Easy to Use Retirement ETFs

Introducing ZGRO.T, ZBAL.T and ZMI

Apr. 26, 2024• Diversified by asset mix, geography and sectors

• Providing monthly, predictable cashflow

• Low cost – Management Expense Ratio – 0.20%*

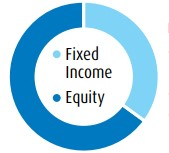

Popular mutual fund strategy now available in an ETF with the introduction of the T Units from BMO ETFs – BMO Growth ETF (Fixed Percentage Distribution Units – T6 Units†) – ZGRO.T and BMO Balanced ETF (Fixed Percentage Distribution Units – T6 Units†). Similar to a T6 mutual fund, ZBAL.T and ZGRO.T both pay out a 6% annual distribution rate monthly and are designed to provide regular and potentially more tax-efficient‡ cash flow. These two solutions compliment our monthly income ETF – ZMI – BMO Monthly Income ETF which launched over 10 years ago.

BMO’s ETFs Retirement Solutions and Asset Allocation ETFs are an easy all-in-one investment vehicle that allow investors to target a specific risk level based on their investment goals and income needs.

BMO ETFs – Retirement Solutions

Key Facts:

| |

| Key Facts:

|

Key Facts:

|

* The Target allocation of the Fund’s Holdings are for illustrative purposes only and will change due to the Fund’s ongoing portfolio transactions without notice.

† These T6 units are Fixed Percentage Distribution Units that provide a fixed monthly distribution based on an annual distribution rate of 6%. Distributions may be comprised of net income, net realized capital gains and/or a return of capital.

‡ Tax Efficient: as compared to an investment that generates an equivalent amount of interest income.

The payment of distributions is not guaranteed and may fluctuate. The payment of distributions should not be confused with a fund’s performance, rate of return or yield. If distributions paid by the fund are greater than the performance of the fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a fund, and income and dividends earned by a fund are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero. Please refer to the funds, distribution policy in the prospectus.

This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence