -0.1% based on these numbers – which is well above the BoC’s -1.5% forecast from yesterday. However, the BoC’s estimates are based off of expenditure data which can differ from the industry data that we received this morning.

Gut feel here - there is another rate cut or two left in this cycle.

b.) Fed: The FOMC is in a similar situation as the BoC – whereby it is carefully monitoring the balance of risks to inflation from slower activity (downside pressure) against tariffs (upside pressure).

Powell’s presser was a bit less dovish than the market anticipated. That’s despite the subtle indications from yesterday’s Q2 GDP release that showed that tariffs are having an effect on activity (final sales to private domestic purchasers slowed from its Q1 pace).

Nevertheless, the key is that for the majority of the FOMC it’s the labor market that matters most. And right now? The labor market is balanced (supply is aligned to demand).

For that reason, there is going to be an inordinate amount of focus on incoming payrolls data. If we do start to see stronger headline gains and/or a drop in the U/E rate, then I’d suspect equity markets will trade defensively.

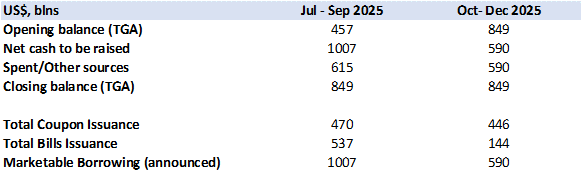

c.) US Treasury QRA: So the Treasury will be raising over $1trln in cash for this quarter and around $537bln of it will be via T-bills.

Also notable is that the Treasury will be doubling the frequency of long-end buybacks to ‘support liquidity’. However, as the Treasury notes, the intent of the program is not to change the overall maturity profile of debt outstanding and there is enough capacity to double the program without materially impacting the weighted average maturity (or WAM).

As such, long-end yields moved higher immediately after the announcement yesterday.

Table 1 – The US Treasury’s Quarterly Refunding Announcement (Highlights)

Source: US Treasury

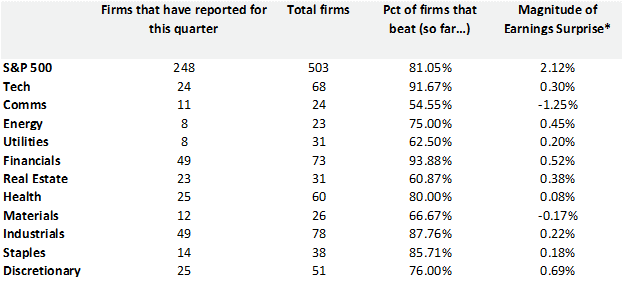

d.) Earnings: Long-story short, both MSFT and META crushed their earnings.

As of Thursday morning, just over half of the S&P 500 have reported earnings, and of those over 80% have outperformed consensus expectations going in.

Nevertheless, it’s tech earnings that equity markets are closely following.

Table 2 – Earnings Season by Sector

*Weighted by mkt cap

**As of July 30th

Source: Bloomberg

e.) Trump and Trade: Two important bits of news from yesterday…

- Trump exempted raw and refined copper components (inputs) from the 50% tariffs. That led traders to immediately price out whatever tariff premium had been baked in for the commodity in the futures market.

- Trump announced that the global exemption on tariffs for packages worth less than $800 (or the de minimis exemption) will end on August 29th.

- The US and South Korea have announced a trade agreement. Details can be found here.

There are cross market implications from the copper sell-off – volatility control and drawdown limits will likely mean position closures in other markets which can cascade fairly easily.

And the week isn’t even over yet.