Weekly Basis Points - What Powell’s Speech Told Us

August 25, 2025Given the tension between the White House and the Federal Reserve, we couldn’t help but see the irony in Chair Powell’s speech on Friday. As it turns out, catalyst for President Trump’s firing of the BLS chief (namely, a weak nonfarms report for July) was also the same catalyst for the Fed Chair to send the ‘all clear’ for the rate cut at the September meeting – something that the President has been clamoring for months now.

But alas, these are the times that we are in.

As for the shift in tone, Chair Powell gave us a few compelling reasons for why a rate cut in September makes sense.

First, there is the clear messaging on the “one-time” adjustment to goods prices from tariffs. This means that the FOMC can look through near-term price increases and focus on the longer-term drivers of inflation during deliberation. Recall, that this has been case being made by a few prominent doves (Waller and Bowman) for months now, but it wasn’t even partially embraced by Powell until last Friday.

Second, despite the “curious balance” that the labor market is in – where demand and supply are falling at similar rates (and keeping the unemployment rate from rising materially) - there is a tacit acknowledgment that the labor demand could fall by more in the coming period. Intuitively, this makes sense as labor demand is the far more flexible of the two in the short-term.

To summarize, when taken with the current stance of moderately restrictive policy, the message from Chair Powell was that it could afford to look past near-term price risks and focus on the cracks showing up in the labor side of the mandate.

However, investors should be careful in extracting what Chair Powell was saying on Friday. What he was saying is that a ‘September rate cut is a lock’. What he was not saying is that the ‘FOMC is behind the curve’. The latter would mean that the Fed would need to expedite rate cuts and that current market pricing for the terminal rate (~3.00%) would need to shift lower.

What does this mean for markets?

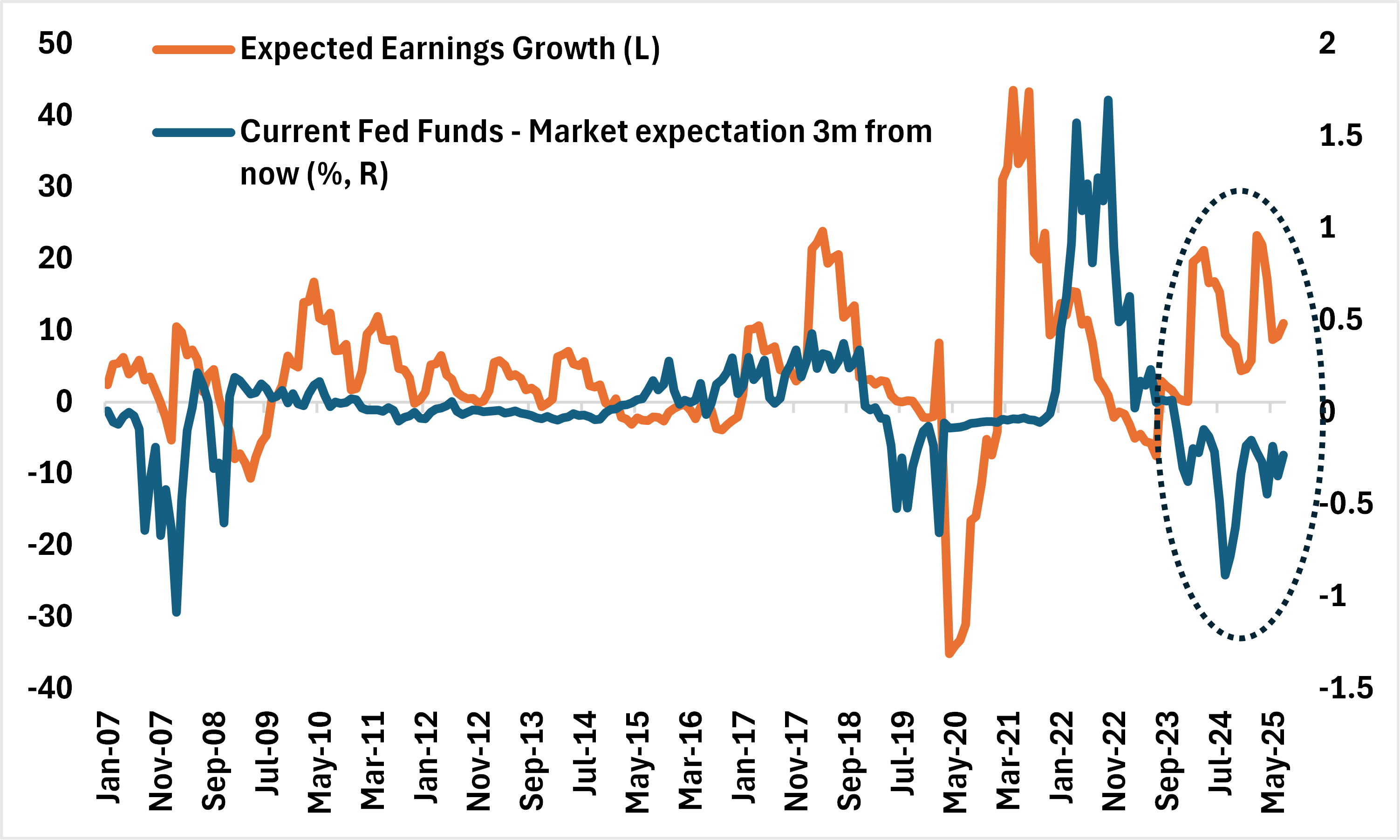

For equities, the message was clear enough to understand. The Fed is easing into a rising earnings cycle (see Chart 1). That is typically bullish for broad risk. Given the constructive fundamentals (especially earnings for Tech and Comms), we see strong momentum here carrying things for at least a few more weeks. Also, given how poorly they’ve performed this year, this could mean further catchup for small caps and mid-caps in the near-term.

The key risks here are seasonality (the S&P 500 tends to be weaker in September) as well as stagflation (see last week’s note).

Chart 1 – The Fed is Easing into a Stronger Earnings Backdrop for the S&P 500

*Expected Earnings Growth = Expectations of earnings for this year minus trailing 12-month earnings

**Market expectations of Fed rate = 1m3m forward USD OIS rate

Source: BMO GAM, Bloomberg

For rates, we take some umbrage on how the markets are reacting. For instance, we do not agree with extrapolating the post-Jackson Hole rally in US duration – and chalk this up to an unwind of hawkish pre-positioning more than anything else.

The reason for this is simple - we still envisage price pressures remaining elevated in the US. Why is the case? While Chair Powell did make mention that the tariff passthrough to goods was likely a “one time” shift, he was also clear that “one-time” adjustments do not mean “all at once”. That implies that there will be leads and lags when it comes to different goods experiencing price increases at different times in the coming months and quarters. At the margin, that could complicate private sector inflation expectations – and inadvertently keep them elevated.

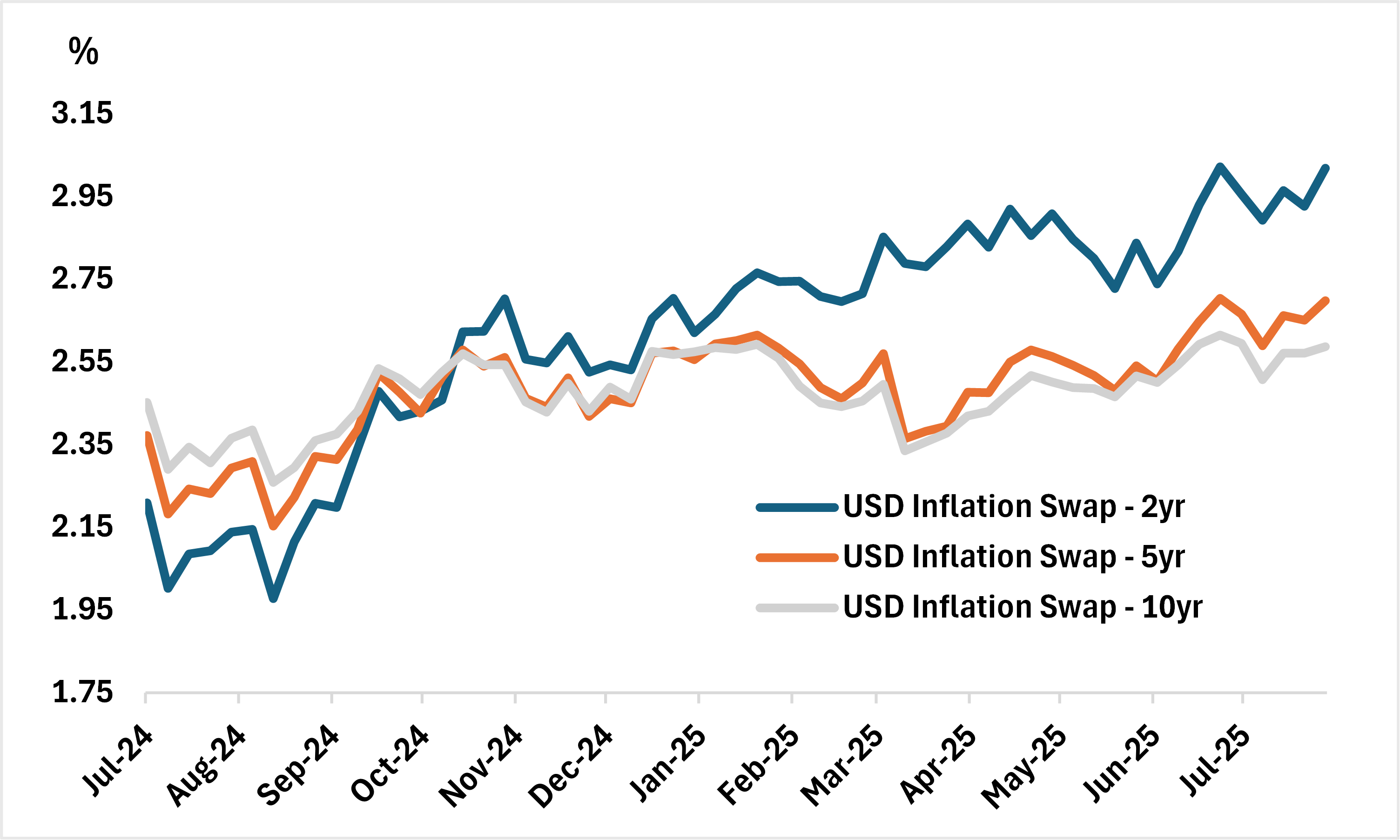

What’s more is that the most recent PPI print made it clear that services (especially trade-related) were being impacted by the tariff noise as well. Don’t take our word for it – just look at where 2-year, 5-year, and 10-year inflation swaps are tracking as of Friday (Chart 2). All of them are pricing in marginally higher rates of inflation over those time horizons relative to earlier in the month.

Chart 2 – Market Expectations of Inflation are Rising

Source: Bloomberg, BMO GAM

This tells us a few things…

- Long-end nominal US yields should underperform real yields (US breakevens shift higher to account for long-term inflation risks).

- Front-end US yields should outperform.

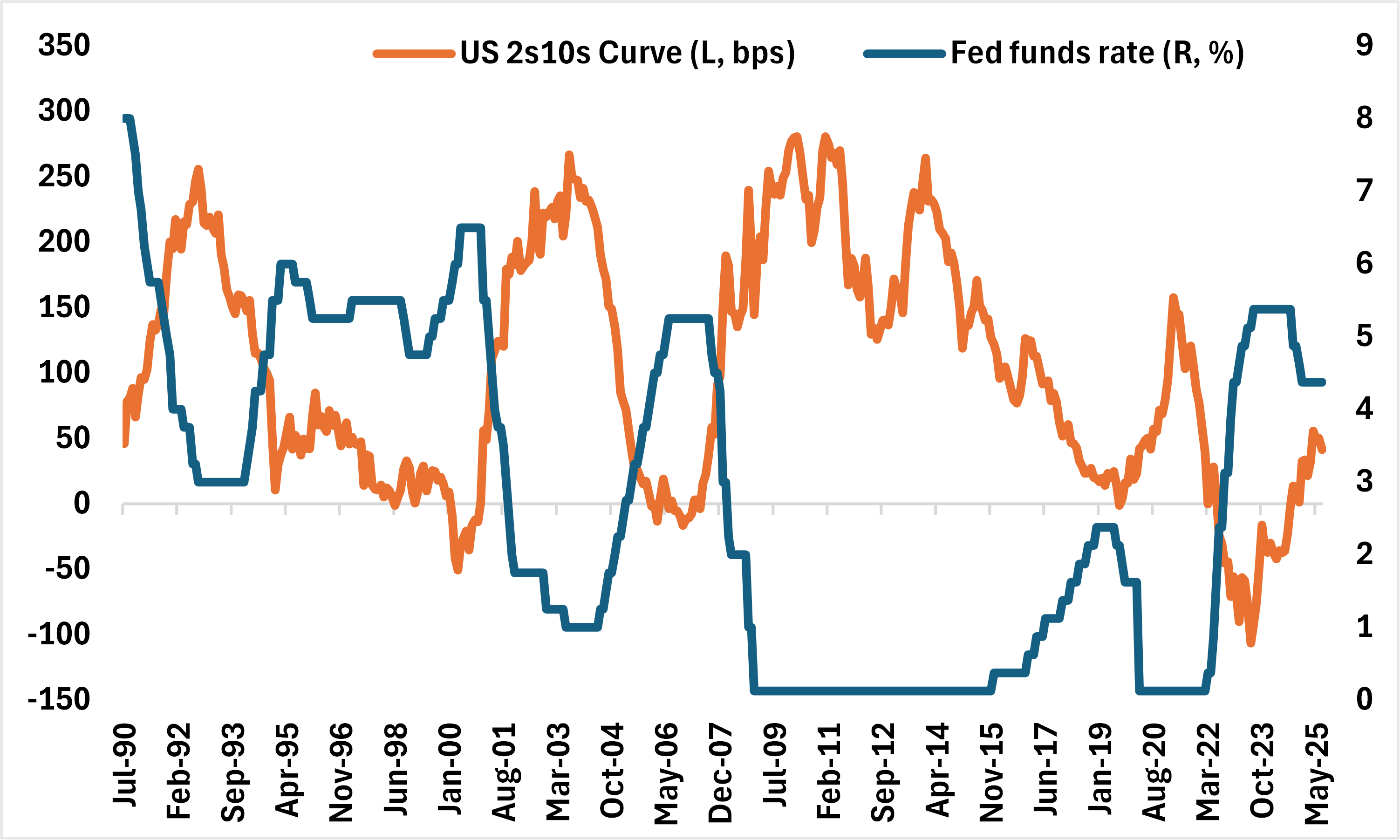

We’ve seen this over prior cycles as well. Whenever the Fed elects to resume rate cuts after a period of pause, the US Treasury yield curve will tend to steepen (Chart 3). That ‘steepening’ is generally led by the front-end. Investors should position accordingly.

As for the US dollar, the resumption of the Fed’s easing cycle comes at a point when most other central banks are mostly done with their own (the ECB and BoC most notably). That suggests that there are downside risks here for the USD at the margin.

Chart 3 – Resumption of Fed Rate Cuts is Generally Consistent with a Steeper Curve

*US 2s10s Curve = UST 10yr yield minus UST 2yr yield

Source: BMO GAM, Bloomberg

Tactical Positioning

Existing

- ZWT (BMO Covered Call Technology ETF)

- ZAAA (BMO AAA CLO ETF)

New

- ZSML/F (BMO S&P US Small Cap Index ETF - Hedged to CAD)

- ZMID/F (BMO S&P US Mid-Cap Index ETF - Hedged to CAD)

Changes

- Removing ZXLV (BMO SPDR Health Care Select Sector Index ETF)

Portfolio Strategy

a.) We continue to prefer Equities and Alts over Fixed Income.

- Within equities, we continue to like Tech, communications, financials and utilities

- From a regional perspective, we do see US markets continuing to perform and expect to see near-term participation from small and mid-caps for now.

b.) For fixed income, we see CAD duration outperforming relative to the US.

For the US, we expect the front-end to outperform as the curve steepens (a ‘bull steepener’) while real yields should also do well.

For credit, while both Canadian and US IG spreads are tight, we still see former outperforming going forward. We continue to optimize for ‘high yield + short duration’ with preference for sub-sovereign exposure.

c.) In the Alts space, we continue to like Gold and infrastructure as diversifiers in the portfolio.

d.) We are now turning bearish on the USD. We expect to see the greenback underperform relative to the EUR and CAD.