3 key reasons why Gold rally can continue higher

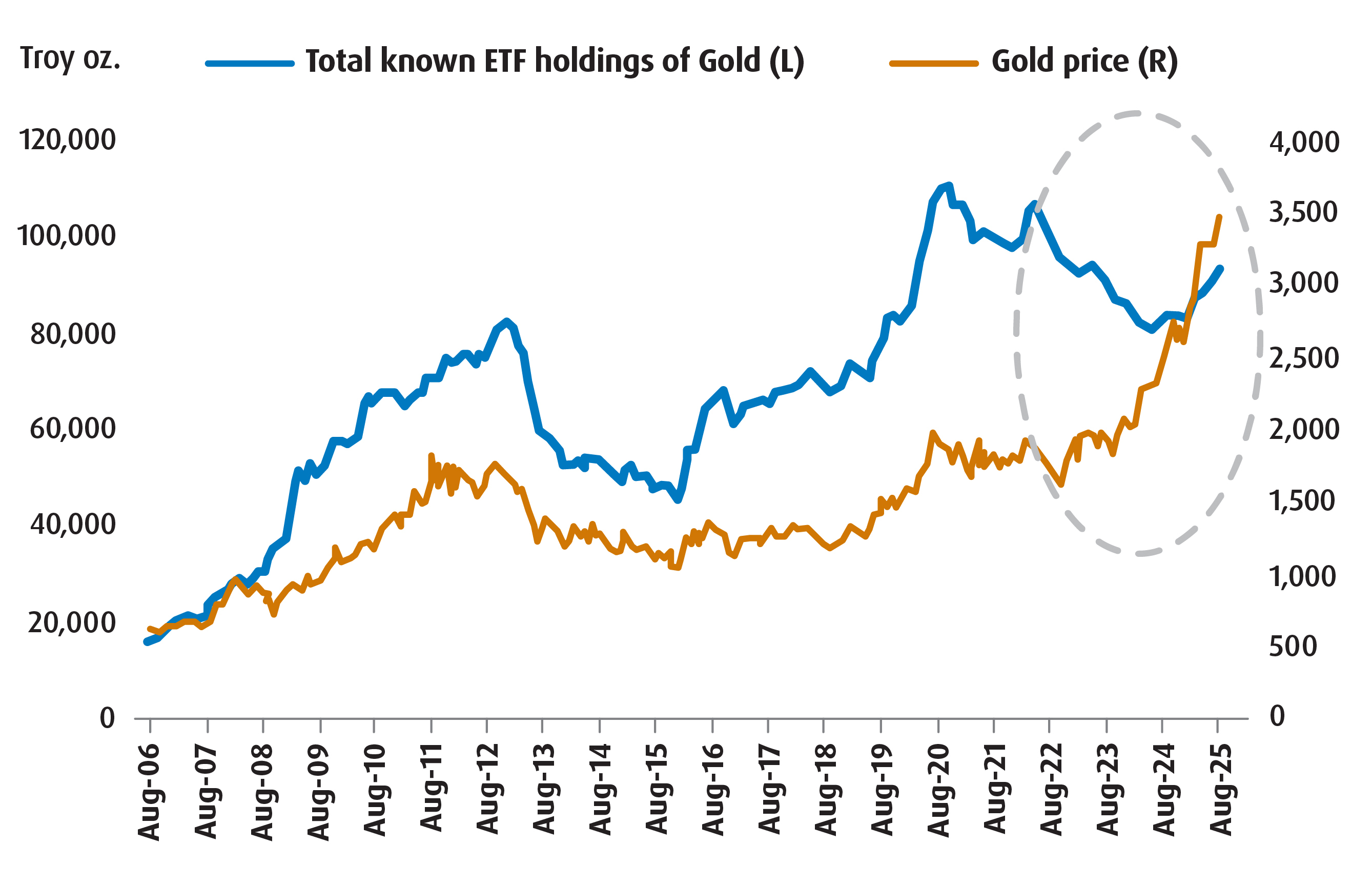

Sep. 30, 2025One of the more interesting wrinkles of the current rally in Gold is that it’s been accompanied by an uptick in global ETF holdings of the precious metal.

That means retail/institutional investors are getting in on the fun this time around – which is a bit of a departure from what we saw between late 2022 and early 2024. During that period, retail/institutional liquidation of Gold was accommodated by central bank buying.

Why are retail/institutional investors more inclined to participate now? Three reasons:

- For one, a restart of the Federal Reserve’s easing cycle means that carrying costs for Gold will be lower (unlike in prior years).

- Second, concerns about the longer-term inflation backdrop are on the rise.

- Third, the erosion of trust in U.S. institutions is becoming more of a tradable theme.

We understand that there may be concerns with current levels of valuation. However, when we add renewed interest from the retail/institutional crowd with existing reasons to be bullish Gold (central bank buying, diversification benefits), the ingredients for a sustained rally to the US$4,500 level by mid-2026 are still there.

Chart – Total ETF holdings of Gold vs. spot price over time

Source: Bloomberg, BMO Global Asset Management, as of August 31, 2025.

For investors seeking to establish or add to their Gold positions, below are three different exposure types to consider depending on risk tolerance and investment objective. Whether you want to invest directly in physical gold, receive monthly cash flow or looking for equity growth potential.

Cash flow: Get paid on your market hedge

- Combines exposure to the price of Gold bullion with a covered call spread strategy to collect premiums and generate cash flow.

- BMO Covered Call Spread Gold Bullion ETF (Ticker: ZWGD)

Direct

- Get exposure to the price of gold bullion without having the hassle of buying and storing the precious metal. Inventory is only held in physical form. Gold is held in a local BMO vault in Toronto.

Gold equities

- Invests in equity securities of mining and exploration companies that tend to fluctuate with the price of Gold. It also provides exposure to company profitability and mining activities.

- BMO Equal Weight Global Gold Index ETF (Ticker: ZGD)

- BMO Junior Gold Index ETF (Ticker: ZJG)

For more weekly market insights and commentary please visit and bookmark the Basis Points blog.

Performance (%)

Fund Name |

Ticker |

Year-to-date |

1-month |

3-month |

6-month |

1-year |

3-year |

5-year |

10-year |

Since inception |

Inception date |

25.37% |

3.01% |

4.63% |

14.69% |

38.72% |

— |

— |

— |

41.96% |

2024-03-04 |

||

86.39% |

23.37% |

26.97% |

62.14% |

88.03% |

54.48% |

16.31% |

19.37% |

7.78% |

2012-11-14 |

||

81.50% |

26.84% |

27.63% |

61.43% |

86.71% |

50.06% |

14.34% |

18.86% |

4.17% |

2010-01-19 |

||

29.28% |

3.74% |

4.07% |

19.24% |

33.69% |

— |

— |

— |

36.68% |

2024-03-05 |

||

31.22% |

3.93% |

4.56% |

20.83% |

36.12% |

— |

— |

— |

41.00% |

2024-03-04 |

||

Returns are not available as there is less than one year’s performance data. |

2025-05-22 |

||||||||||

1 Distributions are not guaranteed and are subject to change and/or elimination.

Disclaimers

For Advisor use.

Changes in rates of exchange may also reduce the value of your investment.

This is for information purposes only. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

Past Performance is not indicative of future results.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under license.