Weekly Basis Points - Three Takeaways from CAD Bank Earnings

September 02, 2025Even with the clear and present macroeconomic risks, Canadian banks are still finding ways to exceed expectations.

Indeed, the general vibe around the most recent round of earnings for the ‘Big Six’ banks were that they were strong. As proof, the TSX Banks Composite Index shifted higher by 3% last week and has generally been on an uptrend since mid-April. This is despite the fact that activity in the domestic economy remains on shaky ground – as evidenced by the release of Q2 GDP on Friday.

Given the importance of the banking sector to the domestic equity market, even macroeconomic analysts (such are ourselves) were forced to take notice of last week’s results. And when we parsed through the writeups of our own banking analysts (Sohrab Mohavedi and his team), we couldn’t help but notice some important takeaways for the Canadian ETF and alternatives space.

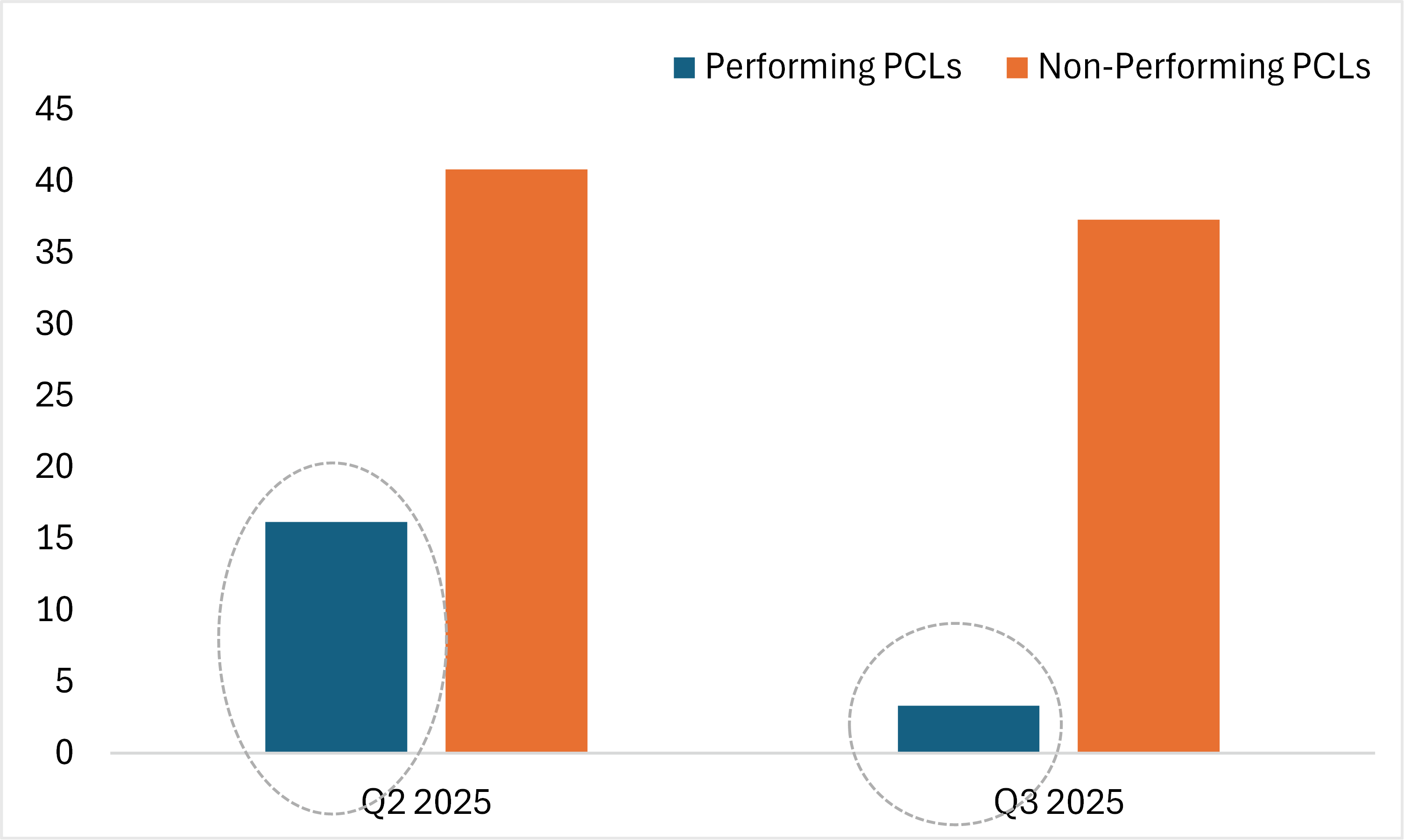

First, CAD banks are setting aside less provisions for credit losses (or PCLs) on loans.

For those that need a quick refresher - recall that banks will set aside an allowance for expected losses on loans extended every quarter. These loans are grouped into three stages - the first and second stages are performing and underperforming loans (the allowance for these is called ‘performing PCLs’). The third stage is for impaired loans, which are loans that are already in default (the allowance for these is called “impaired PCLs”).

Importantly, impaired PCLs reflect actual loans that have gone into default whereas performing PCLs are more forward-looking and dependent upon the Canadian economic backdrop. Since the Canadian economy has performed much better than expected earlier in the year (growth was largely flat in H1 2025), CAD banks were comfortable in revising their performing PCLs lower (see Chart 1). And a revision lower in PCLs will mean a rise in net income.

Chart 1 – Average PCLs for CAD Banks Q2 vs Q

Source: BMO Capital Markets

Second, despite the macro uncertainty, core operations remain strong and profitable.

One way to gauge this is to look at the pre-tax, pre-provision profits (or PTPP) – which bank analysts estimate by summing the net interest and non-interest income and then subtracting non-interest expenses. For almost all of the banks, PTPP was up and largely supported by an increase in revenues for fee-based businesses (underwriting and M&A) as well as revenues related to trading in equities, fixed income, currencies and commodities.

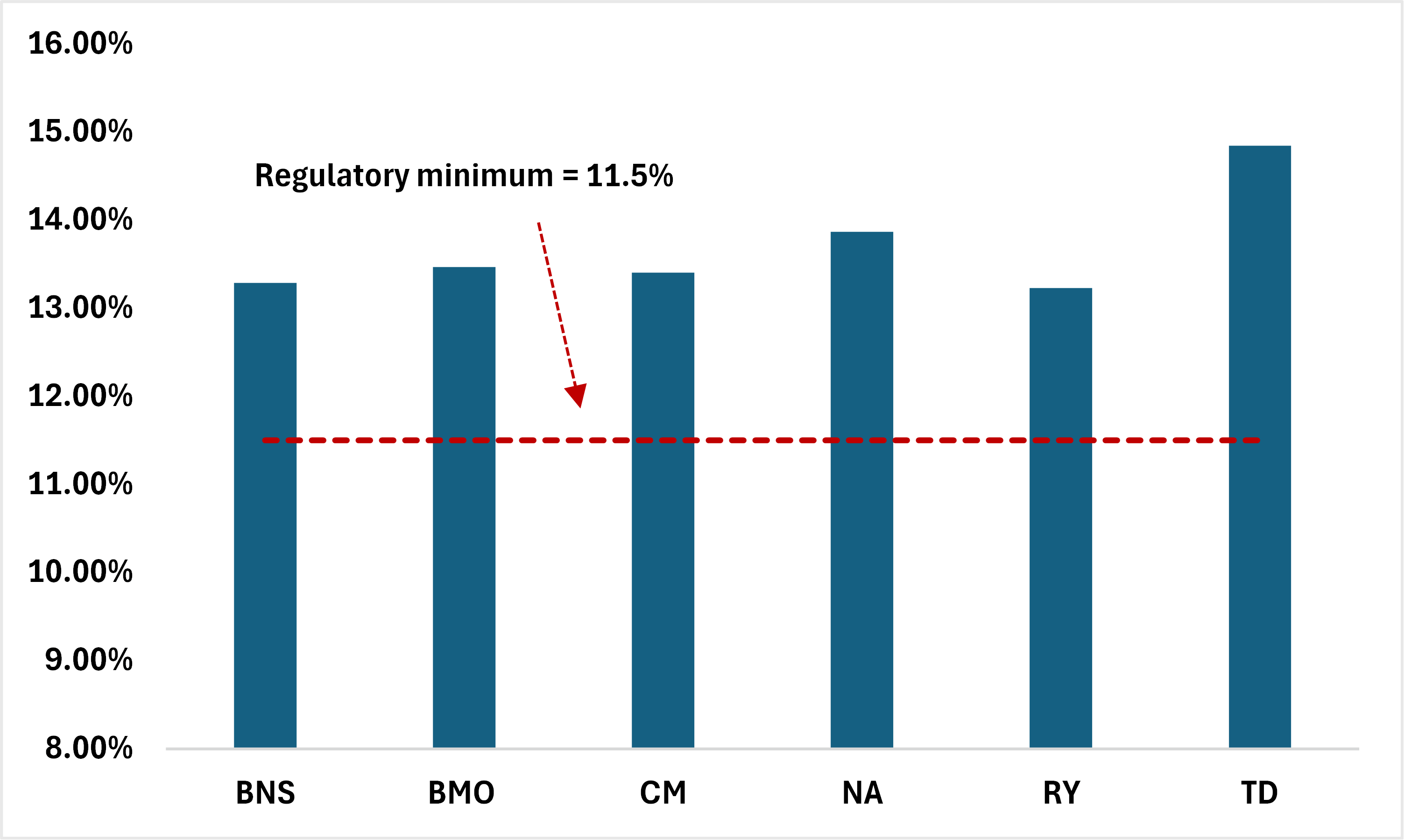

Third, CAD banks are still flush with capital.

Canadian banks still hold more than enough capital to meet regulatory benchmarks (see Chart 2). For instance, the common equity tier 1 (CET1) ratio average for the ‘Big Six’ is 13.7% and all of them surpass the 11.5% requirement for domestic systemically important banks. This speaks to their ability to navigate any potential macro-related setbacks at this point.

This is an important reason for why a few of them announced buybacks in the recent round of earnings.

Chart 2 – CAD Bank CET1 Ratios

Source: BMO GAM, Canadian bank earnings

But we are not stock pickers, we are macro strategists traversing the world of ETFs and alternatives. The question we are most interested in is whether the above points are strong enough to leg into additional longs for a product like ZEB (or the BMO Equal Weights Banks Index).

We say yes – for a few reasons…

- As rocky as it is, the US/Canadian trade relationship is stabilizing. Indeed, it does appear (for now) that both sides are interested in maintaining tariff-free trade for goods that are compliant with the USMCA. That means that the US average effective tariff rate on CAD goods will continue to be much lower than originally feared – which is supportive for the Canadian economic backdrop. By extension, this also means that we could see further progress from CAD banks on performing PCLs.

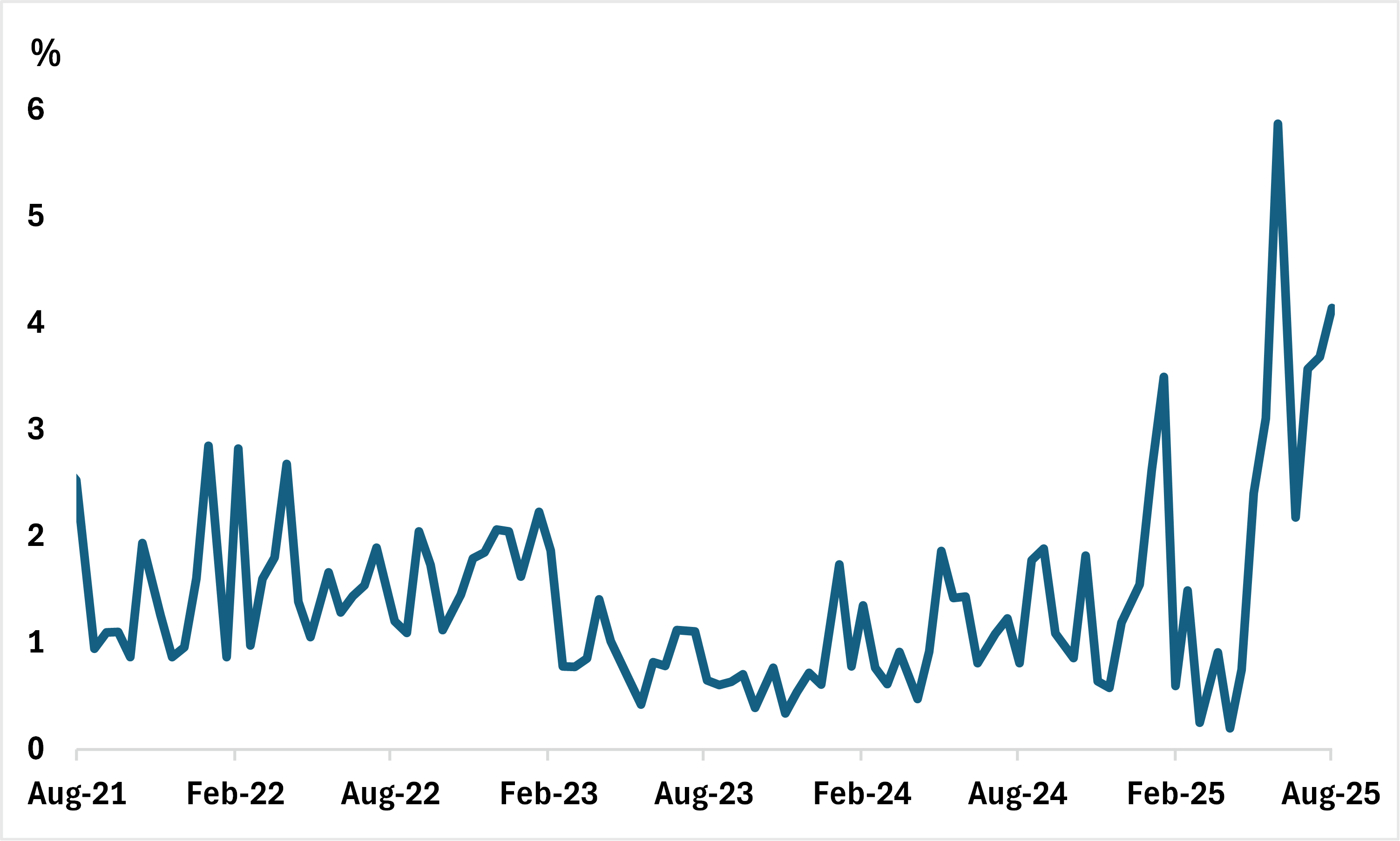

- Short interest in ZEB remains elevated (see Chart 3). True, some of that reflects positioning in structured products, but that doesn’t change the fact that a continued rally in CAD banks could lead to a rise in volatility as investors cover shorts. Being long ZEB is where one would want to be in that scenario.

Of course, the big risk here is that the strength in recent earnings is due to factors that are temporary in nature. As an example, banks could have benefitted from a pickup in loan demand primarily because borrowers wanted to front-run access to credit ahead of any potential tightening in the event that the economic situation deteriorates in Canada. That might leave some questioning whether ZEB makes sense going forward.

While we acknowledge this as an important risk to monitor, we are also confident in the ability of Canadian banks to weather any storms. This is not only because they have enough capital in reserve, but also because they’ve proven to be adept at diversifying revenue streams and sources over time. That leaves us more confident in a product like ZEB to outperform in the current environment – despite the risks.

Chart 3 – Short Interest in ZEB has been rising

*Short interest ratio = Short interest / Avg daily trading volume

Source: Bloomberg, BMO GAM

Tactical Positioning

Existing

- ZWT (BMO Covered Call Technology ETF)

- ZAAA (BMO AAA CLO ETF)

- ZSML/F (BMO S&P US Small Cap Index ETF - Hedged to CAD)

- ZMID/F (BMO S&P US Mid-Cap Index ETF - Hedged to CAD)

Changes

- None from last week

Portfolio Strategy

This is an important week for the macro – especially in the US.

Of course, the focal point will be the release of nonfarm payrolls on Friday, but ahead of then there is also the release of JOLTS job openings as well as ADP employment. Markets are pricing in a 25bps rate for the September meeting as well as another cut beyond that before the year is done. The risk is skewed towards stronger than expected data that might lead some market participants to question the path of Fed easing beyond September.

In Canada, the most important data point is the release of the Labour Force Survey (LFS) on Friday. This number tends to be a lot more volatile than the ‘payrolls’ gauge for Canadian employment (SEPH), and the headline number of jobs added this year in the LFS has been running above the SEPH estimate. That makes us a bit leery about chasing any new tactical opportunities in Canada for the time being.

a.) We continue to prefer Equities and Alts over Fixed Income.

- Within equities, we continue to like Tech, communications, financials and utilities

- From a regional perspective, we do see US markets continuing to perform and expect to see near-term participation from small and mid-caps for now.

b.) For fixed income, we see CAD duration outperforming relative to the US.

For the US, we expect the front-end to outperform as the curve steepens (a ‘bull steepener’) while real yields should also do well.

For credit, while both Canadian and US IG spreads are tight, we still see former outperforming going forward. We continue to optimize for ‘high yield + short duration’ with preference for sub-sovereign exposure.

c.) In the Alts space, we continue to like Gold and infrastructure as diversifiers in the portfolio.

d.) We are now turning bearish on the USD. We expect to see the greenback underperform relative to the EUR and CAD.

Key Events for This Week

Tuesday Sept 2

- US: ISM manufacturing (Aug), House/Senate return from recess

- Brazil: GDP (Q2)

Wednesday Sept 3

- US: Factory orders (Jul), JOLTS job openings (Jul), Beige book is released

- Australia: GDP (Q2)

- China: PMI services (Aug)

- South Korea: GDP (Q2)

- Turkey: CPI (Aug)

Thursday Sept 4

- US: Trade balance (Jul), Initial jobless claims, ADP employment (Aug), ISM services (Aug) + Senate hearing on Miran Fed nomination

- Eurozone: Retail sales (Jul)

- Switzerland: CPI (Aug)

- Sweden: CPI (Aug)

- Malaysia: BNM decision

Friday Sept 3

- US: Nonfarm payrolls (Aug)

- Canada: Labour force survey (Aug)