What Section 899 of the “One, Big Beautiful Bill” Means

May 26, 2025Topics covered…

- All about Section 899 and why it’s bearish for US assets

- An update on Trade + Tariffs

- Ahead of CAD GDP

- Portfolio strategy

1.) What Section 899 of the “One Big, Beautiful Bill” Means

We’ve received a few inbounds on Section 899 and what it means for foreign investors. We’ll do our best here to distill things.

a.) To summarize it succinctly, Section 899 allows for an increase in federal income tax and withholding tax rates on investors that are from a “discriminatory country” – which this bill defines as a country that imposes unfair foreign taxes. Those “unfair foreign taxes” fall under three categories: undertaxed profits rule (UTPR), digital services tax (DST) and diverted profits taxes (DPT) along with other taxes as determined by the IRS and Treasury Department.

For countries that have treaties with the US on withholding taxes, that rate would serve as a starting point for any increases. However, the “notwithstanding existing treaty obligations” verbiage suggests that this bill could override any existing treaties.

Additionally, this section would expand the application of BEAT rules (or base erosion, anti-abuse taxes) for foreign investors.

b.) For those wondering, Canada has a 3% DST on firms that make over $1.1bln globally and $20mln domestically.

Canada also has a tax treaty with the US that allows CAD-based investors to claim a reduced withholding rate of 15% (as opposed to 30%). The wording of the US tax bill suggests that this rate could go higher.

c.) Our take: This is yet another sign that the trade war is now morphing into a capital war – which is bearish for broad markets.

For the White House, the point of Section 899 is to get various countries to pull the plug on any DST and UTPR initiated over the past few years (as part of OECD Pillar II) that are seen to be punitive for US tech firms.

But ultimately, it’s a bad idea for several reasons:

- The US runs a massive current account deficit – which means that (in the aggregate) US entities invest and consume more than they save. That deficit in savings is made by borrowing from the rest of the world.

- Barriers to inward capital flow to the US point to an increase in capital costs for the US entities (that includes the US Treasury).

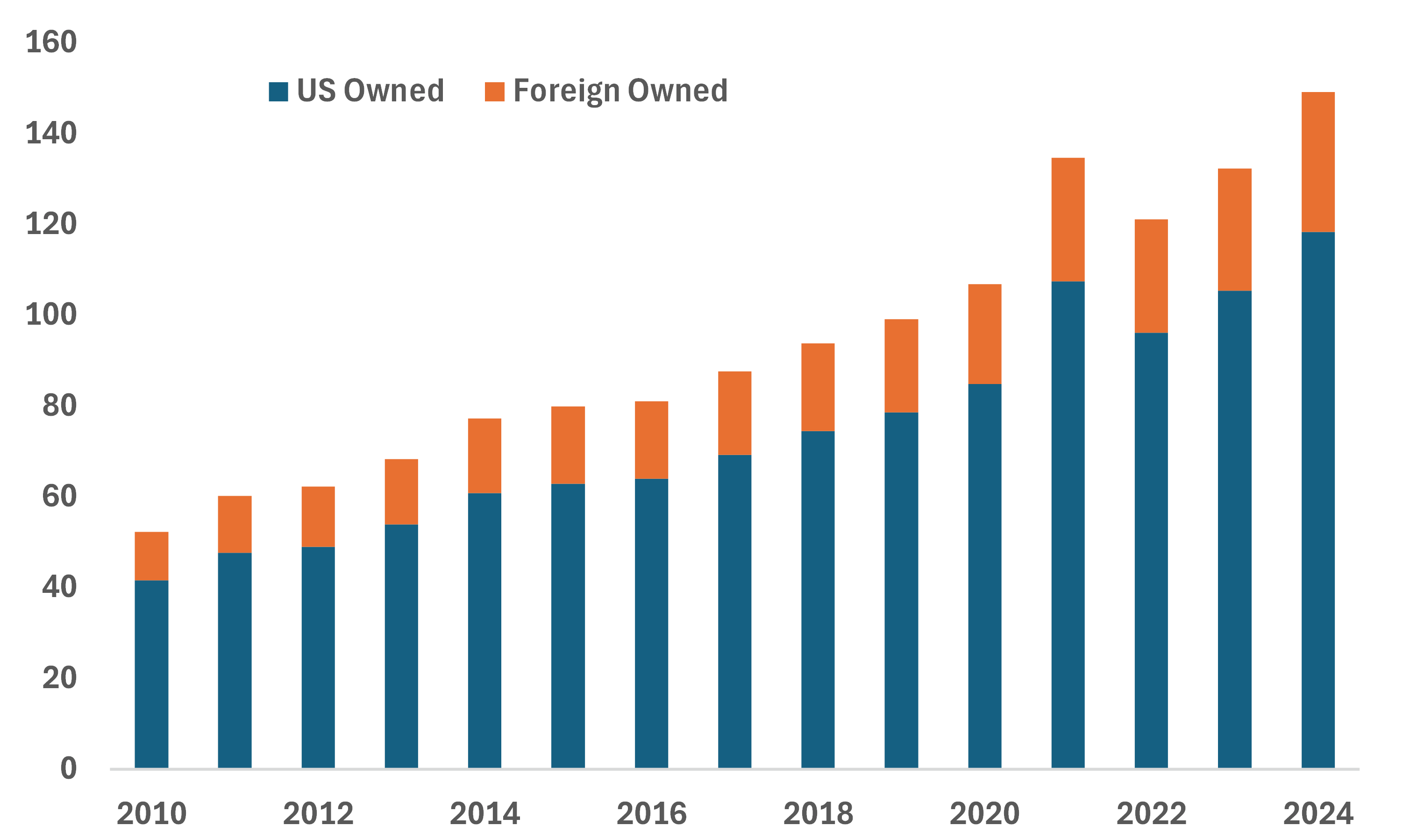

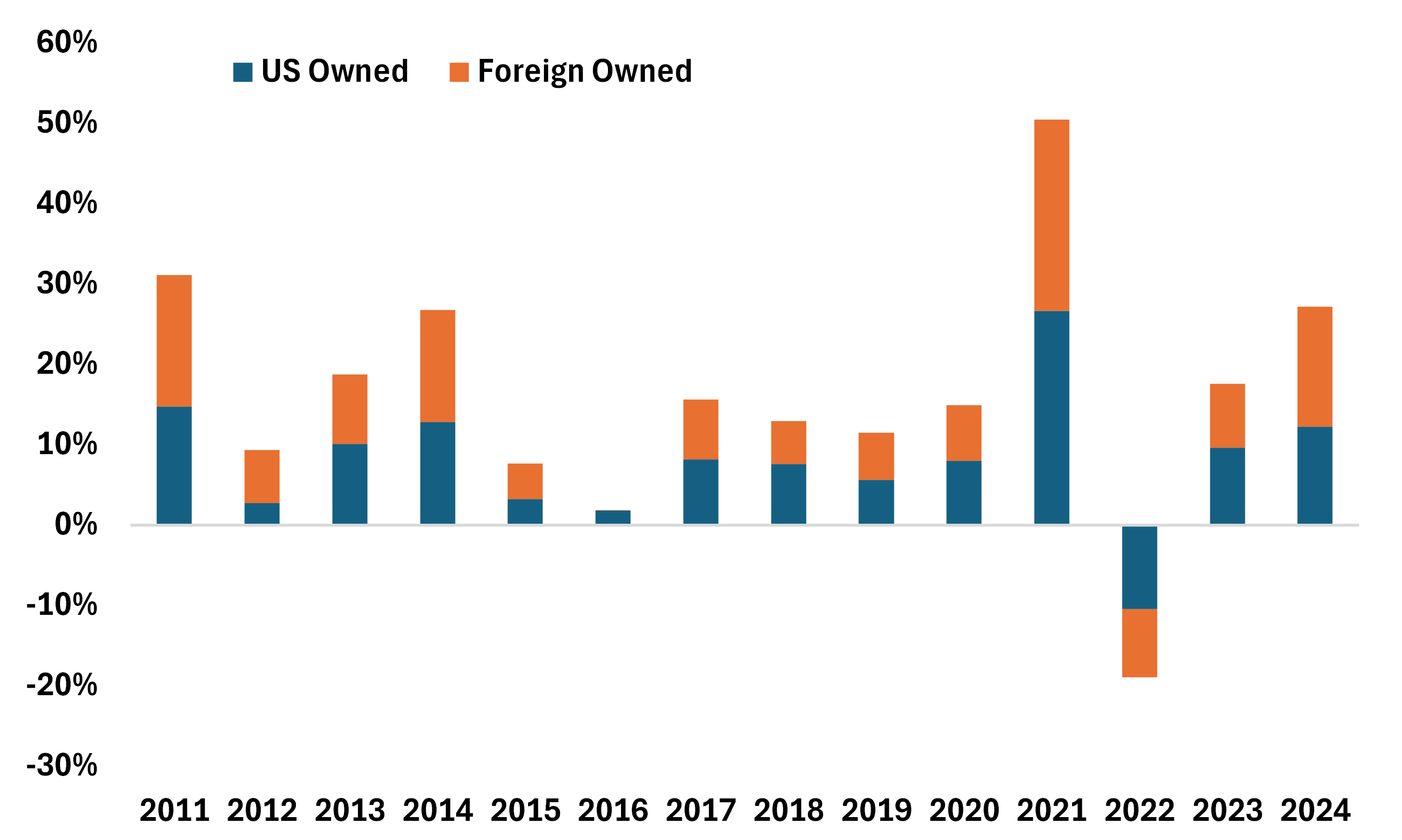

- There is already a massive foreign footprint in US markets. For instance, foreign investment in US securities makes up around 20% of total (Chart 1). If we look at year-to-year growth, there are several years whereby the growth in foreign ownership will actually outstrip that of US (Chart 2).

Chart 1 – Ownership of US Securities (Equities, Treasuries, Agency and Corporate Debt)

*In US$, trlns

Source: US Treasury

Chart 2 – Year-to-Year growth of Foreign and US Investors in US Securities

Source: US Treasury

The point is that by penalizing foreign investors, US securities will almost assuredly need to revalue lower in order to ensure the same degree of foreign investor participation in US markets. Why shouldn’t foreign investors demand a higher premium to buy US securities now?

True, countries could rescind extant DST, UTPR and DPT policy but the language in Section 899 still contains enough vagueness to target other sore spots – including perceived non-tariff barriers like VAT.

Again, this will do more than enough damage to foreign trust in US markets.

d.) I can already hear some readers asking – what about US investors? Wouldn’t they step up and just buy those US securities if foreigners are dumping to avoid potential tax increases?

The Federal Reserve might – but only when it’s clear that the US economy is in a recession and in a disinflationary spiral (which is not right now) and even then it’ll likely only buy UST and agency debt. Other US-based market participants likely wouldn’t get involved unless valuation is much lower. Recent investor surveys point to an increase in angst due to President Trump’s trade war and the uncertain backdrop for the US economy.

Ultimately, this will mean lower US stocks over time.

e.) For those wondering – the next step is for the GOP-led Senate to consider the House version of the bill. Given what we’ve heard so far, the House version of the bill will not be able to pass the Senate without some major changes – most notably on offsets for the tax cut and also on the debt ceiling.

Additional problems that will complicate passage of the bill in the Senate:

- Trump won’t be able to exert the same degree of pressure on GOP Senate members like he did on GOP House members for a variety of reasons. For instance, four potential Senate Republican holdouts that are demanding significant changes (Murkowski, Paul, Johnson, Hawley) don’t have the 2026 midterm elections to worry about. Remember that the GOP Senate can only afford to lose three.

- When it comes to changes to the House bill, the demands of GOP Senators are contradictory at times. For instance, Ron Johnson wants more spending cuts while Lisa Murkowski wants curb cuts to Medicaid.

2.) An Update on Trade + Tariffs

In case you missed it, Trump issued two tariff threats on Friday.

a.) The first is a 50% tariff on EU imports (now delayed to July 9th) that could fall under either IEEPA or Section 338 of the Tariff Act of 1930. Under the latter, 50% would represent the total ad valorem rate that could be stacked onto other rates while also allowing the President to block all imports from the region.

Recall, that this is higher than the original “Liberation Day” rate (20%) that was later scaled back to 10%.

I really don’t have much else to say here – other than talks between high level trade officials from both sides are likely to continue.

b.) The second was a 25% tariff on iPhones not manufactured in the US. This was later expanded to include smartphones manufactured by Samsung and “anybody else that makes that product”.

Theoretically, he could do this by reversing the exemption applied to Chinese made goods (30%).

c.) Keep in mind that there are other sector-related tariffs that could be in the pipeline in the period ahead. These include: lumber/copper, pharmaceuticals, semi-conductors, critical minerals, trucks and parts, commercial aircraft + jet engines.

3.) In Canada

a.) It’s a quiet start to the week on the data front ahead of Friday’s GDP data.

Our own GDP model points to the March number coming in at +0.1% m/m. That would imply that Q1 GDP came in at 1.5% (q/q, annualized) with the handoff to Q2 coming in at -0.1%.

As BoC Governor Macklem has pointed out, much of the tariff-induced weakness to real activity is going to be felt in Q2.

b.) Last week’s CPI number complicates the June 4th decision for the BoC. Indeed, the ‘stickiness’ of core CPI gauges imply that the Bank may have to eschew another rate cut – not least as the trade backdrop and real activity points to the more benign trade war scenario from the April MPR.

For what its worth, markets have already pivoted with the odds of a June rate cut now below 30% from close to 70% just a week ago.

4.) Portfolio Strategy

a.) Last week was notable primarily because markets had shifted from broad optimism (due to Trump trimming the extremes of his trade policy) back to pessimism (due to concerns over the trajectory of US fiscal policy).

Nowhere was this more apparent than in the interplay between US 30-year yields and broad risk. The former closed out the week off the highs but still higher than at any other point this year, while the latter dropped by over 2.5% on the week.

Heading into this week, our strongest tactical conviction is that weakness in the long-end is a bit overdone. In other words, we expect long-end UST yields to fall further from last week’s highs. This is due to the following reasons:

- The immediate catalyst to last week’s rise in US 30y yields was the passage of the House bill alongside the Moody’s downgrade news. However, the total fiscal effect of the House bill is that it adds a mere 0.4% of GDP to the deficit over the next five years. That’s not as bad as some have made it out to be.

- We know from the latest Treasury refunding announcement that UST auction sizes are going to be steady for the next few quarters. The rise in term premiums suggests that markets have been far too quick to price in supply premiums.

- We have already retraced from key technical levels.

With the above in mind, there are two tactical plays that we like this week.

First, we like exploratory longs in ZTL – or the BMO Long-Term US Treasury Bond Index ETF. Second, we like ZUAG – or the BMO US Aggregate Bond Index ETF. The latter should benefit further if we see risks tilt towards quicker Fed cuts, or a more deeper trajectory in the coming years.

b.) Asset Views

Asset Class |

View |

Notes |

Equities |

Slightly bearish |

|

Fixed Income |

Neutral |

|

Alternatives |

Slightly bullish |

|

FX (CAD) |

Slightly bearish |

|

c.) Regional Views

Region |

View |

Notes |

Canada |

Neutral |

|

US |

Slightly bearish |

|

EAFE |

Slightly bullish |

|

EM (China) |

Slightly bullish |

|

EM (ex-China) |

Slightly bearish |

|