Time to Consider Diversification from Nvidia and Magnificent 7? Here’s How.

Mar. 5, 2024U.S. equity markets are off to a strong start on the year with the S&P 500 Composite Index already up 6.3%, slightly trailing the 6.5% return of the Nasdaq 100 Index. The year-to-date rally has been a continuation of the rise in risk assets that started in late October of last year.

Funds in Focus:

BMO MSCI USA High Quality Index ETF (Ticker: ZUQ)

BMO Nasdaq 100 Index ETF (Ticker: ZNQ)

BMO Covered Call Technology ETF (ZWT)

- Diversified portfolios of high-quality stocks screened on high return-on-equity (ROE), low-earnings variability and low financial leverage.

- Maintain exposure to Magnificent 7 while reducing concentration risk.

- ZWT’s covered call overlay offers additional yield potential through options premiums.

Diversifying Away from Nvidia and Magnificent 7

A closer look at the composition of the rally so far this year shows the majority of the returns have come from Nvidia Corp. and to a lesser extent from Microsoft Corp. Tailwinds in the Artificial Intelligence (“A.I.”) theme have significantly benefitted Nvidia with the stock up more than 1,950% in the last five years.

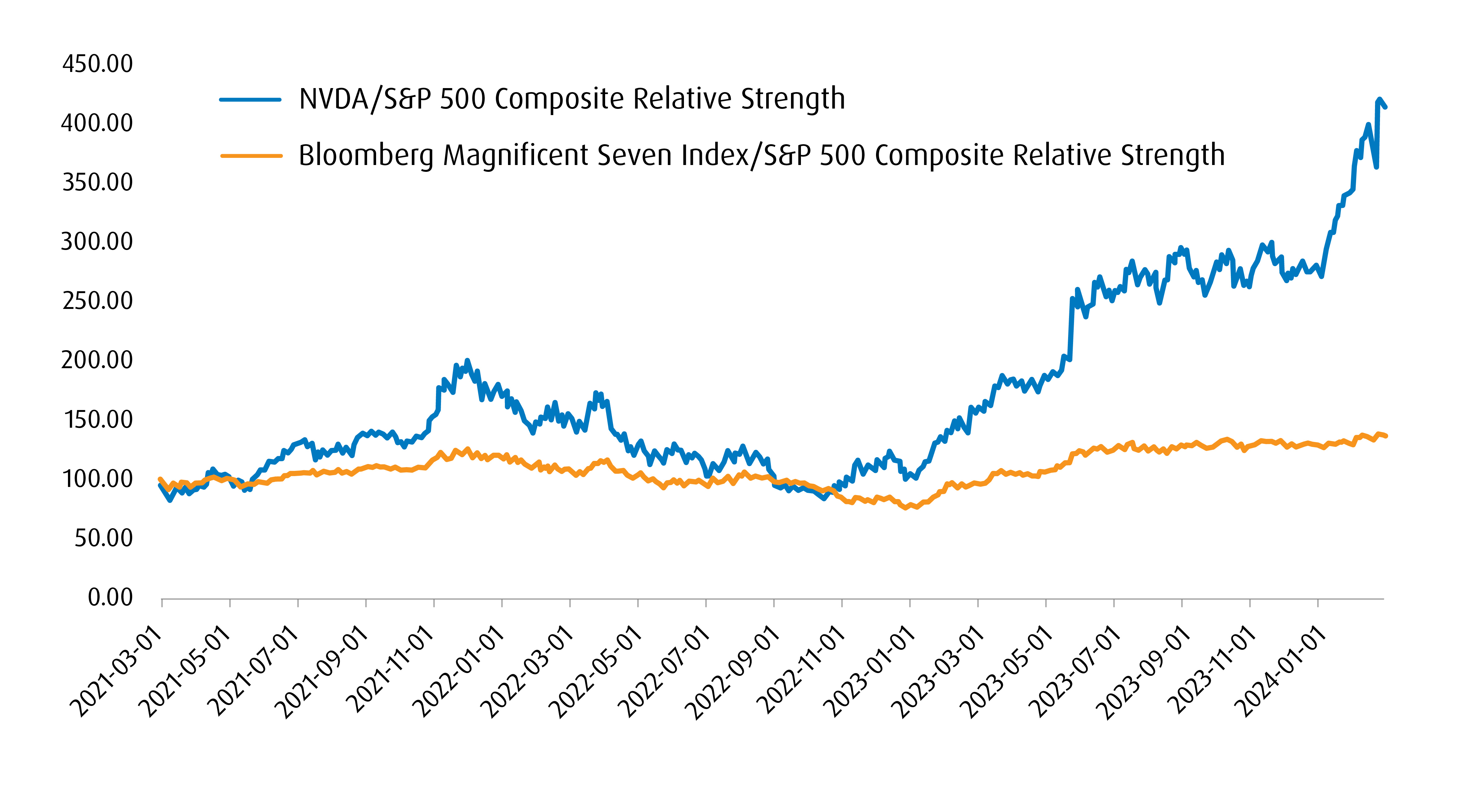

Although expectations have become ever loftier, the semiconductor company continues to significantly exceed analyst targets on its quarterly earnings. This makes it challenging for investors to fully divest the stock, though taking some profits at this point would certainly be prudent. Both Nvidia and the Magnificent 7 (consisting of Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) are notably outpacing the S&P 500 Composite Index over the last three years.

Nvidia & Magnificent 7 vs. Broader Market

At this point in the cycle, our view is that investors may well want to consider diversifying away from Nvidia and other Magnificent 7 stocks by utilizing a broader-based ETF. By doing so, investors can maintain exposure, while reducing overall concentration risk. Given most of the rally in recent months was driven on hopes of aggressive rate cuts by the U.S. Federal Reserve, strong economic data leading to a less dovish policy environment may warrant broadening out equity exposure to a portfolio of stocks rather than single securities that may be more vulnerable to price corrections.

There are a number of ways in which investors can diversify with an ETF while maintaining exposure to Nvidia and/or the Magnificent 7.

Below are three options worth exploring:

1) BMO MSCI USA High Quality Index ETF (Ticker: ZUQ)1 | BMO MSCI USA High Quality Index ETF – USD Units (Ticker: ZUQ.U) | BMO MSCI USA High Quality Index ETF – Hedged Units (Ticker: ZUQ.F)

Diversification Benefits:

- Holds a diversified portfolio of high-quality stocks screened on high return-on-equity (ROE), low-earnings variability and low financial leverage.

- Technology makes up 37.5%2 of the portfolio, with a focus on higher quality, cash-rich companies.

- Has exposure to the Magnificent 7, with the exception of Amazon and Tesla

- Good way for investors to also get exposure to high-quality names outside of technology

- Management fee of 0.30%

2) BMO Nasdaq 100 Index ETF (Ticker: ZNQ)1| BMO Nasdaq 100 Index ETF – Hedged Units (Ticker: ZQQ)

Diversification Benefits:

- The Nasdaq-100 has historically been known as a high-growth U.S. equity index

- Has exposure to the Magnificent 7 as well as being made up of 50.4%3 Technology holdings

- Management fee of 0.35%

3) BMO Covered Call Technology ETF (ZWT)

Diversification Benefits:

- Diversified portfolio of 28 large-cap technology and tech-related names

- Includes a covered call overlay to generate additional yield.

- Suitable for investors looking for U.S. technology exposure with some yield as technology names typically pay low dividends if at all

- Management fee of 0.65%

1 Changes in rates of exchange may also reduce the value of your investment.

2 As at January 31, 2024.

3 As at January 31, 2024.

Advisor Use Only.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

The BMO ETFs or securities referred to herein are not sponsored, endorsed or promoted by MSCI Inc. (“MSCI”), and MSCI bears no liability with respect to any such BMO ETFs or securities or any index on which such BMO ETFs or securities are based. The prospectus of the BMO ETFs contains a more detailed description of the limited relationship MSCI has with BMO Asset Management Inc. and any related BMO ETFs.

Nasdaq® is a registered trademark of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and is licensed for use by the Manager. The ETF has not been passed on by the Corporations as to their legality or suitability. The ETF is not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the ETF. The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

The communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/TM Registered trademarks/trademark of Bank of Montreal, used under licence.