Four reasons to like Quality as an allocation factor

Sept 23, 2025While Quality has had a tough year so far, we expect it to perform going forward. This is largely due to a shifting macro backdrop that favours firms with stable earnings, a still-restrictive Fed monetary policy regime, and exposure to AI.

This is an especially busy period for macro. While both the Bank of Canada (BoC) and Federal Reserve (Fed) have eased policy rates by 25 basis points(bps), there are still risks to the bond market in both Canada/U.S. In the U.S., the market has already priced an aggressive easing profile for the Fed which skews the risk toward higher yields ahead.

Funds in focus

It’s been a tough year for Quality, but that’s changing

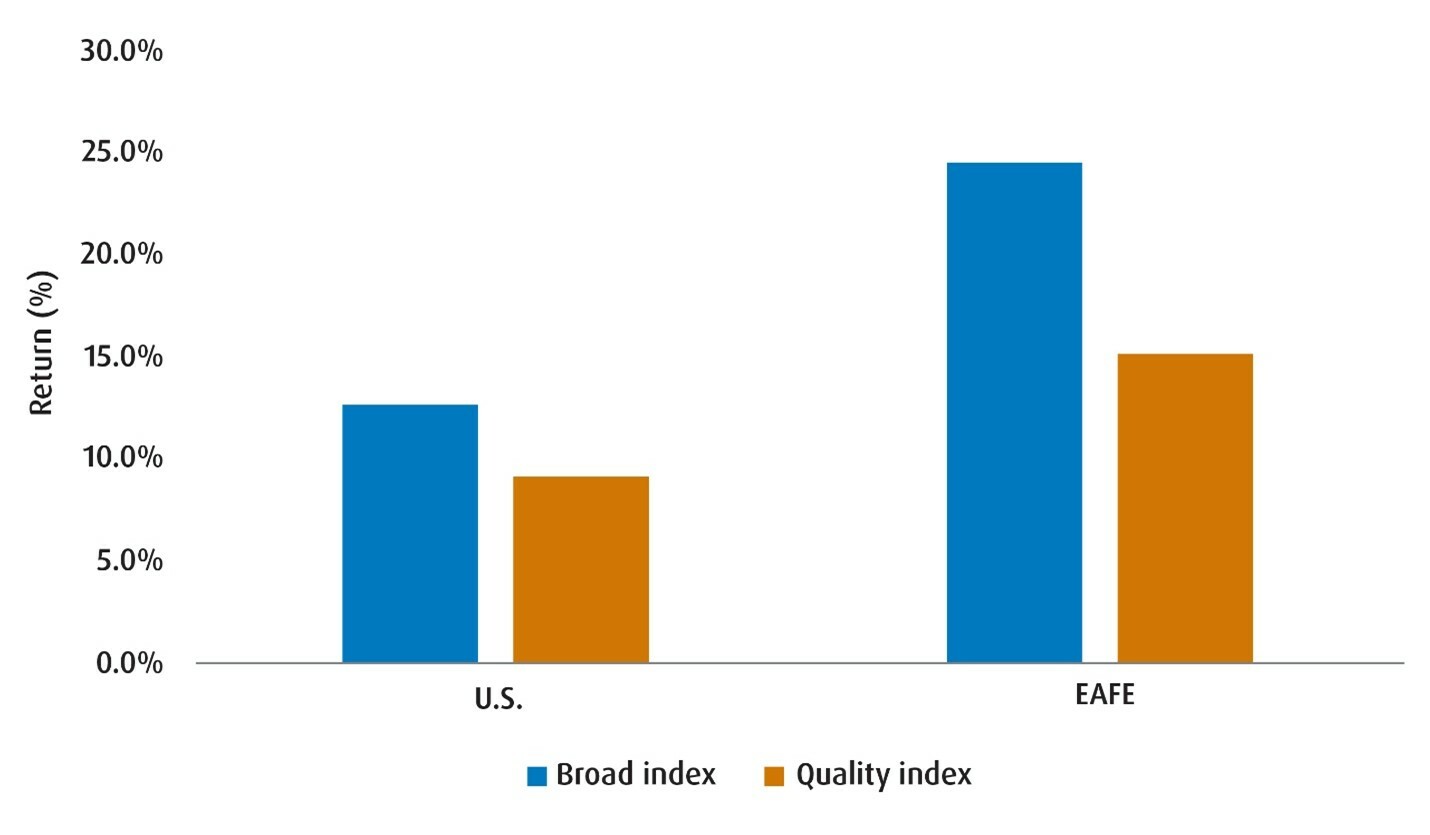

We’ll be the first to admit that it’s been a tough year for‘Quality’ as a factor. For instance, within the U.S. and EAFE regions, MSCI indices that track Quality have underperformed relative to broader equity gauges since the start of this year (Chart 1). And even when compared to the spectrum of other factors, Quality has underperformed relative to Low Vol, Value and even Dividend Yield over the same time frame.

Chart 1 – Quality vs. U.S./EAFE indexes

Source: MSCI, Bloomberg, as of Friday, September 12, 2025.

There are several reasons for its underperformance, but in our minds, Quality has lagged largely because of the heavy weighting that goes to the Health Care sector within most indices that track it. You’ll recall that this sector has been left vulnerable to a tremendous degree of regulatory and trade policy uncertainty (especially in the U.S.). As a result, Quality hasn’t lived up to the hype of being a factor that outperforms during volatility – which has characterized much of 2025.

Nevertheless, we’re going to put forward some reasons for why our readers should consider Quality in the U.S. within their equity sleeves going forward (if they haven’t already done so already).

For those of you with a substantial weighting towards this factor, we’d urge further patience. Indeed, it does feel like the stars are aligning to favour its outperformance going forward.

Reason 1 – The macro backdrop is shifting towards slower growth

The combination of higher trade barriers and restrictive monetary policy in a few of the larger economies (the U.S. and Japan) are but two of the reasons why we project global growth to slow in the coming year. In fact, we’re already seeing this reflected in U.S. data – with the labour backdrop pointing to trouble as non-farms job growth slows and as household sentiment remains subdued. This is the exact‘late cycle’ backdrop that bodes well for firms with stable earnings and strong balance sheets within the Quality style.

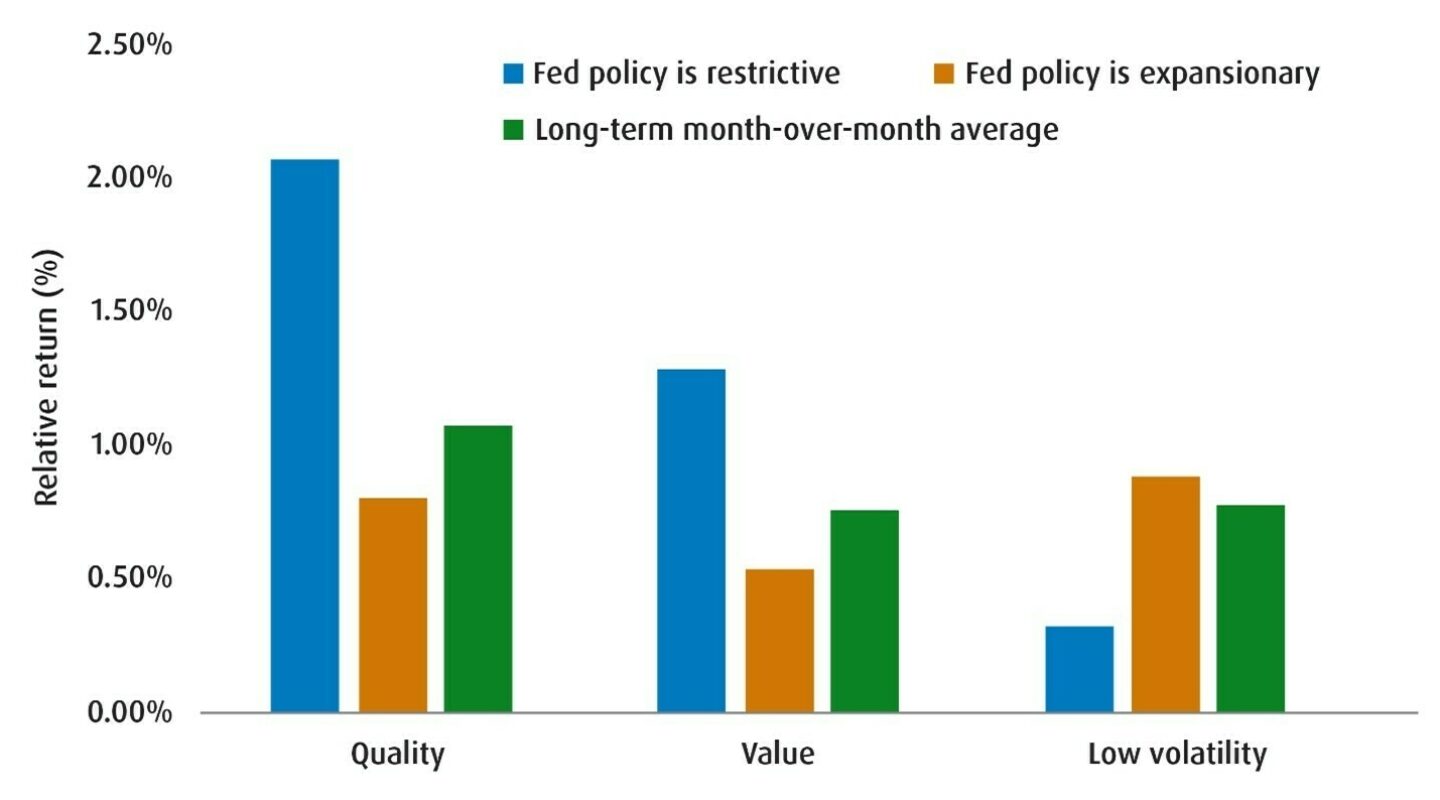

Reason 2 – Restrictive Fed policy regimes tend to work in favour of Quality

Even with the Federal Open Market Committee cutting rates, monetary policy conditions are still tight. That implies firms with high leverage ratios should continue to struggle as credit conditions remain suboptimal. That contrasts with firms within theQuality lens – which tend to carry relatively less debt and have strong free cash flow. Don’t take our word for it – just look at the chart below.

Chart 2 – Quality tends to outperform when Fed policy is restrictive

Source: BMO Global Asset Management, Bloomberg, as of August 31, 2025.

Reason 3 – Exposure to AI

In the U.S., AI-related capital expenditures remain a key contributor to economic growth. At the same time, it has been an integral reason for the rallies in the tech and communications sectors. Again, both of those sectors are weighted the most heavily within the Quality factor.

Reason 4 – The issues with Health Care are likely priced in now

True, Health Care is at the crosshairs of regulatory risk and trade policy uncertainty – not least as Trump has threatened pharmaceutical tariffs for some time now. However, we’re likely closer to a point now where these forces are well understood, and valuations look fairly cheap. Put simply, the drag from the sector is likely done.

Implementation

Readers should remember that Quality typically outperforms during periods when investors are concerned about downside risks to either the economy, or the market and when risk appetite is ebbing to a degree. The current late-cycle setup is consistent with that framework. At the same time, this is a factor that should benefit from additional AI-related optimism and improving sentiment with respect to the Health Care sector.

Our own inclination is to express this view via either ZUQ or ZIQ – with a slight preference for the former.

Performance (%)

Year-to-date |

1-month |

3-month |

6-month |

1-year |

3-year |

5-year |

10-year |

Since inception |

||

2.85 |

1.22 |

6.59 |

-0.78 |

9.89 |

22.94 |

14.56 |

15.75 |

16.16 |

||

Returns are not available as there is less than one year’s performance data. |

||||||||||

Bloomberg, as of August 31, 2025. Inception date for ZUQ = November 5, 2014, ZIQ = October 24, 2024.

Disclaimers

For Advisor use.

The communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

The ETF referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

Past Performance is not indicative of future results.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.