Two Reasons to Stay Long Infrastructure

It may not be as sexy as other themes, but billions are poised to pour into real assets over the next couple of decades, creating a durable investment case for infrastructure.

Dec. 2, 2025Summary

- While not as flashy as crypto or AI, infrastructure offers stability and long-term growth potential, making it an attractive option for investors seeking dependable returns.

- Strong macroeconomic tailwinds: Global demographic shifts, urbanization, aging infrastructure in developed markets, and major government spending initiatives (e.g., Canada, Germany, Japan) are driving demand for transport, energy, and digital projects, creating jobs and boosting productivity.

- Electrification and funding gap: Rising power demand from clean energy and digitalization (AI/data centers) requires massive investment — estimated at US$22 trillion over the next 15 years — amid a global infrastructure funding shortfall of between US$5 – 7 trillion, presenting significant opportunities for private-sector and P3 models.

We’ll acknowledge that “infrastructure” doesn’t typically generate the same type of excitement that other areas might. For instance, “crypto” sounds mysterious and fun while “AI” has the type of buzz you’d associate with something cool and trendy. Going long infrastructure sounds the same as recommending “plastics” to someone in the 1960s - it’s boring and safe.

But branding issues aside, boring and safe can often be a good thing in the world of investing.

We’ve been bullish infrastructure for almost a year now. And as part of our own internal review process, we decided to revisit our rationale in this note. Out of the multitude of reasons that we could have picked, there are two compelling ones for why we still feel that investing in infrastructure will remain a compelling play in the years to come.

- First, there are strong macroeconomic tailwinds in favour of it. Several emerging markets are experiencing massive demographic shifts and increased urbanization. In the developed world, there is the need to urgent need to update aging infrastructure. In the past year, the marked departure away from internationalism and free trade has provided several countries with an opportunity to look at different ways to boost domestic incomes. The optimal way to do this is to spend on improvements to transport systems (roads/highways/bridges/rail, etc.), energy grids, and digital connectivity. Additionally, countries are looking more closely at existing natural resource wealth to diversify trade relationships (think of the renewed federal interest in building pipelines here in Canada).

In 2025 alone, several countries announced major infrastructure initiatives. For example, in the recent Canadian budget, PM Carney announced that his administration would spend C$115bln over the next five years on such projects. In March, the German government circumvented it’s long enshrined ‘debt brake’ to create a fund that will spend EUR550bln over the next ten years on major transport, climate and digitalization projects. In Japan, it’s estimated that around 30% of the JPY21.5trln fiscal stimulus package will go towards public infrastructure projects.

The appeal of these projects is that also lead to immediate job creation – alongside the longer-term benefits through gains in productivity. That is particularly true for sectors that have been more acutely exposed to the current trade conflict, including manufacturing and construction jobs. - The second reason to be bullish infrastructure is the global push towards increased electrification. Already, we’re seeing signs that current digital infrastructure is inadequate to keep pace with the surge in power demand. Whether it’s the push towards sourcing clean energy or the need for more data centers as part of the AI race, electricity grids are close to their peak loads in a lot of places while storage technology has lagged. That has created bottlenecks which, in turn, has meant an increase in electricity costs for the general public.

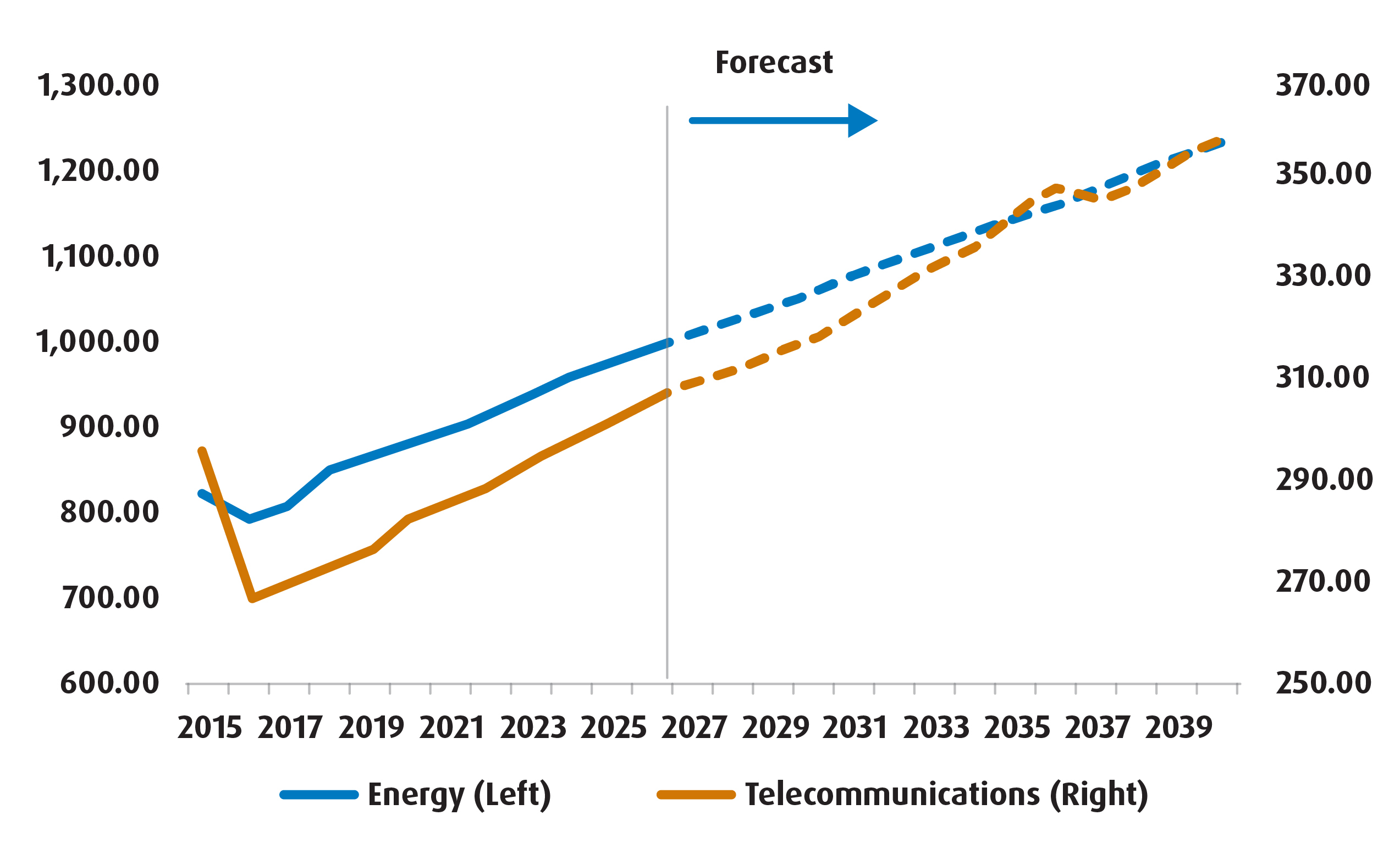

Right now, we can map out expected infrastructure investments related to electrification over the coming decades. In the sectors most relevant to this push (energy and telecoms), we estimate that close to $22trln will be allocated over the next 15 years (Chart 1).

Chart 1 – Forecasted Global Spending on Energy + Telecommunication Infrastructure Over the Next 15 Years (US$, blns)

For many governments, the public-private partnership (or P3) model is the best way to build out infrastructure and spread the risk of big projects – and it’s likely that most of the projects end up taking that approach. Indeed, it’s in the private sector where the financing, technology and operational experience primarily exists. This is also the channel where investors can gain exposure to the type of revenues that infrastructure projects provide – namely, those that are stable, dependent on inelastic demand, and long in duration.

And remember, funding is still mostly lacking in this space. According to some estimates, the need for global infrastructure investment is forecasted to be around US$41-42trln over the next 10 years. Current investment trends are still only around US$35-36trln (see Chart 2).

Chart 2 – The Global Gap in Infrastructure Funding Remains Wide (From 2025- 2040)

Indeed, the need for a variety of infrastructure projects remains large and firms that already generate fees from long-lived assets that are integral to the space (think pipelines, transmission lines, airports, etc.) will be best placed going forward. By extension, funds that either directly hold these long-lived assets, or invest in firms that do should also benefit.

In our next update of our ‘Quarterly Portfolio Strategy’, we’ll likely be increasing our allocation to infrastructure within the alternative sleeve of our portfolio. This will likely be via the BGIF (the BMO Global Infrastructure Fund – Active ETF Series).

Performance (%)

Year-to-Date |

1-Month |

3-Month |

6-Month |

1-Year |

3- Year |

5- Year |

10- Year |

Since Inception |

|

18.24 |

2.67 |

6.17 |

9.05 |

14.50 |

- |

- |

- |

17.95 |

Bloomberg, as of November 28, 2025. BGIF inception date = June 27, 2023.

Disclaimers:

For Advisor use.

The communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the author represent their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

Past Performance is not indicative of future results.

Commissions, management fees and expenses (if applicable) all may be associated with investments in BMO ETFs and ETF Series of the BMO Mutual Funds. Please read the ETF facts or prospectus of the relevant BMO ETF or ETF Series before investing. BMO ETFs and ETF Series are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs or ETF Series of the BMO Mutual Funds, please see the specific risks set out in the prospectus. BMO ETFs and ETF Series trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. The ETF Series of the BMO Mutual Funds are managed by BMO Investments Inc., an investment fund manager and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.